California Complaint for Accounting - General - State Basis

Understanding this form

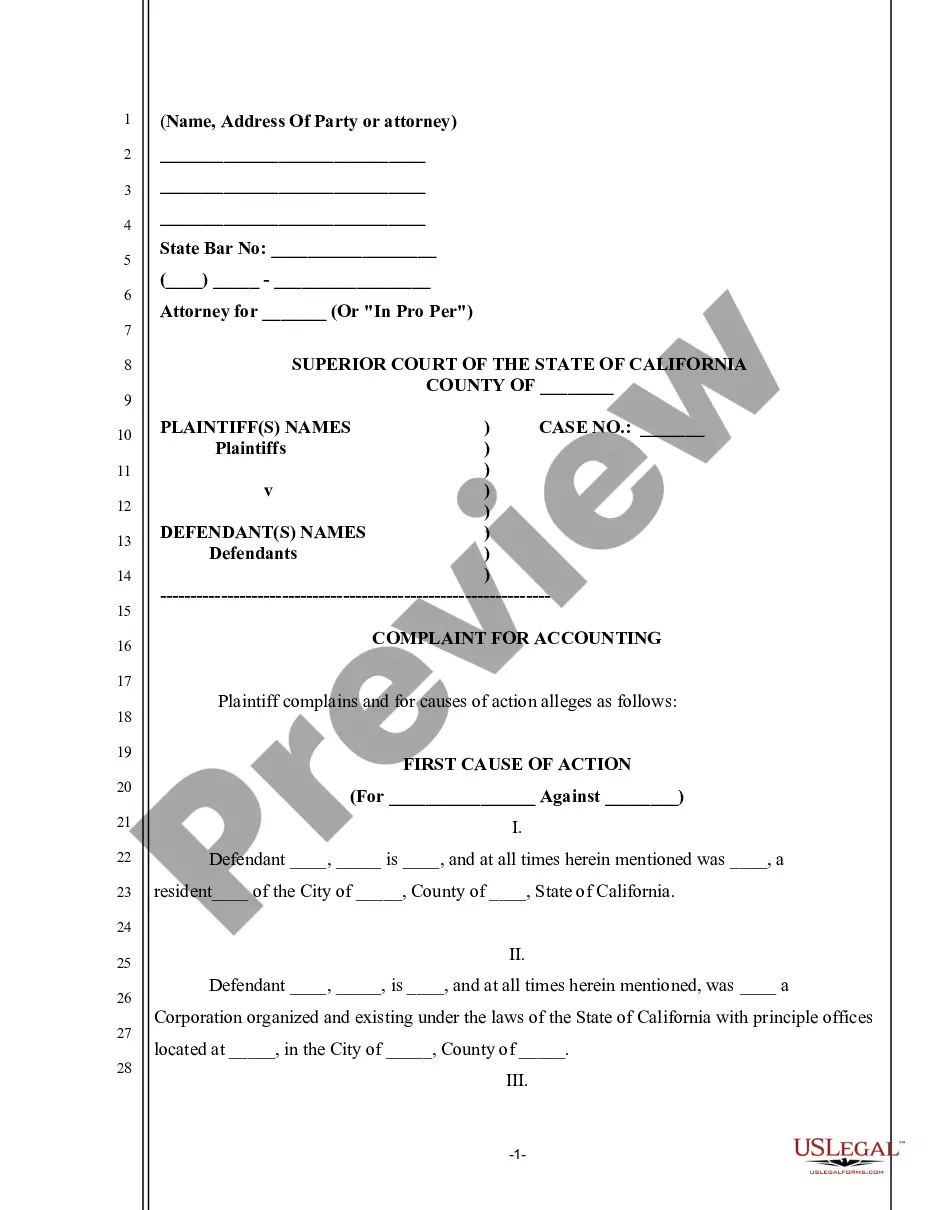

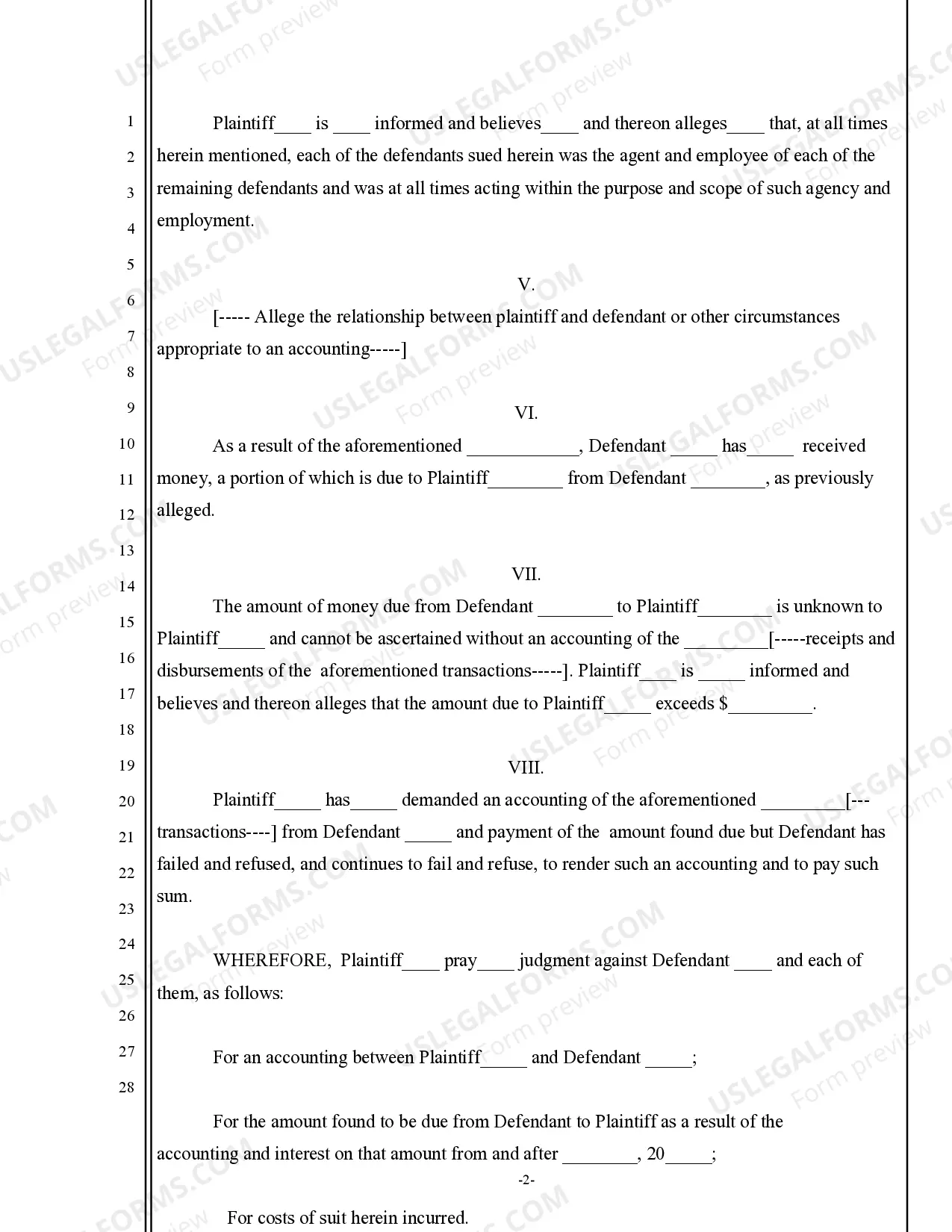

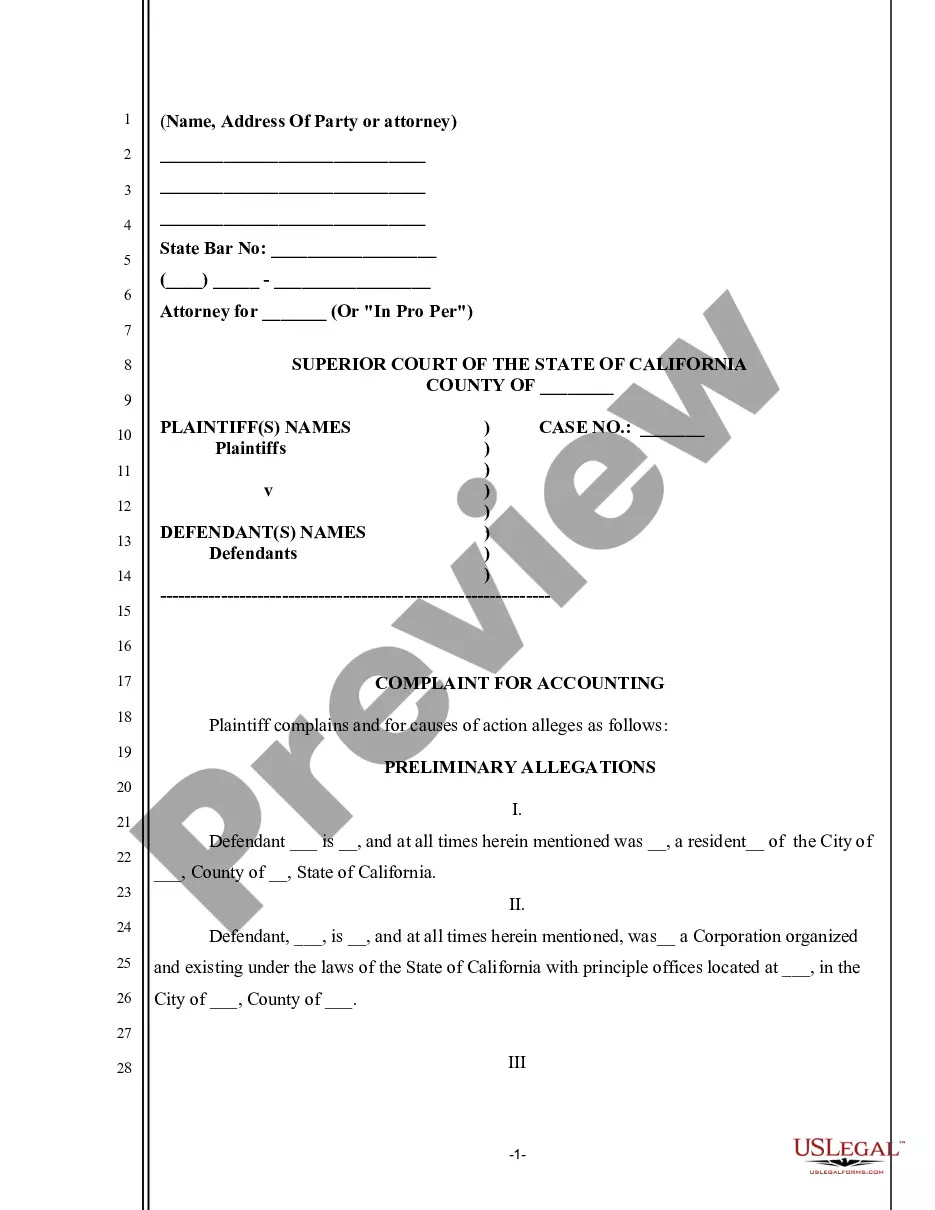

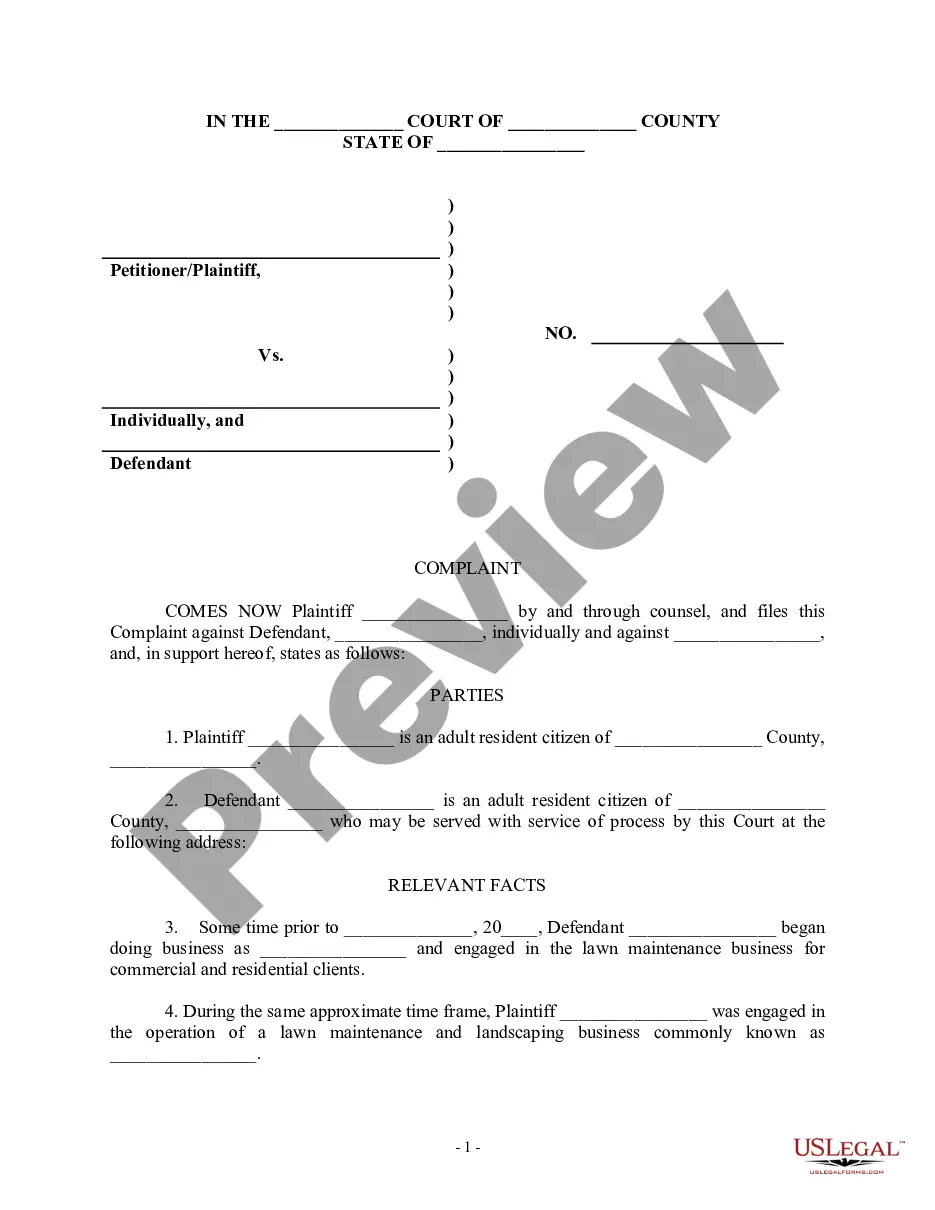

The Complaint for Accounting is a legal document used to request a court order for an accounting of funds owed by one party to another. In this complaint, the plaintiff asserts that they have requested an accounting from the defendant, who has failed to comply. This form is specifically designed for situations where a fiduciary relationship exists, allowing the plaintiff to seek a judicial determination regarding the funds in question and potentially recover the amount owed, along with interest.

