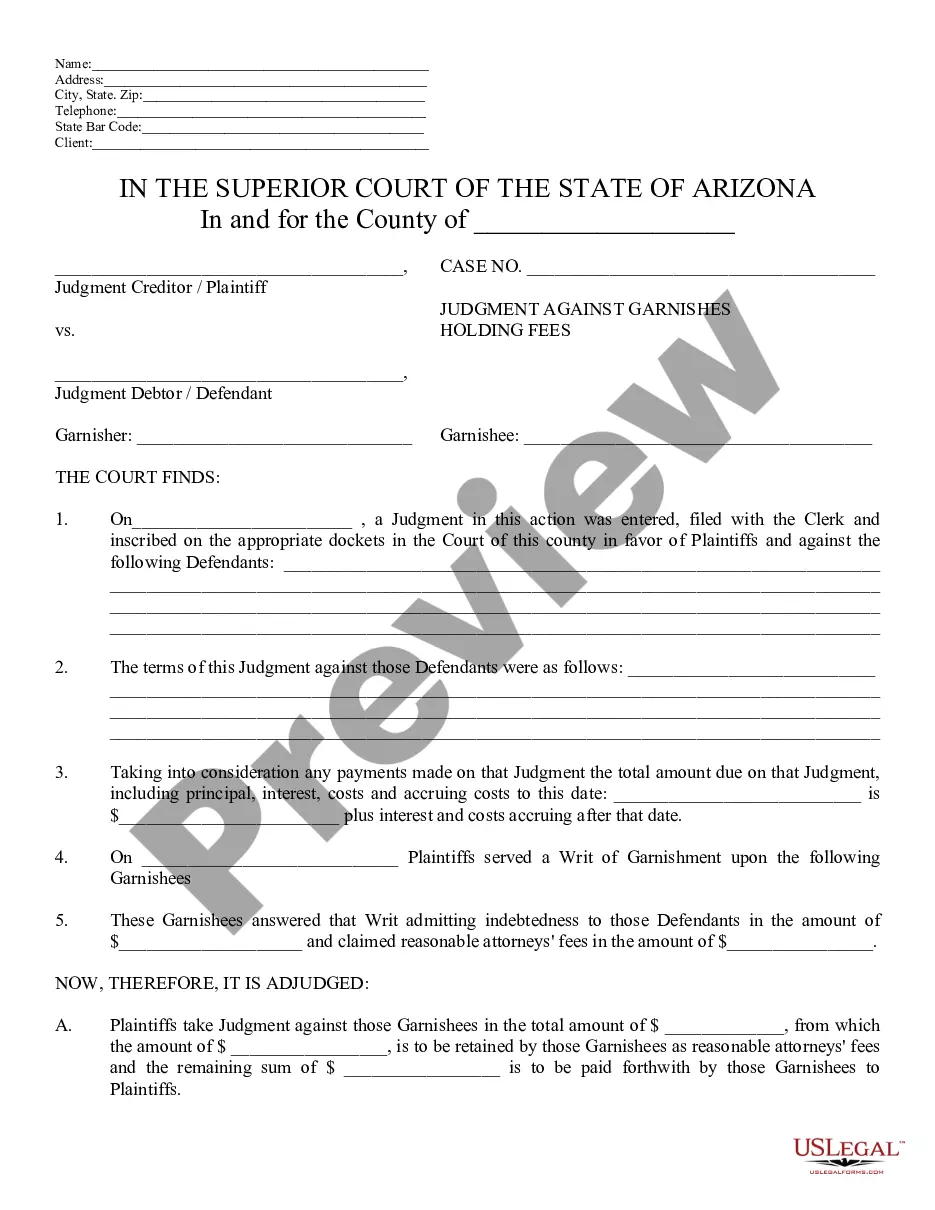

This is a model Judgment form, a Judgment Against Garnishee Holding Funds. The form must be completed to fit the facts and circumstances of whatever judgment the court has rendered. When signed by the Judge, the judgment becomes binding.

Arizona Judgment Against Garnishee Holding Funds

Description

How to fill out Arizona Judgment Against Garnishee Holding Funds?

If you are looking for accurate Arizona Judgment Against Garnishee Holding Funds samples, US Legal Forms is precisely what you require; access documents created and reviewed by state-licensed attorneys.

