Agreement between Unmarried Individuals to Purchase and Hold Residence as Joint Tenants with Right of Survivorship

Description

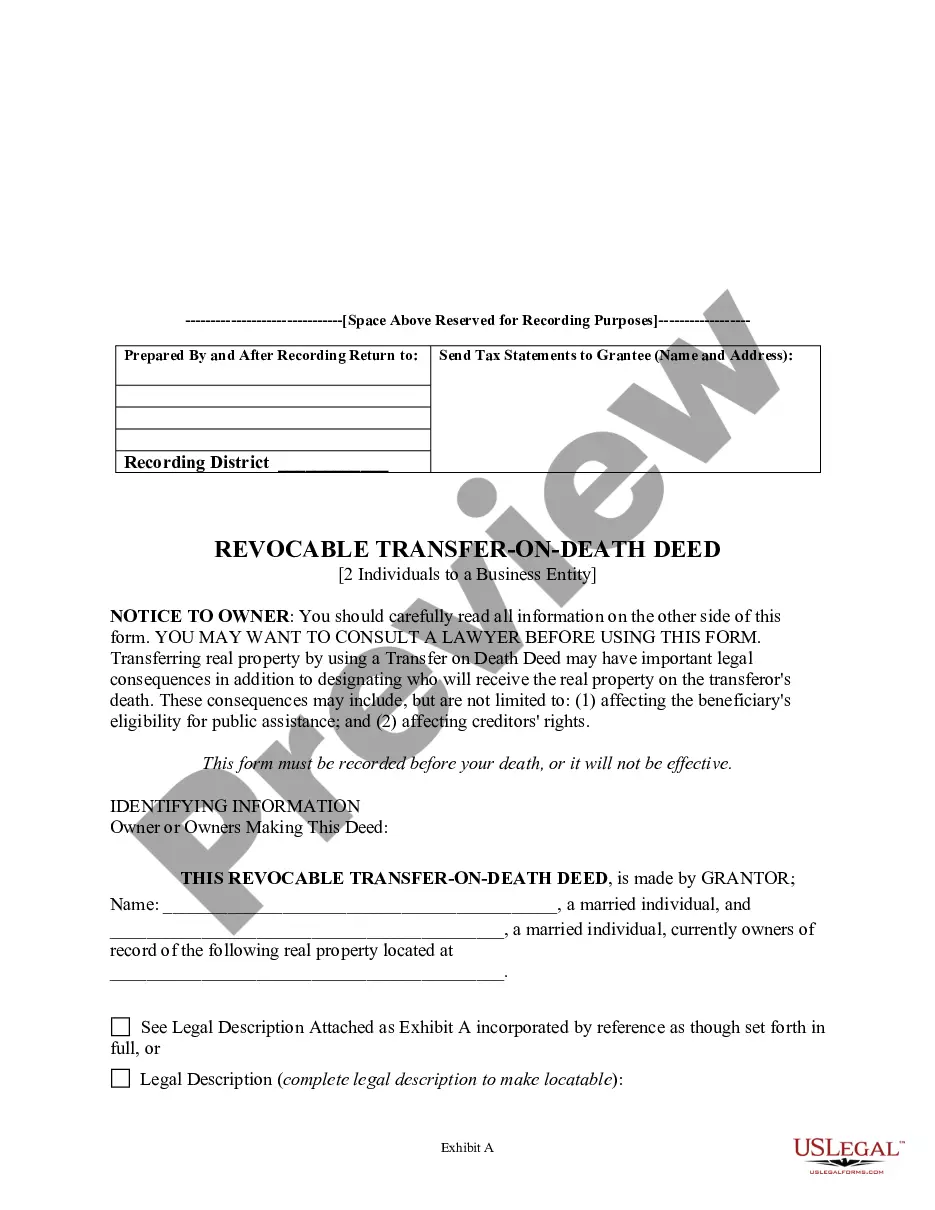

How to fill out Agreement Between Unmarried Individuals To Purchase And Hold Residence As Joint Tenants With Right Of Survivorship?

Aren't you tired of choosing from countless templates each time you need to create a Agreement between Unmarried Individuals to Purchase and Hold Residence as Joint Tenants with Right of Survivorship? US Legal Forms eliminates the wasted time millions of American citizens spend exploring the internet for appropriate tax and legal forms. Our skilled group of lawyers is constantly modernizing the state-specific Forms catalogue, so that it always provides the proper files for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form may be found in the My Forms tab.

Users who don't have an active subscription need to complete easy steps before being able to get access to their Agreement between Unmarried Individuals to Purchase and Hold Residence as Joint Tenants with Right of Survivorship:

- Use the Preview function and read the form description (if available) to ensure that it’s the correct document for what you are looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the appropriate sample for the state and situation.

- Use the Search field at the top of the page if you have to look for another file.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your template in a convenient format to complete, print, and sign the document.

When you have followed the step-by-step guidelines above, you'll always have the ability to sign in and download whatever document you want for whatever state you need it in. With US Legal Forms, completing Agreement between Unmarried Individuals to Purchase and Hold Residence as Joint Tenants with Right of Survivorship templates or other official files is simple. Begin now, and don't forget to examine your samples with accredited lawyers!

Form popularity

FAQ

Because mortgage lenders treat married couples as a single entity, these couples can qualify for sizeable loans with good terms and rates as long as one partner has a good credit history. However, lenders treat unmarried couples as individual home buyers.

Yes. Many lenders allow two families to combine their respective incomes in order to jointly purchase a house. Both households will need to meet the minimum qualifying loan requirements, which may vary lender to lender. Lenders may also require both families to hold equal ownership rights of the house.

Unmarried couples will apply for a mortgage as individuals. This means the partner with the stronger financials and credit score may want to purchase the home to get better mortgage terms and interest rates.Some lenders may allow both parties to apply for a mortgage together.

You can either follow the legal procedures that apply in your statetypically this means the court will order the property to be sold, and the net proceeds (after paying mortgages, liens, and costs of sale) to be dividedor you can reach your own compromise settlement.

Yes. Many lenders allow two families to combine their respective incomes in order to jointly purchase a house. Both households will need to meet the minimum qualifying loan requirements, which may vary lender to lender. Lenders may also require both families to hold equal ownership rights of the house.