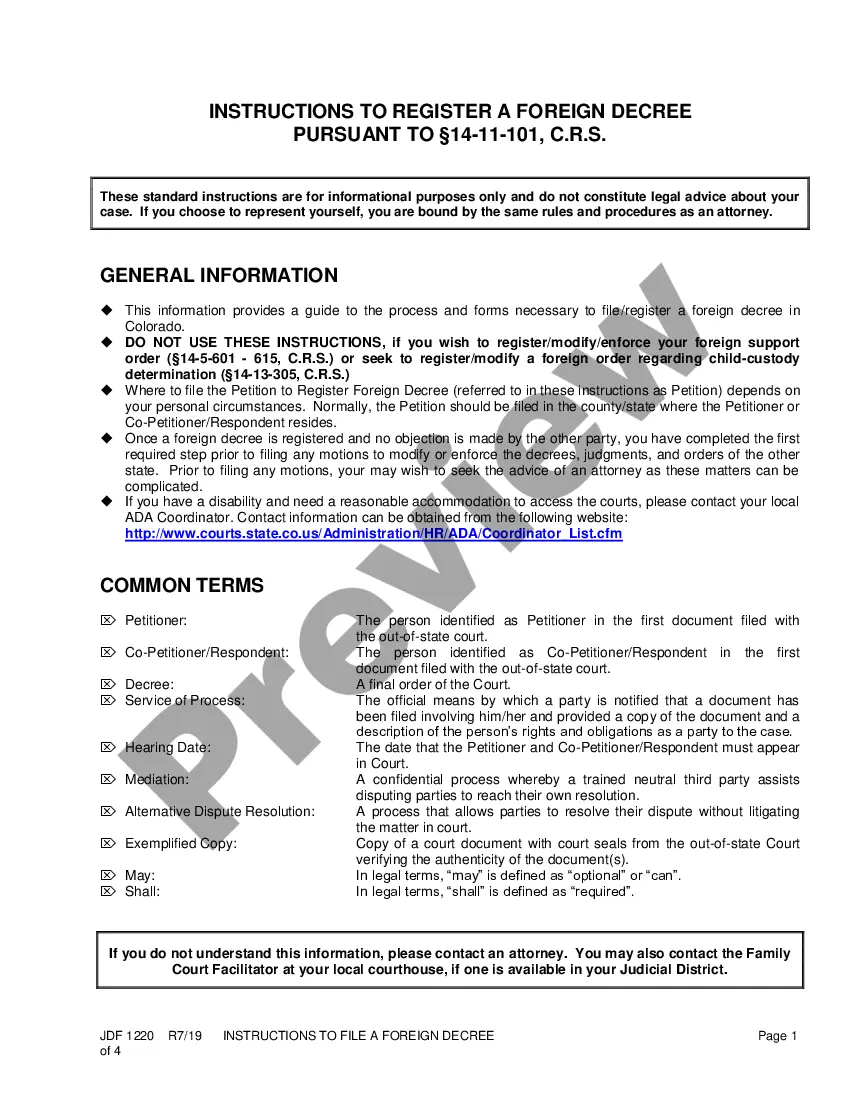

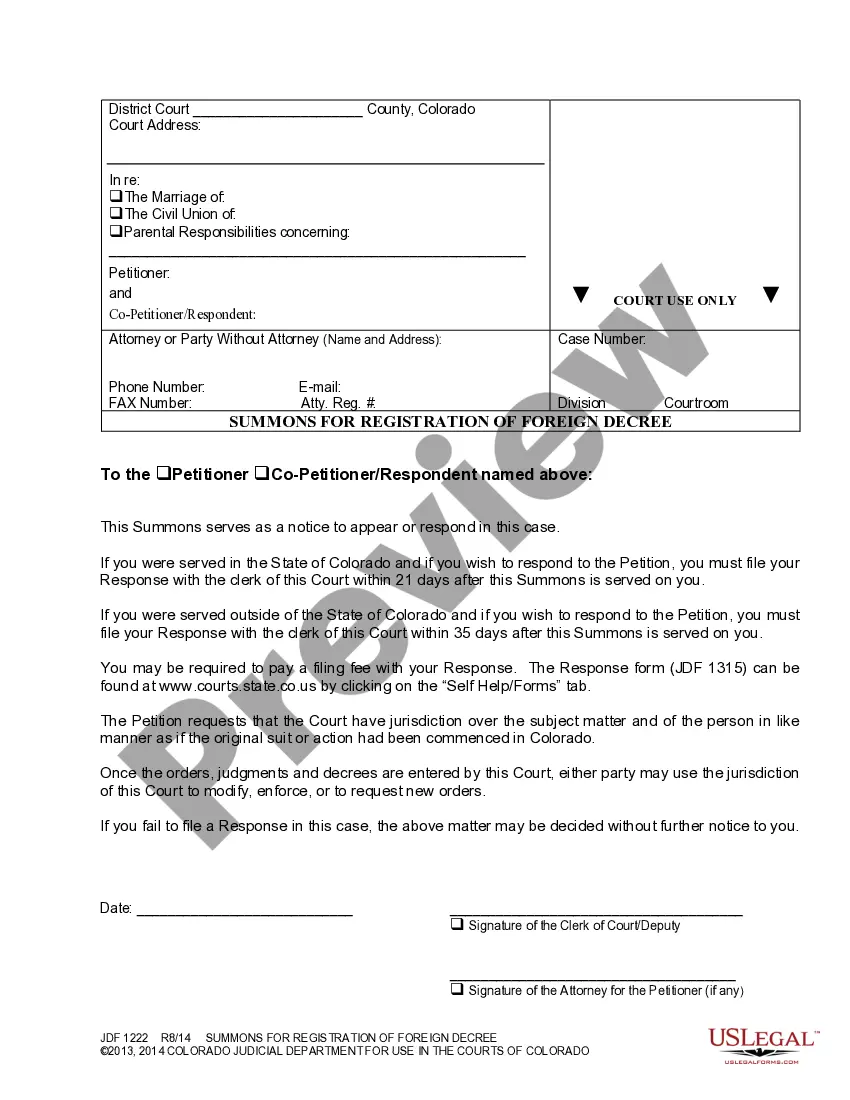

Petition to Register Foreign Decree: This is an official form from the Colorado State Judicial Branch, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Colorado statutes and law.

Colorado Petition to Register Foreign Decree

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Colorado Petition To Register Foreign Decree?

The greater the number of documents you need to produce - the more anxious you become.

You can find a vast collection of Colorado Petition to Register Foreign Decree samples online, however, you are uncertain which ones to trust.

Eliminate the stress and simplify the process of acquiring templates using US Legal Forms. Obtain professionally prepared forms that are created to meet state requirements.

Provide the required information to create your account and pay for your order via PayPal or credit card. Choose a preferred file format and obtain your copy. Access each document you gather in the My documents section. Simply navigate there to complete a new copy of your Colorado Petition to Register Foreign Decree. Even when utilizing professionally crafted templates, it’s essential to consider consulting a local attorney to verify that your document is accurately completed. Accomplish more for less with US Legal Forms!

- If you already have a subscription to US Legal Forms, Log In to your account, and you'll see the Download button on the Colorado Petition to Register Foreign Decree’s page.

- If you haven't used our platform before, complete the registration process by following these steps.

- Make sure the Colorado Petition to Register Foreign Decree is applicable in your state.

- Verify your choice by reviewing the description or by utilizing the Preview feature if available for the selected document.

