The Arizona Filing and Other Fees Help Packet is a comprehensive guide to help businesses and individuals understand the filing and other fees for various services and activities in Arizona. It includes information on the different types of fees, such as business license fees, occupational taxes, sales taxes, use taxes, and more, as well as the filing requirements for each. The packet also includes forms and instructions for filing and payment, as well as details on the payment options available. There are two types of Arizona Filing and Other Fees Help Packets: the Regular Packet and the Small Business Packet. The Regular Packet is designed to help those who need to understand the filing and other fees applicable to large and medium-sized businesses. The Small Business Packet is tailored to the needs of small businesses and includes additional information and resources that are more pertinent to smaller operations.

Arizona Filing and Other Fees Help Packet

Description

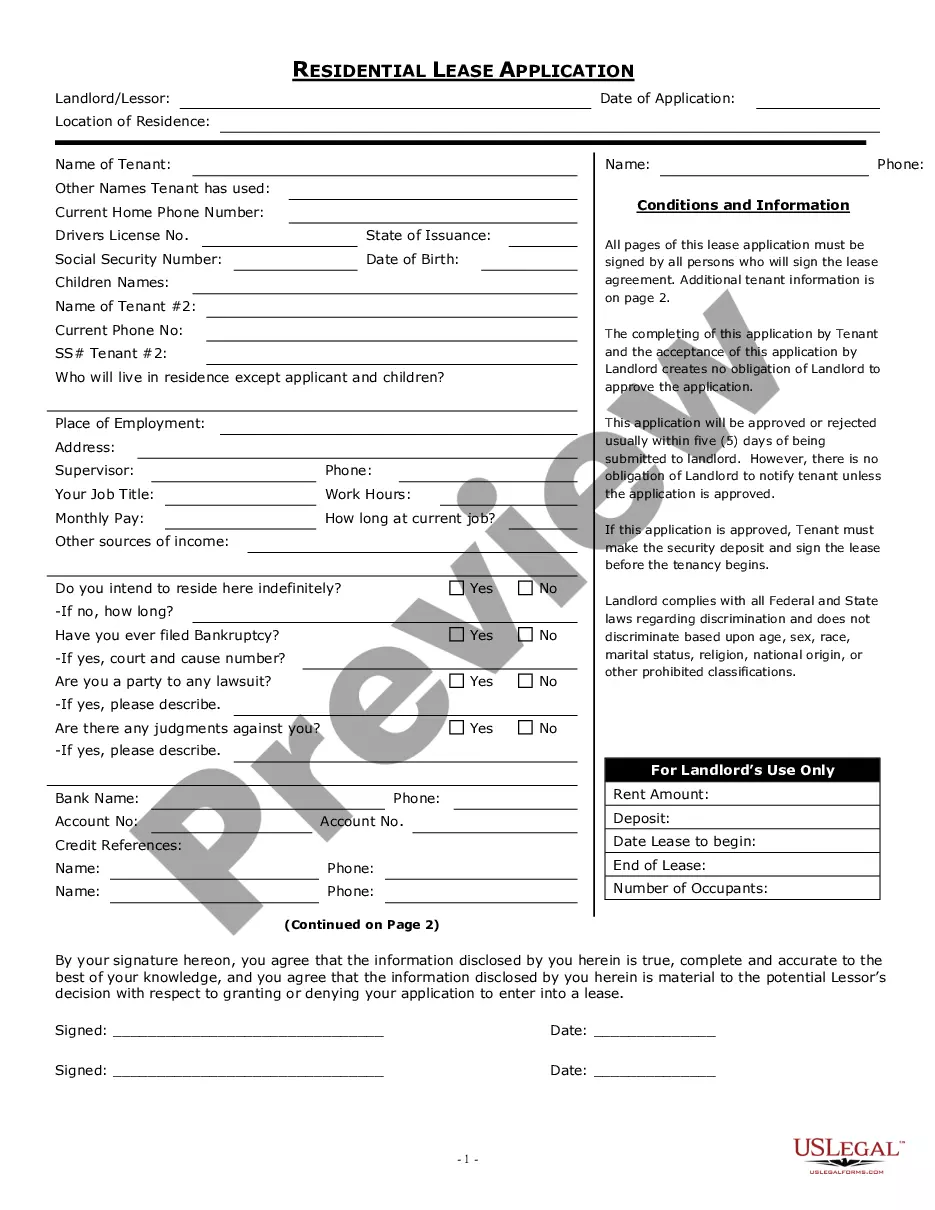

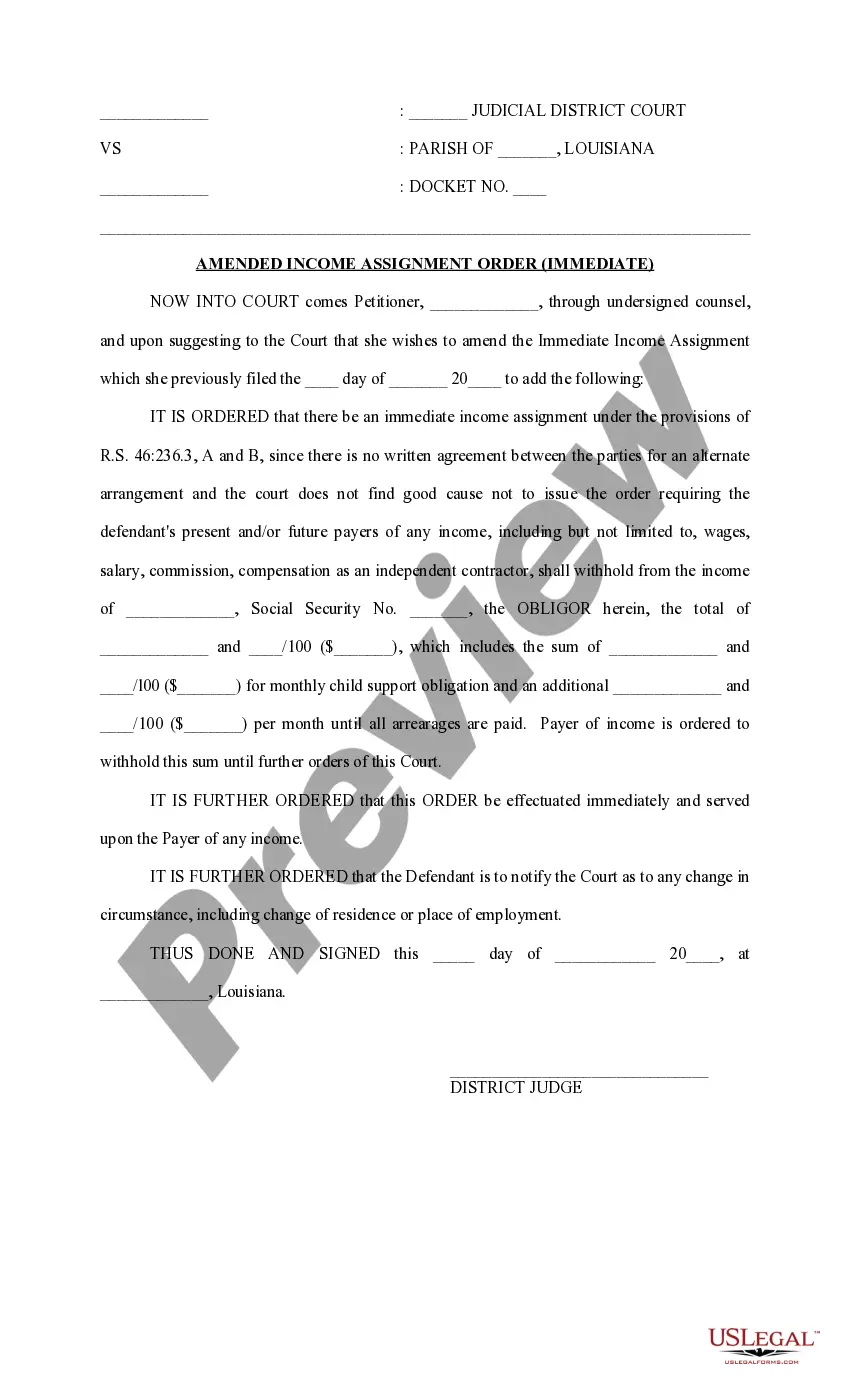

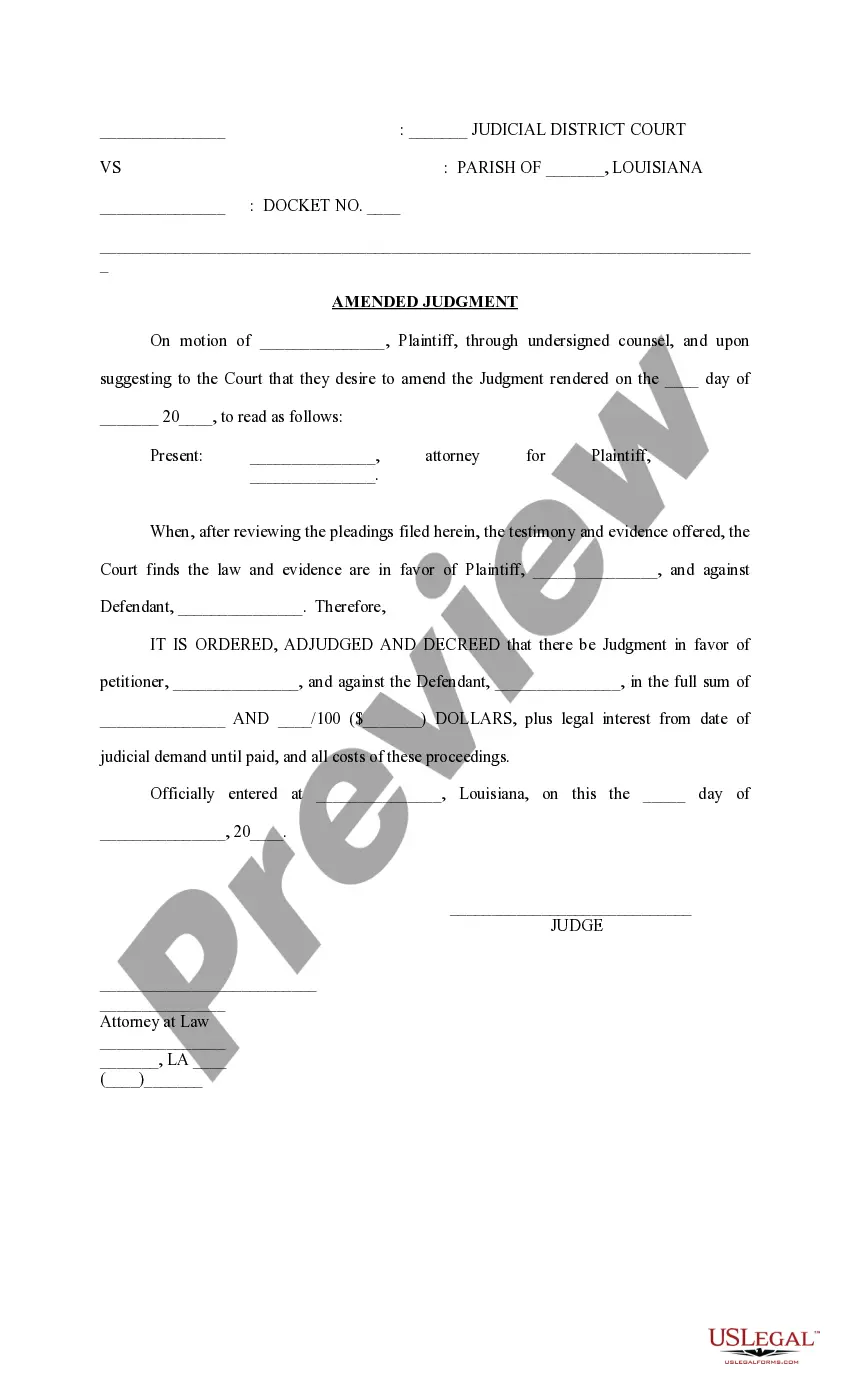

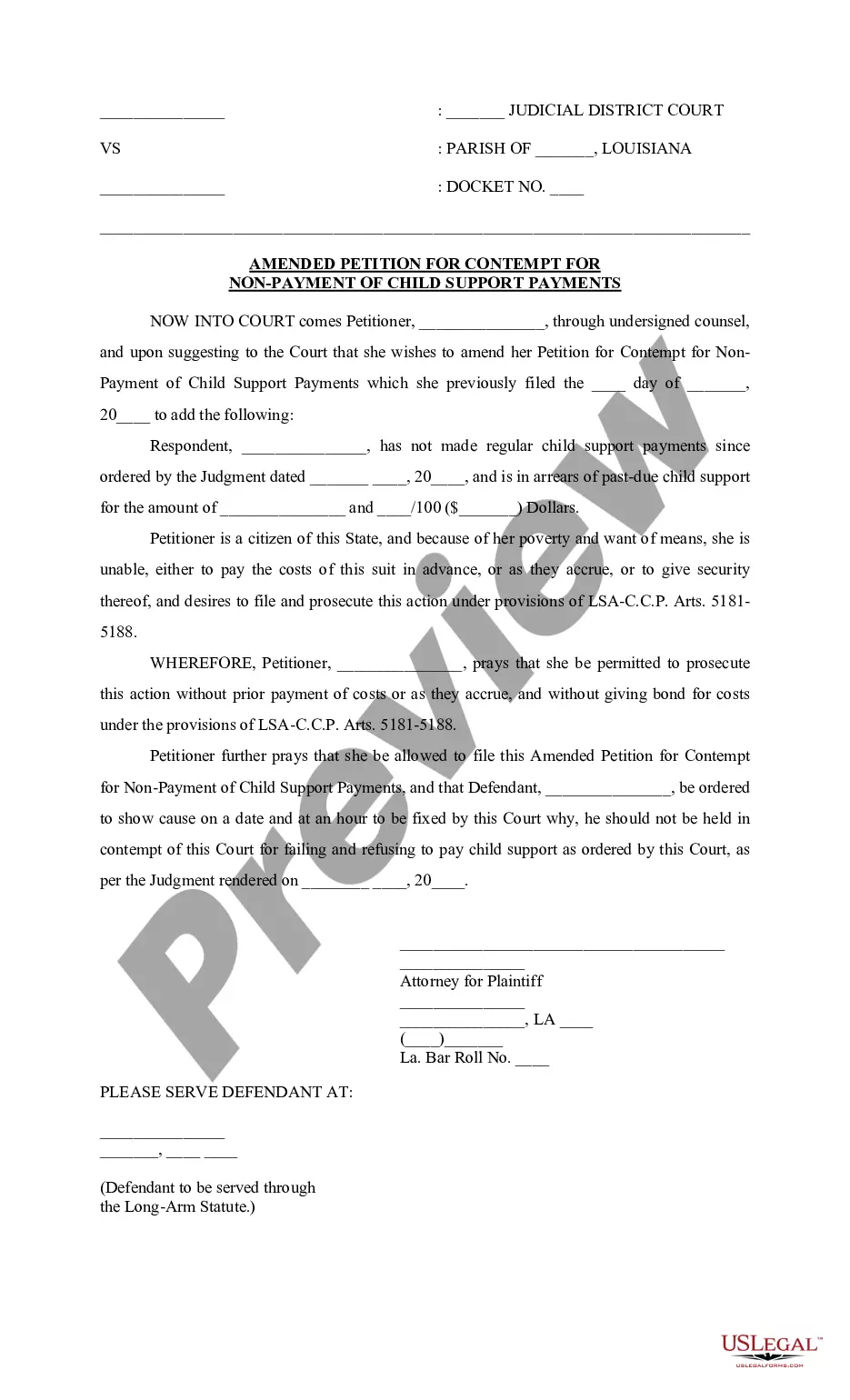

How to fill out Arizona Filing And Other Fees Help Packet?

