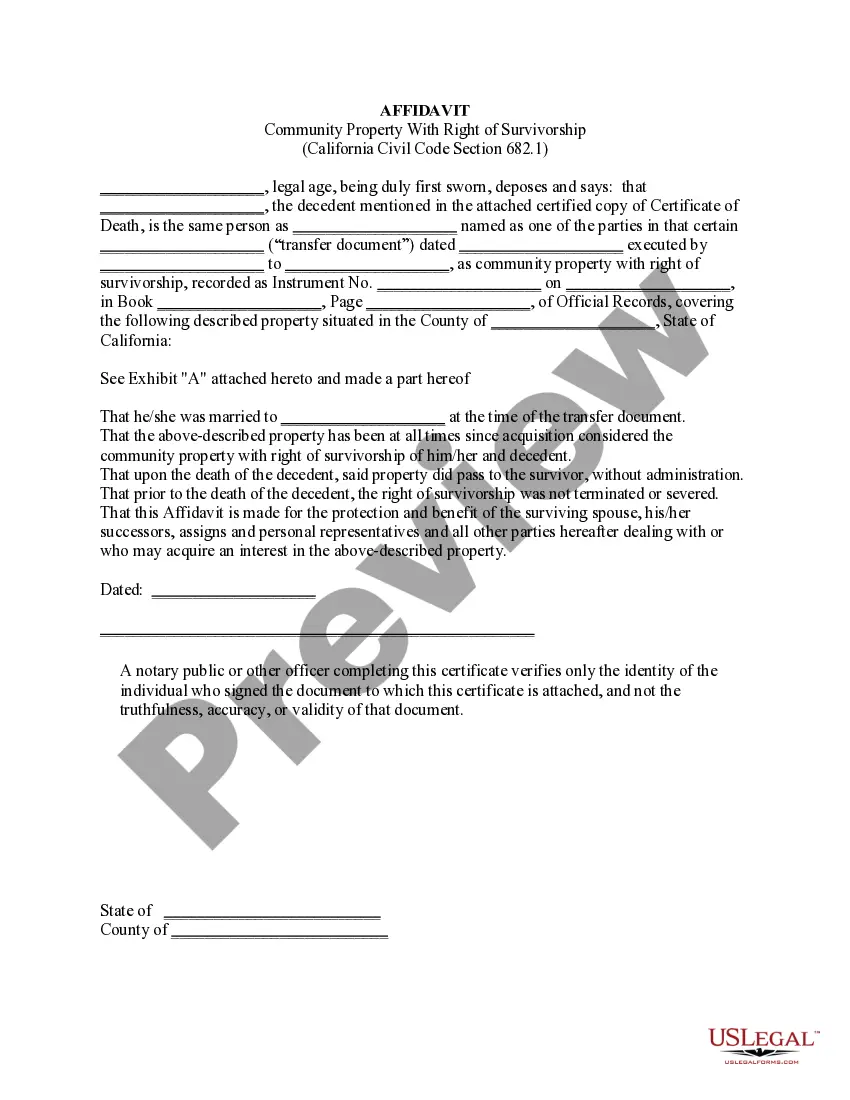

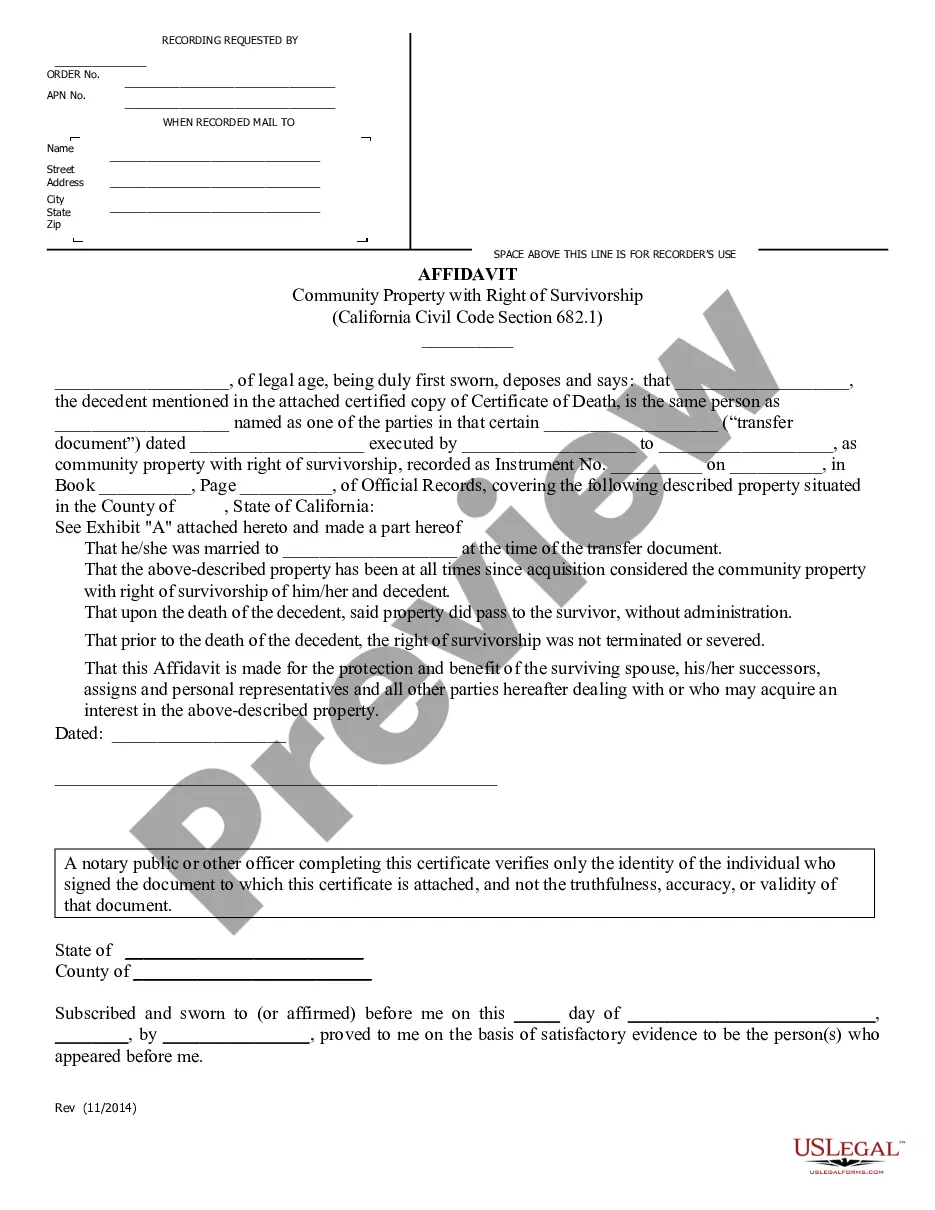

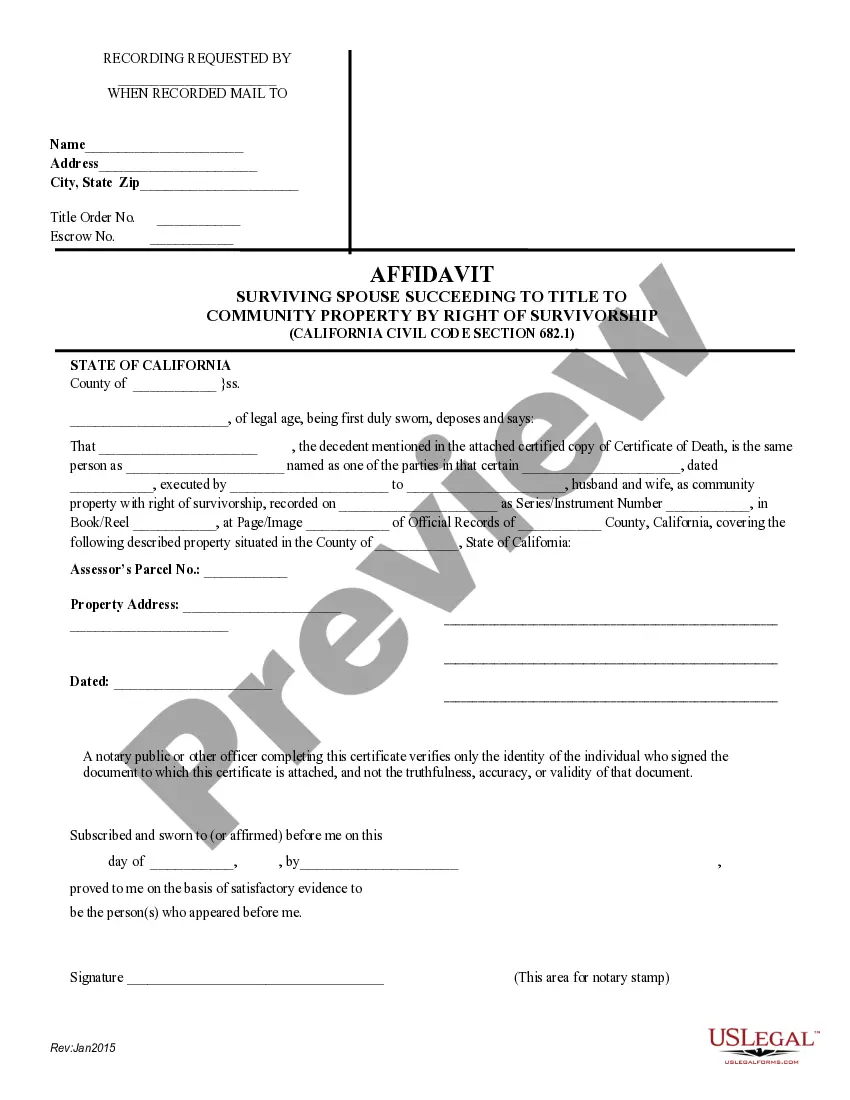

