California Owner Financing Contract for Car

Description

How to fill out Owner Financing Contract For Car?

Are you in a location where you require paperwork for both business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding ones you can rely on is challenging.

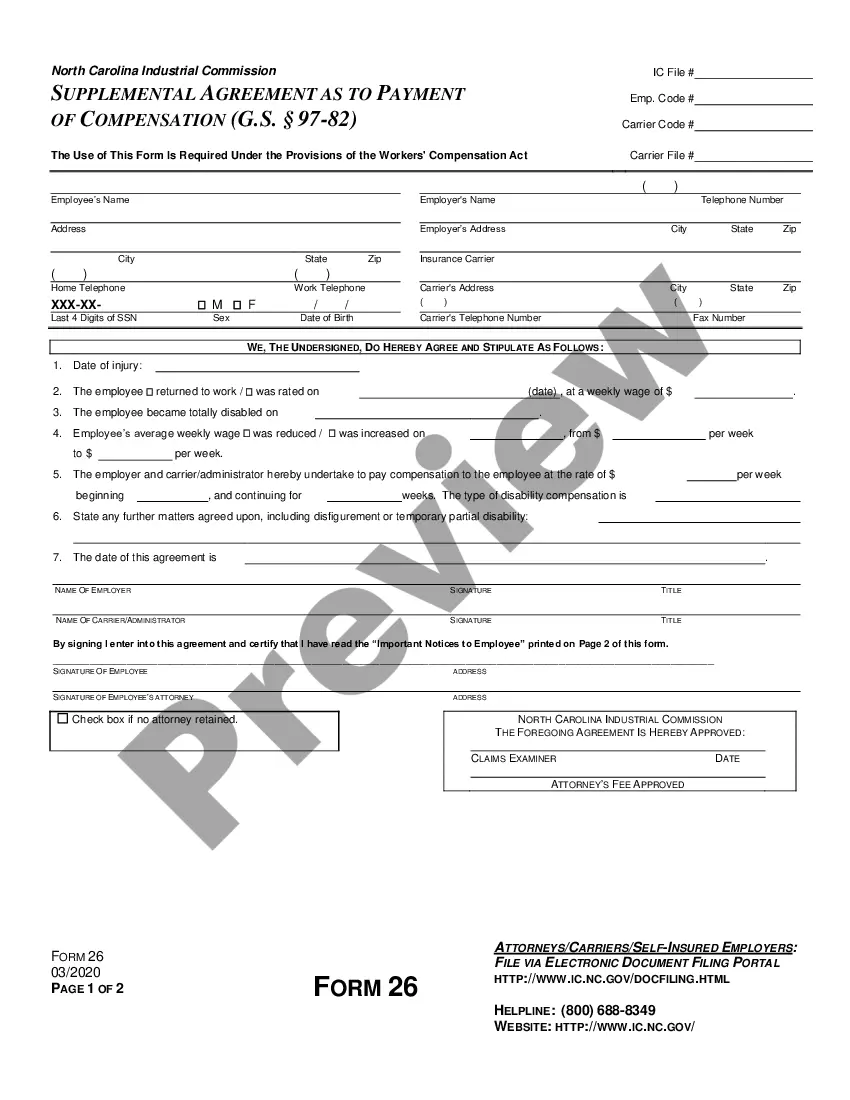

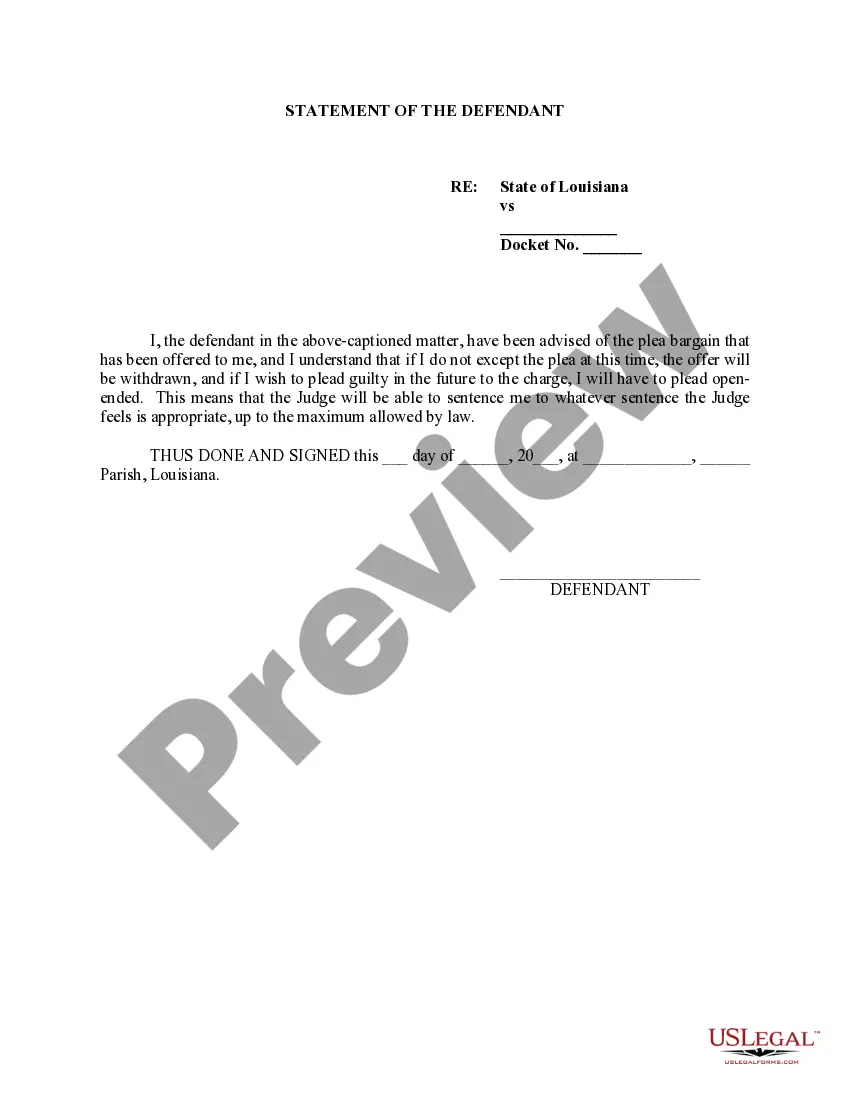

US Legal Forms offers thousands of form templates, such as the California Owner Financing Agreement for Vehicle, which can be tailored to fulfill federal and state regulations.

Once you find the appropriate form, click on Get now.

Select the pricing plan you prefer, provide the required information to create your account, and pay for your order using PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the California Owner Financing Agreement for Vehicle template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is designed for the correct city/area.

- Utilize the Preview button to review the form.

- Check the details to confirm that you have selected the right template.

- If the form is not what you are seeking, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

Owner financing can benefit both buyers and sellers by simplifying the transaction process. Buyers often appreciate the flexibility it offers, especially if they have trouble securing traditional financing. Additionally, sellers can attract more potential buyers and retain more control over the sale, all of which is clearly laid out in a California Owner Financing Contract for Car.

There are several types of owner financing options available to buyers and sellers. The most common include the land contract, lease option, and various installment sale agreements. Each is typically detailed in a California Owner Financing Contract for Car, outlining specific terms and payment structures.

The downside of owner financing can include higher interest rates compared to traditional lenders and the risk of default by the buyer. Additionally, the seller may have to manage the paperwork and legal aspects of the financing agreement. To mitigate risks, ensure you have a thorough California Owner Financing Contract for Car that protects both parties.

