Colorado General Market Survey

Description

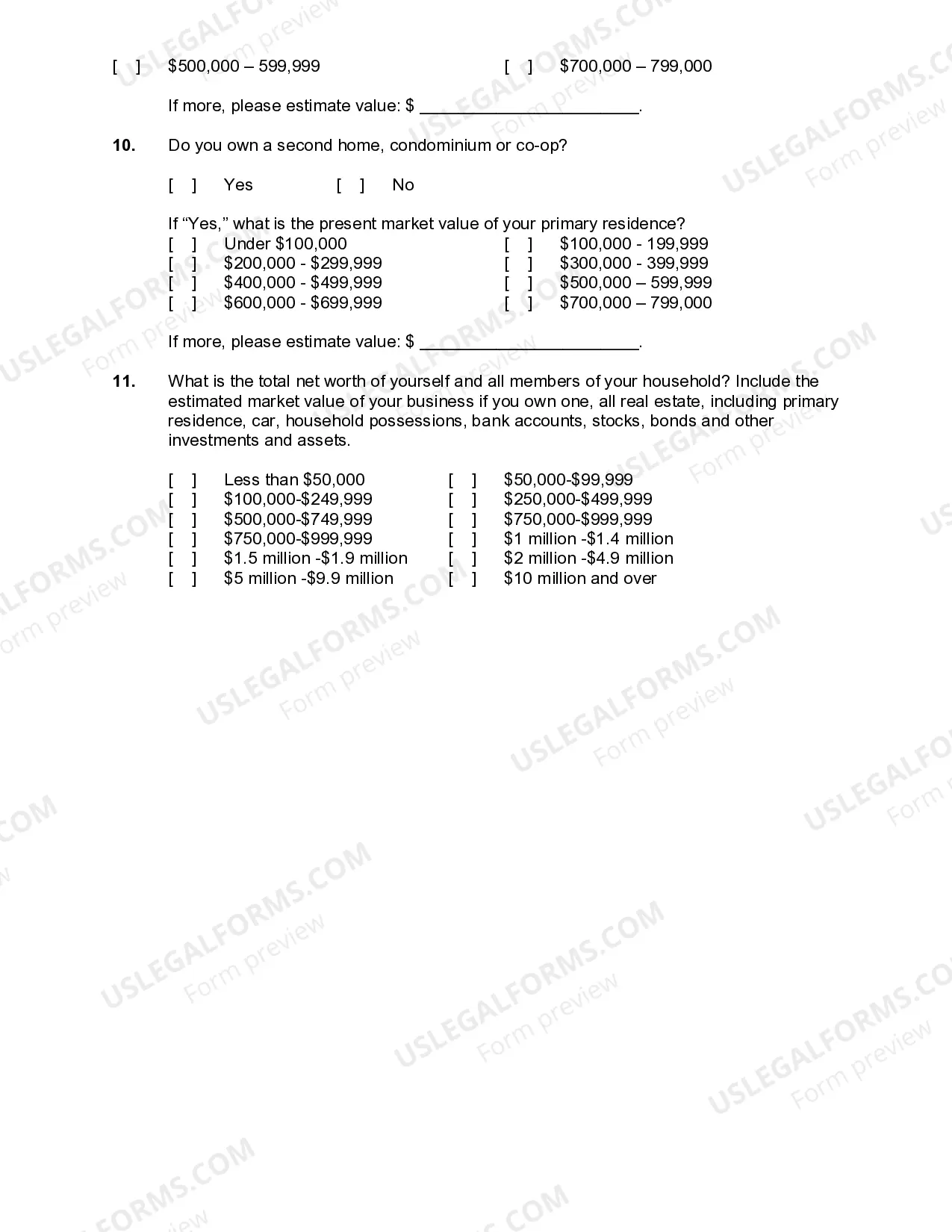

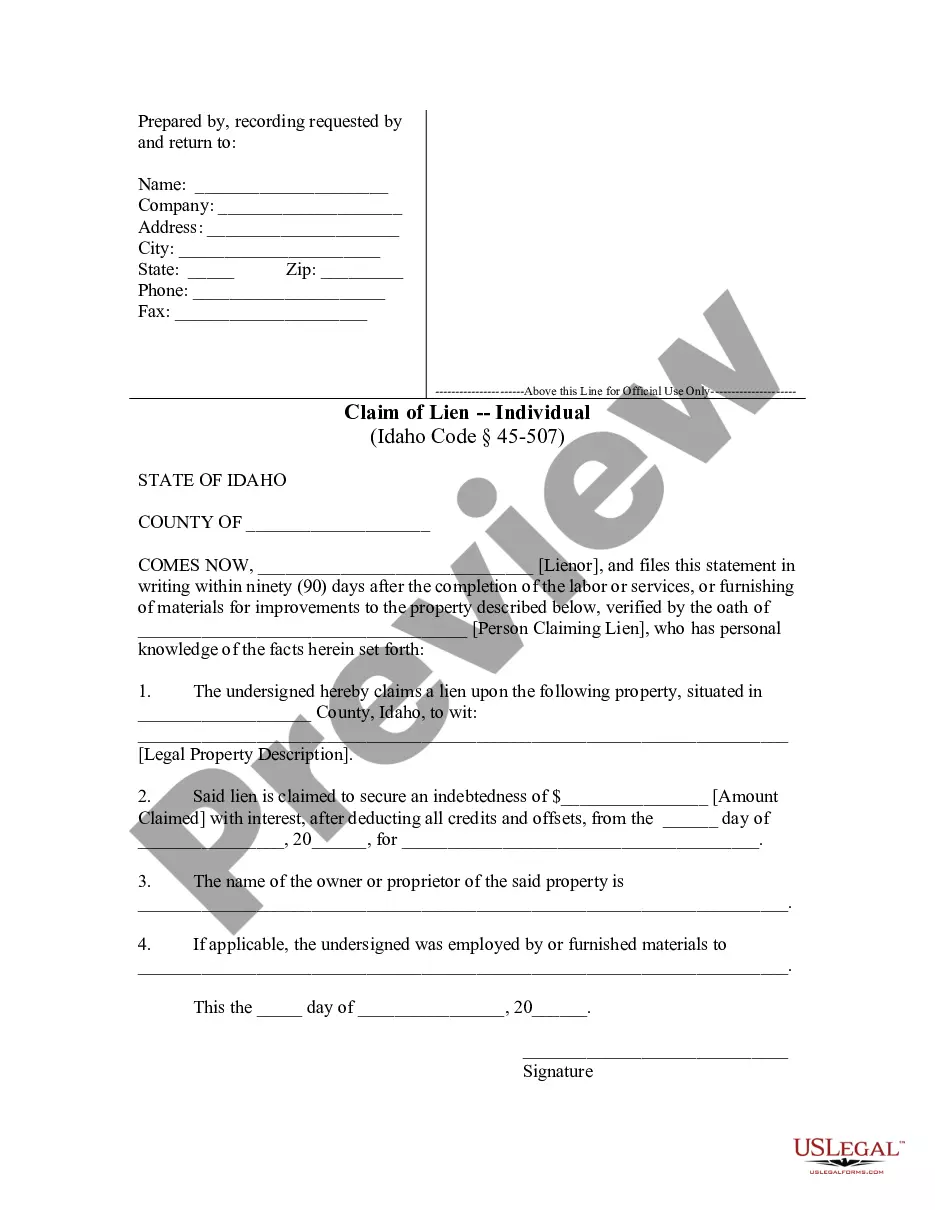

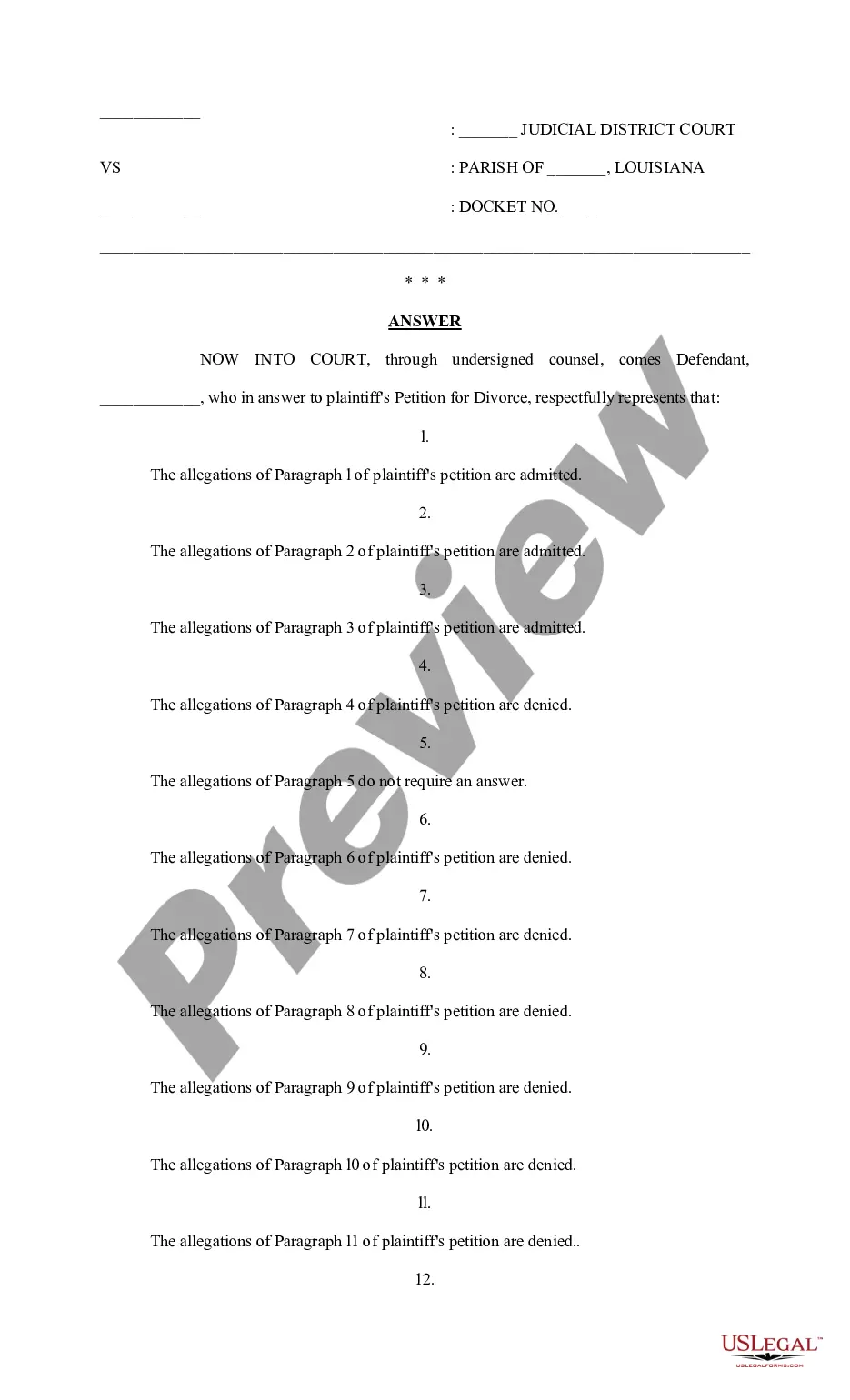

How to fill out General Market Survey?

You might spend hours online looking for the legal document template that fulfills the federal and state criteria you need.

US Legal Forms offers a vast array of legal forms that can be assessed by professionals.

It is easy to obtain or create the Colorado General Market Survey from my service.

If available, use the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can fill out, modify, print, or sign the Colorado General Market Survey.

- Every legal document template you obtain is yours indefinitely.

- To get another copy of any purchased form, visit the My documents tab and then click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/town of your choice.

- Check the form description to confirm you have chosen the right type.

Form popularity

FAQ

Unemployment rates in Colorado are generally lower than the national average, reflecting a robust job market. While some fluctuations occur, the overall trend shows stability and growth. By staying informed through the Colorado General Market Survey, you can track employment trends and understand where job opportunities are most abundant.

In many cases, conducting a survey in Colorado can be highly beneficial but is not always required. It depends on the specific context or industry you are dealing with. The Colorado General Market Survey can help you understand when a survey is necessary, providing clarity on market conditions and compliance issues.

