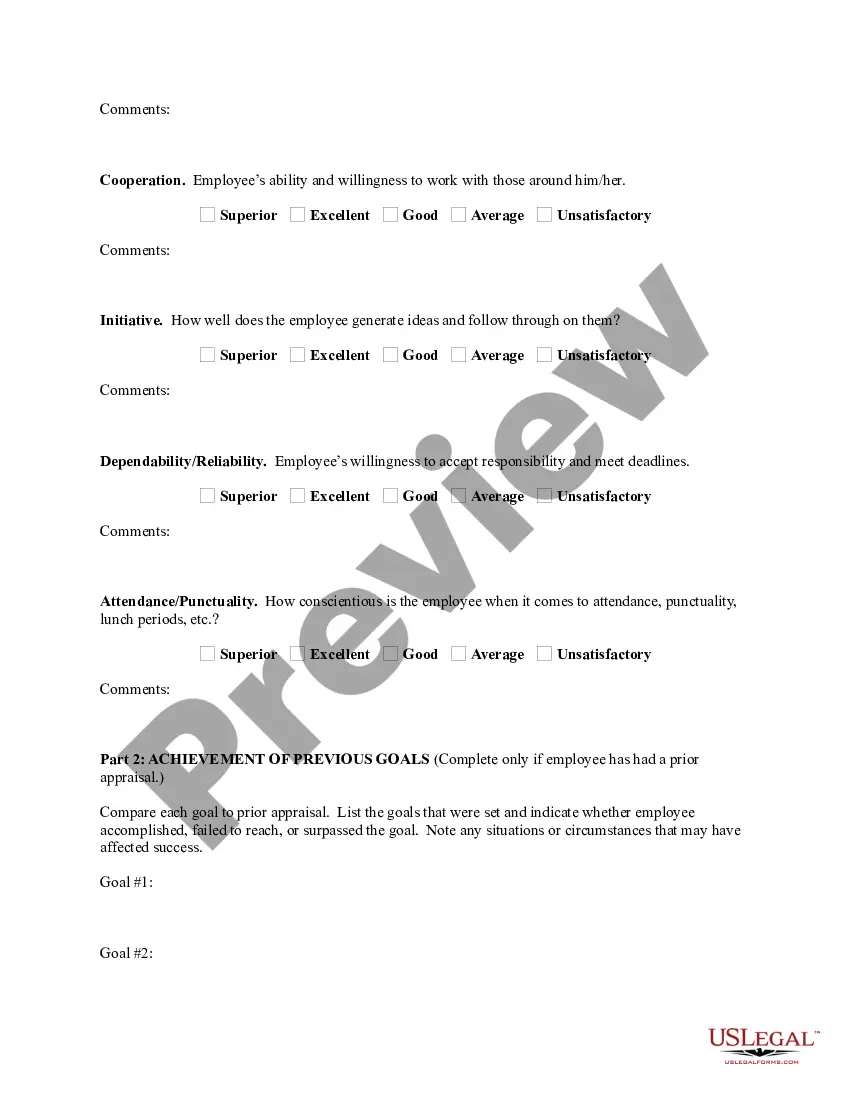

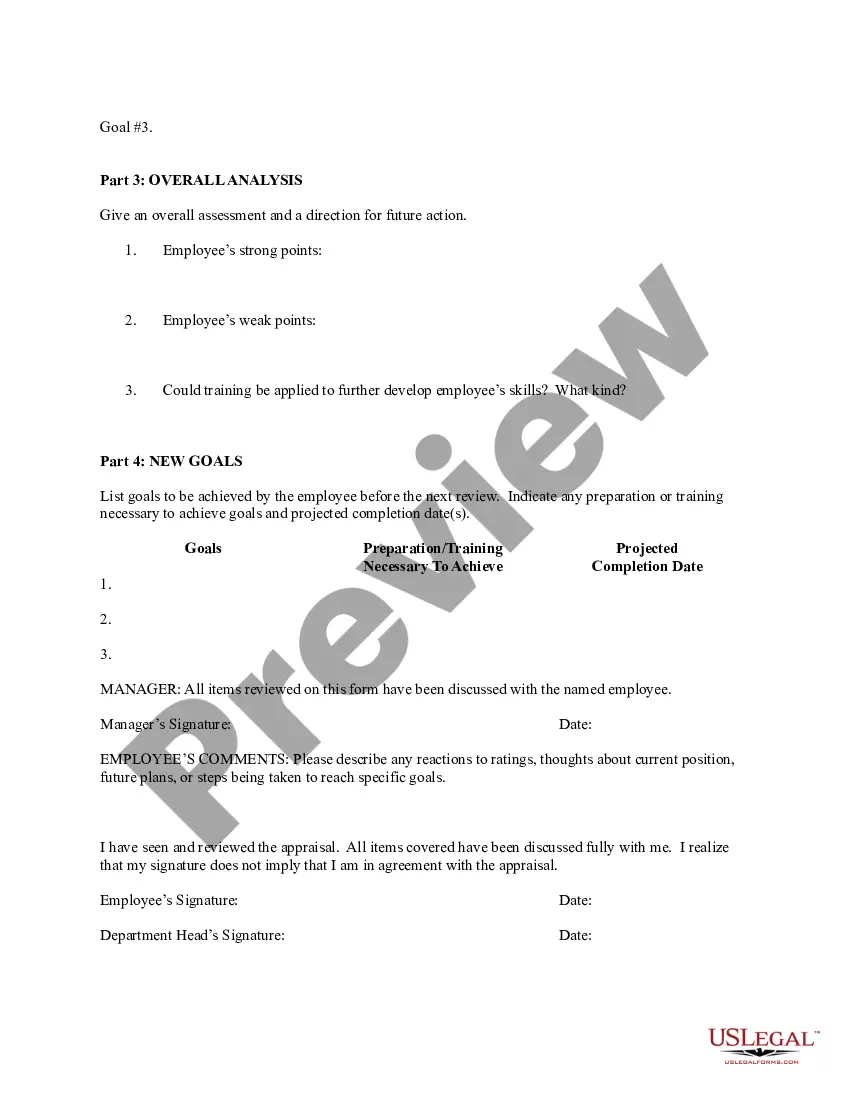

Colorado Performance Evaluation for Nonexempt Employees

Description

How to fill out Performance Evaluation For Nonexempt Employees?

