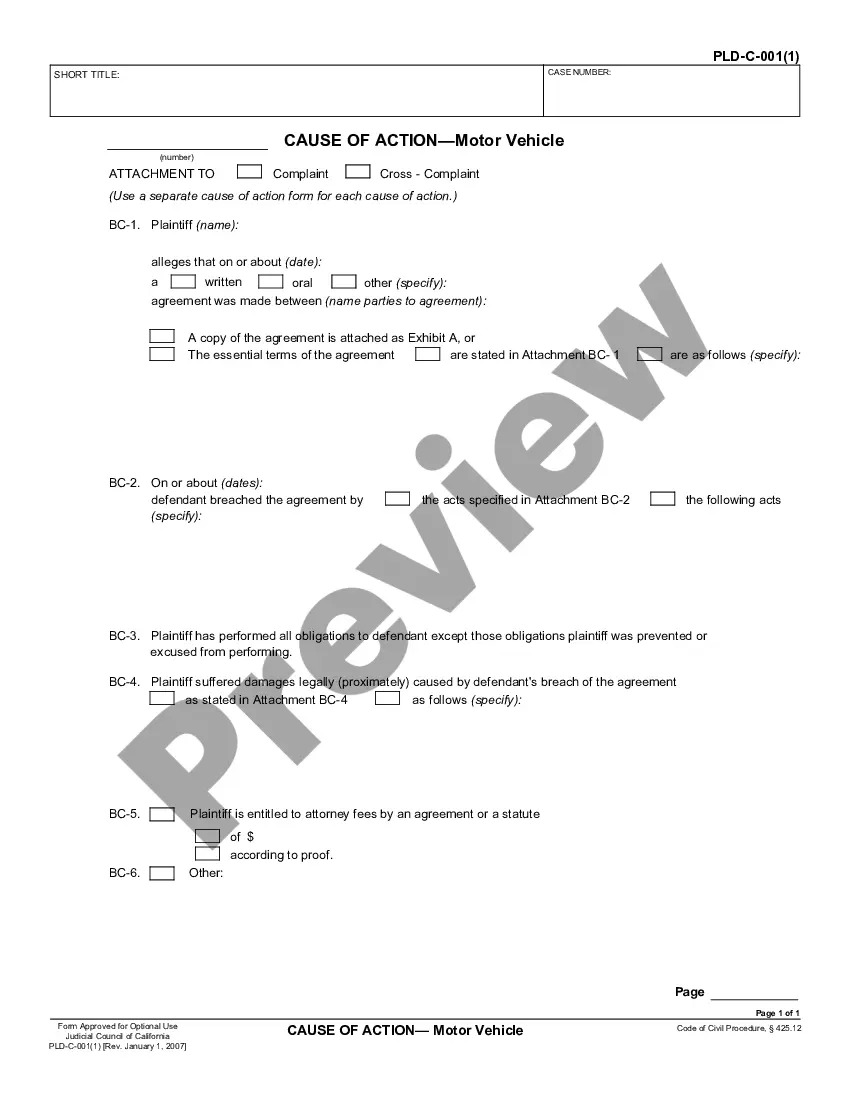

Cause of Action-Common Counts: This Cause of Action form is attached to a Complaint involving money and/or accounts in default. It states both the Plaintiff's and Defendant's names, as well as the circumstances surrounding the Defendant's alleged guilt.

California Cause of Action regarding Common Counts

Description

How to fill out California Cause Of Action Regarding Common Counts?

If you are looking for precise California Cause of Action concerning Common Counts examples, US Legal Forms is what you require; locate documents produced and reviewed by state-certified legal experts.

Using US Legal Forms not only saves you from stress related to legal documents; you also save time and money! Downloading, printing, and filling out a professional template is far less expensive than hiring an attorney to do it for you.

And that’s all. In just a few simple steps, you have an editable California Cause of Action regarding Common Counts. After creating an account, all future purchases will be processed even more smoothly. With a US Legal Forms subscription, just Log In to your profile and then click the Download button found on the form's page. Furthermore, when you need to use this template again, you'll always be able to find it in the My documents section. Don’t waste your time rummaging through numerous forms across different platforms. Purchase professional documents from a single trusted service!

- To start, complete your registration process by entering your email and creating a password.

- Follow the steps below to set up an account and obtain the California Cause of Action regarding Common Counts template to manage your situation.

- Utilize the Preview feature or review the document description (if available) to confirm that the template is the one you need.

- Verify its validity in your state.

- Click on Buy Now to place an order.

- Select a suitable pricing plan.

- Register an account and pay using your credit card or PayPal.

- Choose a preferred format and save the documents.

