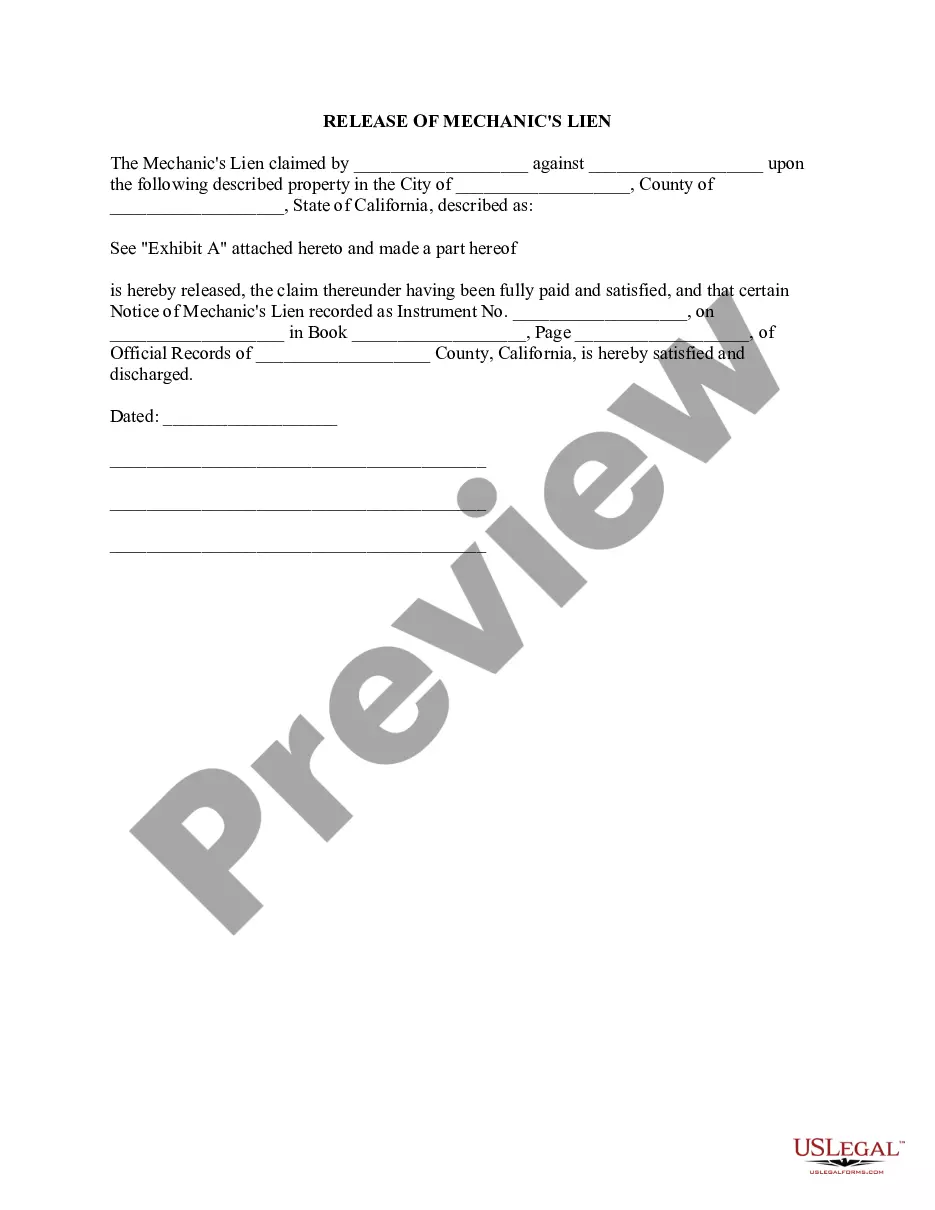

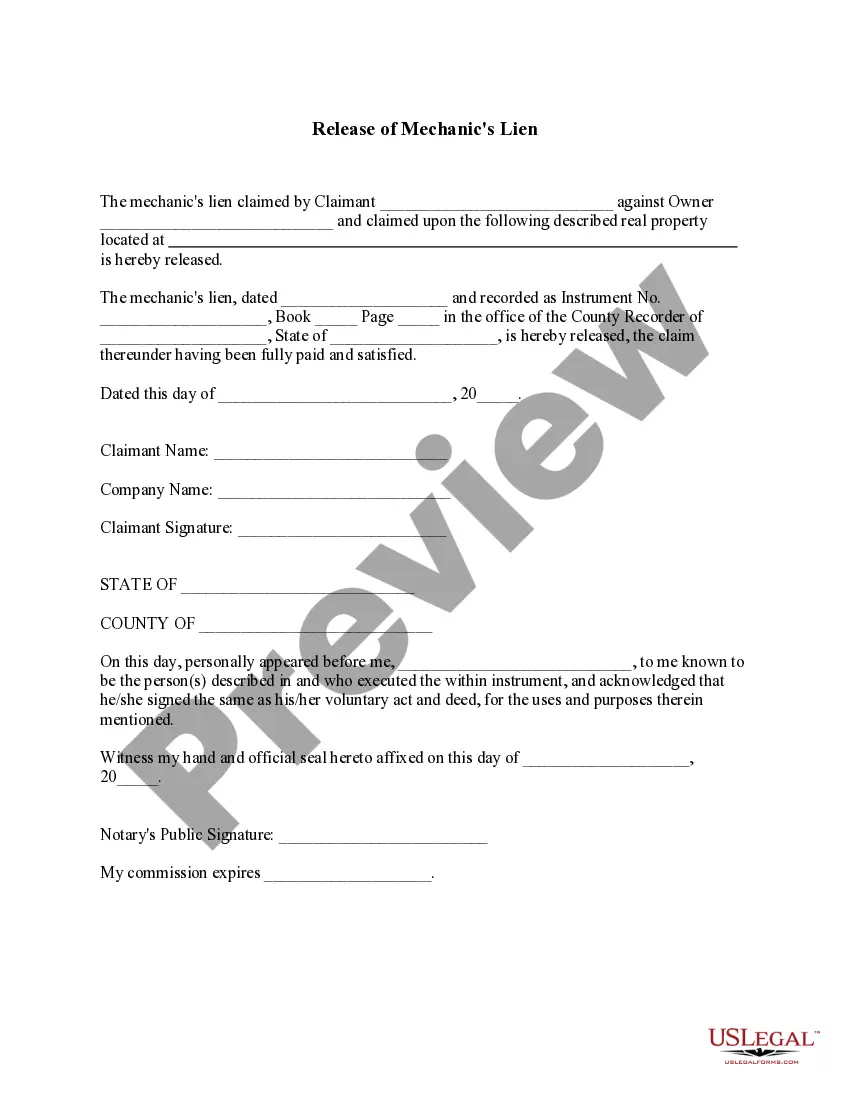

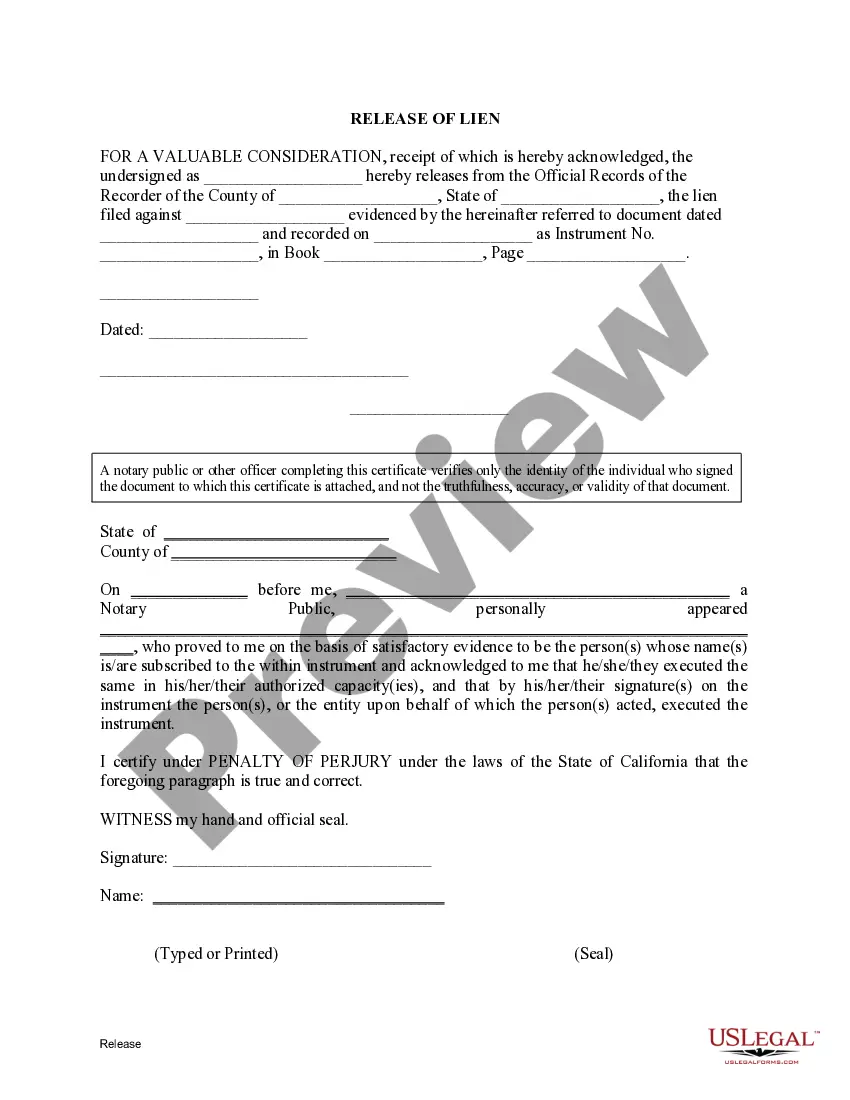

A California Release of Lien is a legal document that is used to release a lien from a piece of property in the state of California. This document is typically used when a lien holder, such as a creditor, agrees to release a claim they have on a property, such as a car or home, in exchange for payment. There are two types of California Release of Lien: a Partial Release of Lien, which is used to release a portion of the lien, and a Full Release of Lien, which is used to release the full amount of the lien. Both documents require the lien holder to fill out the document with the necessary information, including the amount of the lien being released, the name of the lien holder, and the name of the person or entity releasing the lien. Once the document is filled out, it must be notarized and recorded with the county recorder's office in order to be valid and enforceable.

California Release of Lien

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Release of Lien: A legal document which indicates that a lien, often placed as a security interest against a property or asset, has been removed. Lien Waiver: A document from a contractor, worker, or material supplier waiving rights to a lien against the debtor's property upon receiving payment.

Step-by-Step Guide to Obtaining a Release of Lien

- Identify the type of lien: Determine whether it is related to real estate, intellectual property, or another form of personal asset.

- Consult with a professional: Depending on the complexity, contacting an attorney with experience in family law, estate planning, or real estate might be necessary.

