This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

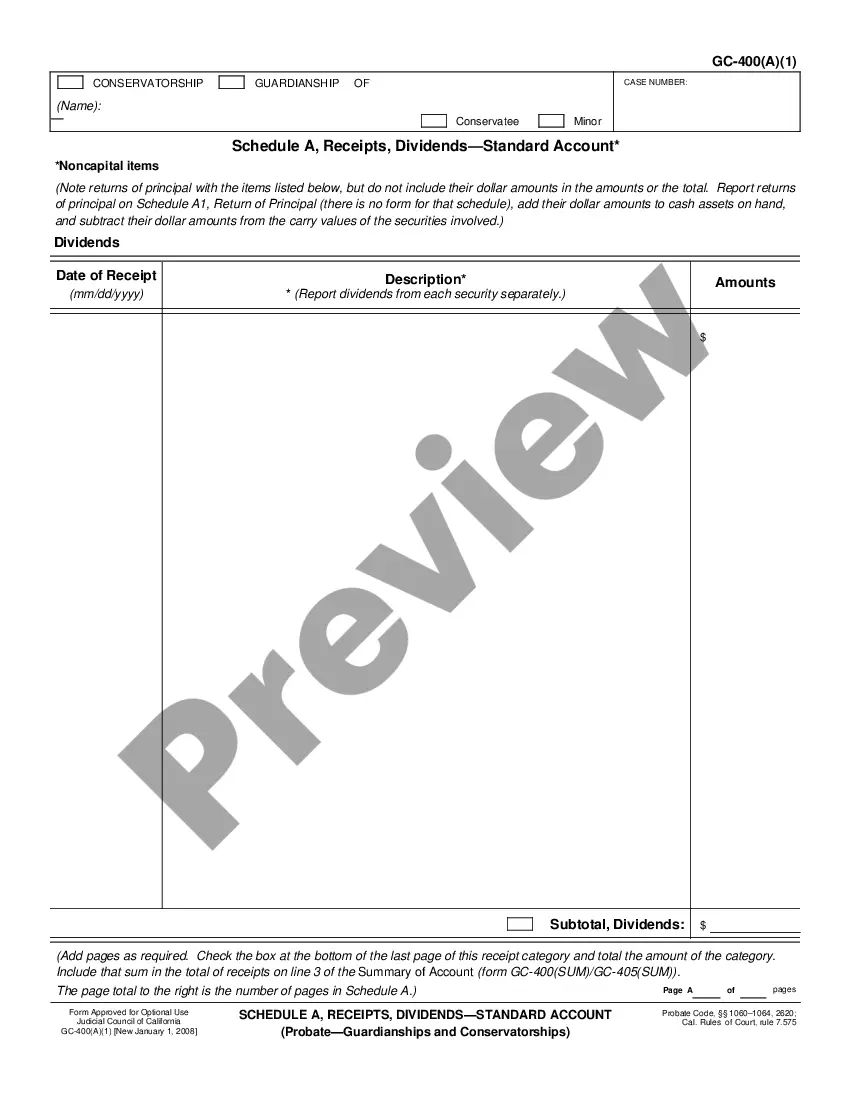

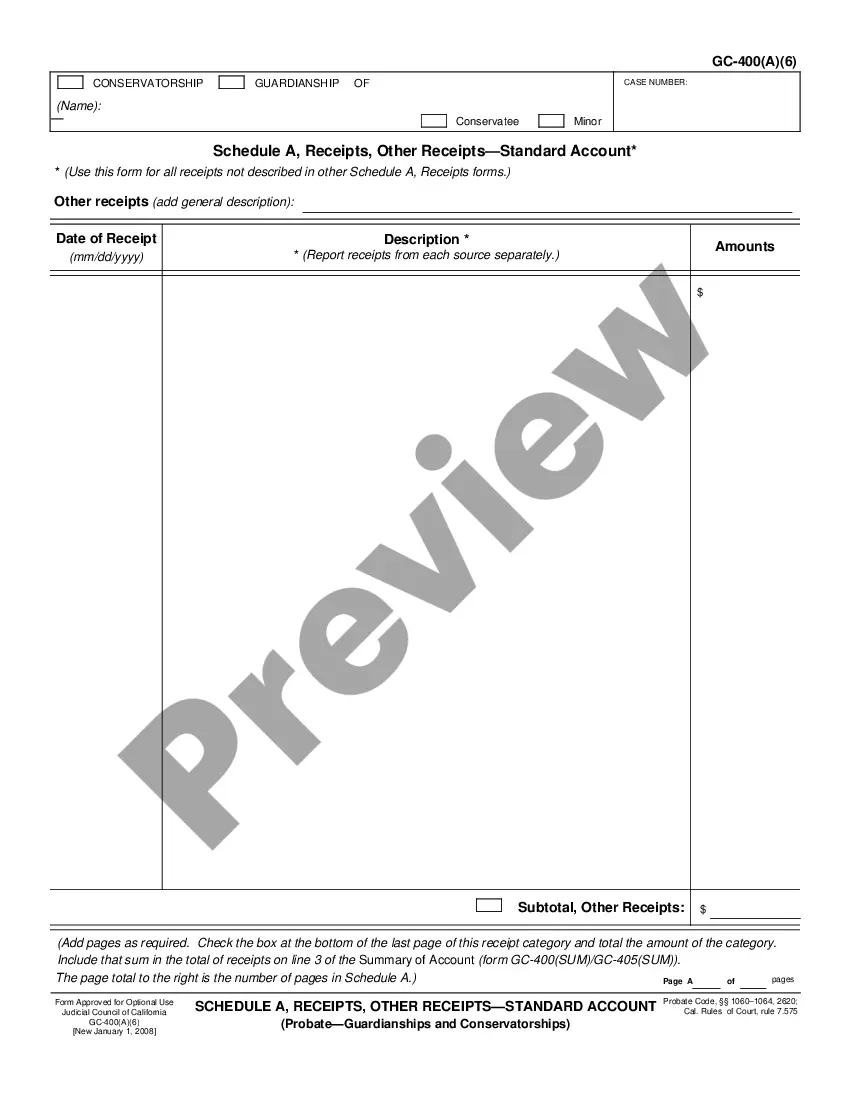

California Schedule A, Receipts, Pensions, Annuities, and other Regular Periodic Payments-Standard Account