Setting up owner financing in California typically requires an agreement between the buyer and seller on key financing terms. Once both parties reach a consensus, a formal contract should be drafted to record these terms. Using US Legal Forms can greatly assist in this process, offering templates that comply with California laws.

To set up a California Owner Financing Contract for Car, both the buyer and seller should start by discussing and agreeing on the financing terms. Next, it is essential to draft a formal contract that outlines these terms, including payment details and responsibilities. Utilizing a platform like US Legal Forms can simplify this process, ensuring all legal requirements are met.

Typical terms for a California Owner Financing Contract for Car often include a down payment, interest rate, and repayment schedule. Buyers typically make monthly payments over a set period, which can range from one to several years. It is crucial for both parties to agree on these terms in writing to avoid misunderstandings.

The owner finance contract for a car outlines the agreement between the buyer and seller regarding payment terms, interest rates, and conditions of ownership. It serves as a legal document that details the responsibilities of both parties in this financial arrangement. Understanding the intricacies of this contract ensures that both buyers and sellers are protected throughout the transaction.

Owner financing carries certain risks that both parties need to consider. Buyers might struggle with installment payments, leading to potential repossession of the vehicle. Similarly, sellers could face the challenge of buyers defaulting on payments, which may require legal action to recover the asset.

Owner financing can be a beneficial option for both buyers and sellers when considering a California Owner Financing Contract for Car. It allows buyers to bypass traditional financing hurdles and enables sellers to widen their pool of potential customers. However, buyers should ensure they fully understand the terms, while sellers must assess the risks involved before proceeding.

Owner financing can be set up by the seller of the vehicle who wishes to provide financing options to potential buyers. Sellers often work with legal professionals to create a solid California Owner Financing Contract for Car that meets their needs. Engaging platforms like uslegalforms can also help streamline the process and ensure all terms are appropriate and legally binding.