Main sections of this form

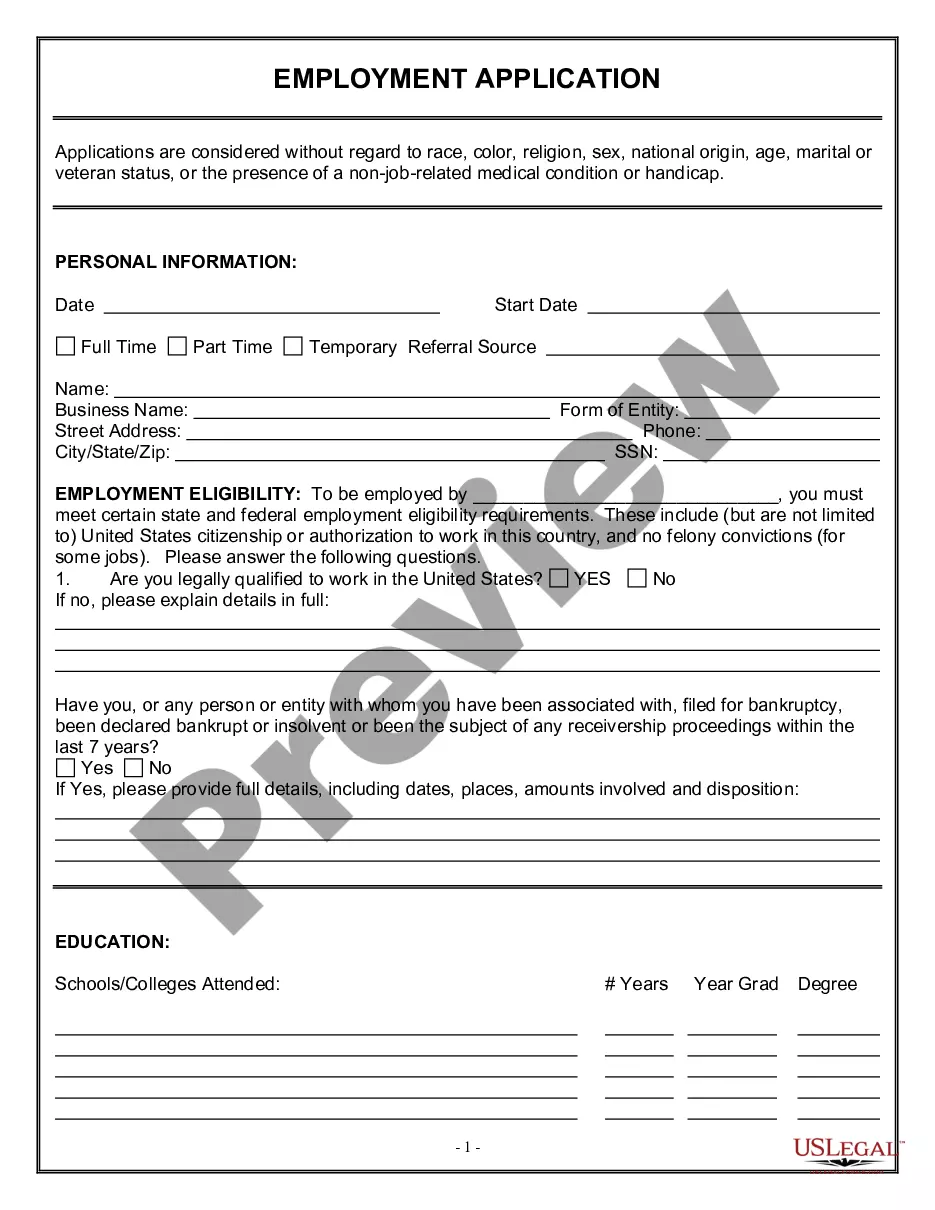

- Parties involved: Identifies the plaintiff and defendant.

- Claims for accounting: Details the relationship and grounds for seeking an accounting.

- Amount due: Specifies the money owed and the basis for the claim.

- Demand for accounting: States the failed duty of the defendant to provide an accounting.

- Prayer for relief: Outlines what the plaintiff is requesting from the court.

