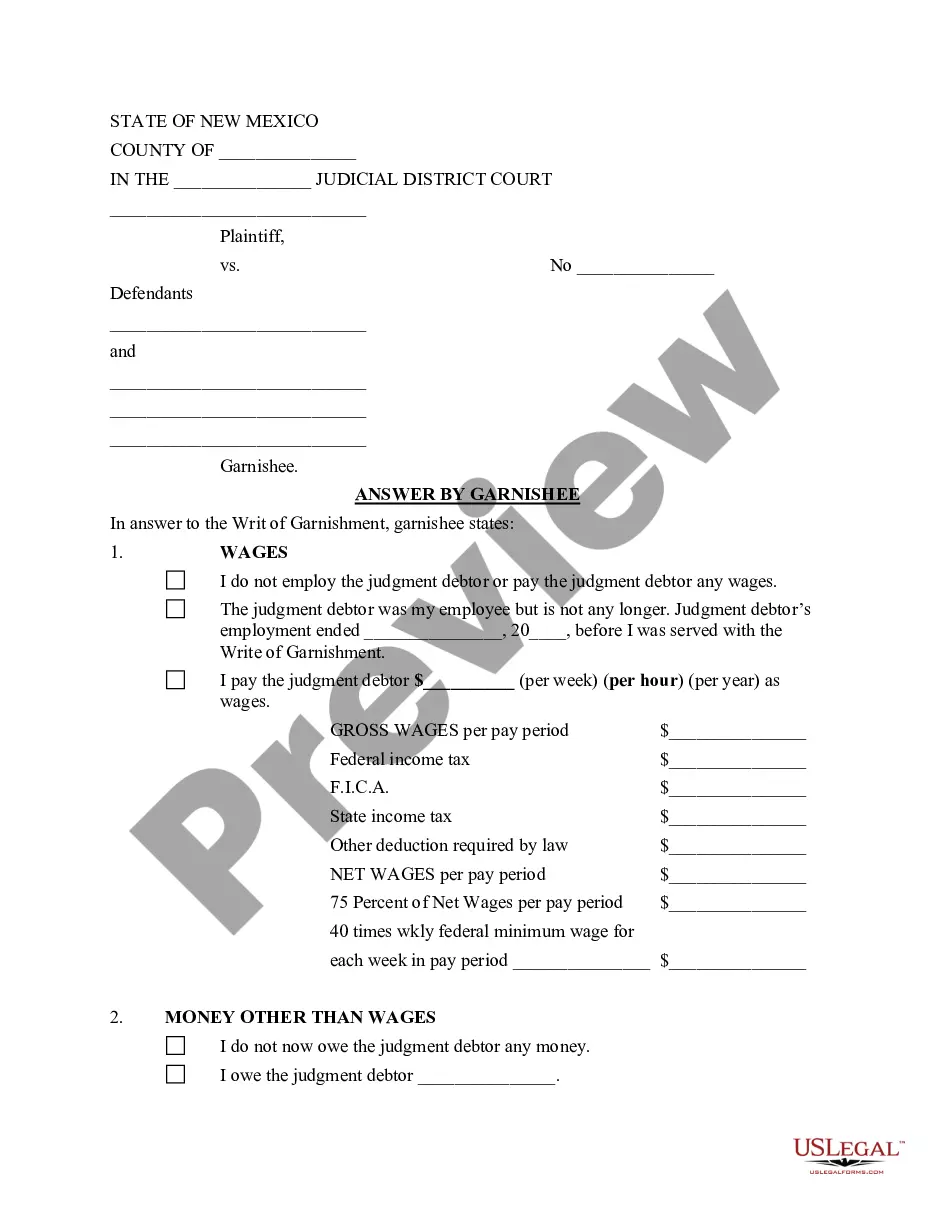

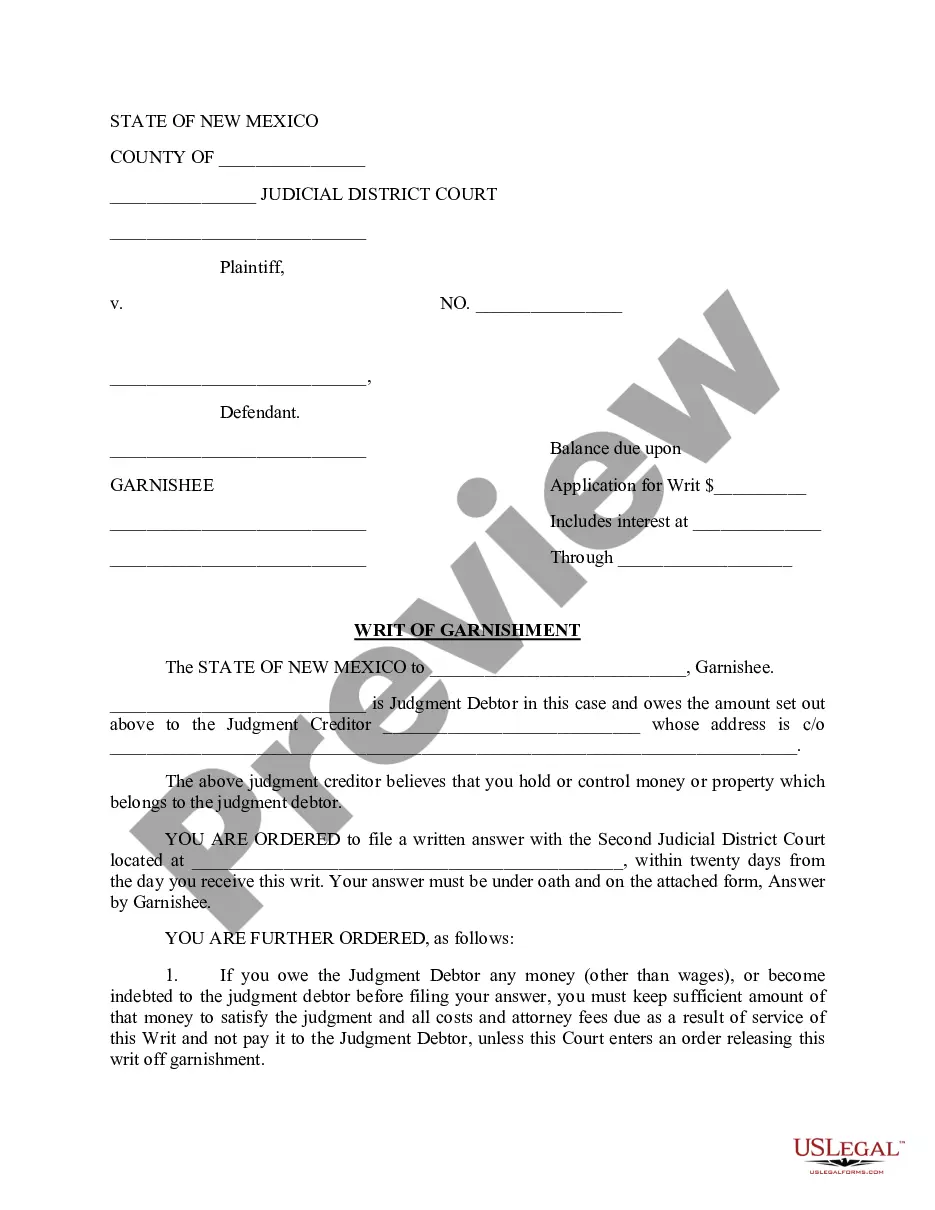

New Mexico Answer by Garnishee

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New Mexico Answer By Garnishee?

US Legal Forms is a unique system where you can find any legal or tax template for filling out, such as New Mexico Answer by Garnishee. If you’re tired of wasting time looking for ideal samples and paying money on record preparation/attorney service fees, then US Legal Forms is precisely what you’re trying to find.

