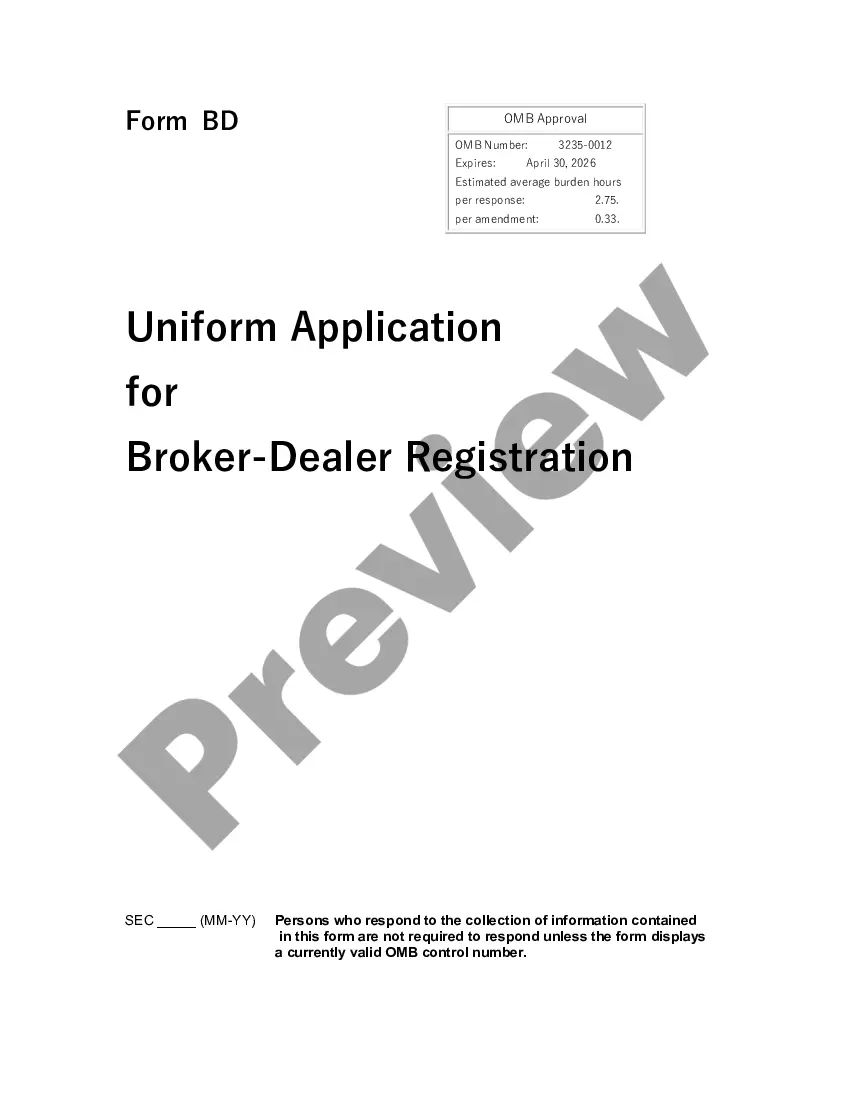

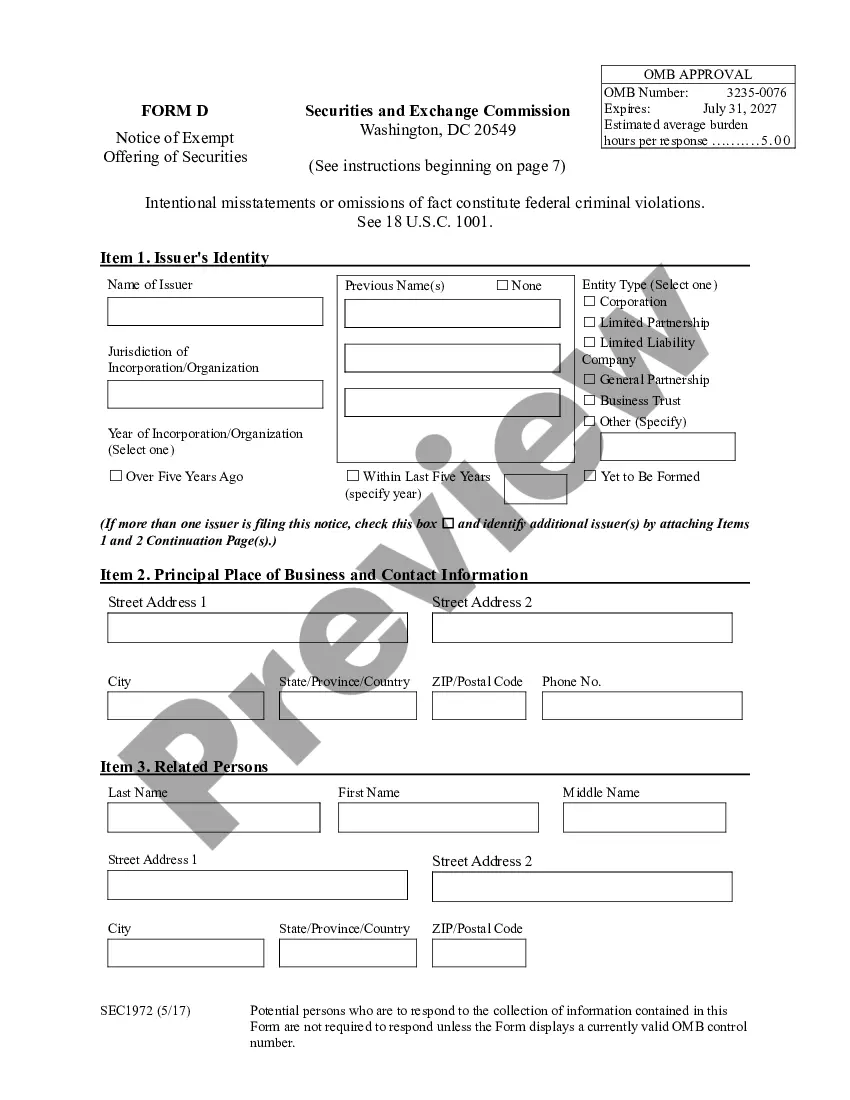

Arizona Form BDW is a document required by the Arizona Department of Revenue to report a business’s taxes. It is also referred to as a “business tax return.” This form is used to report and pay taxes for a variety of taxes, including sales and use tax, corporate income tax, individual income tax, and withholding taxes. There are three different types of Arizona Form BDW: Form BDW-1, Form BDW-2, and Form BDW-3. Form BDW-1 is used to report sales and use taxes. Form BDW-2 is used to report corporate income taxes, and Form BDW-3 is used to report individual income taxes and withholding taxes. All forms must be completed and submitted to the Arizona Department of Revenue.

