Arizona Demand for Collateral by Creditor

Description

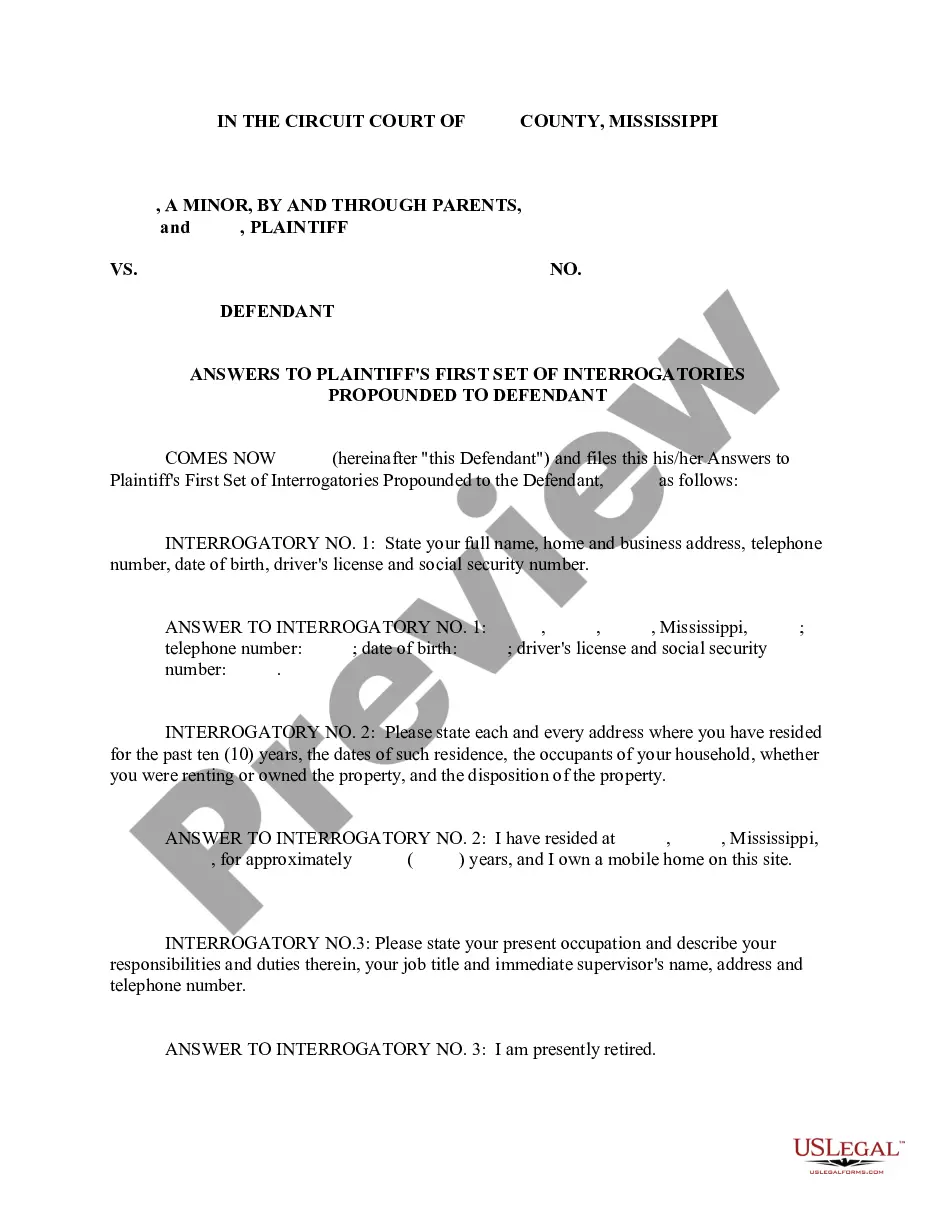

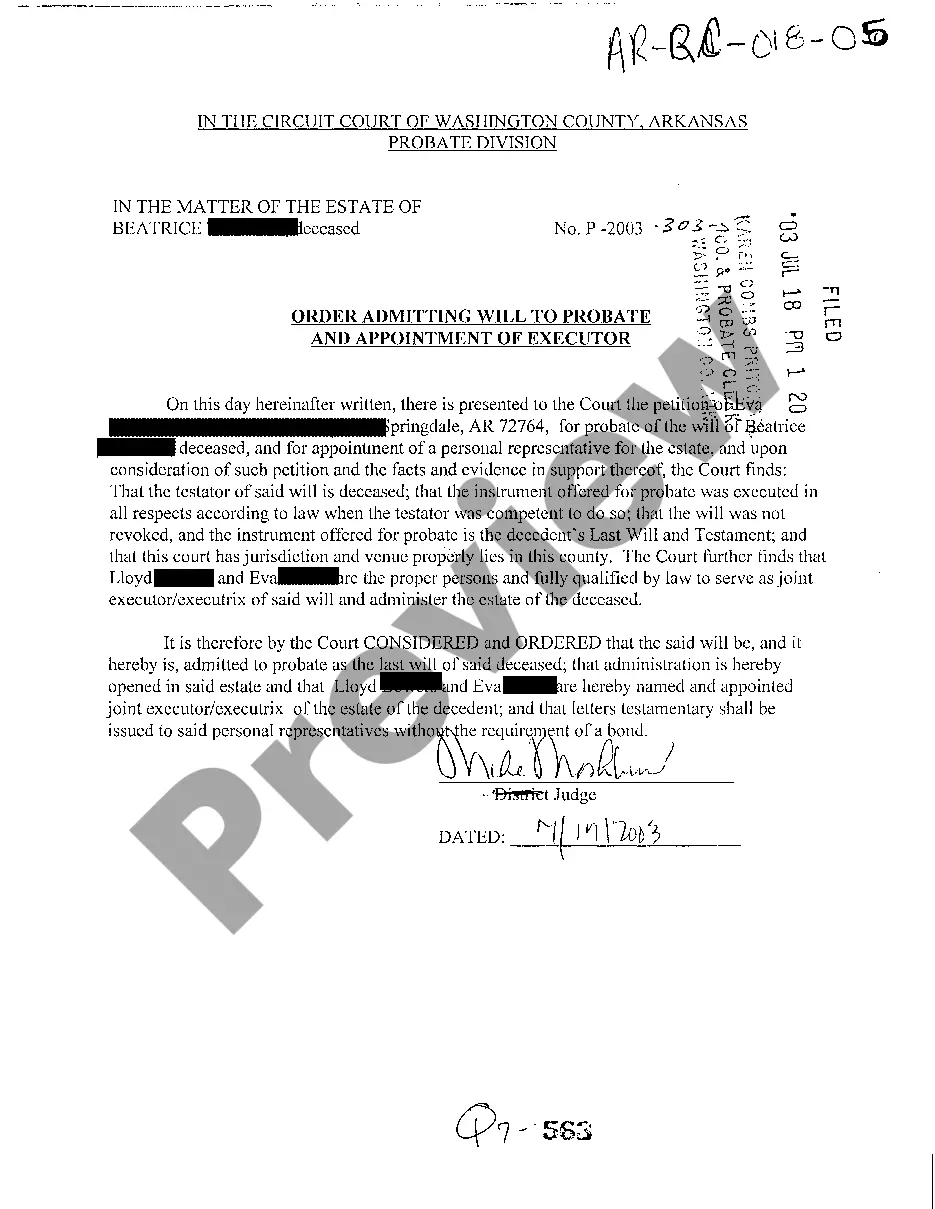

How to fill out Demand For Collateral By Creditor?

US Legal Forms - one of the finest collections of legal documents in the USA - offers a variety of legal template forms that you can acquire or print.

By using the website, you can find thousands of documents for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Arizona Demand for Collateral by Creditor in just minutes.

If the document does not fulfill your needs, utilize the Search field at the top of the screen to find one that does.

When you are satisfied with the document, confirm your choice by clicking the Buy now button. Then, choose your preferred payment method and provide your details to register for an account.

- If you already possess a subscription, Log In and obtain Arizona Demand for Collateral by Creditor from the US Legal Forms catalog.

- The Acquire button will appear on every document you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you've selected the correct form for your region/area. Click on the Review button to examine the document's content.

- Check the document summary to confirm you've selected the appropriate form.

Form popularity

FAQ

In Arizona, specific types of property are exempt from creditors, including necessary household items, a portion of equity in a home, and certain retirement accounts. These exemptions can protect a debtor's essential assets while dealing with an Arizona Demand for Collateral by Creditor. Knowing what is exempt can ease financial burdens during challenging times.

Yes, debtors have certain rights concerning collateral. They have the right to know the status of their collateral and, in many cases, the right to rectify their debts before the creditor seizes it. Engaging with an Arizona Demand for Collateral by Creditor can help ensure you understand and exercise these rights.

The right to redeem collateral allows a debtor to regain their property after it has been taken due to non-payment. Typically, this right exists until the creditor formally disposes of the collateral. Understanding your rights in the context of an Arizona Demand for Collateral by Creditor is crucial to reclaiming your assets.

Both creditors and debtors have specific, protected rights in Arizona. Creditors can demand repayment through legal means, including an Arizona Demand for Collateral by Creditor. On the other hand, debtors have the right to be informed about their debts and to dispute inaccuracies in the claims made against them.

