Arizona Affidavit of Heirship for Real Property

Description

How to fill out Affidavit Of Heirship For Real Property?

Discovering the right legitimate record template might be a have a problem. Needless to say, there are plenty of layouts accessible on the Internet, but how will you obtain the legitimate kind you will need? Use the US Legal Forms web site. The support provides a huge number of layouts, including the Arizona Affidavit of Heirship for Real Property, which you can use for enterprise and personal demands. Each of the forms are checked by professionals and satisfy federal and state demands.

When you are already listed, log in to your profile and click the Acquire button to have the Arizona Affidavit of Heirship for Real Property. Make use of profile to check from the legitimate forms you possess bought in the past. Visit the My Forms tab of your profile and acquire one more version from the record you will need.

When you are a whole new user of US Legal Forms, listed below are easy instructions so that you can comply with:

- Very first, make sure you have chosen the proper kind for the city/state. You can look through the shape making use of the Review button and study the shape description to make sure this is basically the right one for you.

- If the kind is not going to satisfy your requirements, take advantage of the Seach industry to get the appropriate kind.

- Once you are certain that the shape is proper, click on the Buy now button to have the kind.

- Opt for the rates prepare you desire and type in the necessary info. Make your profile and pay for an order using your PayPal profile or Visa or Mastercard.

- Select the data file file format and download the legitimate record template to your system.

- Total, edit and printing and indication the attained Arizona Affidavit of Heirship for Real Property.

US Legal Forms will be the biggest library of legitimate forms for which you will find a variety of record layouts. Use the service to download appropriately-manufactured papers that comply with express demands.

Form popularity

FAQ

To get title to the property after your death, the beneficiary must record a certified copy of the death certificate in the recorder's office. No probate is necessary. Use Nolo's Quicken WillMaker to make a beneficiary deed or transfer on death deed in any state that allows it.

If seeking personal property, it is not necessary to file the small estate affidavit with the court. Instead, give the completed, signed, notarized form to the person or entity holding the asset to be transferred.

The form alerts buyers to some unique circumstances often associated with purchasing rural, unincorporated land in Arizona. For instance, the affidavit acknowledges whether there is legal access and physical access to the property.

This form is used to record the selling price, date of sale and other required information about the sale of property.

