Colorado Performance Evaluation for Exempt Employees

Description

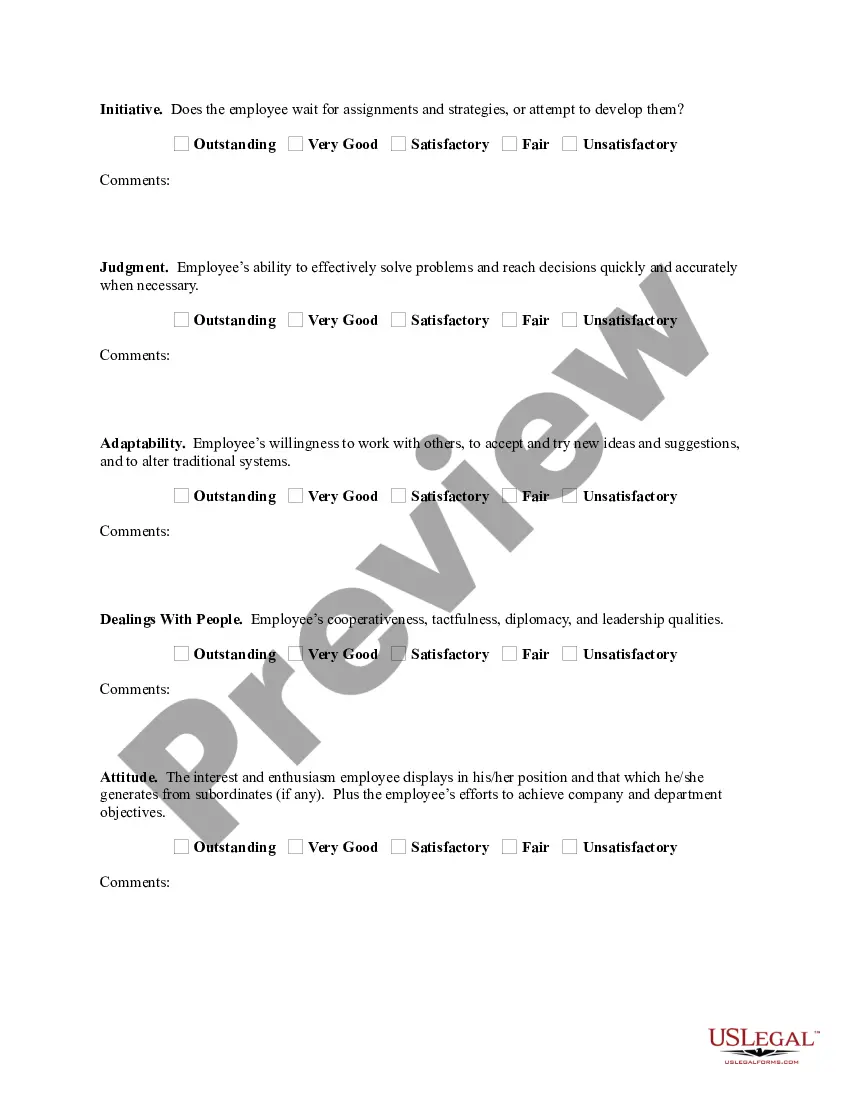

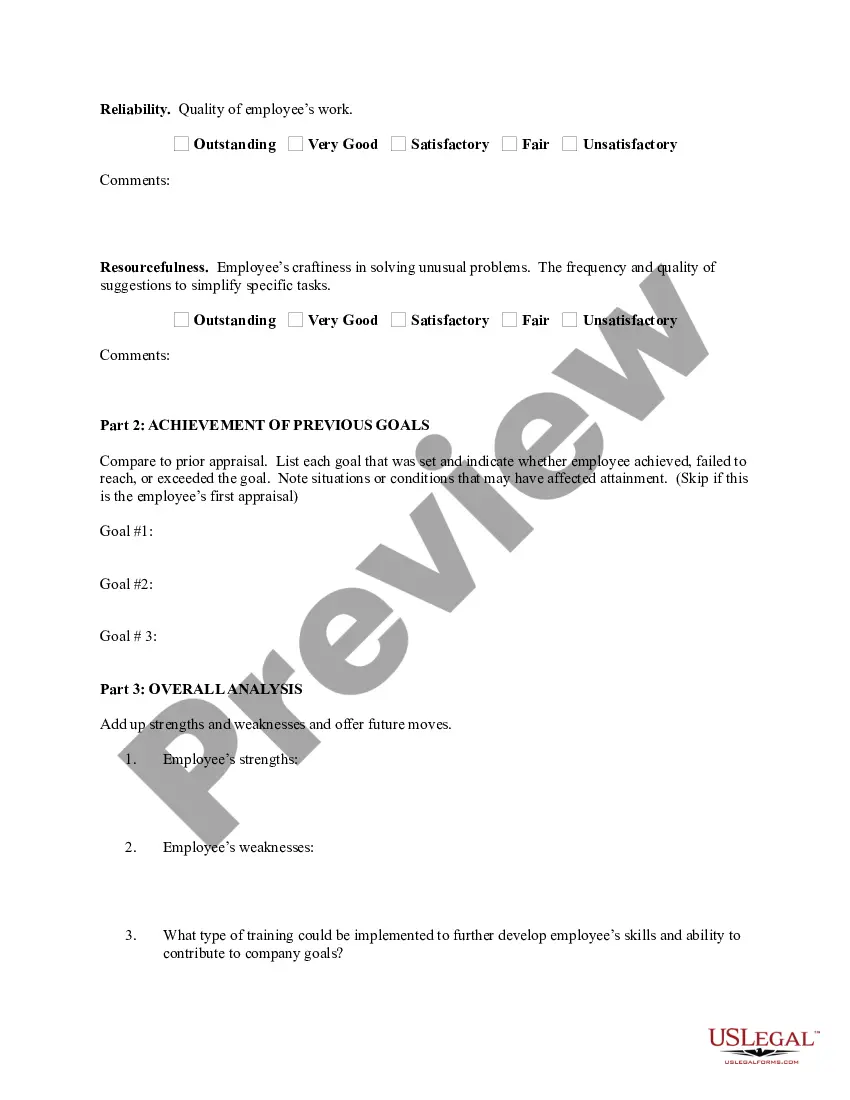

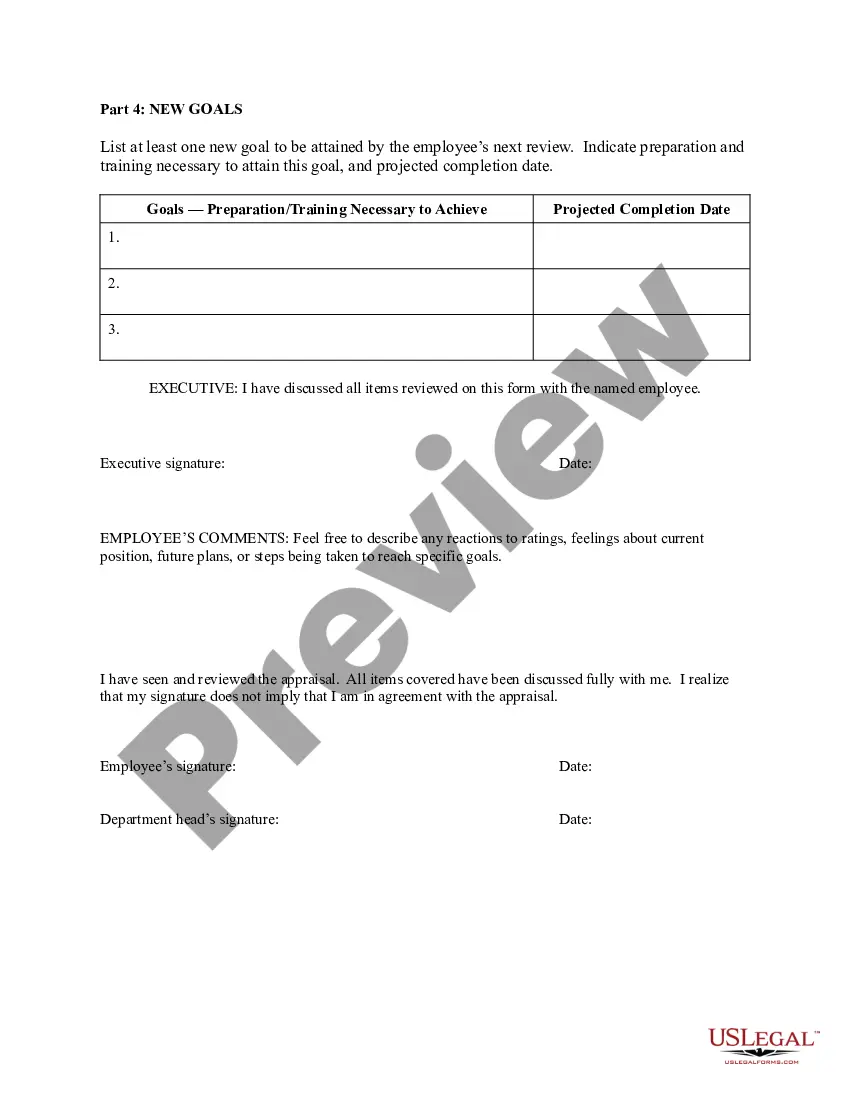

How to fill out Performance Evaluation For Exempt Employees?

You might spend hours online looking for the legal document template that meets the federal and state regulations you need.

US Legal Forms offers a vast array of legal forms that can be reviewed by experts.

You can download or print the Colorado Performance Evaluation for Exempt Employees from your services.

Review the form description to confirm you have selected the correct document. If available, use the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you may sign in and click on the Download button.

- After that, you can complete, modify, print, or sign the Colorado Performance Evaluation for Exempt Employees.

- Every legal document template you obtain is yours indefinitely.

- To obtain another copy of the purchased form, go to the My documents section and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the right document template for the region/state of your selection.

Form popularity

FAQ

