Arizona Profit Sharing Plan

Description

How to fill out Profit Sharing Plan?

Are you currently inside a place the place you need to have files for both enterprise or person functions nearly every day? There are plenty of lawful document themes available on the net, but getting types you can depend on isn`t easy. US Legal Forms delivers a large number of type themes, like the Arizona Profit Sharing Plan, that are composed to meet state and federal specifications.

In case you are currently knowledgeable about US Legal Forms website and have a free account, just log in. Afterward, you may download the Arizona Profit Sharing Plan web template.

Should you not have an profile and need to begin to use US Legal Forms, follow these steps:

- Get the type you want and ensure it is for your correct city/area.

- Utilize the Preview button to examine the shape.

- Browse the description to ensure that you have selected the proper type.

- In case the type isn`t what you`re looking for, take advantage of the Lookup discipline to discover the type that meets your requirements and specifications.

- When you discover the correct type, simply click Purchase now.

- Opt for the rates prepare you would like, complete the necessary information to make your bank account, and buy the transaction using your PayPal or charge card.

- Choose a hassle-free document formatting and download your duplicate.

Find each of the document themes you have bought in the My Forms menu. You can aquire a more duplicate of Arizona Profit Sharing Plan at any time, if needed. Just click on the needed type to download or print the document web template.

Use US Legal Forms, probably the most considerable assortment of lawful forms, to save time and steer clear of errors. The services delivers expertly made lawful document themes that can be used for a variety of functions. Generate a free account on US Legal Forms and start creating your lifestyle a little easier.

Form popularity

FAQ

Profit Sharing Plan Eligibility Has one year of service. Has attained age 21. Works 1,000 hours or more during a plan year. Has not bargained in good faith for pension benefits.

Limitations to profit sharing plans Employers can only deduct contributions to retirement plans of up to 25% of total employee compensation. Total contributions for each employee (including employer contributions and employee deferrals) may not exceed 100% of the employee's compensation.

sharing plan is a great way for a business to give its employees a sense of ownership in the company, but there are typically restrictions as to when and how a person can withdraw these funds without penalties.

sharing plan accepts discretionary employer contributions. There is no set amount that the law requires you to contribute. If you can afford to make some amount of contributions to the plan for a particular year, you can do so. Other years, you do not need to make contributions.

Retire from ASRS if you are eligible. Or, you can: Take a refund of your account, with applicable interest. You may withdraw your funds in cash and pay all taxes and penalties, or you may rollover your funds to another qualified retirement program. This option is also known as a Forfeiture.

The simplest and most common is known as the comp-to-comp method, where contributions are based on the proportion of an employee's compensation to the total compensation of all employees of the organization. There's no required profit-sharing percentage, but experts recommend staying between 2.5% and 7.5%.

There are three basic types of profit sharing plans: traditional, age-weighted and new comparability.

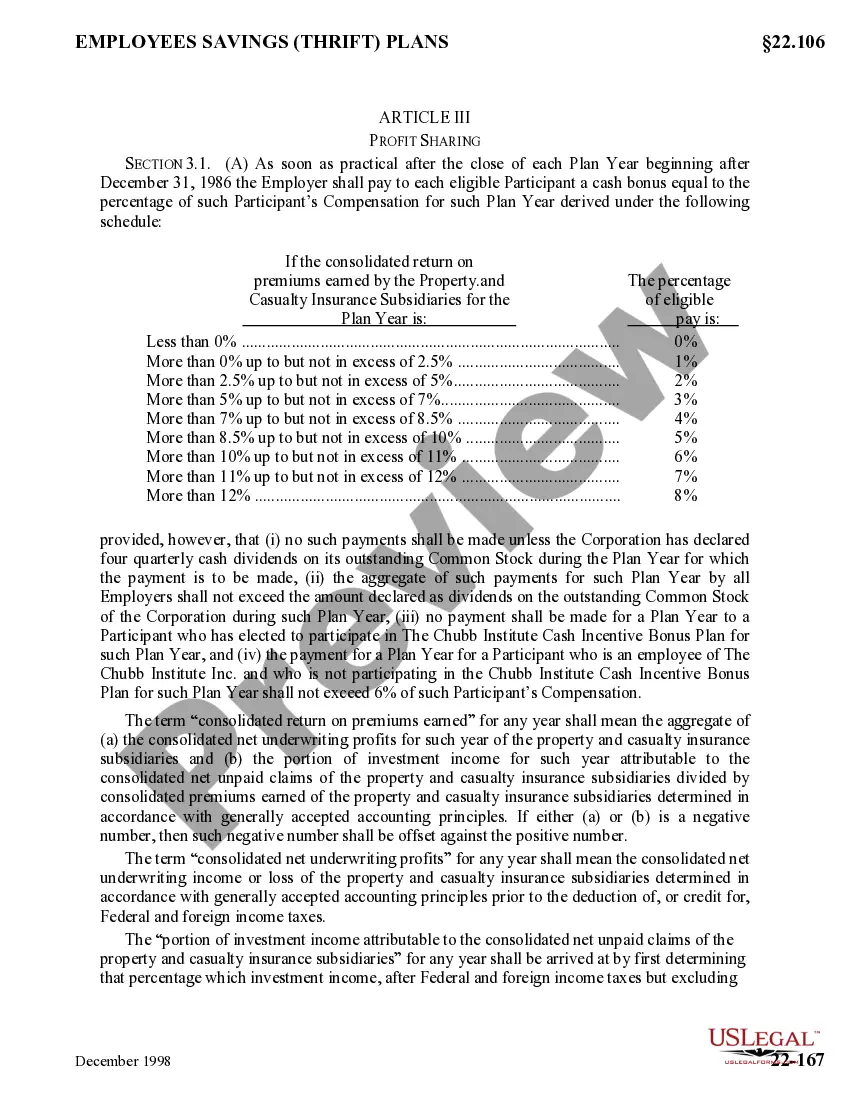

If you, the employer, make contributions to a profit sharing plan, you can deduct up to 25 percent of the compensation paid during the taxable year to all participants. Your contributions to the plan can either be fully vested (nonforfeitable) when made, or they can vest over time ing to a vesting schedule.