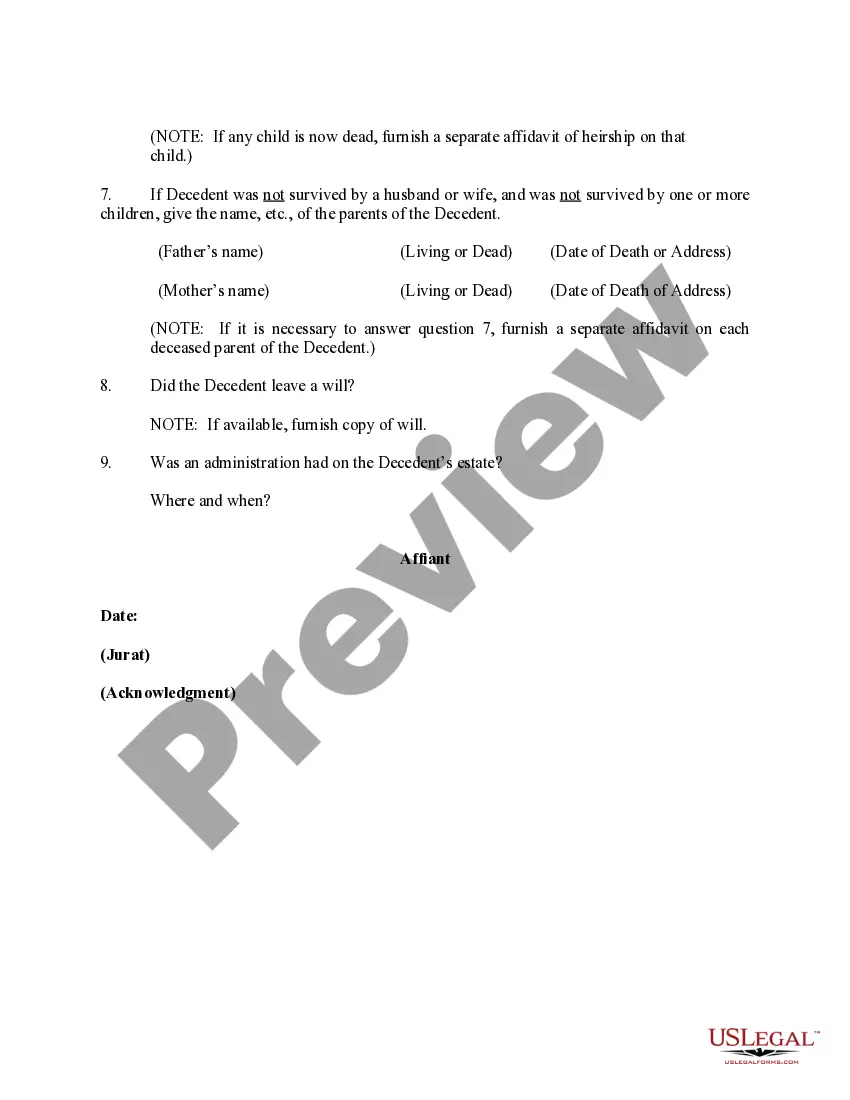

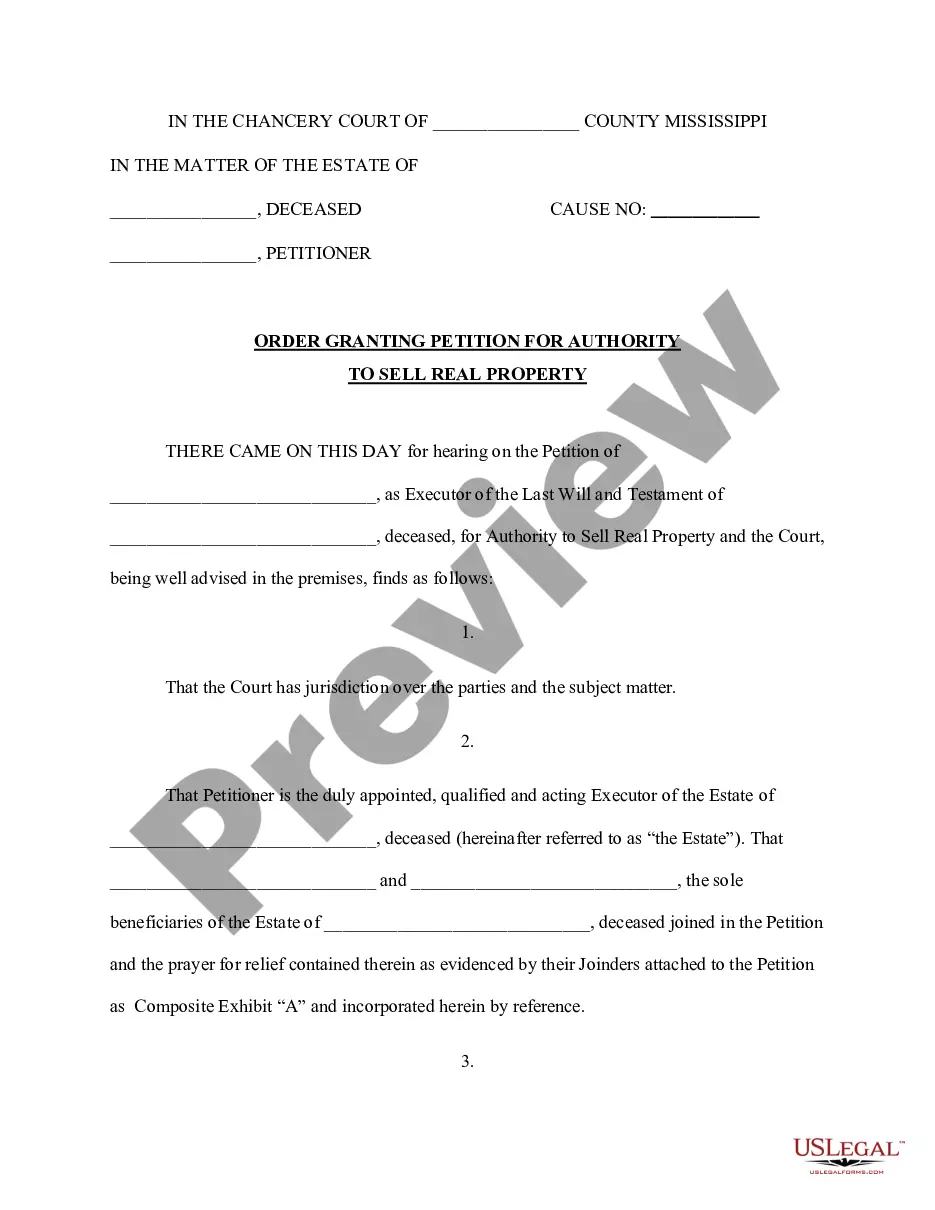

Real estate or a debt secured by a lien on real property may be transferred to the successor or successors by affidavit if certain requirements are met. This affidavit must be filed in the county where the decedent was domiciled or, if not domiciled in this state, in the county where the property is located.

The document contains sworn statements confirmed in the presence of a notary public, and provides notice that the successor has assumed the authority of the preceding trustee relevant to real property held in trust.