US Legal Forms - one of the largest collections of legal templates in the United States - offers a selection of legal document formats that you can download or print.

By using the website, you can discover numerous forms for business and personal use, organized by categories, states, or keywords. You can quickly obtain the latest versions of forms such as the Colorado Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement.

If you possess a subscription, Log In to download the Colorado Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously obtained forms from the My documents tab in your account.

Process the payment. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make modifications. Fill out, edit, and print and sign the downloaded Colorado Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement. Each format you add to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Gain access to the Colorado Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement with US Legal Forms, the most comprehensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

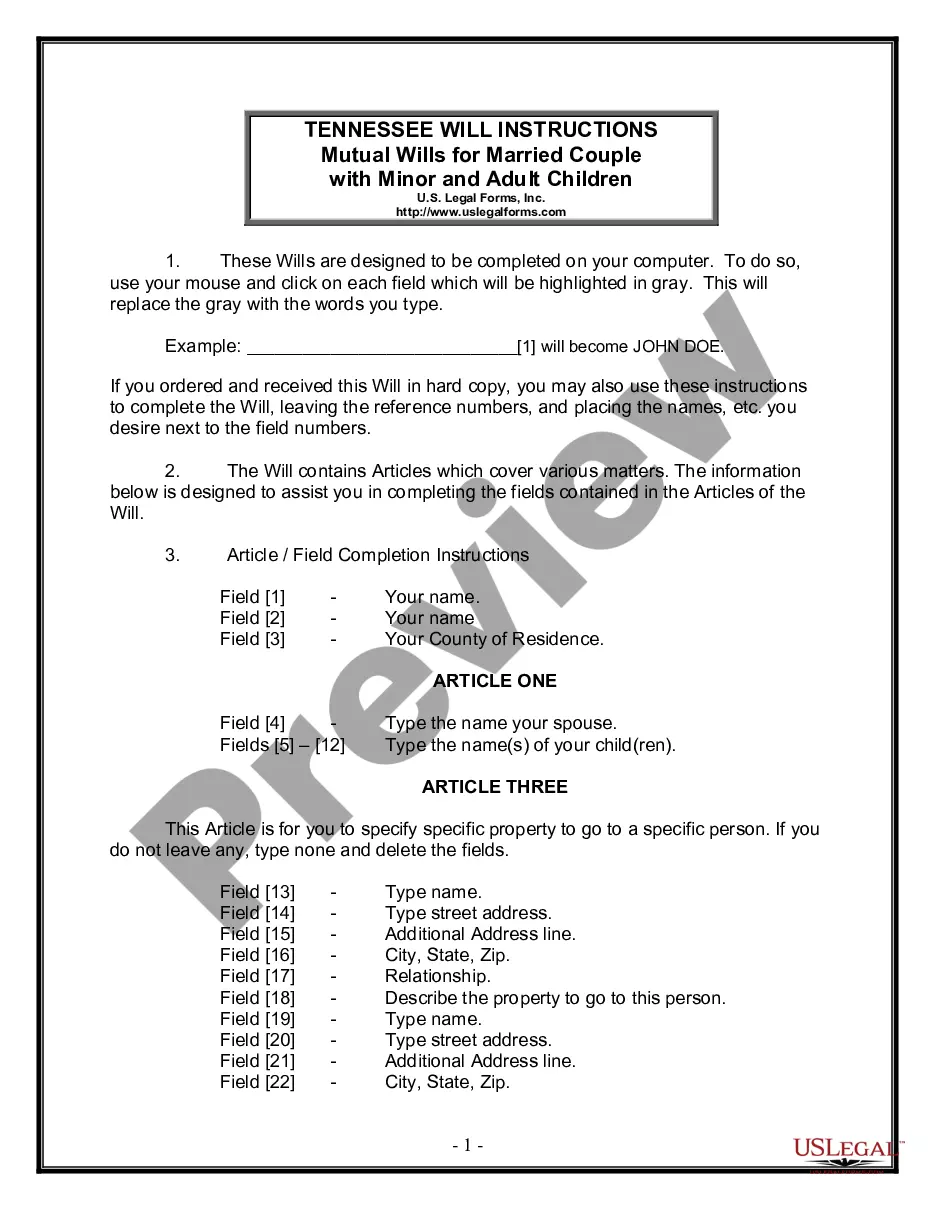

- If you're using US Legal Forms for the first time, here are simple instructions to get you started.

- Ensure you have selected the correct form for your state/region.

- Click the Review button to examine the form’s content.

- Check the form details to confirm that you have selected the appropriate form.

- If the form does not meet your needs, utilize the Search box at the top of the screen to find one that does.

- If you're satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you desire and provide your credentials to create an account.