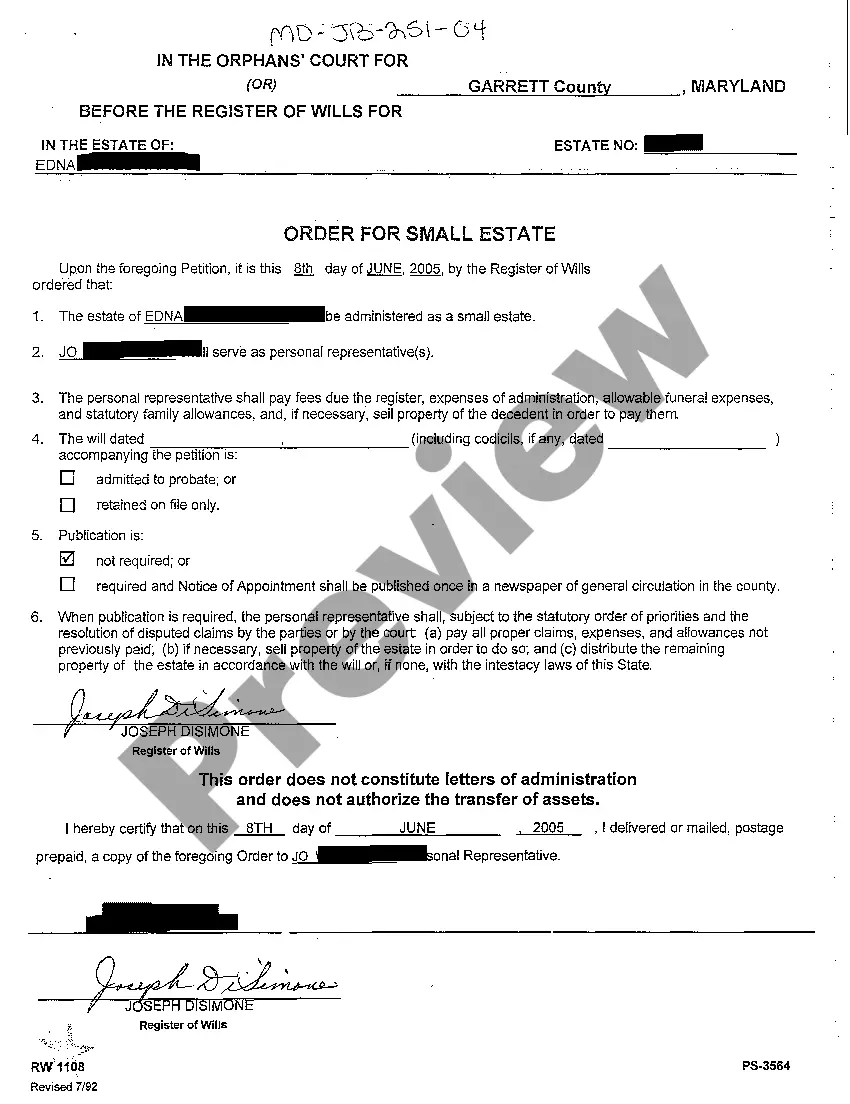

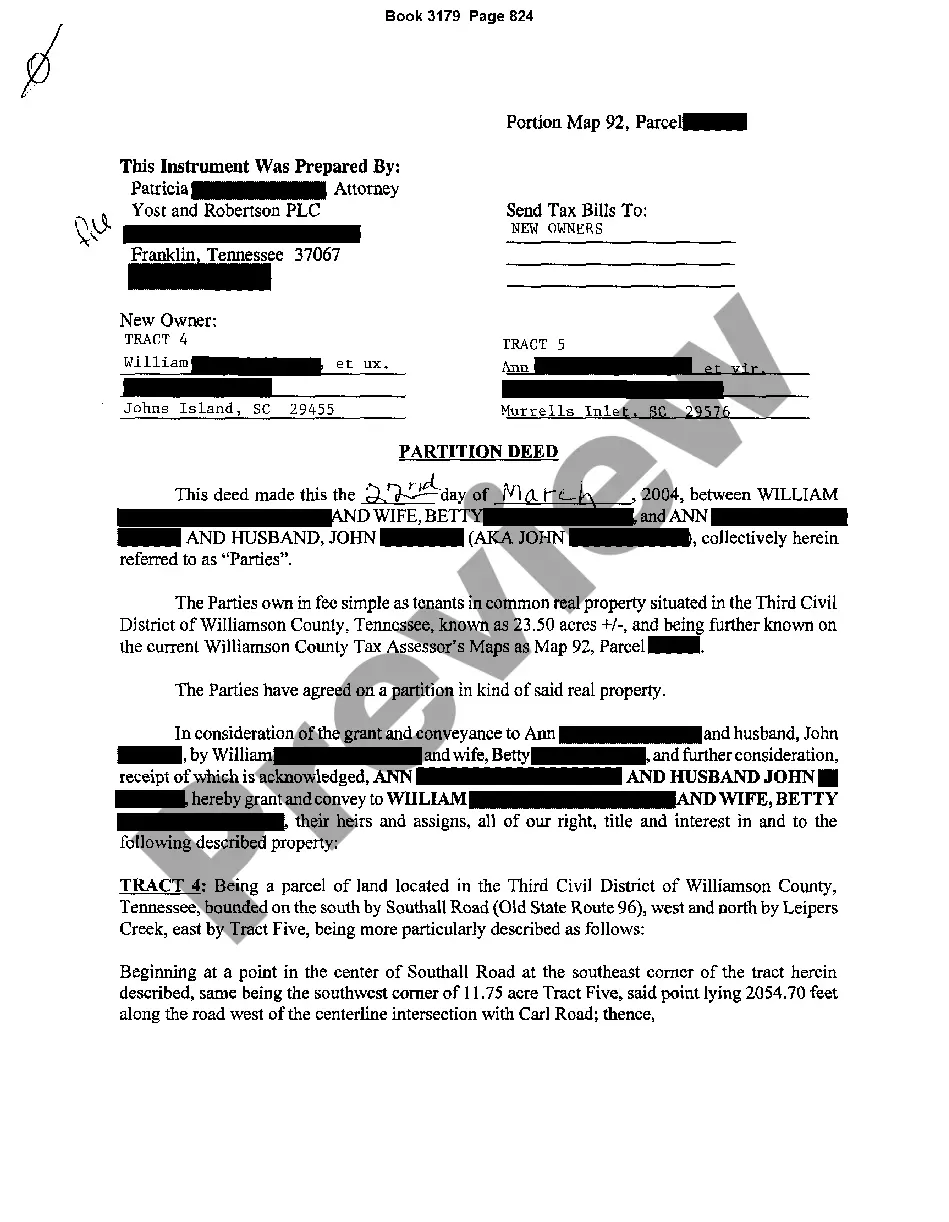

Arizona Request for Proof of Debt

Description

How to fill out Request For Proof Of Debt?

If you need to thorough, acquire, or print out official document templates, utilize US Legal Forms, the largest collection of official forms available online.

Make use of the site's straightforward and user-friendly search to locate the documents you require.

A variety of templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

Step 6. Retrieve the format of the official form and download it onto your device. Step 7. Complete, modify, and print out or sign the Arizona Request for Proof of Debt. Every official document template you acquire is yours forever. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print out or download again. Be proactive and acquire, and print the Arizona Request for Proof of Debt with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to find the Arizona Request for Proof of Debt in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to access the Arizona Request for Proof of Debt.

- You can also access forms you previously downloaded within the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to read through the details.

- Step 3. If you are dissatisfied with the type, use the Search field at the top of the screen to find alternative versions of the official form template.

- Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your credentials to register for the account.

Form popularity

FAQ

To request proof of debt, you can draft a formal letter or use an online form that specifies your request. Clearly state that you are making an Arizona Request for Proof of Debt, and include all necessary details about the debt. Consider using platforms like US Legal Forms, which can provide you with templates and guidance to ensure your request is properly formatted and effective.

Proof of debt may include various documents that confirm the validity of the amount owed. This could consist of contracts, account statements, or payment records. When making an Arizona Request for Proof of Debt, be sure to specify what type of documentation you need to verify the debt's legitimacy.

To submit proof of debt, you typically send your documentation to the creditor or collection agency that holds your account. This can be done via mail or, in some cases, electronically. Ensure that you keep copies of all correspondence, and consider using a service like US Legal Forms to streamline the process of submitting your Arizona Request for Proof of Debt.

When writing a letter to request proof of debt, start with your contact information and the date at the top. Next, address the letter to the creditor or debt collector, and clearly state your request for an Arizona Request for Proof of Debt. Include specific details about the debt in question, such as the amount owed and the account number, to make it easier for them to respond.