California Affidavit- Community Property with Right of Surviorship

Description

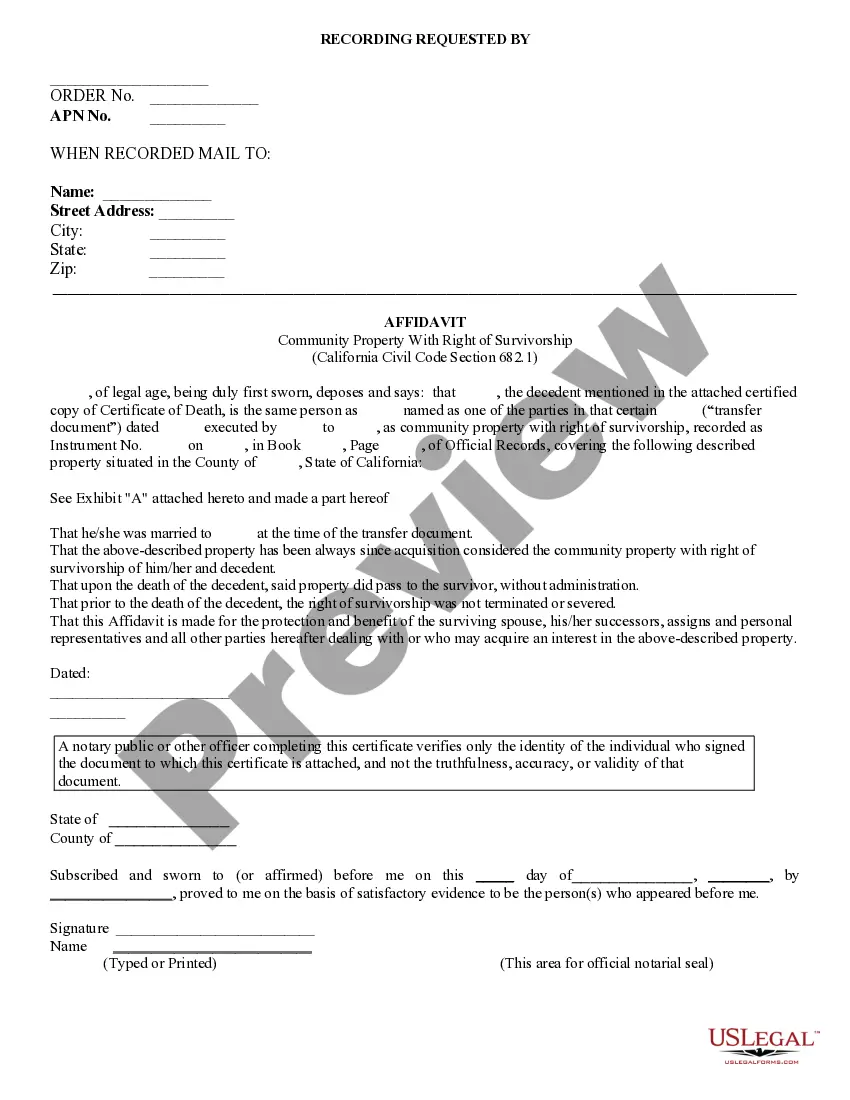

How to fill out California Affidavit- Community Property With Right Of Surviorship?

