Colorado General Form for Bill of Sale of Personal Property

Description

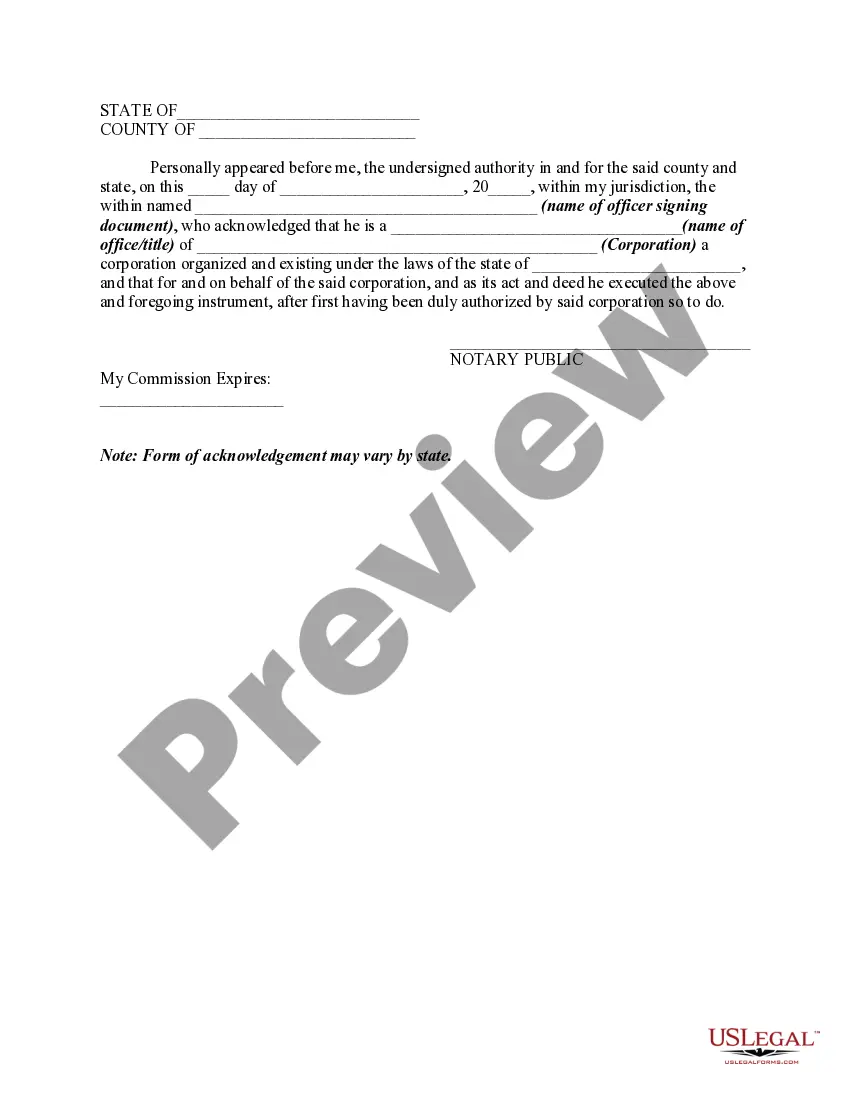

How to fill out General Form For Bill Of Sale Of Personal Property?

Selecting the appropriate approved document template may be a challenge.

It goes without saying that there are numerous templates accessible online, but how will you find the sanctioned form you require.

Utilize the US Legal Forms website. The service offers a vast array of templates, including the Colorado General Form for Bill of Sale of Personal Property, suitable for both business and personal purposes.

You can review the form using the Review option and inspect the form description to confirm it is the right one for you.

- All of the forms are reviewed by experts and comply with state and federal requirements.

- If you are already registered, Log In to your account and then click the Download button to access the Colorado General Form for Bill of Sale of Personal Property.

- Use your account to search for the legal forms you have previously purchased.

- Visit the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

- First, ensure you have selected the correct form for your area/state.

Form popularity

FAQ

To obtain a Colorado General Form for Bill of Sale of Personal Property, you can visit legal websites like US Legal Forms. These platforms provide easy access to customizable and state-specific forms. You can download, print, and fill out the form needed for your transaction in just a few minutes. Additionally, using a reliable service ensures that your document meets all local legal requirements.

In Colorado, you can legally drive a vehicle with just a bill of sale for a temporary period, typically up to 60 days, before you must obtain proper registration. The Colorado General Form for Bill of Sale of Personal Property serves as a valuable document during this time, providing proof of ownership and your right to operate the vehicle. It is important to apply for registration promptly to avoid any legal complications. Always carry the bill of sale with you while driving to avoid issues if stopped by law enforcement.

In Colorado, a notarized bill of sale is not a legal requirement for most transactions involving personal property. However, utilizing the Colorado General Form for Bill of Sale of Personal Property can offer extra protection and clarity in your agreement. Having the document notarized can also help in situations involving disputes or providing further legitimacy. It is always good to check with local authorities when in doubt.

Yes, you need a bill of sale to register a trailer in Colorado. This document serves as proof of ownership and is required for proper registration with the state. Using the Colorado General Form for Bill of Sale of Personal Property simplifies this process, providing clear evidence of the transaction.

Absolutely, you can write your own bill of sale in Colorado. It allows you to customize the document to fit your specific needs and circumstances. Nonetheless, incorporating the components of the Colorado General Form for Bill of Sale of Personal Property is advisable to ensure compliance with state laws and protect your interests.

Property tax rates in Colorado vary by county, but on average, the residential property tax rate is around 0.5% to 1.0% of the property's assessed value. It's essential to check specific rates in your area, as they can influence your financial planning. When buying or selling property, having a Colorado General Form for Bill of Sale of Personal Property can clarify ownership and obligations, potentially affecting tax assessments.

In Colorado, personal property refers to movable items that are not permanently attached to land or buildings. This can include furniture, vehicles, equipment, and other tangible goods. Understanding what constitutes personal property is important, especially when dealing with transactions. A Colorado General Form for Bill of Sale of Personal Property can help formalize the sale of these items.