In Arizona, creditors can pursue a debt for up to six years for most types of debt. This time limit, known as the statute of limitations, can vary based on the type of obligation. When dealing with an Arizona Demand for Collateral by Creditor, understanding these timelines helps protect your rights.

A security interest becomes perfected through several methods, with the most common being the filing of a financing statement. In Arizona Demand for Collateral by Creditor cases, perfection can also occur through the creditor's possession of the collateral or when the creditor has the rights to control the collateral. These methods ensure that the creditor's interest is enforceable against third parties, safeguarding their investment.

You can perfect a security interest in an account receivable by filing the appropriate financing statement with the state. It's essential to accurately describe the accounts receivable to avoid any disputes. By doing this, in the light of Arizona Demand for Collateral by Creditor, the creditor gains priority over other creditors claiming the same collateral, thereby strengthening their position.

To perfect a security interest in accounts receivable, the creditor must file a financing statement that specifically identifies the accounts receivable as collateral. Additionally, the creditor may need to provide notice to the account debtors involved. This process, crucial in the context of Arizona Demand for Collateral by Creditor, helps ensure that the creditor's interest in the accounts is legally recognized and protected.

To become a secured party, a creditor must create a security agreement with the debtor. This agreement outlines the terms of the security interest and specifies the collateral securing the debt. Once the agreement is executed, the creditor can begin the process of perfecting the security interest, thus formally recognizing their rights in relation to the collateral under Arizona Demand for Collateral by Creditor.

The most common way to perfect a security interest is through filing a financing statement. This statement, often referred to as a UCC-1 form, is submitted with the appropriate state authority to publicly indicate the creditor's claim against the collateral. In the context of Arizona Demand for Collateral by Creditor, this filing plays a crucial role in ensuring that creditors are recognized and prioritized in case of debtor default.