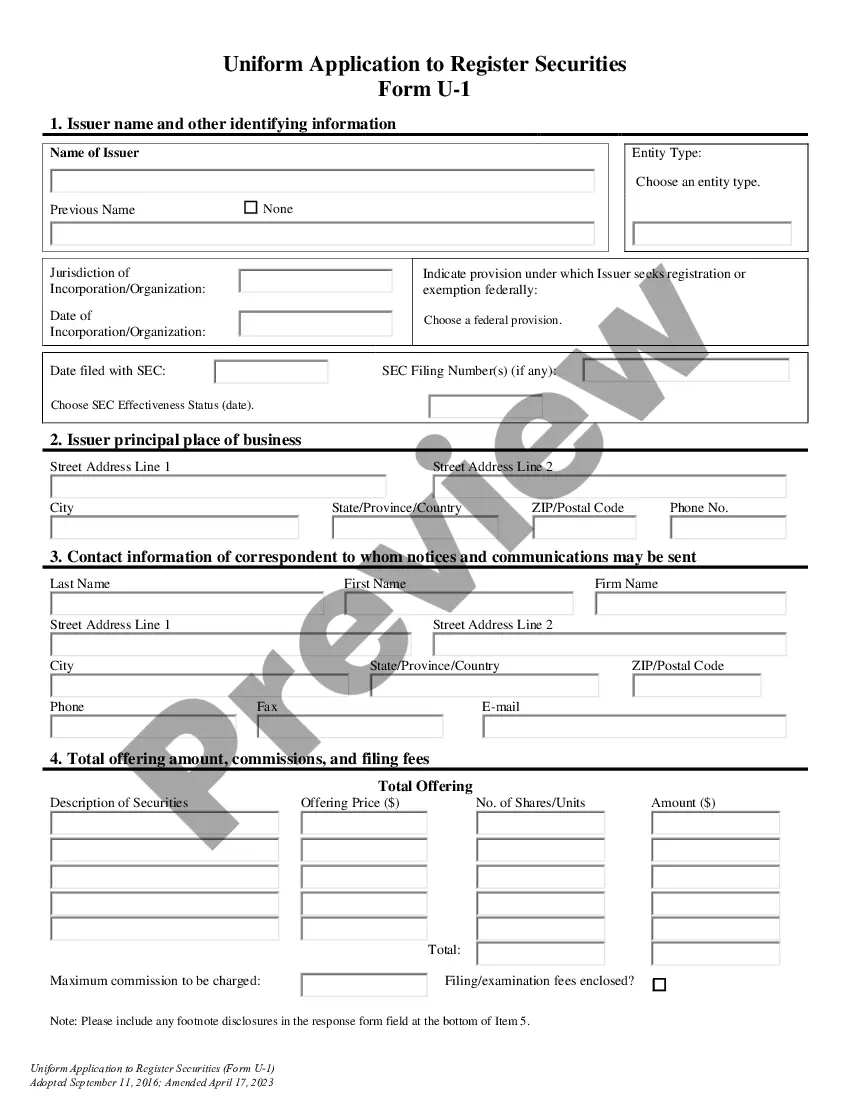

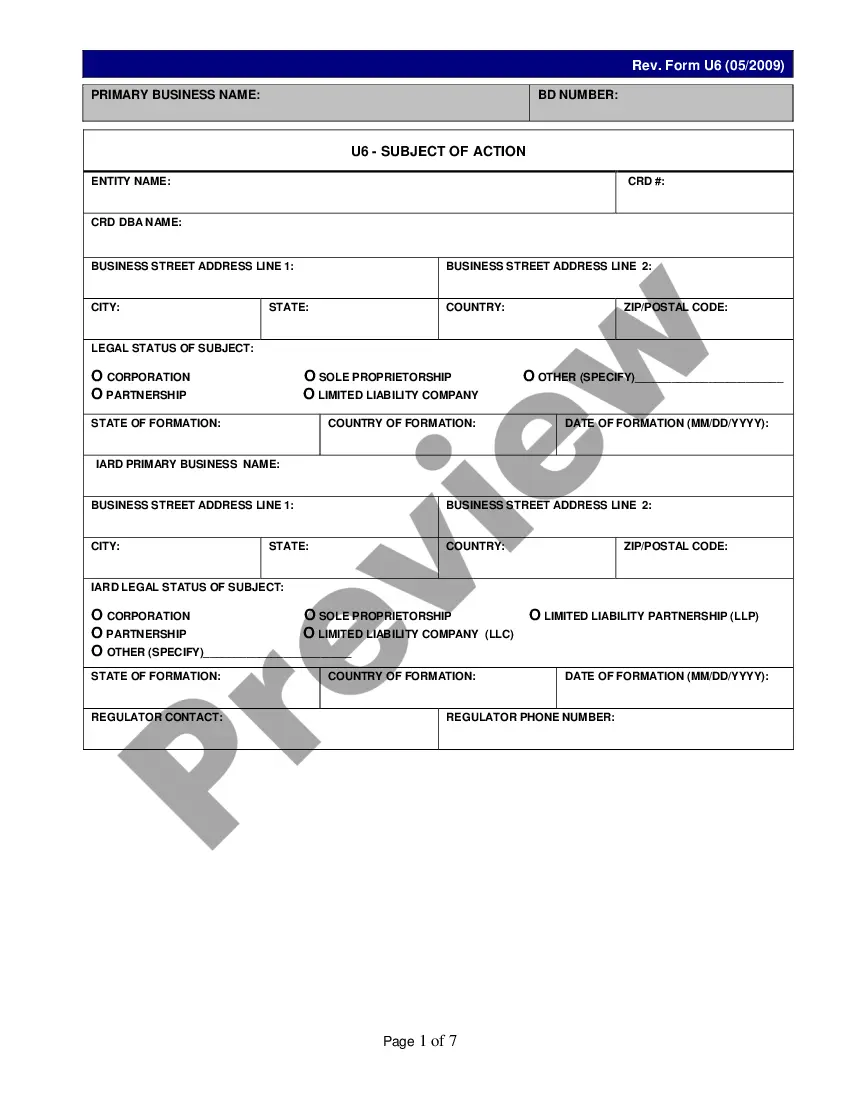

Arizona Form D is a state-specific form required by the Arizona Corporation Commission (ACC) for certain entities engaging in certain transactions involving the offer and sale of securities. It is used for the registration of securities for sale in the state of Arizona. There are several types of Arizona Form D: Form D-1A for the registration of a franchise offering, Form D-2A for the registration of a public offering, Form D-3A for the registration of a limited partnership offering, Form D-4A for the registration of a limited liability company offering, and Form D-5A for the registration of an offering of interests in a real estate investment trust.

Arizona Form D

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Form D?

Managing official paperwork necessitates focus, precision, and utilizing well-crafted templates. US Legal Forms has assisted individuals across the country in achieving this for 25 years, ensuring that when you select your Arizona Form D template from our platform, it adheres to federal and state regulations.

Utilizing our service is straightforward and efficient. To acquire the required document, all you need is an account with an active subscription. Here’s a concise guide to obtaining your Arizona Form D within moments.

All documents are designed for versatile use, similar to the Arizona Form D you see here. If you need them again, you can fill them out without additional payment - simply visit the My documents section in your account and complete your document whenever necessary. Try US Legal Forms and execute your business and personal documentation swiftly and fully in legal compliance!

- Ensure to thoroughly verify the form's content and its compliance with general and legal standards by reviewing it or examining its description.

- Look for an alternative official blank if the one initially accessed does not align with your circumstances or state requirements (the option for this is located in the upper corner of the page).