When this form is needed

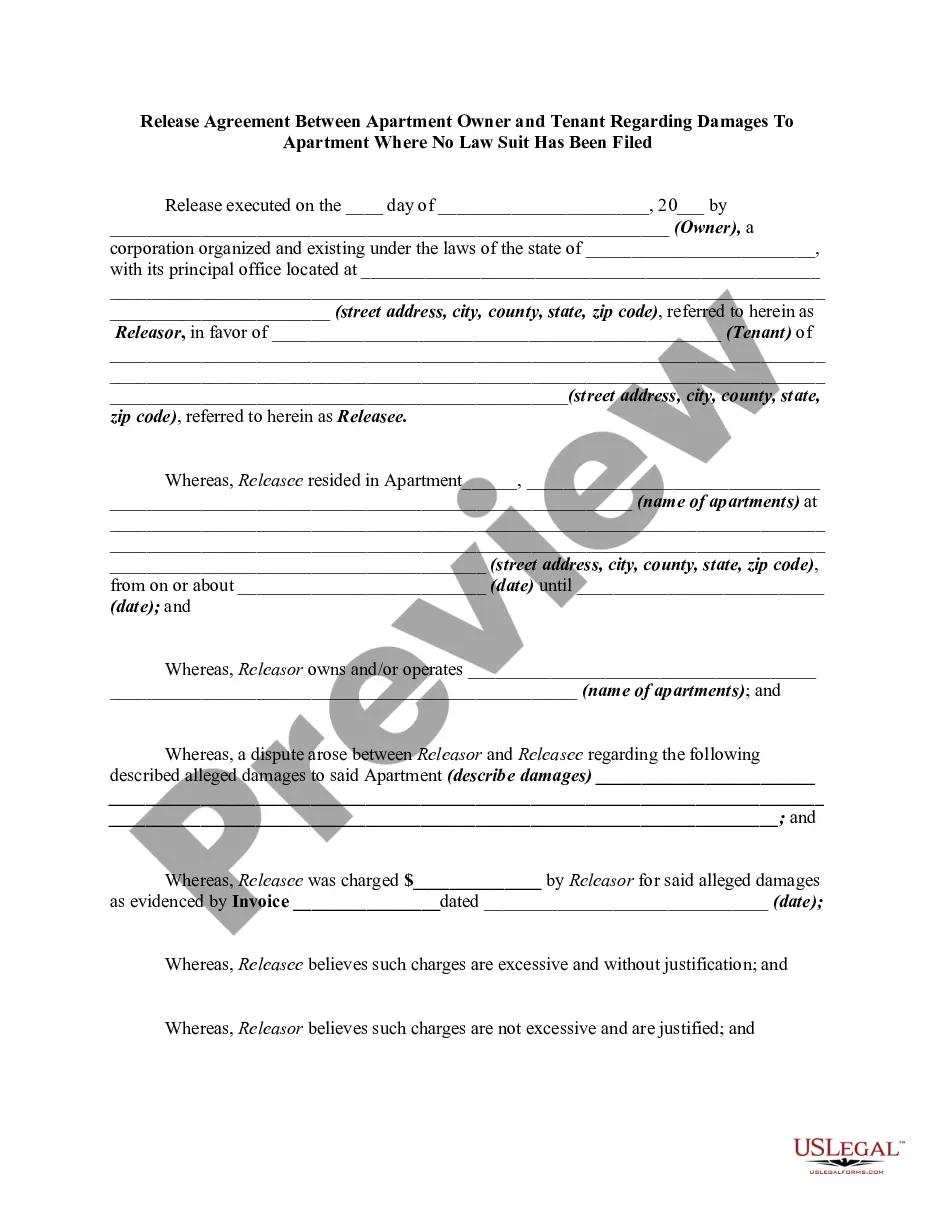

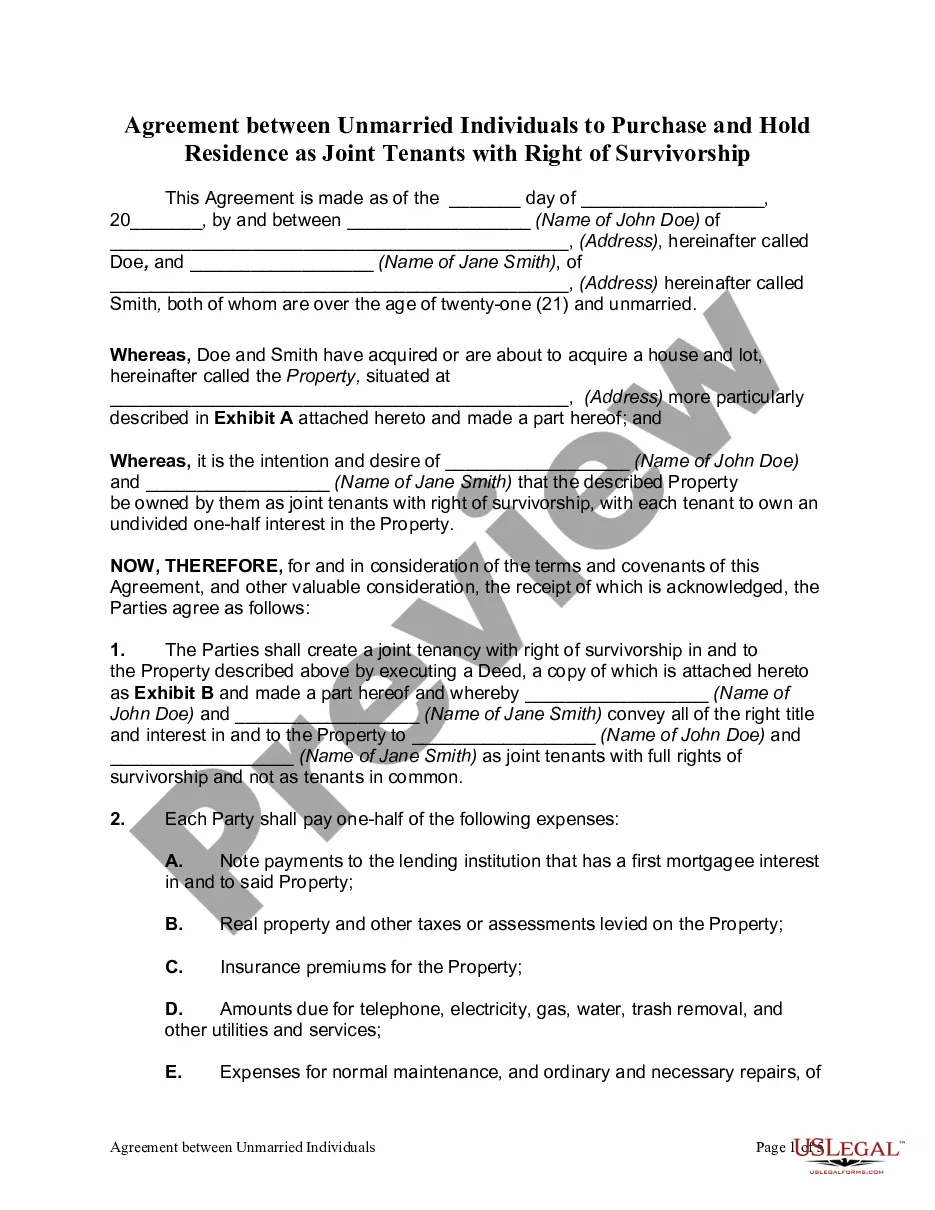

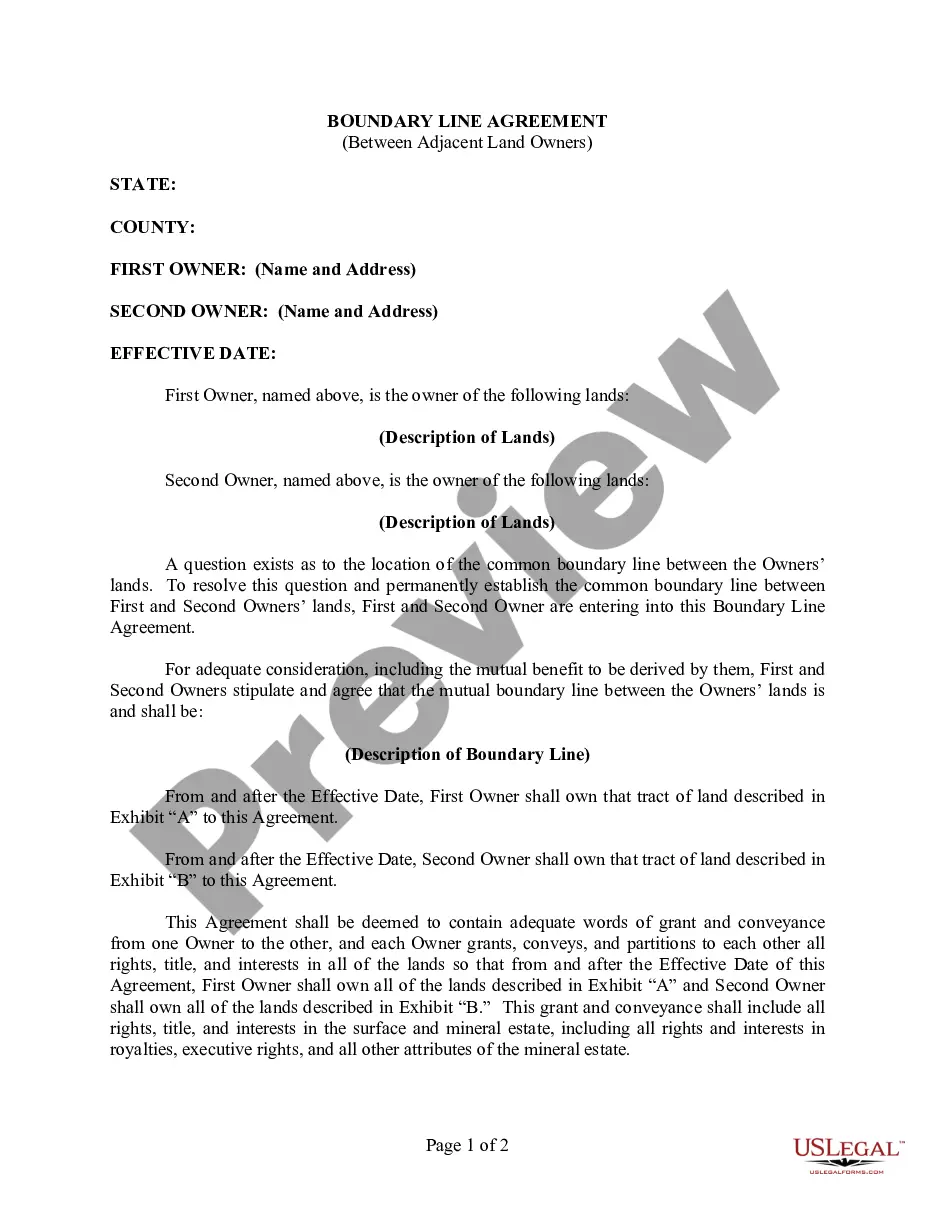

This form should be used when an individual or entity has a legitimate claim against another party for an accounting of funds. Situations that may warrant the use of this form include disputes over trust funds, partnership agreements, or any arrangement where one party manages or controls funds belonging to another party and fails to provide a proper account of these funds.

