Colorado Purchase Order for Non Inventory Items

Description

How to fill out Purchase Order For Non Inventory Items?

You might spend multiple hours online trying to locate the proper legal document format that complies with the federal and state regulations you require.

US Legal Forms provides a plethora of legal templates that have been assessed by professionals.

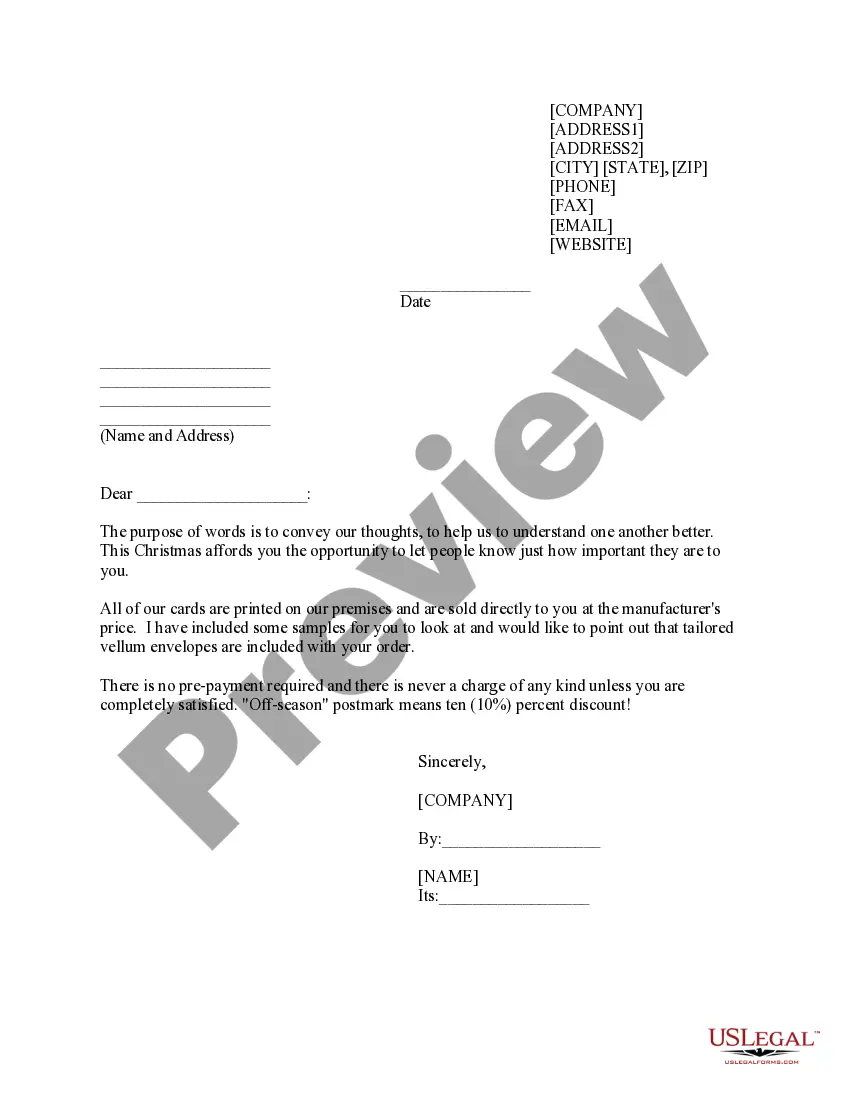

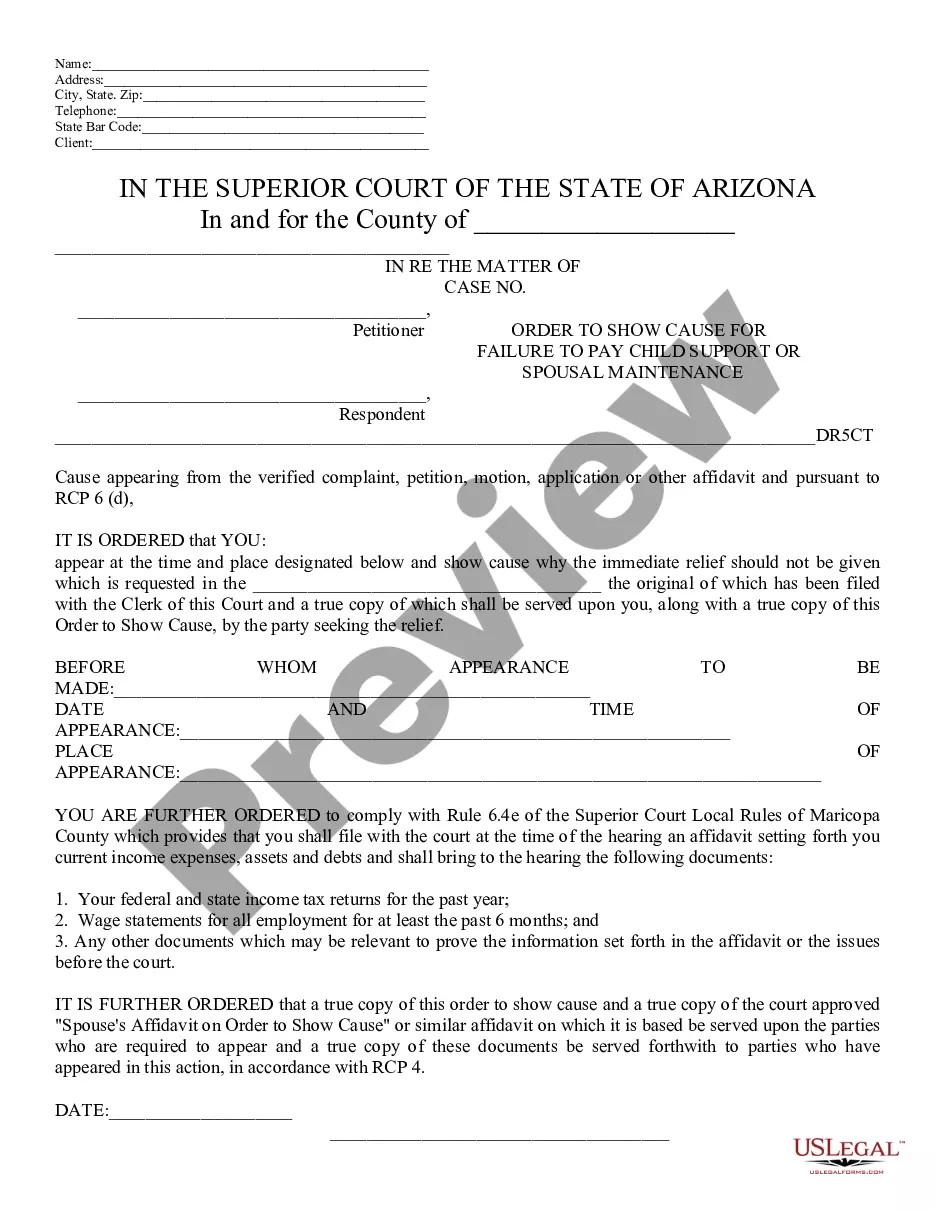

You can download or print the Colorado Purchase Order for Non-Inventory Items from the platform.

If applicable, use the Preview button to review the document format as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Colorado Purchase Order for Non-Inventory Items.

- Every legal document template you obtain is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, verify that you have chosen the correct document format for the county or town of your selection.

- Check the form details to ensure you have selected the right template.

Form popularity

FAQ

Generally, purchases that are categorized as inventory items will be included in your inventory records. However, when it comes to a Colorado Purchase Order for Non Inventory Items, these purchases do not become part of your inventory stock. Therefore, they do not appear in your inventory count, freeing up resources for tracking items that contribute directly to your sales. It's important to classify purchases correctly to maintain accurate financial reporting.

A SKU, or Stock Keeping Unit, is a unique identifier for a specific product or item in inventory, allowing businesses to track each item efficiently. On the other hand, a Purchase Order (PO) is a document created by a buyer to authorize a purchase transaction, which can include various items, both inventory and non-inventory. When dealing with a Colorado Purchase Order for Non Inventory Items, the PO serves to formalize the acquisition of goods or services that do not enter your inventory system. Understanding this difference can enhance your purchasing strategy.

