New Jersey Notice of Adverse Action - Non-Employment - Due to Credit Report

Description

How to fill out Notice Of Adverse Action - Non-Employment - Due To Credit Report?

You can spend countless hours online searching for the official document format that meets federal and state requirements. US Legal Forms offers a vast array of official templates that can be reviewed by professionals.

You can obtain or print the New Jersey Notice of Adverse Action - Non-Employment - Due to Credit Report from their service.

If you already have a US Legal Forms account, you can Log In and click the Download button. After that, you can complete, modify, print, or sign the New Jersey Notice of Adverse Action - Non-Employment - Due to Credit Report. Every official document template you acquire belongs to you indefinitely.

Complete the transaction. You can use your credit card or PayPal account to purchase the official form. Select the format of the document and download it to your device. Make modifications to your document if needed. You can complete, edit, sign, and print the New Jersey Notice of Adverse Action - Non-Employment - Due to Credit Report. Download and print numerous document templates using the US Legal Forms website, which offers the largest collection of official forms. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document format for the jurisdiction/location you choose. Review the form description to confirm you have selected the appropriate form.

- If available, use the Preview button to view the document format as well.

- If you wish to get an additional version of the form, use the Search section to find the format that fits your needs and requirements.

- Once you have found the format you want, click Purchase now to proceed.

- Choose the pricing plan you prefer, enter your details, and create an account on US Legal Forms.

Form popularity

FAQ

A creditor must notify the applicant of adverse action within: 30 days after receiving a complete credit application. 30 days after receiving an incomplete credit application. 30 days after taking action on an existing credit account.

The notice must either disclose the applicant's right to a statement of specific reasons within 30 days, or give the primary reasons each creditor relied upon in taking the adverse action - clearly indicating which reasons relate to which creditor.

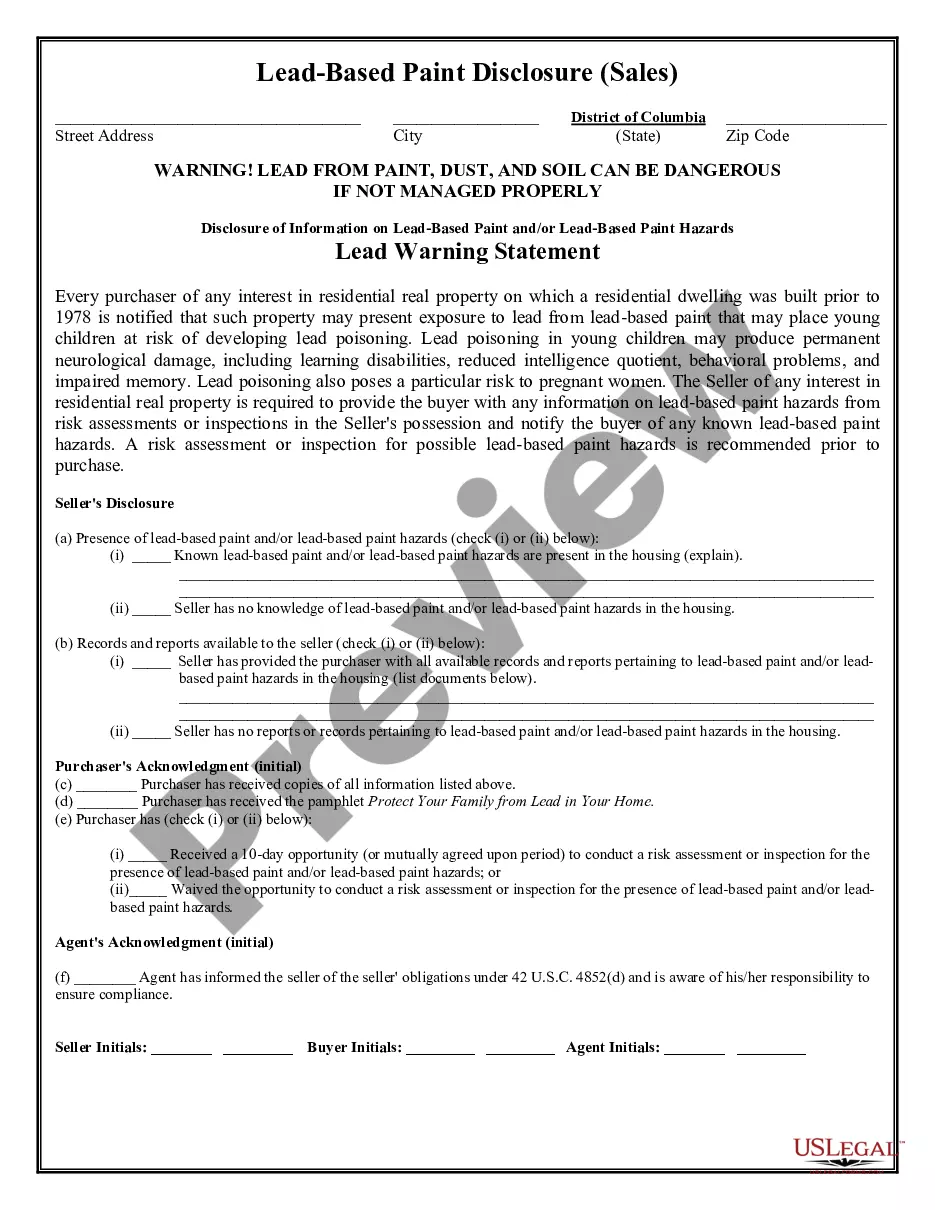

An adverse action notice is an explanation that issuers must give you if you're denied credit or if you're given less favorable financing terms based on your credit history. You may also get an adverse action notice if your credit is a reason an employer turns you down for a job.

A creditor must notify the applicant of adverse action within: 30 days after receiving a complete credit application. 30 days after receiving an incomplete credit application. 30 days after taking action on an existing credit account.

An adverse action notice will not hurt your credit score or show up on your credit report. However, if the creditor pulls a hard credit inquiry, this may temporarily lower your scoreand all hard inquiries remain on your credit report for two years.

The following are examples of adverse actions employers might take: discharging the worker; demoting the worker; reprimanding the worker; committing harassment; creating a hostile work environment; laying the worker off; failing to hire or promote a worker; blacklisting the worker; transferring the worker to another

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

The FCRA requires agencies to remove most negative credit information after seven years and bankruptcies after seven to 10 years, depending on the kind of bankruptcy. Restrictions around who can access your reports.

It must include information about the credit bureau used, an explanation of the specific reasons for the adverse action, a notice of the consumer's right to a free credit report and to dispute its accuracy and the consumer's credit score.

In finance, the term "adverse action" refers to a type of notice given by a lender when a borrower's credit application has been denied.