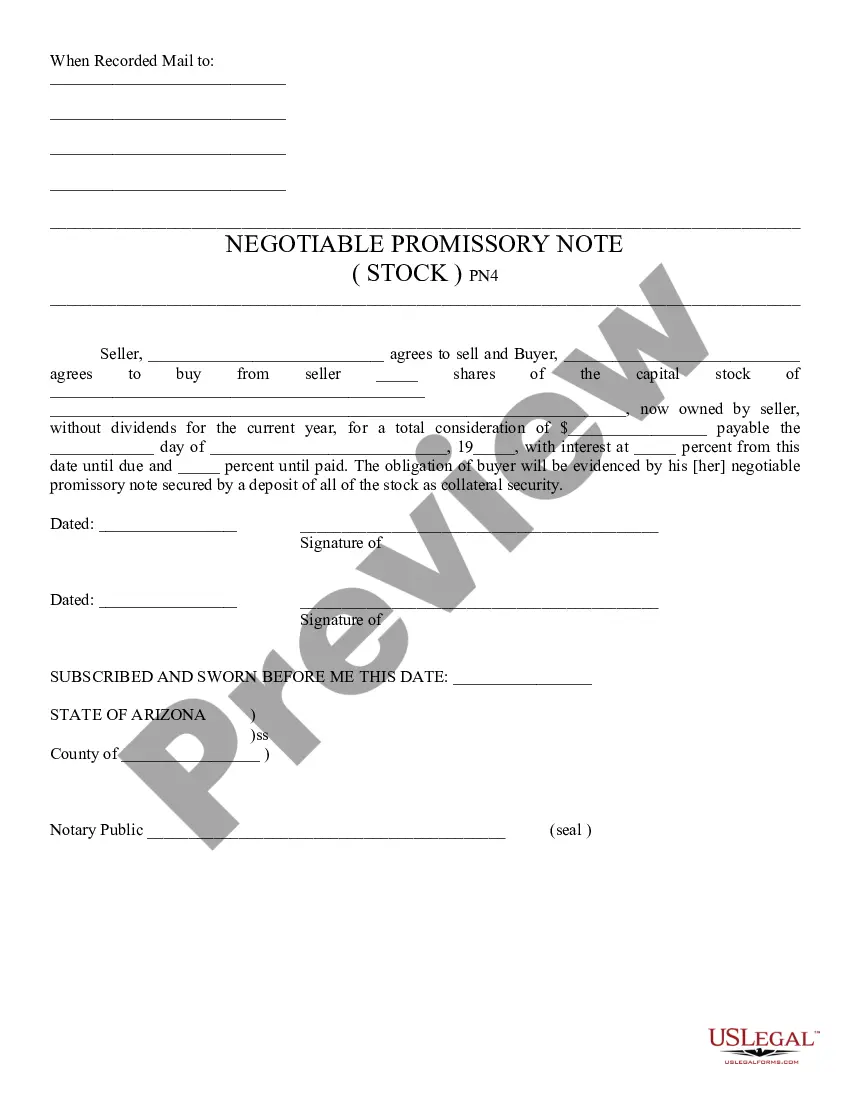

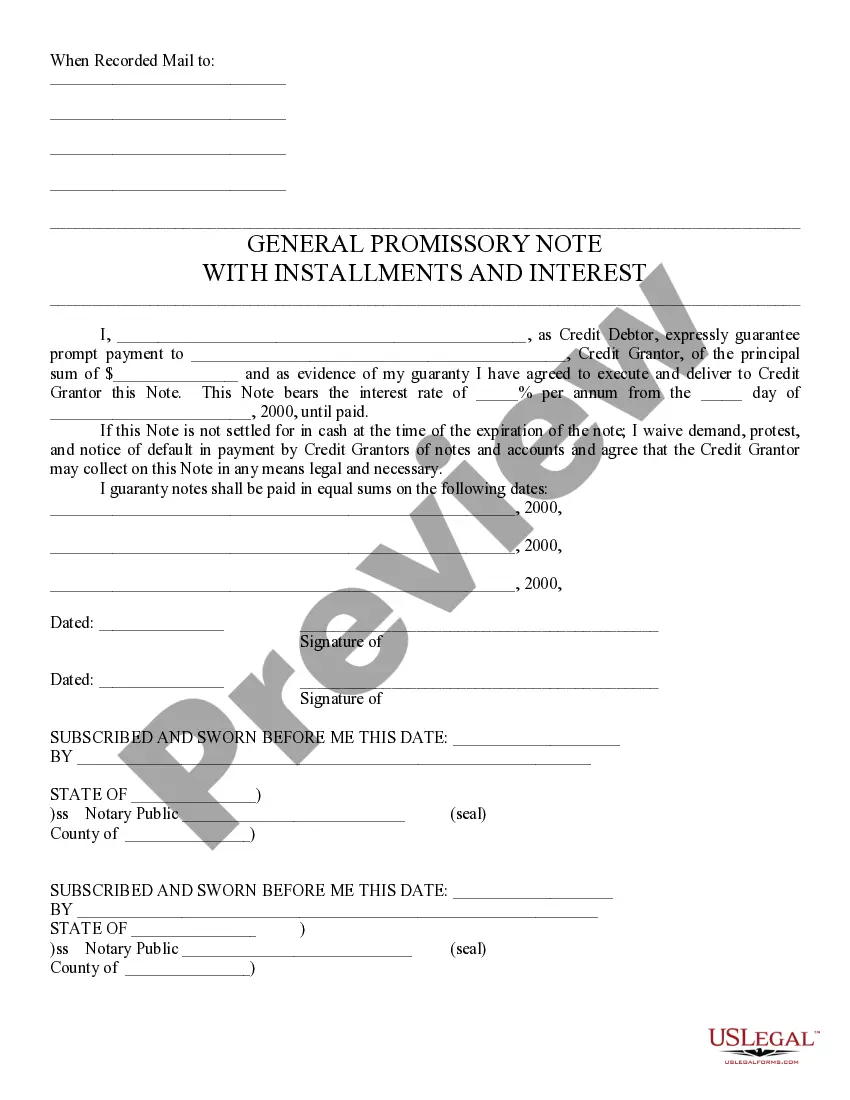

A promissory note is a promise to pay a debt. In this general promissory note, the credit debtor expressly guarantees prompt payment to the credit grantor of a certain principal sum. The credit debtor states that if the note is not settled for in cash at the time of the expiration of the note, then he/she waives demand, protest, and notice of default in payment by credit grantors of notes and accounts and agrees that the credit grantor may collect on the note by any legal means necessary.

Arizona Negotiable Promissory Note

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Negotiable Promissory Note?

If you're seeking exact Arizona Negotiable Promissory Note examples, US Legal Forms is precisely what you require; access documents reviewed and validated by state-certified legal experts.

Using US Legal Forms not only protects you from issues related to legal documents; you also conserve time, effort, and money! Downloading, printing, and completing a professional form is significantly cheaper than hiring an attorney to handle it for you.

- To begin, finalize your registration process by providing your email and creating a password.

- Follow the instructions below to set up your account and obtain the Arizona Negotiable Promissory Note template to address your needs.

- Use the Preview option or review the document details (if available) to confirm that the form is the one you need.

- Verify its legality in your jurisdiction.

- Click Buy Now to place an order.

- Select a preferred pricing plan.

- Create your account and pay using a credit card or PayPal.

- Choose an appropriate format and save the document.

Form popularity

FAQ

Negotiability refers to the ability of a promissory note to be transferred to another party. In the context of an Arizona Negotiable Promissory Note, this means the note must be easily transferable to ensure that the holder can claim the payment. A note is considered negotiable if it meets the criteria established by the Uniform Commercial Code, ensuring its value remains intact through transfers. Understanding this concept is vital for anyone looking to utilize or invest in promissory notes.

An example of an on-demand promissory note is a document stating that the borrower agrees to repay a specified amount upon the lender's request. This type of note typically includes the lender's name, the borrower's details, and the total amount owed. For clarity and accuracy, consider using US Legal Forms, which offers customizable templates for on-demand notes.

