New Mexico Notice of Adverse Action - Non-Employment - Due to Credit Report

Description

How to fill out Notice Of Adverse Action - Non-Employment - Due To Credit Report?

Are you in a scenario where you frequently require documents for either business or personal reasons.

There are many legitimate document templates available on the internet, but locating trustworthy ones can be challenging.

US Legal Forms provides thousands of form templates, including the New Mexico Notice of Adverse Action - Non-Employment - Due to Credit Report, designed to meet state and federal requirements.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased from the My documents menu. You can download an additional copy of the New Mexico Notice of Adverse Action - Non-Employment - Due to Credit Report at any time, if necessary. Just click on the requested form to download or print the document template. Use US Legal Forms, the largest collection of legal forms, to save time and avoid errors. The service offers properly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the New Mexico Notice of Adverse Action - Non-Employment - Due to Credit Report template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and verify that it is for your correct area/region.

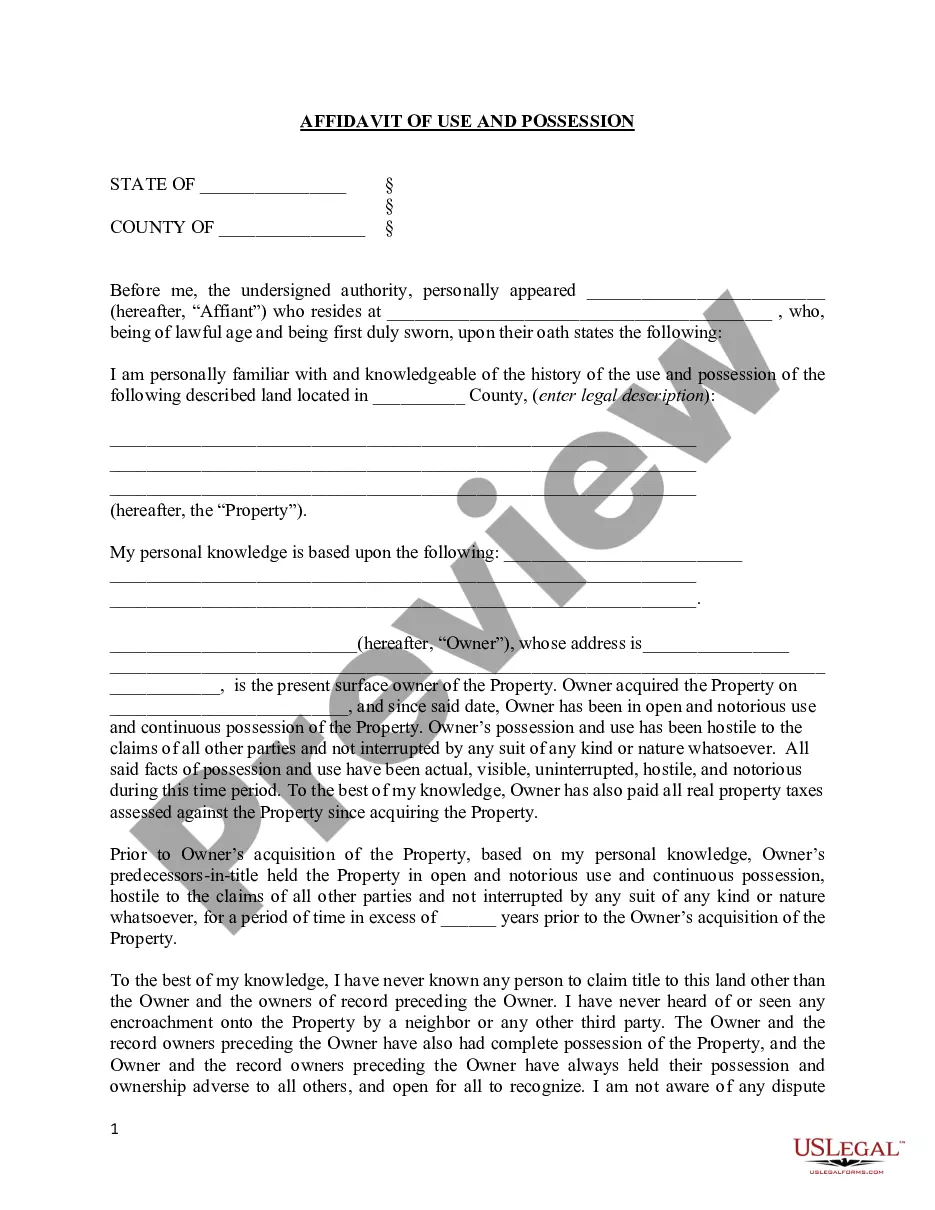

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the right form.

- If the form does not meet your needs, use the Search field to find the form that suits you and your requirements.

- Once you find the appropriate form, click Acquire now.

- Select the payment plan you prefer, fill in the needed information to create your account, and complete your purchase using PayPal or credit card.

Form popularity

FAQ

Continue with the hire or take adverse action Taking adverse action is regrettable for both the organization and the candidate, but eventually you'll need to decide to rescind your job offer or proceed with hiring.

They can't see your credit score or any account numbers. They cannot see information that would violate equal employment laws, such as date of birth or marital status. They can only see your payment record (on-time and late payments), the total amount you owe and your available credit.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

Yes, you can be denied a job because of bad credit in 39 states and the District of Columbia, while 11 states ban the practice in most cases. But all 11 states have exceptions, most of which concern being hired to jobs that involve finance or looking at credit late in the hiring process (such as after an interview).

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

A creditor must notify the applicant of adverse action within: 30 days after receiving a complete credit application. 30 days after receiving an incomplete credit application. 30 days after taking action on an existing credit account.

Yes, you can be denied a job because of bad credit in 39 states and the District of Columbia, while 11 states ban the practice in most cases. But all 11 states have exceptions, most of which concern being hired to jobs that involve finance or looking at credit late in the hiring process (such as after an interview).

It must include information about the credit bureau used, an explanation of the specific reasons for the adverse action, a notice of the consumer's right to a free credit report and to dispute its accuracy and the consumer's credit score.

Banks and other financial institutions use credit scores to determine if you meet their criteria for a loan or a credit card. However, a credit score is used for more than financial matters; it may also be used to determine if you qualify for a job. It is possible to be denied a job because of bad credit.

There is no requirement that the lender have it signed. It is advantageous to have a point of contact listed, by name or department. But a signature is not required.