This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

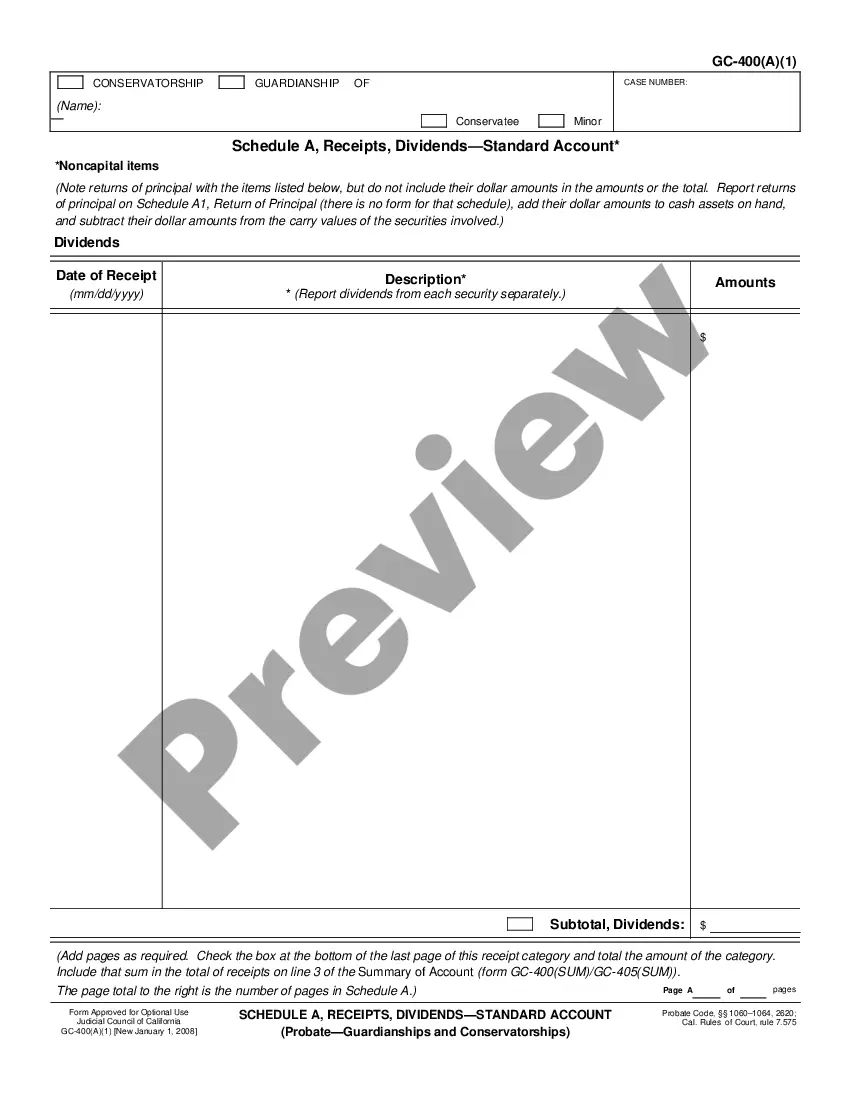

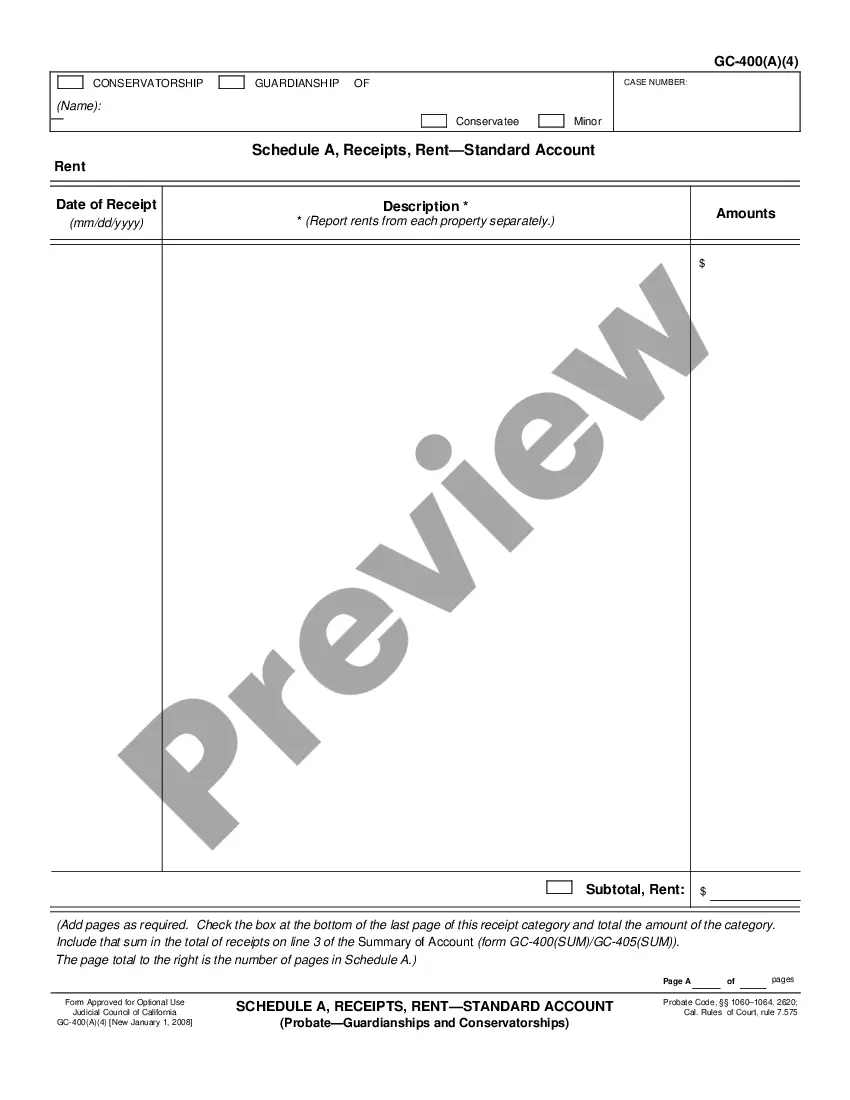

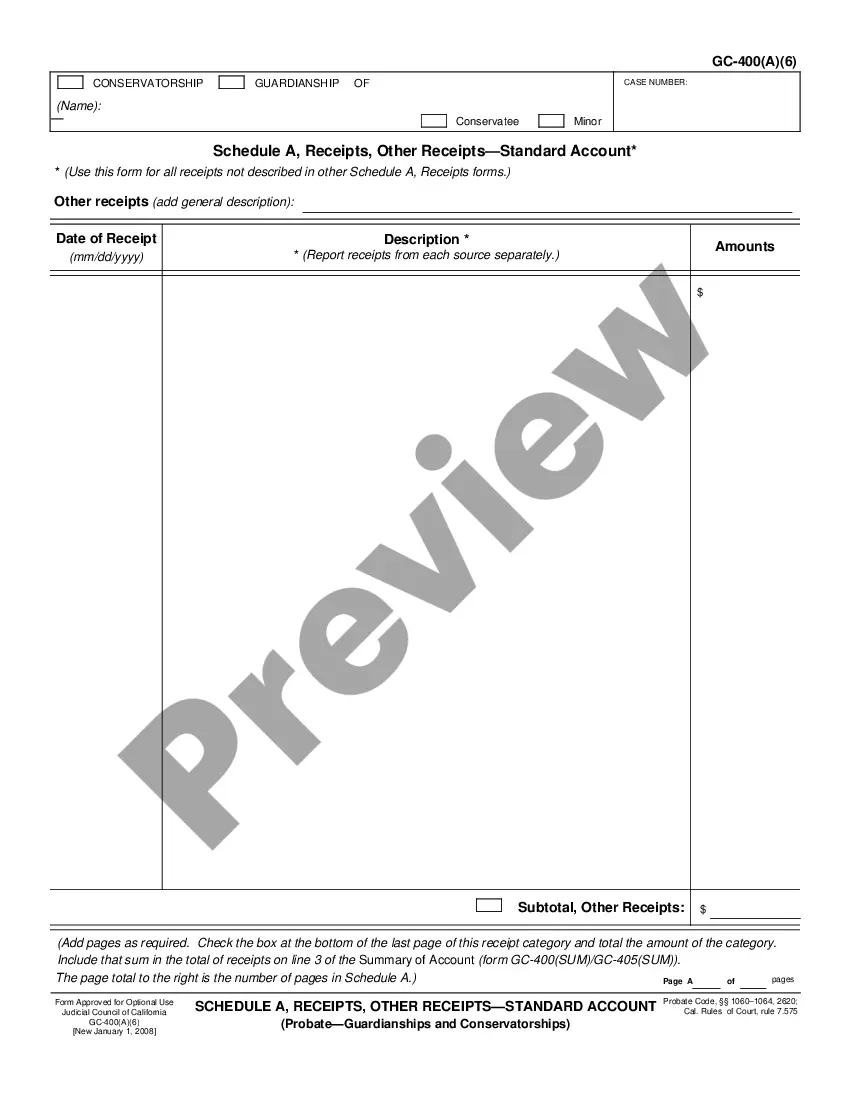

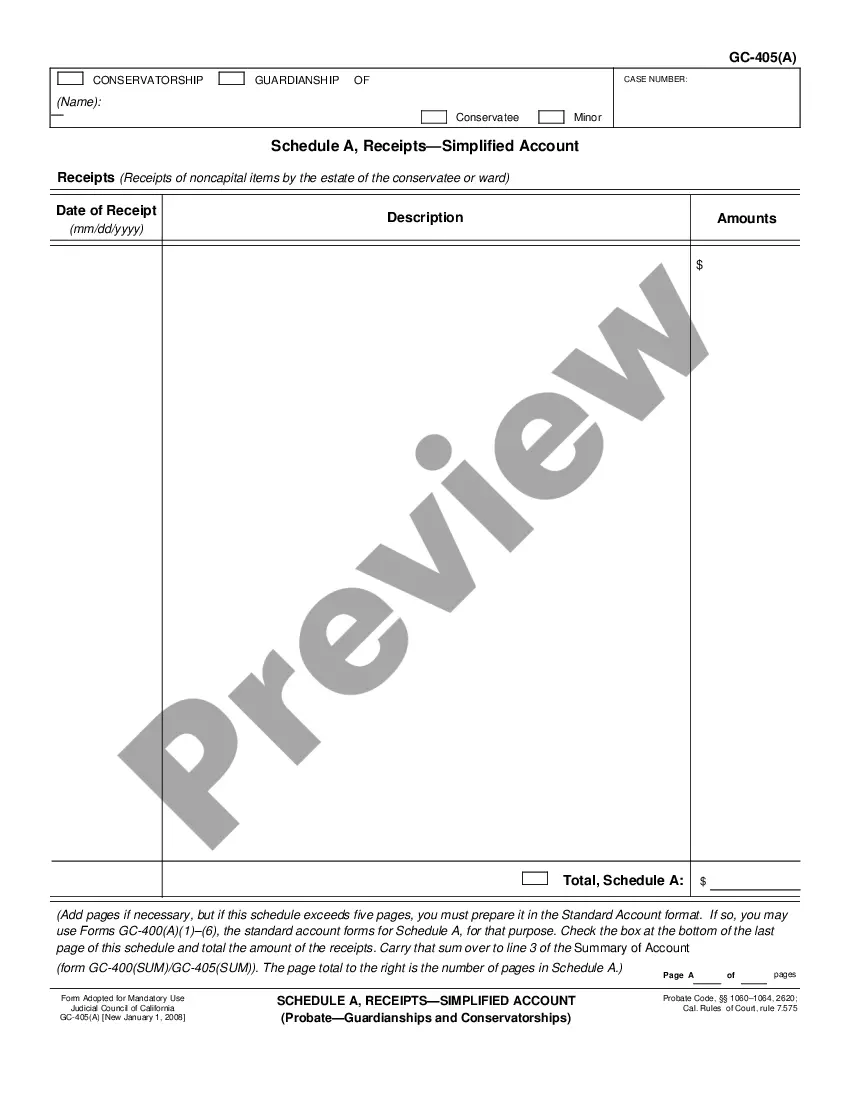

California Schedule A, Receipts, Interest-Standard Account

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Schedule A, Receipts, Interest-Standard Account?

If you are looking for the correct California Schedule A, Receipts, Interest-Standard Account examples, US Legal Forms is exactly what you require; obtain documents supplied and verified by state-certified legal professionals.

Utilizing US Legal Forms not only saves you from stress related to legal documentation; additionally, you conserve time, effort, and money! Downloading, printing, and completing a professional template is considerably more cost-effective than requesting an attorney to draft it for you.

And that’s all. In just a few simple steps, you have an editable California Schedule A, Receipts, Interest-Standard Account. Once you create your account, all future purchases will be processed