Drafting legal documents can be a significant source of anxiety unless you possess ready-to-use editable templates. With the US Legal Forms online repository of official documents, you can trust the forms you select, as they all comply with federal and state regulations and are validated by our experts.

Acquiring your California Affidavit- Community Property with Right of Survivorship from our service is as straightforward as 1-2-3. Existing users with a valid subscription just need to Log In and hit the Download button once they locate the correct template. Afterwards, if necessary, users can access the same document from the My documents section of their profile.

Haven't you explored US Legal Forms yet? Register for our service today to quickly and effortlessly obtain any official document whenever you need it, and keep your records organized!

- Document compliance assessment: It is crucial to thoroughly examine the details of the form you require and confirm that it meets your specifications and adheres to your state's legal standards. Reviewing your document and checking its general overview will assist you in achieving this.

- Alternative search (optional): If there are any discrepancies, navigate through the library using the Search tab at the top of the page until you discover an appropriate form, and select Buy Now when you identify the one you desire.

- Account setup and document purchase: Register for an account with US Legal Forms. After verifying your account, Log In and choose your ideal subscription plan. Proceed with the payment to continue (options include PayPal and credit cards).

- Template download and subsequent use: Choose the file format for your California Affidavit- Community Property with Right of Survivorship and click Download to store it on your device. You can print it to complete your documents manually or utilize a versatile online editor to create an electronic version more swiftly and effectively.

Form popularity

FAQ

One downside of community property with rights of survivorship is the irrevocable nature of this arrangement. Once established, it cannot be easily undone without mutual consent from both spouses. This can limit flexibility in how you choose to manage your assets over time. Understanding these implications is crucial, and utilizing tools like a California Affidavit- Community Property with Right of Survivorship can be beneficial for informed decision-making.

While community property with rights of survivorship offers many advantages, it also has disadvantages. One significant drawback is that it may expose the surviving spouse to creditors of the deceased spouse, impacting their financial security. Additionally, if the surviving spouse wishes to sell their portion, it can require the consent of the estate if it’s not managed correctly. A California Affidavit- Community Property with Right of Survivorship can help clarify these potential risks.

To file a Right of survivorship in California, you must complete a California Affidavit- Community Property with Right of Survivorship form. This affidavit requires details about the property and the ownership, and it must be signed by both spouses. Once completed, you should file this document with the county recorder's office where the property is located. By doing this, you ensure that the right of survivorship is legally recognized and enforceable.

Yes, the right of survivorship typically overrides a will in California. When property is held as community property with rights of survivorship, it transfers directly to the surviving spouse upon the other spouse's death, regardless of any directives stated in a will. This feature is important to consider when creating an estate plan, as it changes how property is passed on. Consulting with a knowledgeable advisor about a California Affidavit- Community Property with Right of Survivorship can clarify these aspects.

Yes, California law does allow community property with rights of survivorship. This legal arrangement simplifies the transfer of property upon one spouse's death, ensuring the surviving spouse automatically inherits the deceased spouse's share. To establish this type of ownership, a California Affidavit- Community Property with Right of Survivorship must be properly executed and filed with the county. This can streamline estate planning and provide peace of mind.

An Affidavit of Death allows a surviving spouse to establish that their husband or wife has died and they are now the sole owner of any property that the couple held as co-trustors.

Community property with right of survivorship is a legal distinction that allows two spouses to equally share assets through marriage as well as pass on assets to the other spouse upon death without going through probate.

California Affidavit of Surviving Spouse Information Section 100(a) of the California Probate Code states that when a married person dies, one-half of the couple's community property belongs to the surviving spouse and the other half stays in the decedent's name, ostensibly for probate distribution.

Disadvantages of community property with a right of survivorship: If a spouse dies having willed a piece of property titled as community property with a right of survivorship to someone other than their spouse, their gift may be deemed invalid.

(Revised: 01/2021) Probate Code section 13100 provides for the collection or transfer of a decedent's personal property without the administration of the estate or probate of the will.