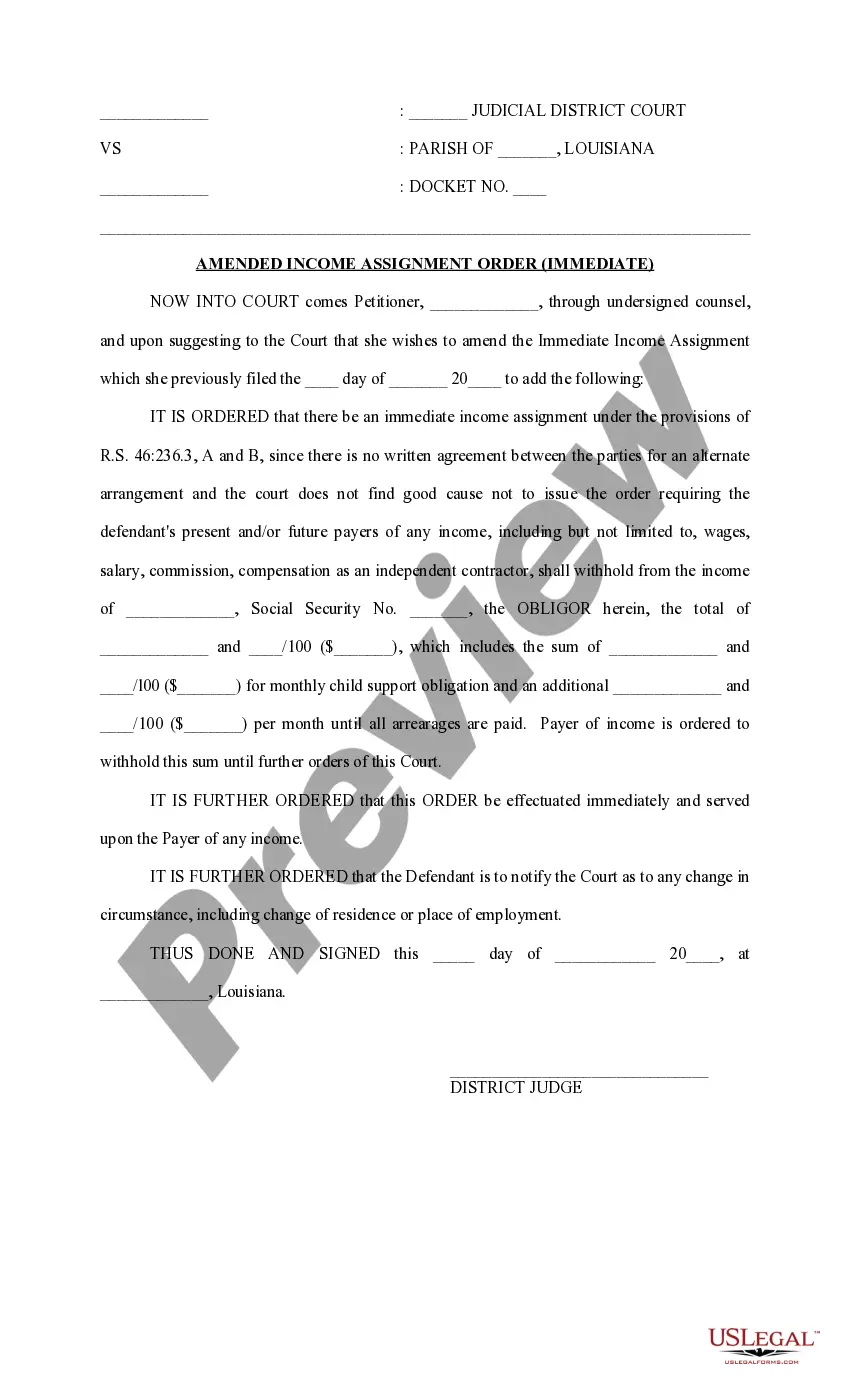

Louisiana Amended Income Assignment Order Immediate

About this form

The Amended Income Assignment Order Immediate is a legal document used to modify an existing court order that directs an employer to withhold child support payments directly from an employee's wages. This form is vital in situations where child support payments are not being made voluntarily. Unlike standard income assignment orders, this amended version allows for changes to the original order based on current circumstances, ensuring the recipient continues to receive necessary support without disruption.

Form components explained

- Identification of the petitioner and the obligor parent, including contact information.

- Details of the income assignment, including the amount to be withheld from wages.

- Instruction to the employer to implement the income withholding immediately.

- Statement regarding changes in circumstances the defendant must notify the court about.

- Signature of the district judge to validate the order.

When to use this form

This form should be used when a custodial parent needs to amend an existing income assignment order due to changes in circumstances, such as the obligor's employment status or income level. It is particularly relevant in instances where previous arrangements for child support payments have failed, necessitating direct wage deductions to ensure consistent support for the child.

Intended users of this form

This form is intended for:

- Custodial parents seeking to enforce or amend child support payments.

- Attorneys representing clients in child support cases.

- Individuals involved in legal proceedings relating to child support assignments.

How to complete this form

- Provide the names and contact information of the petitioner and obligor parent.

- Enter the amount of support to be withheld and include any arrears owed.

- Ensure the form is signed and dated by the district judge.

- Submit the form to the appropriate court and ensure it is served to the obligor's employer.

- Keep a copy of the served order for your records.

Is notarization required?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to include all necessary details about the obligor parent.

- Not specifying the exact withholding amounts, including arrears.

- Overlooking required signatures from both the petitioner and the district judge.

- Not serving the amended order to the employer promptly.

Why use this form online

- Convenient access to templates and guidance at any time.

- Editability allows personalization to fit specific situations easily.

- Reliable forms drafted by licensed attorneys ensure legal compliance.

Summary of main points

- The Amended Income Assignment Order Immediate is essential for modifying child support collection methods.

- It ensures that payments are deducted directly from wages to support the child's needs.

- Understanding how to properly complete and serve this form is crucial for effective enforcement.

Looking for another form?

Form popularity

FAQ

You can amend the return by selecting the Change button toward the top-right side of the return. LaTAP will allow you to amend your previously filed returns, regardless of whether it was originally filed electronically or on paper.

Fill in your personal information on Form 1040-X. At the very top of Form 1040-X, check the box next to the year of the tax return you're amending. If the year isn't provided, write it in next to "Other year." Then, fill out your name, address, and Social Security number.

Can I file an amended Form 1040-X electronically? You can now submit the Form 1040-X, Amended U.S. Individual Income Tax Return electronically using available tax software products. Only tax year 2019 Forms 1040 and 1040-SR returns can be amended electronically.

As a reminder, amended returns take up to 16 weeks to process. It can take up to three weeks from the date you mailed it to show up in our system.

If you amended return has an adjusted status this means "The processing of your Form 1040X- Amended Tax Return resulted in an adjustment to your account. An adjustment may result in a refund, balances due, or no tax change".

Although the IRS appreciates when taxpayers file an amended return to correct a mistake, they can still assess a penalty or charge interest for not paying the proper amount when the taxes were originally due.

Include copies of any forms and/or schedules that you're changing or didn't include with your original return. To avoid delays, file Form 1040-X only after you've filed your original return. Allow the IRS up to 16 weeks to process the amended return.

An amended return is a form filed in order to make corrections to a tax return from a previous year. An amended return can be used to correct errors and claim a more advantageous tax statussuch as a refund. For example, one might choose to file an amended return in instances of misreported earnings or tax credits.

How long will it take to process an amended return? A Form 1040-X, Amended U.S. Individual Income Tax Return can take up to 16 weeks to process once we receive it.