- Access your account and save the Arizona Form D in your desired format. If this is your first visit to our site, click Purchase now to proceed.

- Establish an account, select your subscription tier, and complete payment using your credit card or PayPal.

- Choose the format in which you wish to receive your form and click Download. Print the document or incorporate it into a professional PDF editor for electronic submission.

Form popularity

FAQ

You can find the Arizona Form D on the official state website, but navigating through paperwork can be challenging. A valuable solution is to use platforms like USLegalForms, which offer easy access to necessary forms and step-by-step guidance. This platform can streamline your filing process, ensuring you have everything required to complete your Arizona Form D accurately.

Filing the Arizona Form D is necessary for protecting your business from potential legal issues. It ensures full disclosure to the state regarding business activities and funding processes. Moreover, it helps maintain transparency, which is key for building trust with investors and stakeholders.

The Arizona tax form refers to various documents required for tax reporting in Arizona. For instance, the Arizona Form D may be part of the documentation needed for businesses when disclosing investment information. It's essential for business owners to understand these forms to stay compliant with state tax regulations.

The Arizona Form D is primarily used for notifying state authorities about certain expiring business entities. This form helps maintain accurate records and fosters compliance within the state. By utilizing the Arizona Form D, businesses can communicate important information regarding their operational status.

Finding a Form D is quite simple, especially through the SEC's EDGAR database, which houses various filings made by companies. You can search for specific companies or offerings using their name or applicable criteria. Moreover, platforms like US Legal Forms provide easy access to templates and guides for completing your own Arizona Form D. This combination ensures you have the right resources at your fingertips.