How much time and resources do you usually allocate for drafting formal documents.

There’s a superior alternative to obtaining such forms than engaging legal professionals or investing hours searching online for an appropriate template. US Legal Forms is the premier online repository that provides expertly crafted and verified state-specific legal paperwork for any purpose, including the Arizona Filing and Other Fees Help Packet.

Another advantage of our library is that you can retrieve previously downloaded documents, which you securely store in your profile in the My documents section. Access them any time and re-complete your paperwork as often as you need.

Conserve time and energy preparing legal documents with US Legal Forms, one of the most reliable online services. Sign up today!

- Review the form content to confirm it meets your state regulations. To do this, read the form description or use the Preview option.

- If your legal template does not meet your requirements, find another one using the search bar at the top of the page.

- If you are already a member of our service, Log In and download the Arizona Filing and Other Fees Help Packet. If not, carry on to the next steps.

- Click Buy now once you locate the correct document. Select the subscription plan that best fits your needs to access the full features of our library.

- Create an account and process your payment for the subscription. You can pay with your credit card or through PayPal - our service is thoroughly trustworthy for that.

- Download your Arizona Filing and Other Fees Help Packet onto your device and complete it on a printed edition or electronically.

Form popularity

FAQ

Yes, Arizona mandates that LLCs file Articles of Organization to officially register. Additionally, there are ongoing reporting and tax obligations for maintaining your LLC status. For more information, review the Arizona Filing and Other Fees Help Packet, which offers step-by-step guidance for LLC compliance.

You can obtain Arizona tax forms directly from the Arizona Department of Revenue’s website. They provide a comprehensive list of necessary forms for various tax categories. To simplify your tax preparation, the Arizona Filing and Other Fees Help Packet includes links and guidance on accessing these forms.

Corporations earning income in Arizona, whether domestic or foreign, are required to file an Arizona Corporation return. This applies even if the corporation is not physically located in Arizona but generates income from Arizona sources. For guidance on corporate filings, consult the Arizona Filing and Other Fees Help Packet.

Individuals and entities earning income within Arizona must file a tax return. This includes residents and nonresidents who meet certain income thresholds. Explore the Arizona Filing and Other Fees Help Packet for detailed information pertinent to your situation.

Arizona requires residents and nonresidents who earn income to file tax returns annually. The specific forms and due dates depend on your individual circumstances and income levels. Utilize the Arizona Filing and Other Fees Help Packet to help clarify your filing requirements.

To reach Arizona tax help via email, you can use the contact forms provided on the Arizona Department of Revenue’s website. This allows you to send your inquiries directly to the appropriate department. The Arizona Filing and Other Fees Help Packet may offer additional resources for efficient communication.

If you earn income in Arizona but live outside the state, you generally need to file a tax return. This includes income from rental properties, business, or labor performed in Arizona. Be sure to refer to the Arizona Filing and Other Fees Help Packet for details on how to properly file as a nonresident.

The Arizona form 140NR is designated for non-residents to report income from Arizona sources for the tax year 2024. This form helps non-residents determine their tax obligation within the state. To ensure you complete it accurately and gain a full understanding, the Arizona Filing and Other Fees Help Packet is an excellent resource to assist you.

Whether you need to file an Arizona state tax return usually depends on your income level, residency status, and filing status. If your income exceeds specific limitations, you must file a return. The Arizona Filing and Other Fees Help Packet can guide you through the decision-making process regarding your filing responsibilities.

Individuals who earn income in Arizona, including residents and certain non-residents, are typically required to file an Arizona tax return. If your income exceeds the state's filing thresholds, you must complete and submit the necessary forms. For more detailed requirements about filing obligations, refer to the Arizona Filing and Other Fees Help Packet for clarity.