Who is eligible for overtime pay? To qualify as an exempt employee one who does not receive overtime pay staff members must meet all the requirements under the duties and salary basis tests.

Even though there is no law that governs when performance reviews are to be conducted, if you never received one at all during your employment, and you were terminated for cause specifically for performance-related issues or during your probationary period, there may be grounds to fight your termination.

If you don't, ask your supervisor or the HR department about the policy on performance reviews. If you are represented by a union, check your contract to see if there's a provision on reviews and evaluations.

There is no legal requirement to carry out appraisals, but most employers have a yearly or twice-yearly review process. Appraisals are often used to determine whether targets have been achieved and make decisions about future work.

In order to be exempt, an employee must meet the salary and duties requirements. Effective January 1, 2021, the salary threshold for overtime exemption is $40,500, then will increase to $45,000 in 2022, to $50,000 in 2023, and to $55,000 in 2024.

Performance appraisals are essential for the growth of a company and the employee. It helps the company to find out whether the employee is being productive or is a liability. It helps the employee to find out where his / her career is heading. It is an essential part of HR management.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

Although the higher Colorado salary requirement does not go into effect until July, nearly all Colorado employers are subject to the FLSA and are therefore required to make sure their employees' salaries meet the minimum requirement of $35,569 as of January 1, 2020 to qualify for the white collar exemptions.

No law requires companies to conduct job reviews, but businesses that do may have a better understanding of their employees. The information gained from performance reviews can be used to determine raises, succession plans and employee-development strategies.

Exemptions from Overtime OnlyCertain employees of automobile, truck, or farm implement retail dealers. Salespersons employed by trailer, aircraft, and boat retail dealers. Commission salespeople earning at least 50% of their total earnings in commissions whose regular rate of pay is at least time and a half minimum