To experience all of the service’s advantages, you don't need to install any application but simply choose a subscription plan and sign up your account. If you already have one, just log in and get a suitable sample, download it, and fill it out. Saved documents are kept in the My Forms folder.

If you don't have a subscription but need to have New Mexico Answer by Garnishee, check out the guidelines listed below:

- make sure that the form you’re looking at applies in the state you want it in.

- Preview the form and read its description.

- Click Buy Now to access the sign up page.

- Choose a pricing plan and proceed signing up by entering some info.

- Select a payment method to complete the sign up.

- Save the document by selecting the preferred file format (.docx or .pdf)

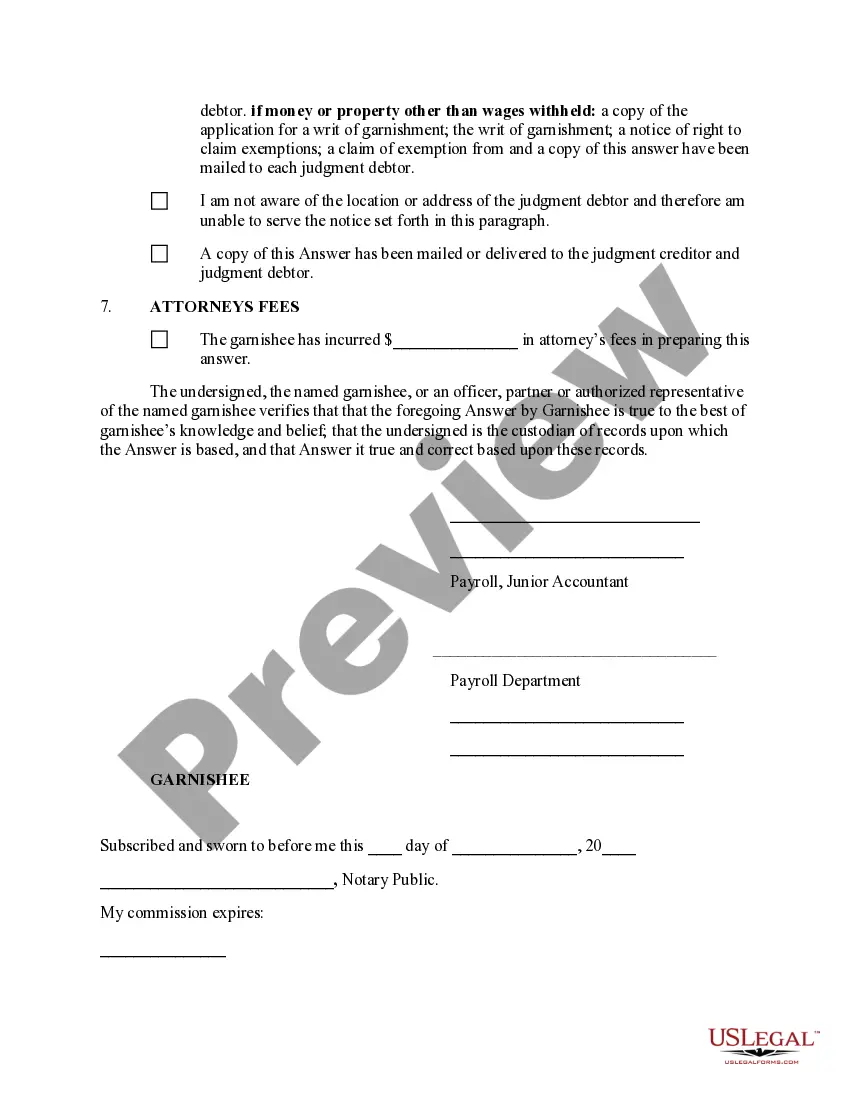

Now, fill out the file online or print out it. If you feel unsure regarding your New Mexico Answer by Garnishee sample, speak to a attorney to examine it before you decide to send or file it. Get started hassle-free!