Filing Form ID involves submitting a request to the SEC for an identification number and is critical for proper documentation of your offering. You can file this form through the SEC's EDGAR system, ensuring that all required information is accurately entered. This establishes your legitimacy in the investment space and is necessary before filing your Arizona Form D. By using resources on platforms like US Legal Forms, you can navigate this process smoothly.

You can obtain Arizona tax forms through the Arizona Department of Revenue website, where they provide an array of downloadable forms. Additionally, many legal and tax preparation services offer assistance in gathering and understanding these forms. It is essential to ensure that you use the correct forms for your specific situation, especially when related to filings like the Arizona Form D. Accurate form selection can streamline tax compliance and reporting.

To file an Arizona Form D, prepare the necessary supporting documents, such as offering details and the issuer's information. You can then either file it online via the SEC's EDGAR system or submit it directly to the appropriate state authorities. Ensure you meet all deadlines and requirements to avoid any complications. Using platforms like US Legal Forms can simplify this process by providing templates and guidance tailored for your needs.

Filing the Arizona Form D online is a straightforward process that can save you time and effort. You can start by visiting the SEC's EDGAR system, where you can complete the form electronically. Make sure you gather all necessary information beforehand, such as details about your offering and the related parties. This ease of filing allows you to focus more on your business while aligning with regulatory requirements.

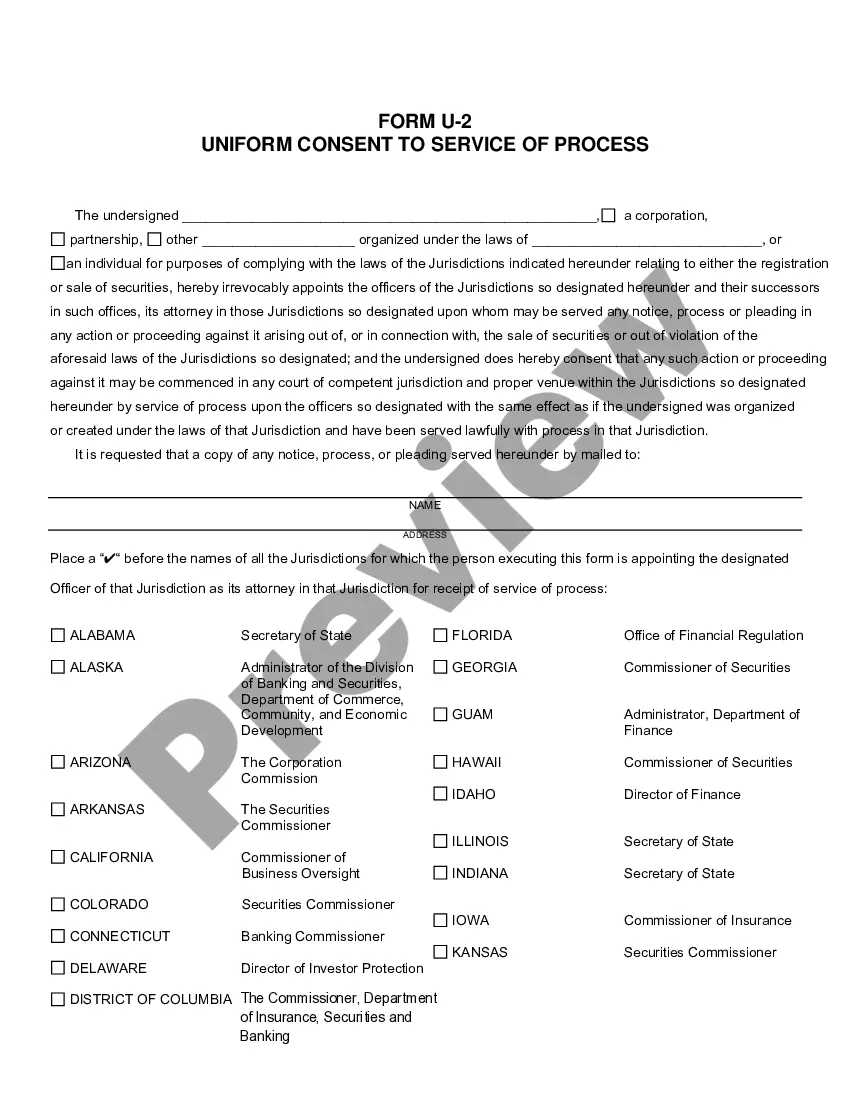

To comply with Reg D, companies must meet specific criteria that include limited offerings and accredited investors. Typically, this means that the issuance of securities must adhere to specific financial thresholds and restrictions. When filing the Arizona Form D, it is crucial to ensure that your offering meets these regulations. This not only adheres to legal standards but also helps in building trust with potential investors.