Form popularity

FAQ

A cause of action count is a distinct claim within a legal complaint that specifies the reasons the plaintiff believes they are entitled to relief. Each count addresses a separate issue related to the overall case, which allows the court to assess them individually. In the context of California, understanding different counts, including those involving the California Cause of Action regarding Common Counts, aids in structuring a comprehensive legal strategy.

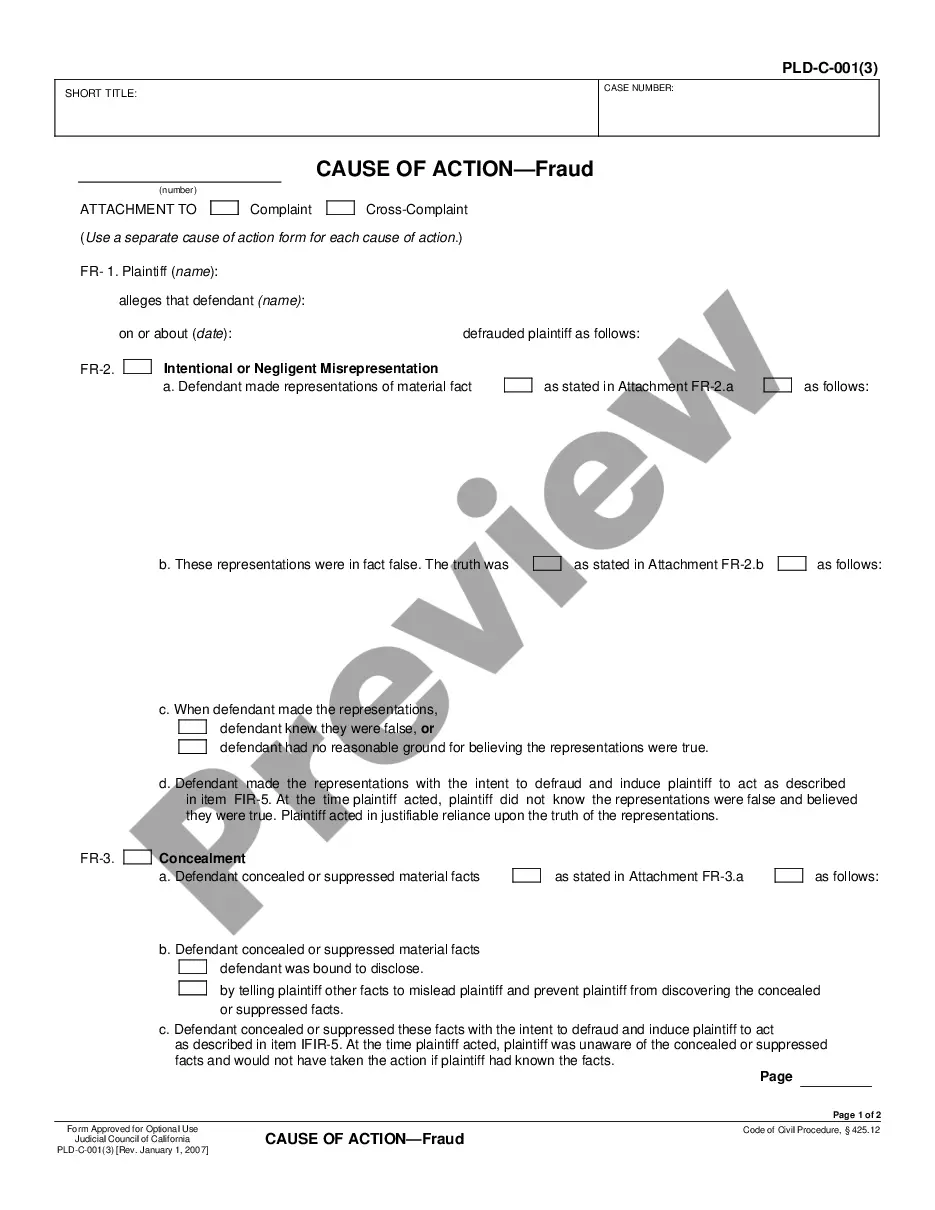

A common law cause of action refers to a legal claim that arises from court decisions and precedents, rather than from statutes or regulations. It provides foundational principles that govern various types of lawsuits, including tort and contract law. By building on past judicial decisions, the common law allows individuals to seek remedies for wrongs committed. Exploring the California Cause of Action regarding Common Counts can help you navigate these claims effectively.