Form popularity

FAQ

Any person identified as a dependent by an Order of the Court; Any child of the debtor who is under 18 years of age & lives with the debtor; The spouse or adult interdependent partner of the debtor; or.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

It releases your garnishment! When a creditor sues you, they eventually get a judgment in court. With this judgment, they can send a letter to your employer so that they can garnish your wages.A release of garnishment would stop any future garnishments.

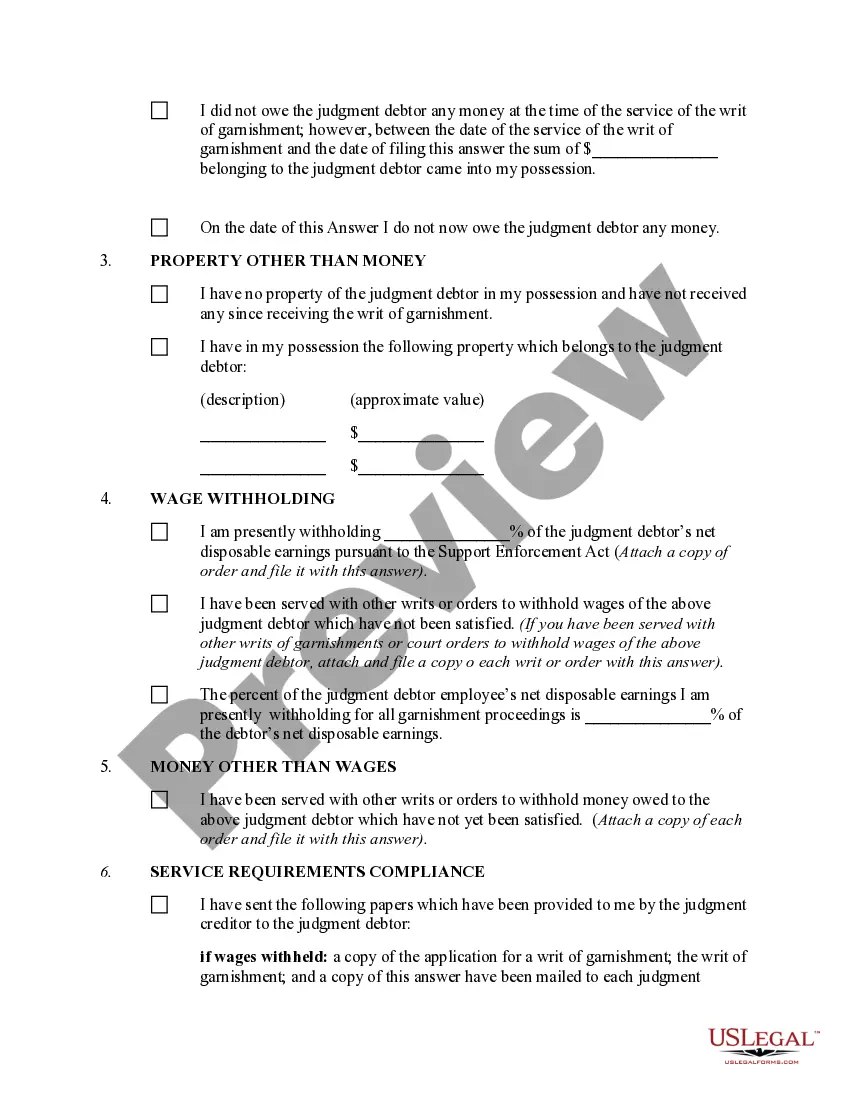

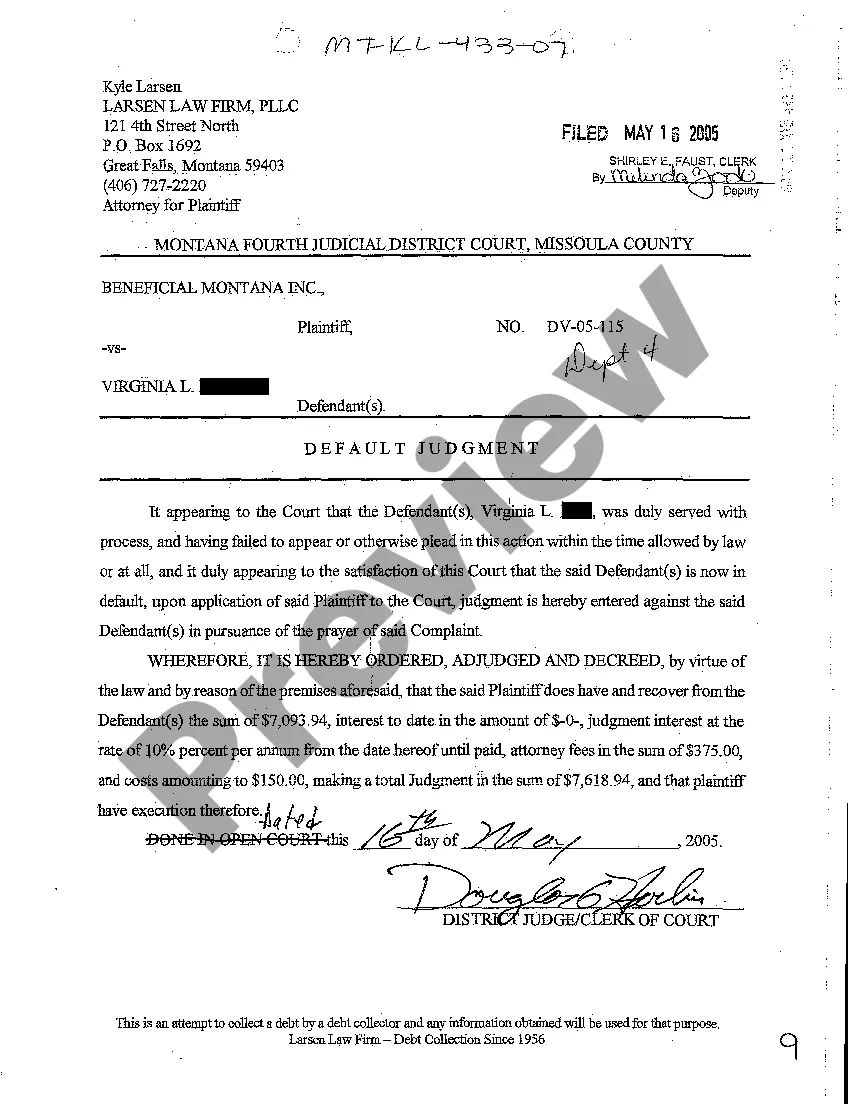

An individual who holds money or property that belongs to a debtor subject to an attachment proceeding by a creditor. For example, when an individual owes money but has for a source of income only a salary, a creditor might initiate Garnishment proceedings.

A garnishee order is a common form of enforcing a judgment debt against a creditor to recover money. Put simply, the court directs a third party that owes money to the judgement debtor to instead pay the judgment creditor. The third party is called a 'garnishee'.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

