Arizona VETS-100 Report

Description

How to fill out VETS-100 Report?

Are you experiencing a scenario where you need documents for either business or personal uses almost constantly.

There are numerous authentic document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides a wide array of form templates, such as the Arizona VETS-100 Report, which can be customized to meet federal and state requirements.

Upon finding the right form, click Get now.

Select the pricing plan you prefer, enter the required information to create your account, and complete your purchase using PayPal or a credit card. Choose a convenient file format and download your copy. Access all the document templates you have acquired in the My documents section. You can obtain an additional version of the Arizona VETS-100 Report anytime if needed; simply follow the necessary form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Arizona VETS-100 Report template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is suited for the correct jurisdiction.

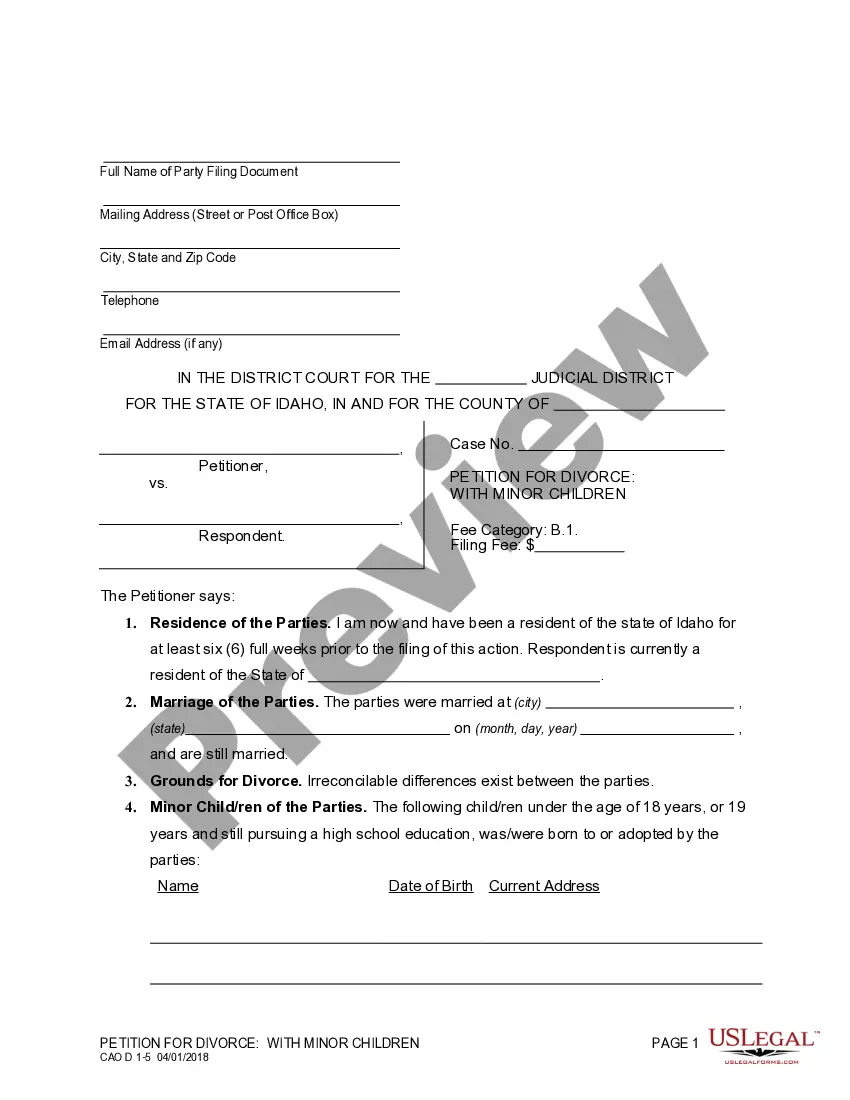

- Utilize the Review button to examine the document.

- Read the description to confirm you have chosen the appropriate form.

- If the form does not meet your expectations, use the Lookup section to find the document that satisfies your requirements.

Form popularity

FAQ

The VETS-100A Report is now named the VETS-4212 Report. The VETS-100 Report is rescinded, rendering obsolete the VETS reporting requirements applicable to Government contracts and subcontracts entered into before December 1, 2003. The term covered veteran is replaced with the term protected veteran.

Arizona offers the following discounts to their state parks: 50% day-use discount to all active duty, guard and reserve military members and up to three accompanying adult family members. 50% day-use discount to all resident military retirees. 50% off day-use pass to ALL disabled military.

A disabled veteran in Arizona may receive a property tax exemption of $3,000 on his/her primary residence if the total assessed value does not exceed $10,000.

100 Percent Disabled Veteran A veteran owning or co-owning a vehicle is exempt from payment of vehicle license tax or registration fee, if the veteran is certified by the Department of Veterans Affairs to be 100 percent disabled and drawing compensation on that basis.

If the veteran is 100 percent disabled as a result from service then they may receive a full property tax exemption. Other homestead exemptions may exist for veterans over the age of 65 and surviving spouses.

What Other Benefits Are You Entitled to With a 100 Percent Rating?Priority Group 1 for Health Care.Emergency Care Outside of the VA.Dental Care Benefits.Vision Care and Hearing Aids for Veterans.CHAMPVA Benefits.Specially Adapted Housing Program.Dependents Education Assistance Program.Veteran Readiness and Employment.More items...?

Arizona Veteran Financial BenefitsIncome Tax. Active duty pay is tax-free.Arizona Military Family Relief Fund.Vehicle License Tax and Registration Fees.Property Tax.Hiring Preference.Veteran Tool Kit.CDL Skills Test Waiver.Real Estate Licensing.More items...?

Arizona 100% Disabled Veteran License Tax and Registration Fee Exemption: Veterans that are 100% disabled and receiving compensation from the VA are eligible for a vehicle license tax and registration fee exemption for one vehicle that they own or co-own.