In California, the elements of an accounting cause of action include a fiduciary relationship between the parties, a request for an accounting, and a failure to provide it. Essentially, the plaintiff must demonstrate that the defendant holds information regarding transactions that are not shared. This claim seeks to determine the amount owed based on the accounting records. Understanding the California Cause of Action regarding Common Counts can help clarify financial disputes.

In California, the statute of limitations for common counts is typically six years. This timeframe means that a party must initiate legal action within six years from the date the payment was due. If you are considering a California Cause of Action regarding Common Counts, it’s crucial to act within this period to protect your rights. For detailed guidance, you may find resources on the US Legal Forms platform beneficial.

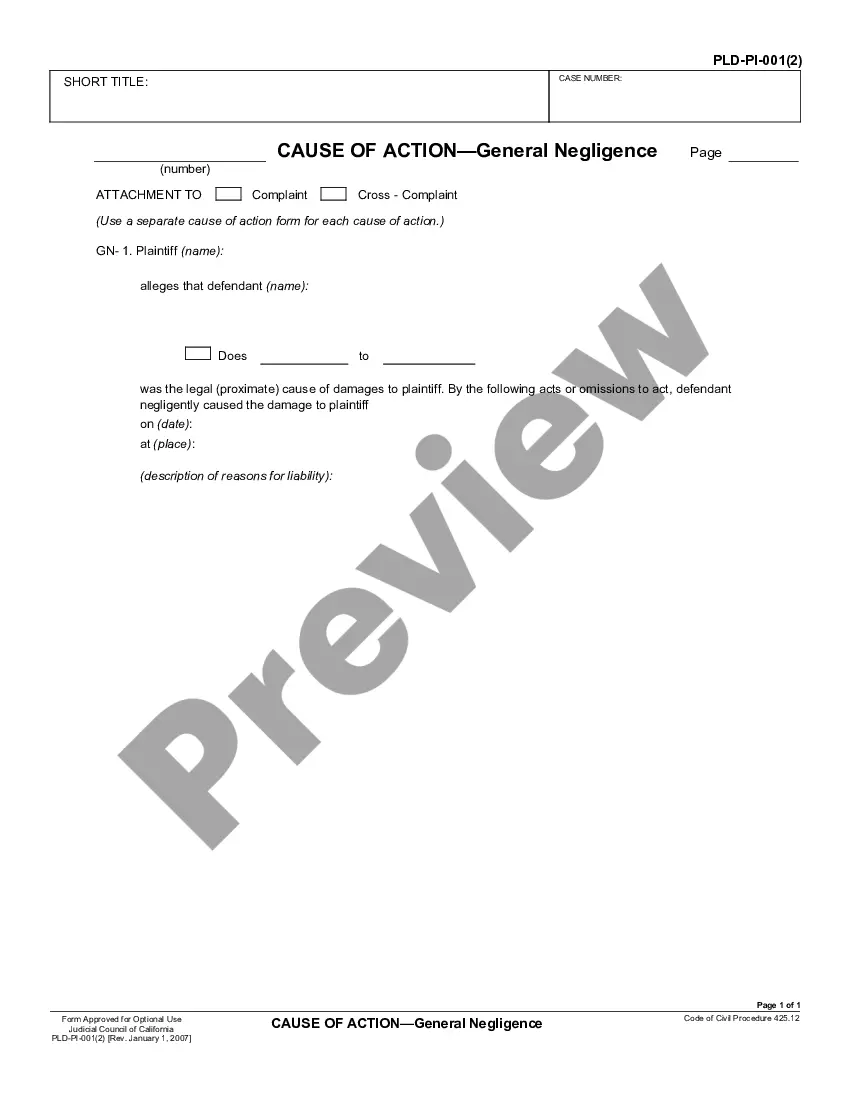

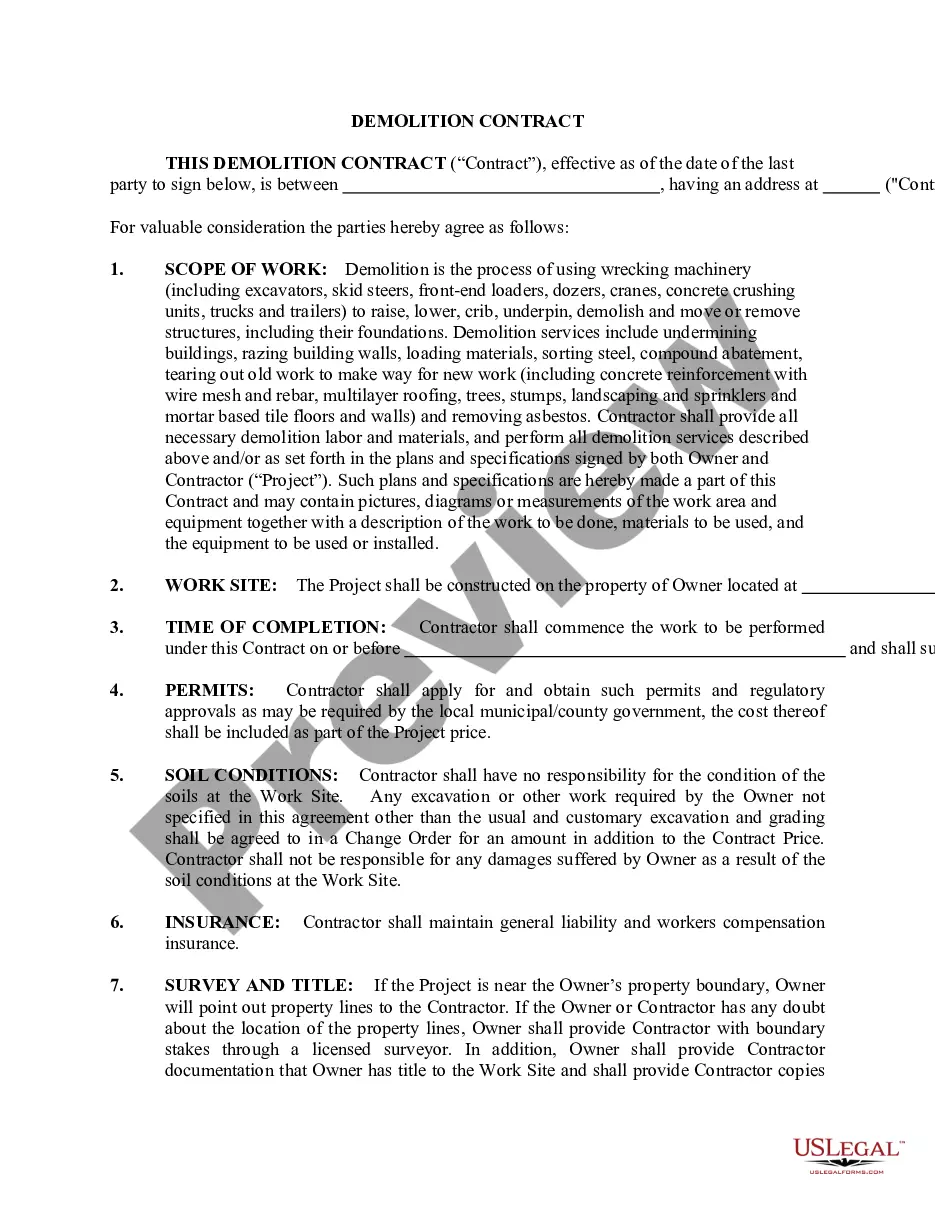

An example of a cause of action could be when a contractor finishes work but does not receive payment. In this scenario, the contractor could file a claim based on common counts, seeking compensation for the labor and materials provided. This is especially relevant in cases invoking California Cause of Action regarding Common Counts. To get assistance in preparing such claims, consider using resources available through US Legal Forms, which can simplify the preparation process.

A cause of action refers to the underlying legal theory that grounds a lawsuit, while a count is typically a specific instance of a cause of action presented in a complaint. In legal documents, you may see multiple counts addressing different claims under the same cause of action. Understanding this distinction is crucial for effectively navigating the complexities of a California Cause of Action regarding Common Counts.

An example of a cause of action is a breach of contract claim, where one party fails to fulfill their obligations under an agreement. In California, this can often relate to various types of agreements, such as service contracts or sales contracts. This example illustrates how the California Cause of Action regarding Common Counts can apply to many everyday situations where legal rights are in question.

To write causes of action, start by identifying the legal theory underlying your claim and then formulate the supporting facts accordingly. Each cause should have a clear title, a statement of facts, and a request for relief. By utilizing tools from US Legal Forms, you can effectively draft your California Cause of Action regarding Common Counts and ensure that your claims are compelling and legally sound.

Writing a cause of action involves clearly stating the legal basis for your claim, as well as detailing the relevant facts that support it. It's crucial to ensure that your writing is structured logically, presenting each element of the cause of action coherently. For those seeking assistance, US Legal Forms offers resources that can guide you through creating a California Cause of Action regarding Common Counts effectively.

In California, a cause of action typically consists of several key elements: the duty owed, a breach of that duty, causation, and the resulting damages. Each element must be clearly stated to establish a strong foundation for your claim. Understanding these components is essential when formulating a California Cause of Action regarding Common Counts, as each aspect directly impacts the validity of your case.