Arizona Form BDW

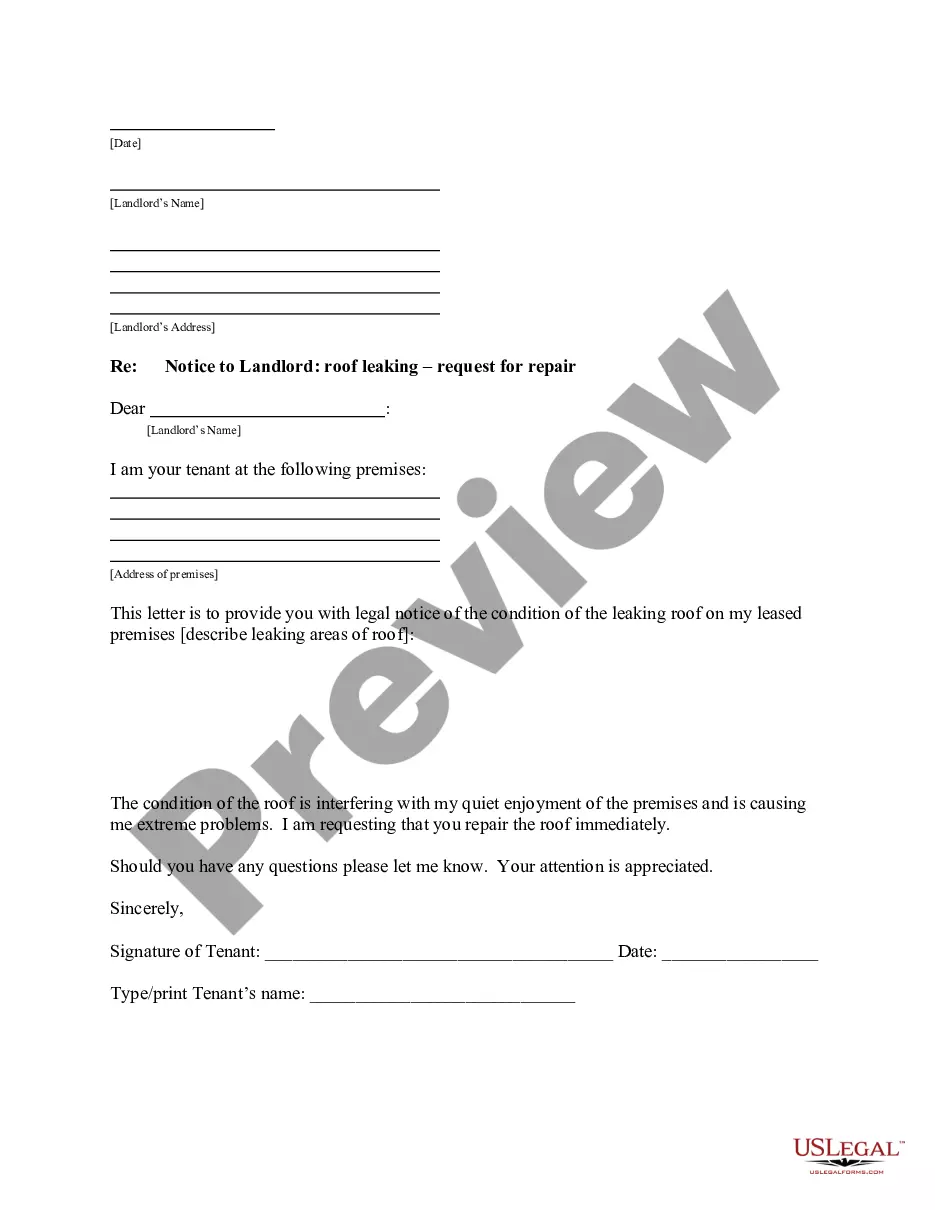

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

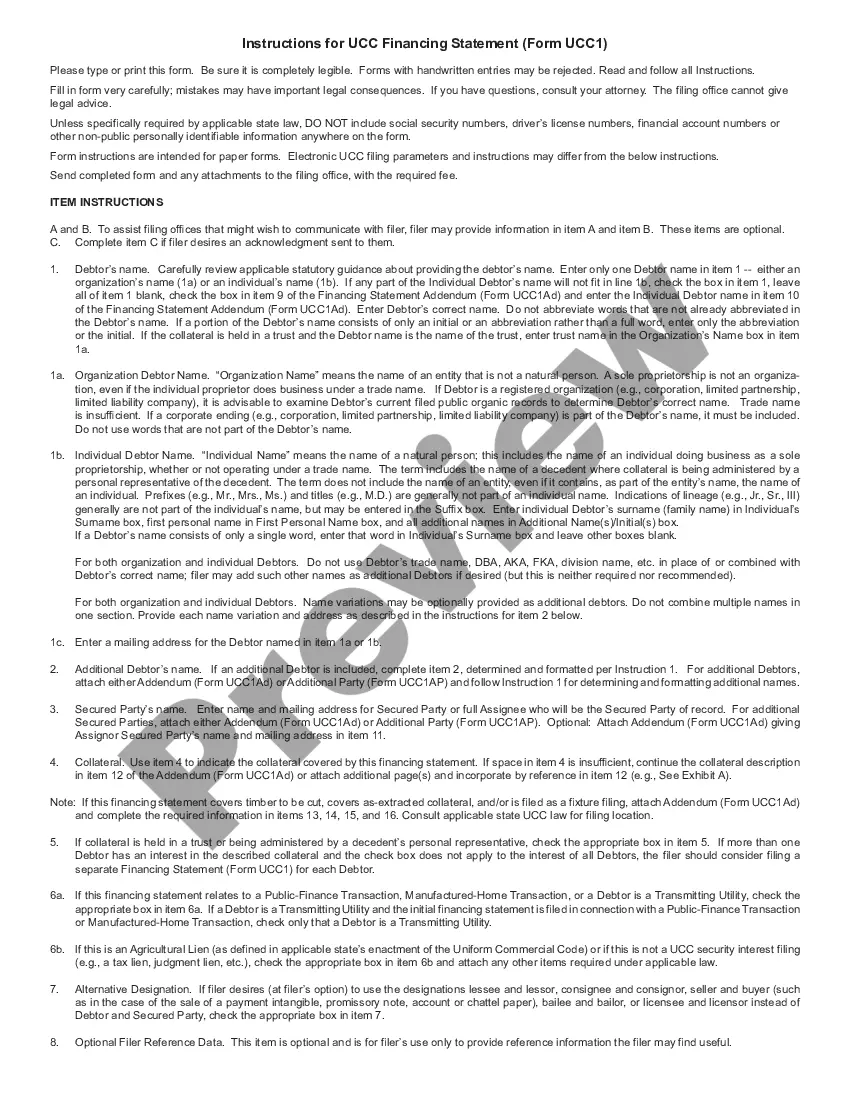

How to fill out Arizona Form BDW?

If you’re looking for a method to effectively fill out the Arizona Form BDW without engaging a lawyer, then you’ve arrived at the ideal location.

US Legal Forms has established itself as the most comprehensive and trustworthy collection of official templates for every individual and business circumstance.

Another excellent aspect of US Legal Forms is that you will never misplace the paperwork you acquired - any of your downloaded templates can be found in the My documents tab of your profile whenever you require it.

- Verify that the document displayed on the page aligns with your legal situation and state regulations by reviewing its text description or exploring the Preview mode.

- Enter the document title in the Search tab at the top of the page and select your state from the dropdown to find an alternative template if there are any discrepancies.

- Repeat the content verification and click Buy now when you are assured of the documents meeting all the standards.

- Log in to your account and click Download. Register for the service and select a subscription plan if you don’t have one yet.

- Use your credit card or the PayPal option to acquire your US Legal Forms subscription. The document will be ready for download immediately afterward.

- Choose the format in which you want to save your Arizona Form BDW and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it swiftly or print it to prepare your paper copy manually.