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

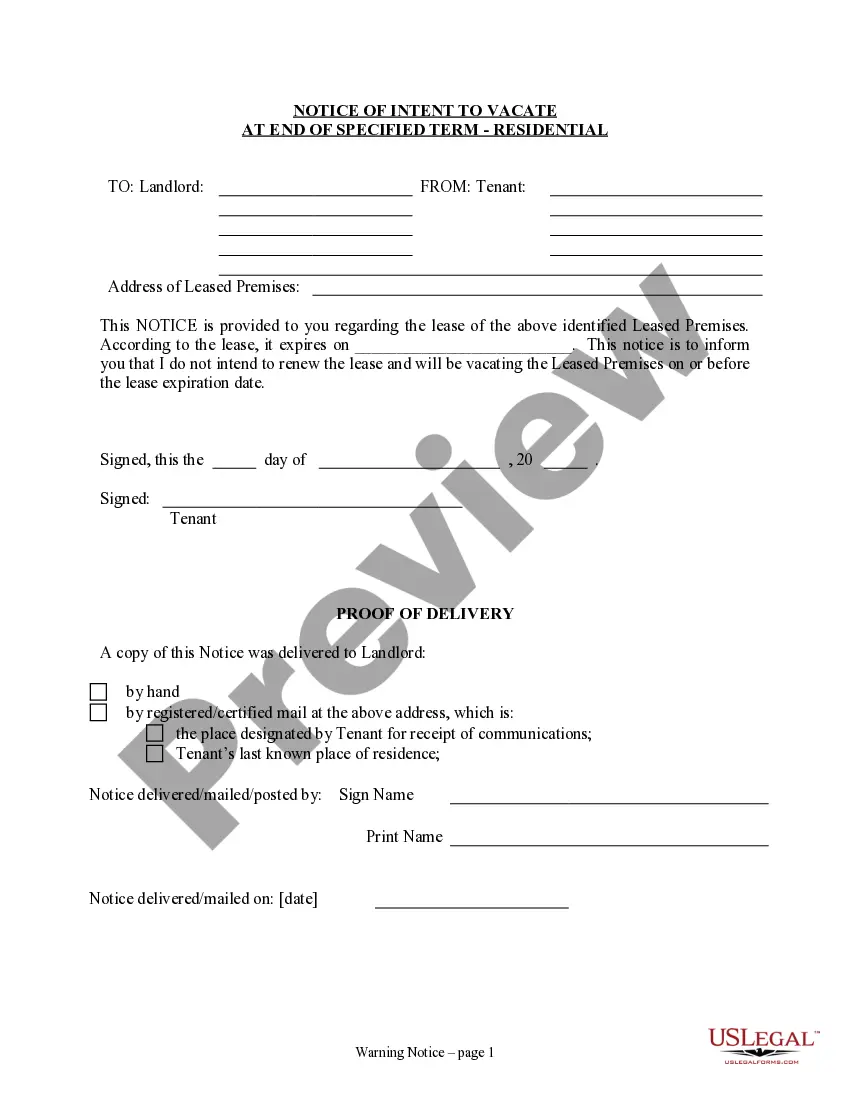

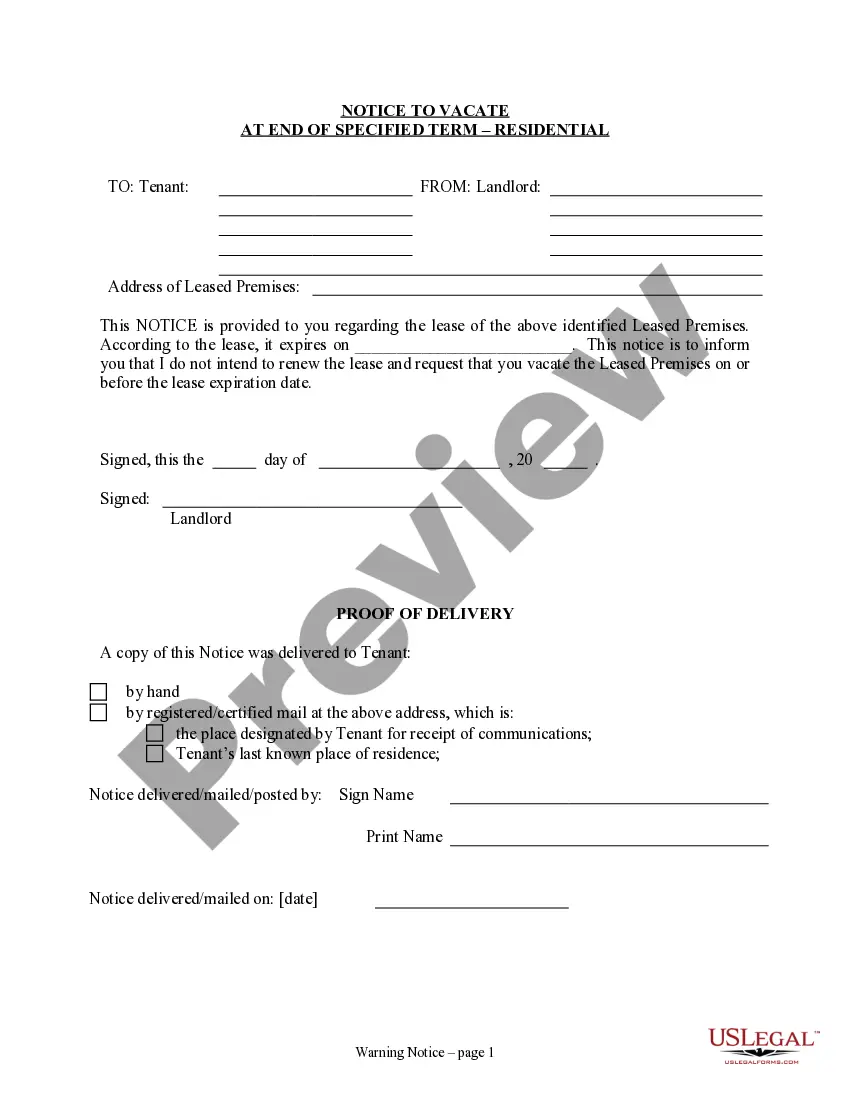

How to fill out California Schedule A, Receipts, Pensions, Annuities, And Other Regular Periodic Payments-Standard Account?

If you are aiming to locate the correct California Schedule A, Receipts, Pensions, Annuities, and other Regular Periodic Payments-Standard Account samples, US Legal Forms is precisely what you require; access files created and vetted by state-certified legal experts.

Utilizing US Legal Forms not only prevents you from troubles concerning legal documents; moreover, you conserve both time and money! Obtaining, printing, and filling out a professional form is significantly less expensive than hiring an attorney to do it for you.

And there you have it. With a few straightforward steps, you obtain an editable California Schedule A, Receipts, Pensions, Annuities, and other Regular Periodic Payments-Standard Account. After creating an account, all subsequent requests will be processed even more easily. Once you have a US Legal Forms subscription, simply Log In to your account and then click the Download button found on the form's webpage. Afterward, when you need to use this form again, you will always be able to find it in the My documents section. Don't waste your time comparing multiple forms on various websites. Acquire accurate copies from a single secure service!

- To get started, complete your registration process by entering your email and setting a password.

- Follow the steps provided below to create an account and find the California Schedule A, Receipts, Pensions, Annuities, and other Regular Periodic Payments-Standard Account template to resolve your concerns.

- Utilize the Preview feature or review the document details (if available) to ensure that the template is the one you need.

- Verify its relevancy where you reside.

- Click Purchase Now to place an order.

- Choose a preferred pricing plan.

- Set up your account and pay using your credit card or PayPal.