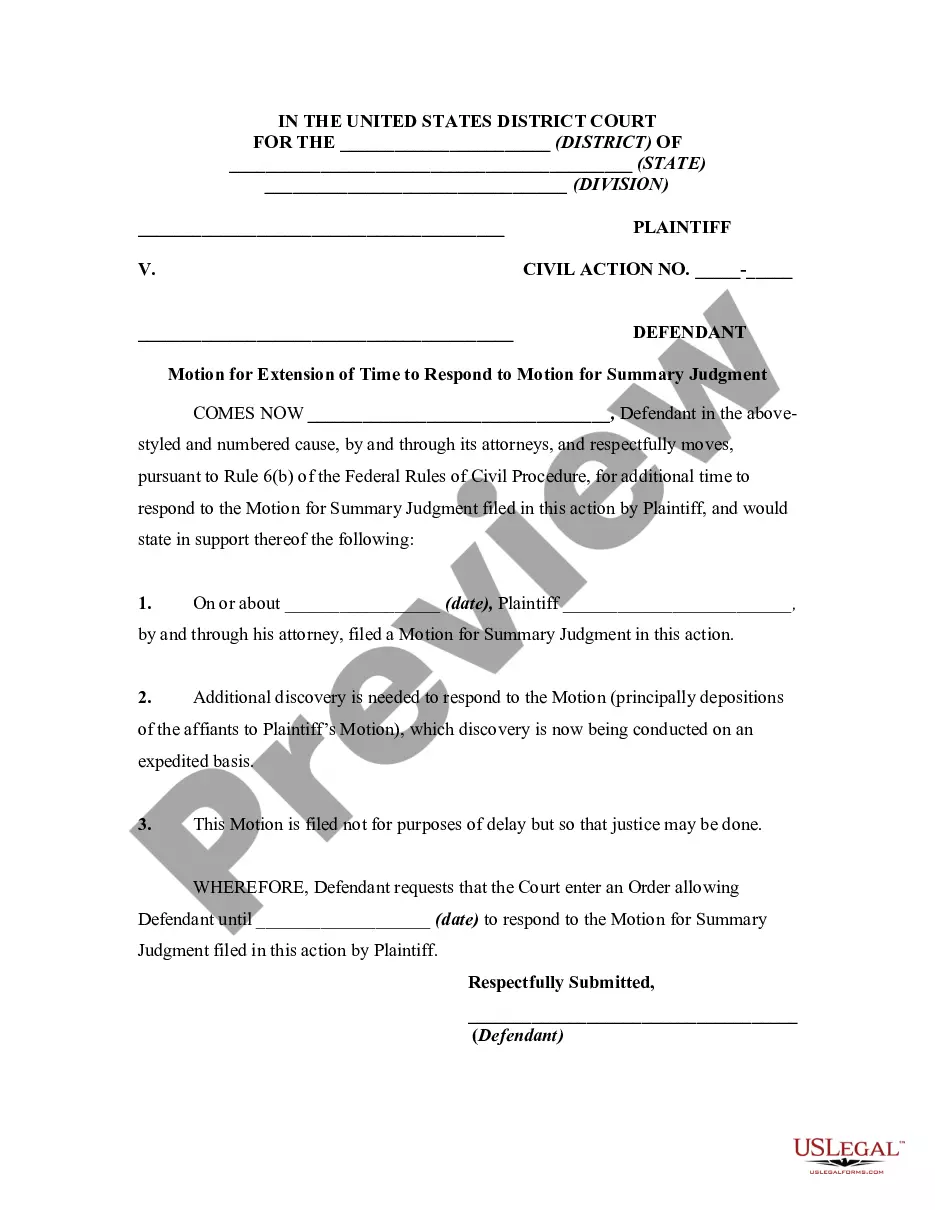

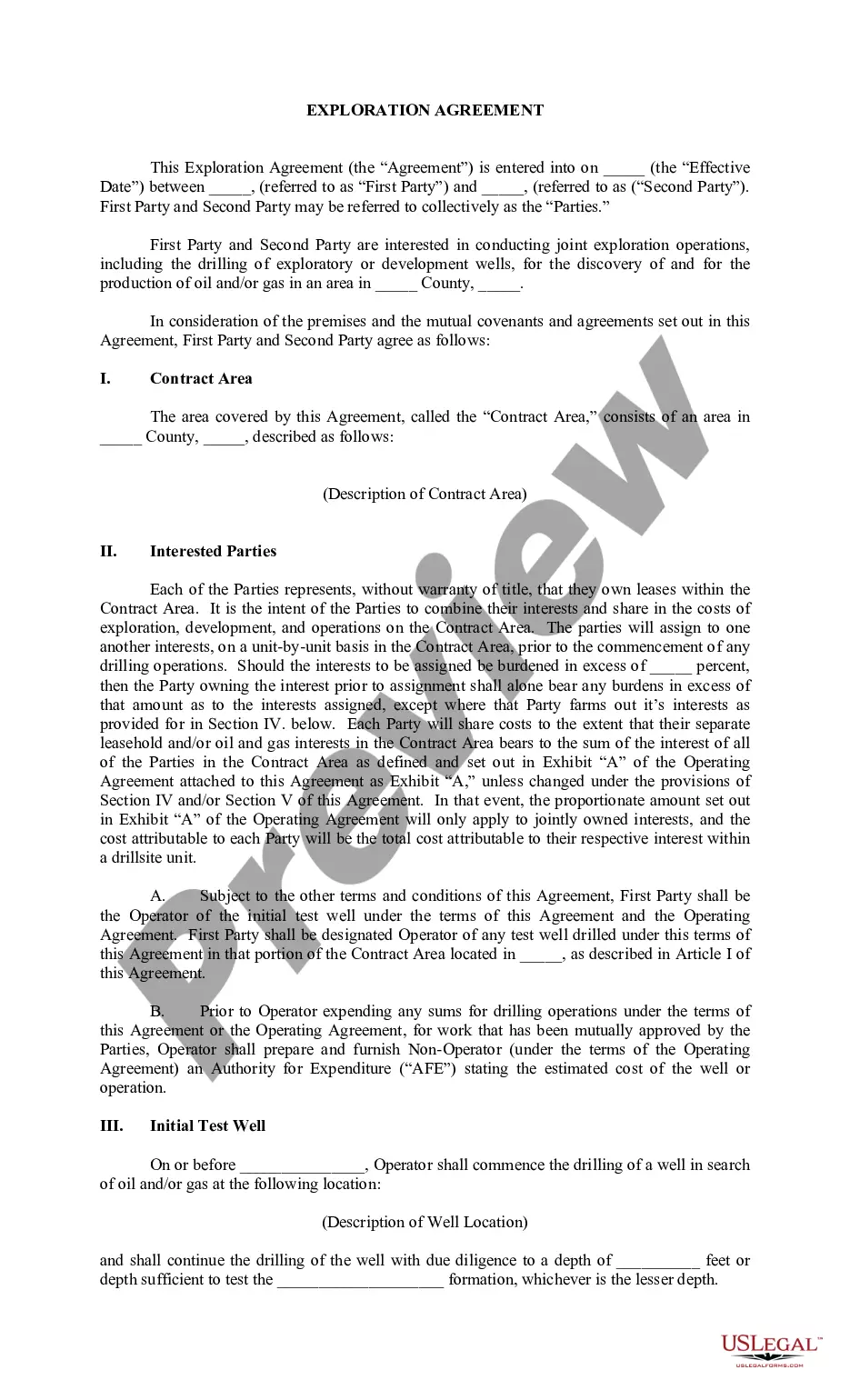

Selecting the most suitable authorized document template can be challenging. Obviously, there are numerous templates available online, but how can you identify the official form you require? Utilize the US Legal Forms website. The service provides thousands of templates, including the Colorado Performance Assessment for Nonexempt Employees, which you can use for both business and personal needs.

All of the forms are verified by experts and comply with state and federal regulations.

If you are already a member, Log In to your account and hit the Download button to obtain the Colorado Performance Assessment for Nonexempt Employees. Use your account to search for the official forms you may have previously purchased. Check the My documents section of your account to retrieve an additional copy of the document you need.

Complete, modify, print, and sign the downloaded Colorado Performance Assessment for Nonexempt Employees. US Legal Forms is the largest repository of authorized forms where you can find a variety of document templates. Take advantage of the service to download professionally crafted documents that adhere to state standards.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- First, ensure you have chosen the correct form for your city/county. You can review the form using the Review button and examine the form outline to confirm it is the right one for you.