Form popularity

FAQ

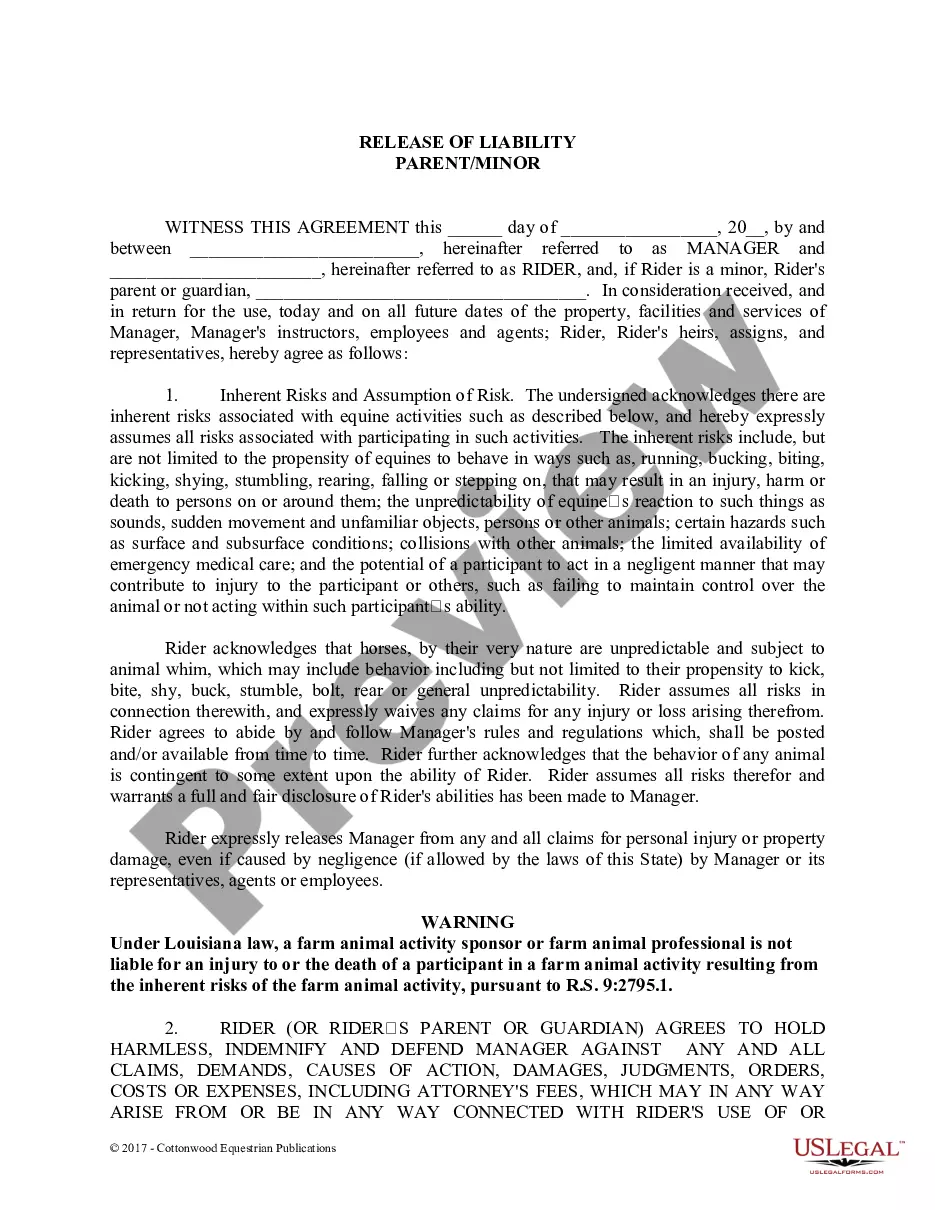

Arizona Form 285 is the Arizona Application for Extension to File Income Tax Returns. This form allows taxpayers to request additional time to file their returns without incurring penalties. It's important to note that while it extends the filing deadline, it does not extend payment deadlines. For more information and to access this form, check out resources available on US Legal Forms.

The Arizona A 4 form is an employee's Arizona withholding exemption certificate. This form helps you determine the amount of tax to withhold from your paycheck based on your personal circumstances. Ensuring the correct withholding amount can help you manage your tax obligations more effectively. For assistance with this and other forms, visit US Legal Forms.

The transfer of ownership form in Arizona is used to officially change the ownership of property or assets. This form is crucial for ensuring that ownership records are accurate and up-to-date, protecting both buyers and sellers. When completing this form, gather all pertinent information about the property and the parties involved. US Legal Forms offers tools and templates to assist you in this process.

To obtain power of attorney in Arizona, you need to complete a power of attorney form that outlines your specific needs. This form grants someone the authority to act on your behalf in legal matters. Make sure to choose a trusted individual for this role, as they will have significant control over your affairs. Platforms like US Legal Forms can provide access to the required documents to simplify this process.

In Arizona, residents and non-residents that earn income in the state are required to file an Arizona return. If you qualify based on income thresholds or specific circumstances, you must complete the appropriate forms, including the Arizona Form BDW if applicable. Filing your return accurately ensures you meet state obligations and avoid penalties. Consider using US Legal Forms for a streamlined filing experience.

The tax form for non-residents in Arizona is known as the Arizona Form BDW. This form is specifically designed for individuals who do not reside in the state but have income sourced from Arizona. It enables non-residents to report their income and calculate any taxes owed. You can easily access this form through platforms like US Legal Forms.

To get Arizona tax forms, you can visit the Arizona Department of Revenue's website, where they provide downloadable forms for various tax purposes. Additionally, you might want to consult with a tax professional for tailored advice. If you are also managing your business documentation, securing your Arizona Form BDW can support your tax obligations and compliance.

To obtain a certificate of good standing in California, you must request it from the California Secretary of State. You may complete this request online, by mail, or in person. Just ensure you have the necessary information about your business ready, as it will help you retrieve your Arizona Form BDW efficiently.

In Arizona, various professional licenses require proof of good standing to maintain compliance. This includes licenses for businesses, real estate agents, and healthcare professionals. If you are applying for or renewing a license in Arizona, you will likely need to present your Arizona Form BDW as part of your documentation.

Closing a broker-dealer involves specific steps, including the completion of the Arizona Form BDW to notify the state regulators. You will need to settle outstanding obligations, notify clients, and submit any required forms to officially terminate your license. For a seamless process, consider using uslegalforms, which simplifies the necessary paperwork and ensures compliance.