Arizona Affidavit of Heirship for Motor Vehicle

Description

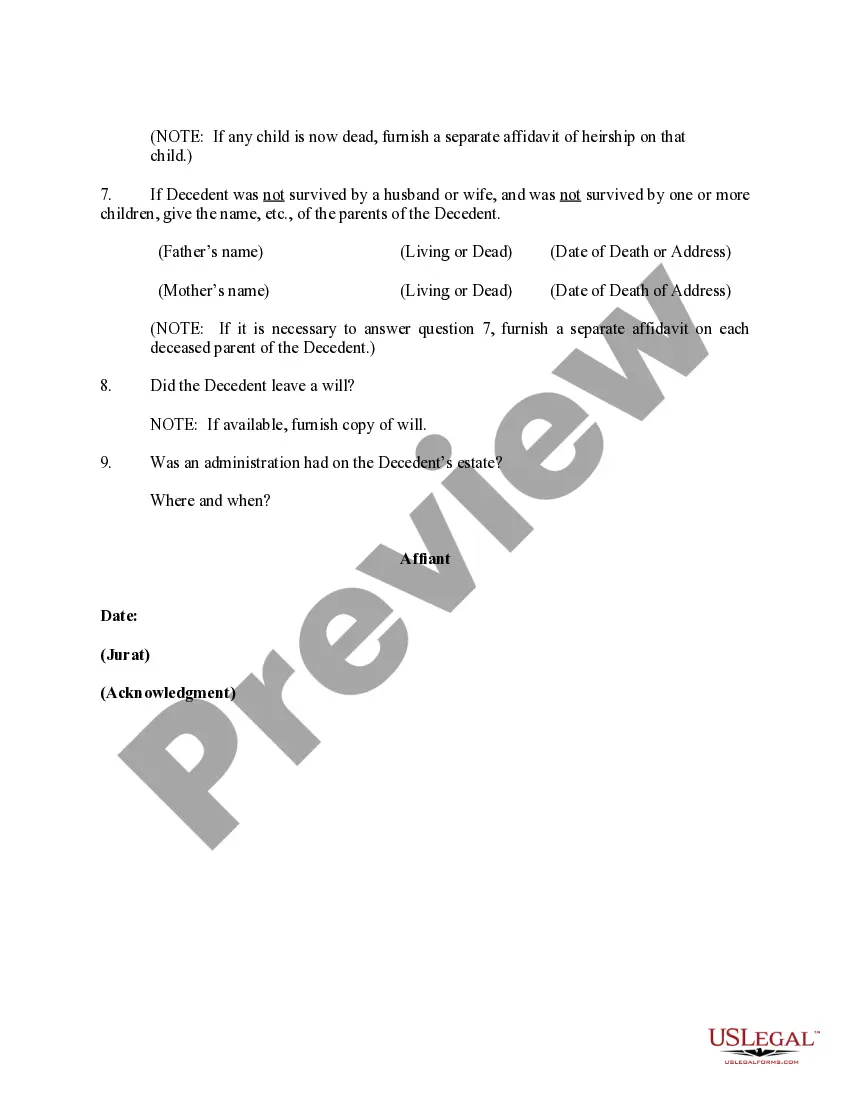

How to fill out Affidavit Of Heirship For Motor Vehicle?

If you have to comprehensive, acquire, or printing legal papers themes, use US Legal Forms, the biggest selection of legal varieties, which can be found on the web. Utilize the site`s simple and convenient research to get the papers you require. Numerous themes for company and specific reasons are categorized by types and suggests, or search phrases. Use US Legal Forms to get the Arizona Affidavit of Heirship for Motor Vehicle within a number of click throughs.

Should you be presently a US Legal Forms customer, log in in your account and click on the Down load button to have the Arizona Affidavit of Heirship for Motor Vehicle. You may also accessibility varieties you formerly saved from the My Forms tab of your own account.

Should you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Make sure you have selected the shape for that proper area/nation.

- Step 2. Utilize the Review solution to examine the form`s content material. Don`t forget to read the explanation.

- Step 3. Should you be not happy together with the kind, utilize the Search industry on top of the display to find other types of the legal kind web template.

- Step 4. Once you have discovered the shape you require, click on the Get now button. Select the prices plan you like and include your references to sign up for the account.

- Step 5. Approach the deal. You can use your Мisa or Ьastercard or PayPal account to finish the deal.

- Step 6. Choose the structure of the legal kind and acquire it on your device.

- Step 7. Full, modify and printing or indicator the Arizona Affidavit of Heirship for Motor Vehicle.

Every legal papers web template you purchase is your own property for a long time. You might have acces to every single kind you saved inside your acccount. Go through the My Forms area and select a kind to printing or acquire yet again.

Be competitive and acquire, and printing the Arizona Affidavit of Heirship for Motor Vehicle with US Legal Forms. There are millions of skilled and condition-distinct varieties you may use for your personal company or specific requires.

Form popularity

FAQ

Hear this out loud PauseUnder current Arizona law, small estates are defined as those in which the deceased owned less than $100,000 in real estate equity or less than $75,000 worth of personal property. For estates over this size, probate is typically required, and those estates will not be eligible for the small estate affidavit process.

A ballpark fee for preparation of the affidavit is between $750 for a very simple estate with few heirs to several thousand dollars for a more complicated estate with many heirs. The filing fees to record the affidavit in each county where the real property is located usually run about $50 to $75 in Texas.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

Hear this out loud PauseReal estate or a debt secured by a lien on real property may be transferred to the successor or successors by affidavit if certain requirements are met. This affidavit must be filed in the county where the decedent was domiciled or, if not domiciled in this state, in the county where the property is located.

Hear this out loud PauseOnce signed and notarized, the affidavits must be filed with the probate court in the county where the property is physically located. A certified copy of the death certificate and a copy of the will, if any, must be attached to each affidavit, along with title documents for real estate and other large assets.

Hear this out loud PauseSpecific information is needed to determine the identity of the Heirs at Law of the Heir Property. A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death.

The disinterested witnesses must be someone who knew the decedent and was familiar with the decedent's family history. The disinterested witness can be a friend of the decedent, a friend of the family, or a neighbor, but it cannot be an individual who will directly benefit from the estate financially.

The mailing address is: Harris County Clerk, P.O. Box 1525, Houston, TX 77251-1525.