- If the form does not meet your needs, utilize the Search box to find the appropriate form.

- Once you are confident that the form is correct, click the Buy now button to acquire the form.

- Select the pricing plan you prefer and enter the required information. Create your account and process your payment using your PayPal account or credit card.

- Choose the document format and download the authorized document template to your device.

Form popularity

FAQ

Who is eligible for overtime pay? To qualify as an exempt employee one who does not receive overtime pay staff members must meet all the requirements under the duties and salary basis tests.

In order to be exempt, an employee must meet the salary and duties requirements. Effective January 1, 2021, the salary threshold for overtime exemption is $40,500, then will increase to $45,000 in 2022, to $50,000 in 2023, and to $55,000 in 2024.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

Although the higher Colorado salary requirement does not go into effect until July, nearly all Colorado employers are subject to the FLSA and are therefore required to make sure their employees' salaries meet the minimum requirement of $35,569 as of January 1, 2020 to qualify for the white collar exemptions.

Employees who are paid less than $23,600 per year ($455 per week) are nonexempt. (Employees who earn more than $100,000 per year are almost certainly exempt.)

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.

Employees who do not meet the requirements to be classified as exempt from the Minimum Wage Act are considered nonexempt. Nonexempt employees may be paid on a salary, hourly or other basis. Employees who do not qualify for an exemption but are paid on a salary basis are considered salaried nonexempt.

Salaried: An individual who receives the same salary from week to week regardless of how many hours he or she works. Exempt employees must be paid on a salary basis, as discussed above. Nonexempt employees may be paid on a salary basis for a fixed number of hours or under the fluctuating workweek method.

Salary level test. Employees who are paid less than $23,600 per year ($455 per week) are nonexempt. (Employees who earn more than $100,000 per year are almost certainly exempt.)

Exempt employee definition: Exempt employees refer to workers in the United States who are not entitled to overtime pay. This simply implies that employers of exempt employees are not bound by law to pay them for any extra hours of work. The federal standard for work hours in the United States is 40 hours per workweek.