Finding work in Colorado varies depending on your field and level of experience. Some sectors may be more challenging than others. Utilizing resources like the Colorado General Market Survey can help you identify job openings and understand the current market conditions, making your job search more effective.

Yes, Colorado has a strong job market known for its diverse economy and high employment rates. The state attracts talent due to its quality of life and business-friendly environment. By utilizing the Colorado General Market Survey, you can gain valuable insights that highlight the strengths of various industries in the state.

The job market in Colorado is quite dynamic and offers a variety of opportunities across several sectors. Many industries, such as technology, healthcare, and renewable energy, are expanding rapidly. Additionally, the Colorado General Market Survey provides insights on emerging trends and job availability, helping job seekers make informed decisions.

Individuals who have overpaid their state taxes or meet certain income criteria may receive a Colorado state tax refund. The state uses information from tax returns and other official documents to determine eligibility. The Colorado General Market Survey can help clarify how refunds are processed and who qualifies. Platforms like uslegalforms can provide guidance to ensure you understand the process and receive any refunds owed.

Eligibility for the Colorado tax rebate usually requires taxpayers to have a taxable income below a certain threshold. The rebate is designed to provide relief to individuals and families financially strained by rising costs. By understanding these criteria presented in the Colorado General Market Survey, you can ascertain your eligibility more confidently. If you have questions, uslegalforms can assist in navigating the tax rebate application.

Qualifications for sales tax exemption in Colorado often include specific types of organizations or individuals, like non-profits or government entities. Additionally, certain purchases may be exempt if they meet specific criteria outlined by the state. Knowing these qualifications can significantly benefit your financial planning as reflected in the Colorado General Market Survey. Resources like uslegalforms can help clarify the qualification process for you.

Not everyone qualifies for the Colorado sales tax refund. Eligibility typically depends on income level and filing status, alongside the specifics of your transactions. To determine your status, it's useful to review the criteria outlined in the Colorado General Market Survey. If you're unsure, resources from uslegalforms can guide you through the eligibility requirements for the sales tax refund.

The Regional Transportation District (RTD) tax in Colorado is a sales tax levied to fund public transportation systems. This tax applies to most retail transactions within the district and supports various transportation initiatives. When assessing costs in your Colorado General Market Survey, it’s important to factor in this tax. Understanding the RTD tax helps you gauge how it impacts your overall expenses.