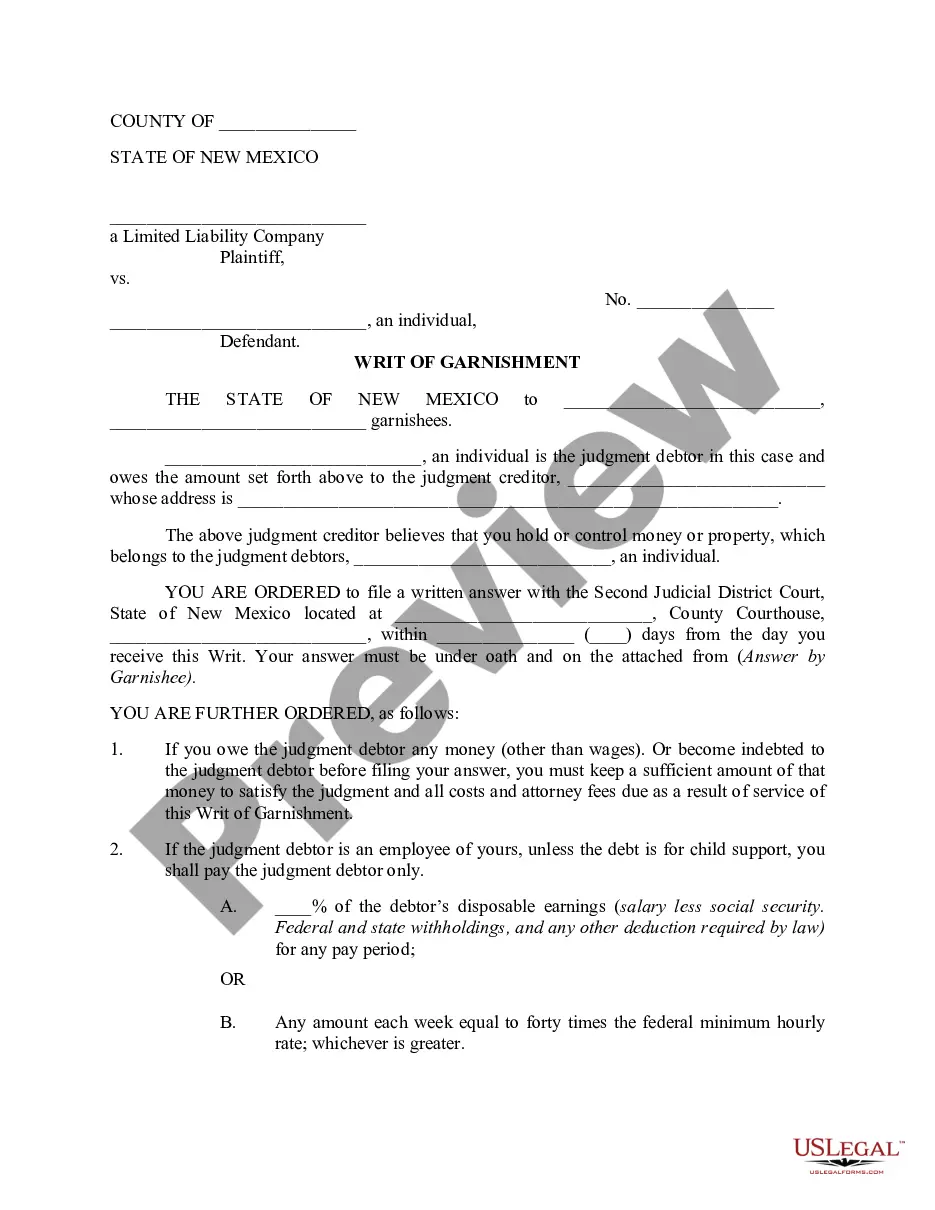

A court may order a garnishment to help a successful plaintiff collect money damages from a defendant. A garnishment order instructs a third-party who owes money to the defendant to pay some or all of that money to the plaintiff instead of the the defendant. This third party is called a "garnishee."

It releases your garnishment! When a creditor sues you, they eventually get a judgment in court. With this judgment, they can send a letter to your employer so that they can garnish your wages.A release of garnishment would stop any future garnishments.

Wage garnishment is a legal procedure in which a person's earnings are required by court order to be withheld by an employer for the payment of a debt such as child support.

When a creditor obtains a writ of garnishment, the employer is the garnishee and the creditor is the garnishor.In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.