- Obtain the necessary documents: Collect all documents related to the debt or claim.

- Payment of the owed amount: Fulfill the payment obligations as stated in the lien document.

- Filing the release: File the lien release form with the appropriate local county office or similar entity.

Risk Analysis of Incorrect Lien Release

- Legal penalties: Non-compliance can result in financial penalties or a continuation of the lien.

- Damage to credit score: Liens can negatively impact credit scores if not properly released.

- Obstructions in future transactions: Existing liens can stall the sale or transfer of the property.

Best Practices in Managing Release of Lien

- Maintain thorough records: Keep all documents related to the lien and its release.

- Verify with a professional: Consult with a lawyer with years of experience in relevant law fields before and after the process of lien release.

- Check local laws: Understand and follow state-specific guidelines and laws for the release of liens.

How to fill out California Release Of Lien?

If you’re looking for a way to properly prepare the California Release of Lien without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every individual and business situation. Every piece of paperwork you find on our web service is designed in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Follow these straightforward instructions on how to obtain the ready-to-use California Release of Lien:

- Make sure the document you see on the page meets your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the document name in the Search tab on the top of the page and select your state from the dropdown to find an alternative template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your California Release of Lien and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

California Civil Code section 8416 Failure to serve the Mechanic's Lien and Notice of Mechanic's Lien on the owner, or alternatively if the owner cannot be served on the lender or direct contractor, shall cause the Mechanic's Lien to be unenforceable as a matter of law (Civil Code Section 8024(d)).

In California, it is required that a mechanics lien be enforced within 90 days from the date on which the lien was recorded. If this 90-day time period passes without an action being commenced to enforce the lien, the lien expires.

From an owner's perspective, a lien is a security interest registered against the title to your property. Any lien placed on the property, even though its validity must be proven in a court of law, will have the power to stop your project.

The cost for these bonds is between 2-3% of the value of the lien inclusive of court costs. So if a mechanics lien is filed for $500,000.

When a lien is bonded off, a payment bond is available to pay off the lien. This provides a guarantee for payment to the construction firm and allows the property owner to be able to sell, finance or transfer the property without fear of a lien on the title.

A lien release is a document that is filed in the public land records as the official notice that the lien is removed. Once payment has been received, a contractor has a duty to remove any lien that was filed against the property.

The bond shall be in an amount equal to 125 percent of the amount of the claim of lien or 125 percent of the amount allocated in the claim of lien to the real property to be released. The bond shall be executed by an admitted surety insurer.