Using US Legal Forms not only alleviates concerns related to legal paperwork; it also saves you time, effort, and money! Downloading, printing, and completing a professional document is much more economical than hiring an attorney to handle it for you.

And that's it. In just a few easy clicks, you have an editable Arizona Judgment Against Garnishee Holding Funds. Once you create your account, all future purchases will be processed even more effortlessly. After subscribing to US Legal Forms, simply Log In to your profile and click the Download button displayed on the form’s page. Then, when you need to access this form again, you can always find it in the My documents section. Don’t waste your time and energy sifting through countless forms on various websites. Obtain professional documents from one reliable service!

- To get started, complete your registration process by entering your email and creating a secure password.

- Follow the instructions below to establish an account and locate the Arizona Judgment Against Garnishee Holding Funds sample to address your situation.

- Utilize the Preview tool or review the document details (if available) to ensure that the template is the one you require.

- Verify its legality in your state.

- Click on Buy Now to place an order.

- Select a preferred pricing plan.

- Set up an account and pay with a credit card or PayPal.

- Choose a convenient format and store the documents.

Form popularity

FAQ

Filing an answer to a summons in Arizona involves preparing a written response to the summons you received. This document should outline your position regarding the claims made against you. Be sure to file your answer with the appropriate court within the specified timeframe to address the Arizona Judgment Against Garnishee Holding Funds effectively. Resources from uslegalforms can guide you through this process.

To stop a garnishment in Arizona, you can file a motion with the court that issued the judgment. This motion may argue that the garnishment creates undue hardship or address other valid concerns. You can also consult a legal professional to explore your options regarding the Arizona Judgment Against Garnishee Holding Funds, as they can help strategize the best approach based on your situation.

The statute of garnishments in Arizona outlines the legal framework for collecting debts through garnishment. Generally, this process allows creditors to obtain funds directly from a debtor's bank account or wages. In cases involving an Arizona Judgment Against Garnishee Holding Funds, it's important to understand the specific limits and requirements defined in Arizona law to ensure compliance and protect rights.

Yes, a creditor can garnish your bank account in Arizona if they have obtained a judgment against you. They must first follow specific legal procedures to access these funds, often requiring a writ of garnishment. Using resources from platforms like US Legal Forms ensures you are well-equipped to handle any issues related to Arizona Judgment Against Garnishee Holding Funds.

The new garnishment law in Arizona has updated certain thresholds and protections for debtors. It now allows for increased exemptions for essential income, aiming to protect more individuals from severe financial strain. Staying informed about these changes can help you manage your financial situation better regarding Arizona Judgment Against Garnishee Holding Funds.

In Arizona, your check can be garnished up to 25% of your disposable earnings after taxes, though the exact amount can vary based on your specific situation. Additionally, certain types of income are exempt from garnishment, such as Social Security benefits. Understanding these limits can help you navigate your financial obligations related to Arizona Judgment Against Garnishee Holding Funds.

To collect a judgment in Arizona, you first need to obtain a writ of execution from the court. This document allows you to take action against the debtor's assets, including bank accounts or wages. Utilizing services from platforms like US Legal Forms can streamline the process of collecting your Arizona Judgment Against Garnishee Holding Funds effectively.

To stop wage garnishment in Arizona, you can file a motion with the court that issued the garnishment order. You may be able to claim exemptions based on your financial situation or the type of income you receive. Consulting with a legal professional can help you understand your rights and options regarding Arizona Judgment Against Garnishee Holding Funds.

In Arizona, the maximum wage garnishment is typically set at 25% of your disposable earnings or the amount by which your weekly earnings exceed 30 times the federal minimum wage, whichever is less. This law exists to protect your ability to afford basic living expenses while also addressing debts. Having knowledge about the Arizona Judgment Against Garnishee Holding Funds can help you understand how these garnishments are calculated. To navigate this process effectively, consider consulting resources on the USLegalForms platform for detailed information and assistance.

To stop a wage garnishment in Arizona, you need to act quickly and file the appropriate paperwork with the court. Consider filing a motion to quash the garnishment based on valid grounds, such as a change in financial circumstances or an error in the original judgment. Additionally, you might explore options to negotiate directly with your creditor or seek assistance from professionals who understand Arizona Judgment Against Garnishee Holding Funds. Utilizing platforms like USLegalForms can provide you with the necessary documentation and guidance throughout this process.