Items not included in inventory typically encompass non-tangible assets and services. For instance, equipment, supplies, or consumables that are used but not stored for resale fall under non-inventory items. Additionally, items like software licenses or contracts for professional services also fit this category. When creating a Colorado Purchase Order for Non Inventory Items, it's essential to understand these distinctions to ensure proper financial and operational tracking.

When an item has no inventory, it indicates that it is not stored or tracked in the same way as traditional stock items. This typically applies to items that are purchased for immediate use or for services. Understanding this concept is crucial, especially when creating a Colorado Purchase Order for Non Inventory Items, as it impacts budgeting and financial planning for your business.

An example of a non-inventory item could be a subscription to a software service. In this case, you are not purchasing a physical product that you can hold, but rather access to a service over time. When you utilize a Colorado Purchase Order for Non Inventory Items, you can effectively manage these types of purchases while keeping your accounting accurate and transparent.

inventory purchase order (PO) is a document that authorizes the purchase of items that do not require stocking in inventory. Often used for services or onetime purchases, a Colorado Purchase Order for Non Inventory Items simplifies procurement by clearly documenting what the business intends to buy. This ensures accurate tracking and accountability for nontangible assets.

Examples of non-inventory items often include services, software, office supplies, and maintenance materials. These items are essential for operations but do not require physical storage like traditional inventory. Using a Colorado Purchase Order for Non Inventory Items allows businesses to effectively manage these essential purchases without complicating inventory management.

The main difference between inventory and non-inventory lies in how products are managed and tracked. Inventory items are goods that a business keeps on hand for sale, while non-inventory items are typically services or materials that do not require storage. When you create a Colorado Purchase Order for Non Inventory Items, you typically focus on items that are not counted as part of the stock in your warehouse, which streamlines your budgeting and purchasing process.