- Click Buy Now to initiate the registration process and select a pricing plan that meets your needs.

Form popularity

FAQ

A Foreign LLC is not an LLC that is formed outside of the United States. The requirement to file for a Foreign LLC is usually to expand one's business operations or to open an additional retail or brick-and-mortar location in a new state.

There are no citizenship or residence requirements for ownership of a C Corporation or an LLC. The S Corporation however does not allow nonresident aliens to be shareholders (owner), but any US citizen or resident alien may be a shareholder (owner).

Foreign corporation is a term used in the United States to describe an existing corporation (or other type of corporate entity, such as a limited liability company or LLC) that conducts business in a state or jurisdiction other than where it was originally incorporated.

To register the foreign LLC, you will need the information from the Articles of Organization and you will need a copy of the official LLC document from the state. Next, determine if you are "doing business" in another state and are thus required to register as a foreign LLC in that state.

To register a foreign LLC in Colorado, you must file a Statement of Foreign Entity Authority with the Colorado Secretary of State. The Statement of Foreign Entity Authority costs $100 to file and it must be filed online on the secretary of state's website. All foreign entities must have a registered agent in Colorado.

Yes, a US LLC can be owned entirely by foreign persons.United States Tax laws require that foreigners pay taxes on any earnings made in the United States. Regardless of immigration status, the United States will allow foreigners to form a company as long as they have registered for a Taxpayer Identification Number.