- Select a suitable format and download the file.

Form popularity

FAQ

Schedule A is required in any year you choose to itemize your deductions. The schedule has seven categories of expenses: medical and dental expenses, taxes, interest, gifts to charity, casualty and theft losses, job expenses and certain miscellaneous expenses.

Schedule A is the tax form used by taxpayers who choose to itemize their deductible expenses rather than take the standard deduction. Tax law changes in 2017 as a result of the Tax Cuts and Jobs Act (TCJA) eliminated many deductions and also nearly doubled the amount of the standard deduction.

Use Schedule A (Form 1040) to figure your itemized deductions.If you itemize, you can deduct a part of your medical and dental expenses, and amounts you paid for certain taxes, interest, contributions, and other expenses. You can also deduct certain casualty and theft losses.

Taxes You Paid Deductions for state and local sales tax (SALT), income, and property taxes can be itemized on Schedule A. The total amount you are claiming for state and local sales, income, and property taxes cannot exceed $10,000.

Schedule A is an IRS form used to claim itemized deductions on your tax return. You fill out and file a Schedule A at tax time and attach it to or file it electronically with your Form 1040. The title of IRS Schedule A is Itemized Deductions.

Also known as U.S. Tax Return for Seniors, Internal Revenue Service (IRS) Form 1040-SR is a result of the Bipartisan Budget Act of 2018. It has larger text and less shading than the regular 1040 to help older folks whose vision isn't what it used to be.

The simplest IRS form is the Form 1040EZ. The 1040A covers several additional items not addressed by the EZ. And finally, the IRS Form 1040 should be used when itemizing deductions and reporting more complex investments and other income. Here are a few general guidelines on which form to use.

Medical and Dental Expenses. State and Local Taxes. Mortgage and Home Equity Loan Interest. Charitable Deductions. Casualty and Theft Losses. Eliminated Itemized Deductions.