An Arizona Negotiable Promissory Note generally follows a structured format, starting with the title, date, and the parties involved. It includes the principal amount, interest rates, repayment terms, and any late fees. Additionally, incorporate a section for signatures to confirm agreement. You can find well-organized formats on US Legal Forms.

Yes, you can modify a promissory note, but doing so typically requires the agreement of both parties involved. Changes can include adjustments to the payment amount, interest rate, or due dates. If you're considering making modifications to your Arizona Negotiable Promissory Note, consulting a platform like USLegalForms can streamline the process.

Yes, you can demand a promissory note from a borrower as part of a lending agreement. It's important to include specific terms in the note to protect your interests. If you are unsure how to structure an Arizona Negotiable Promissory Note, using a platform like USLegalForms can be beneficial to ensure all legal requirements are met.

Yes, you can often get out of a promissory note, but the process may vary depending on the terms of the agreement. You might be able to renegotiate the terms or seek legal avenues to discharge the debt. It is advisable to consult with a legal expert, especially when dealing with an Arizona Negotiable Promissory Note, to understand your options.

In Arizona, a promissory note remains valid until the debt is satisfied or the agreed-upon terms conclude. There is no specific duration that limits the life of a promissory note unless expressly stated in the document. Always consult an expert when drafting or reviewing an Arizona Negotiable Promissory Note to maintain its validity.

Arizona law does not require a promissory note to be witnessed or notarized, but doing so can enhance the enforceability of the document. If there are significant amounts or particular terms involved, having a witness or notary can be a prudent choice. Ultimately, an Arizona Negotiable Promissory Note can be a more secure arrangement with these additional signatures.

In Arizona, a promissory note does not require notarization to be legally binding. However, having a notarized promissory note can add an additional layer of proof and security should any disputes arise. For those seeking clarity in their agreements, using a notarized Arizona Negotiable Promissory Note can be beneficial.