even more smoothly. When you have a US Legal Forms subscription, simply Log In to your profile and click the Download option seen on the form’s page. Then, when you need to use this template again, you can always find it in the My documents section. Don’t waste your time and effort comparing countless documents on various websites. Acquire professional templates from one reliable platform!

- To begin, complete your registration process by providing your email and creating a secure password.

- Follow the directions below to create your account and obtain the California Schedule A, Receipts, Interest-Standard Account sample to address your situation.

- Use the Preview feature or review the document description (if available) to ensure that the sample is the one you require.

- Verify its validity in the state you reside in.

- Click Buy Now to complete your purchase.

- Choose a preferred pricing plan.

- Establish an account and pay with a credit card or PayPal.

- Select an appropriate format and save the document.

Form popularity

FAQ

Task 7: On Line 12, use your Form(s) W-2 to fill in your state wages. Task 8: On Line 13, enter your adjusted federal adjusted gross income from Form 1040, Form 1040 A, or Form 1040 EZ.

Qualifying to Use Form 540 2EZ Be 65 or older and claim the senior exemption. If your (or your spouse's/RDP's) 65th birthday is on January 1, 2021, you are considered to be age 65 on December 31, 2020.

Do not attach a federal return unless the client is filing Form 540 with any federal schedules other than Schedule A or Schedule B, Long or Short Form 540NR, or a return for an RDP couple. Note: For e-file, your software should transmit the federal return, when it is required, with the state return.

Filling in Your Tax Return Use black or blue ink on the tax return you send to the FTB. Enter your social security number(s) (SSN) or individual taxpayer identification number(s) (ITIN) at the top of Form 540, Side 1. Print numbers and CAPITAL LETTERS between the combed lines. Be sure to line up dollar amounts.

This schedule is used by all taxpayers who are required to apportion business income.The market assignment method and single-sales factor apportionment may result in California sourced income or apportionable business income if a taxpayer is receiving income from intangibles or services from California sources.

If you have a tax liability for 2020 or owe any of the following taxes for 2020, you must file Form 540. Tax on a lump-sum distribution.

You must file California Corporation Franchise or Income Tax Return (Form 100) if the corporation is: Incorporated in California. Doing business in California. Registered to do business in California with the Secretary of State.

A Form 540 is also known as a California Resident Income Tax Return.This form is used each year to file taxes and determine if the filer owes taxes or is entitled to a tax refund. The form will be sent to the state organization that processes and records the tax information.

Any tax due must be paid by April 15, 2020, to avoid penalties and interest. See form FTB 3519. You cannot use Form 540 2EZ if you make an extension payment with form FTB 3519. You can CalFile, e-file, or use Form 540, or Form 540NR when you file your tax return.