To ask for proof of debt, you should reach out to your creditor or debt collector directly. You can do this through a simple letter or email that clearly states your request for an Arizona Request for Proof of Debt. Make sure to include your account details and any relevant information to help them process your request efficiently.

The fair debt collection law in Arizona aims to protect consumers from abusive debt collection practices. This law regulates how collectors can interact with debtors, ensuring they do not use deceptive or unfair tactics. If you believe a collector has violated these laws, consider filing a complaint or seeking legal advice. The Arizona Request for Proof of Debt can also help you navigate your rights and responsibilities throughout this process, making it easier to manage your debts effectively.

In Arizona, the time frame for collecting a debt typically lasts for six years, but this can vary depending on the type of debt. After this period, creditors can no longer pursue legal action to collect the debt. However, it's important to note that they may still attempt to collect the debt through other means. If you receive an Arizona Request for Proof of Debt, it can clarify your situation and help you understand your rights regarding debt collection.

A proof of claim form is a document that a creditor submits to a bankruptcy court to establish their right to receive payment from a debtor's estate. This form provides details about the debt, including the amount owed and the basis for the claim. When going through bankruptcy, the Arizona Request for Proof of Debt can help you understand your responsibilities and ensure all claims are properly documented. Using resources like US Legal Forms can simplify this process.

Proof of debt should include essential details such as the total amount owed, the basis for the debt, and the date it became due. Additionally, attach any supporting evidence, such as contracts or payment history, to strengthen your claim. Using the Arizona Request for Proof of Debt template can help ensure you do not miss any critical elements. A well-prepared proof of debt increases your credibility and likelihood of resolution.

To fill out a proof of claim form, start by identifying the case number and the creditor's name. Provide a clear description of the debt and attach any supporting documents to substantiate your claim. The Arizona Request for Proof of Debt can aid in this process by offering a structured format to accurately present your information. This approach enhances your chances of a successful claim.