Who this form is for

- Individuals or business entities seeking accountability for funds managed by another party.

- Trustees or fiduciaries who need to compel the accounting of assets they manage.

- Anyone involved in a contractual relationship where financial transparency is required.

How to complete this form

- Identify the plaintiff and defendant: Fill in the names and addresses of all parties involved.

- State the basis for the complaint: Provide details regarding the relationship and reason for the accounting.

- Specify the amount due: Indicate the sum that the plaintiff claims is owed by the defendant.

- Complete the prayer for relief: Clearly state what the plaintiff is asking the court to do.

- Sign and date the verification section: Ensure that the declaration is completed accurately under penalty of perjury.

Is notarization required?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include proper identification of all parties involved in the complaint.

- Not specifying the exact amount of money owed or the basis for this amount.

- Omitting the demand for accounting, which is crucial for the case.

- Neglecting to sign the form, especially the verification section.

- Error in jurisdiction if attempting to use this form in a state other than California.

Benefits of using this form online

- Instant access: Download the form immediately upon purchase.

- Accuracy: Forms are drafted by licensed attorneys, reducing legal errors.

- Convenience: Fill out the form at your own pace from anywhere with internet access.

- Editability: Easily customize the form to reflect your specific situation.

Looking for another form?

Form popularity

FAQ

Yes, the California Board of Accountancy serves as the governing body for accountants in the state. This board is responsible for licensing, regulating, and enforcing compliance among accounting professionals. If you have concerns about an accountant, you can reach out to this authority. Filing a California Complaint for Accounting - General - State Basis with them is your step towards addressing any issues.

Yes, accountants can be held accountable under California's laws and regulations. If they fail to adhere to professional standards or ethics, you can file a California Complaint for Accounting - General - State Basis against them. The regulatory authority will investigate and take necessary actions based on their findings. Ensuring accountability helps maintain trust in financial practices.

Making a formal complaint about an accountant in California involves completing the California Complaint for Accounting - General - State Basis. Start by gathering all relevant documentation and evidence concerning your complaint. Formal complaints can be filed with the California Board of Accountancy, which will review your submission. Clarity and detail in your complaint can lead to better outcomes.

To make a complaint against an accountant in California, submit a California Complaint for Accounting - General - State Basis through the appropriate regulatory body. Gather documentation that supports your claim and provide a clear description of the issue. This information will assist the board in addressing your concerns effectively. Utilizing legal form platforms like UsLegalForms can ease the process of filing.

If you suspect false accounting, it is important to gather supporting evidence before making a California Complaint for Accounting - General - State Basis. You can report false accounting to the California Board of Accountancy. They will review your evidence and determine whether further investigation is warranted. Acting promptly can help protect your interests.

To file a California Complaint for Accounting - General - State Basis, visit the California Department of Consumer Affairs website. You will find the necessary forms and detailed instructions on how to submit your complaint. Ensure you provide all required documentation and information for a complete submission. Following these steps helps ensure your complaint is processed efficiently.

Filing a complaint with the California State Attorney General starts with gathering your documentation and completing the complaint form available on their website. This process allows you to articulate your grievances clearly, which is crucial for effective communication. If your complaint involves accounting irregularities, consider framing it through a California Complaint for Accounting - General - State Basis for clarity and relevance.

To complain about an accountant, begin by clearly outlining the problems you have experienced, accompanied by any corresponding evidence. You may consider expressing your concerns directly with the accountant first; however, if satisfaction is not achieved, it may be time to escalate your complaint. Utilizing uslegalforms can assist in preparing a California Complaint for Accounting - General - State Basis to formalize your issue.

Reporting unfair business practices involves documenting any incidents and understanding the laws that may apply. You can report your concerns to the Federal Trade Commission or your state's Attorney General. Often, filing a California Complaint for Accounting - General - State Basis provides a structured approach to address the unfair practices you've encountered.

Filing a complaint against an accountant in California begins with visiting the California Board of Accountancy's website to access the required forms. Ensure that you provide ample details about your complaint, including all relevant documentation. With resources available through uslegalforms, you can navigate the California Complaint for Accounting - General - State Basis efficiently and effectively.