Arizona Form U-1 is a form used by employers to report the wages and contributions of employee wages for state unemployment insurance tax purposes in the state of Arizona. It is a quarterly report used to report the amount of wages paid to employees during the quarter and the amount of contributions due for the quarter. The form is used to report the following information: 1. Employer's name, address, and Federal Employer Identification Number (VEIN) 2. Total wages for the quarter 3. Total contributions due 4. Employees' names, Social Security numbers, and wages There are two versions of Arizona Form U-1: the standard Form U-1 and the Form U-1-C. The standard Form U-1 is used to report wages and contributions to the state's unemployment insurance fund. The Form U-1-C is used to report wages and contributions to a state unemployment insurance fund when an employer is located in another state.

Arizona Form U-1

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Form U-1?

Preparing official documentation can be a significant hassle if you lack ready-to-utilize fillable templates. With the US Legal Forms online collection of formal documents, you can trust the blanks you discover, as they all adhere to federal and state regulations and are verified by our experts.

Acquiring your Arizona Form U-1 from our library is as simple as 1-2-3. Previously registered users with an active subscription just need to Log In and click the Download button after they find the correct template. Subsequently, if needed, users can select the same blank from the My documents tab of their account. However, even if you are a newcomer to our service, signing up with a valid subscription will only take a few minutes. Here’s a brief guide for you.

Haven't you experimented with US Legal Forms yet? Sign up for our service now to obtain any official document quickly and effortlessly whenever you require it, and keep your paperwork organized!

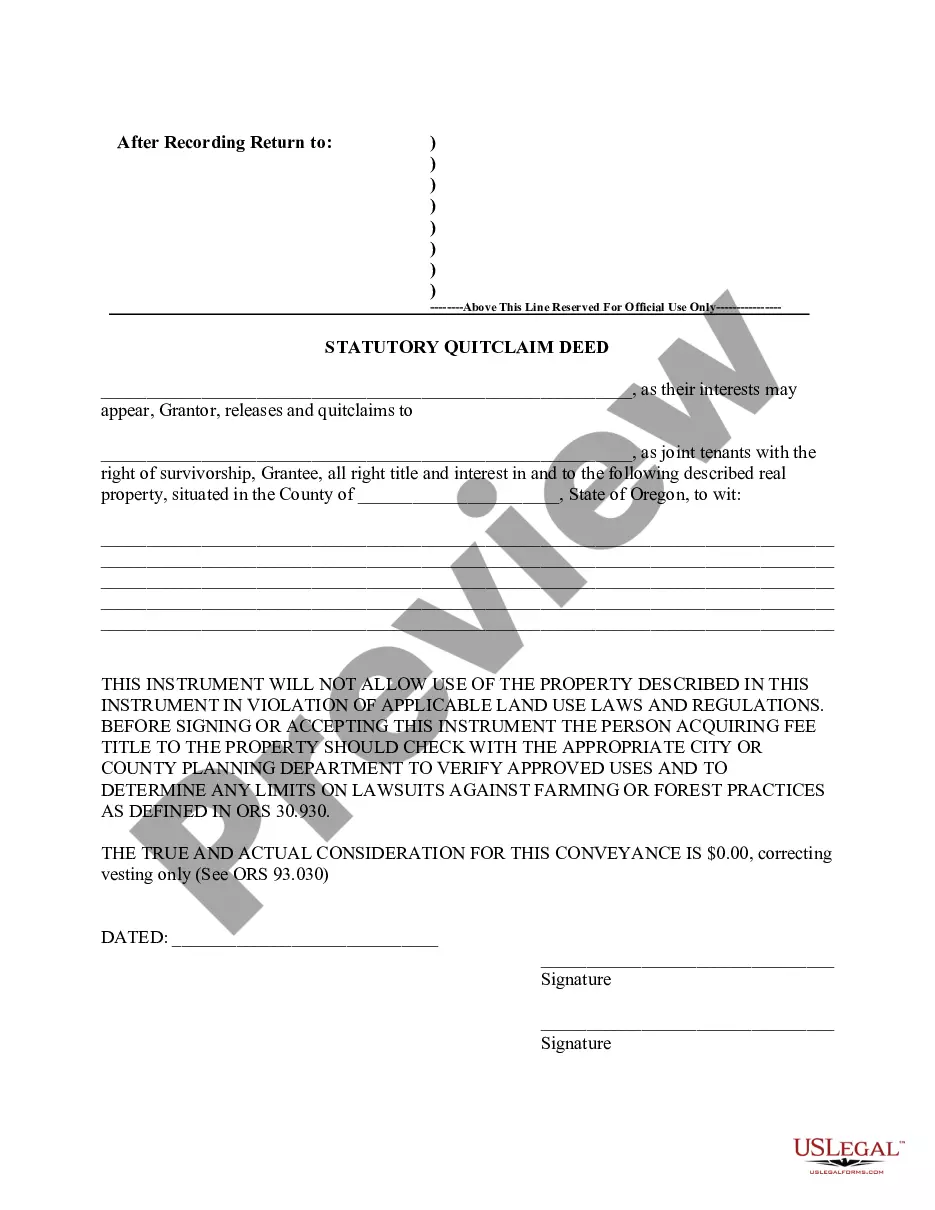

- Document compliance verification. You should carefully review the content of the form you wish to use and ensure it meets your requirements and complies with your state law stipulations. Previewing your document and assessing its overall summary will assist you in doing this.

- Alternative search (optional). If any discrepancies arise, navigate the library using the Search tab above until you find a suitable blank, and click Buy Now once you locate the one you desire.

- Account creation and form acquisition. Register for an account with US Legal Forms. After your account is verified, Log In and select your desired subscription plan. Process your payment to continue (PayPal and credit card methods are available).

- Template download and further application. Choose the file format for your Arizona Form U-1 and click Download to store it on your device. Print it to manually complete your paperwork, or use a versatile online editor to generate an electronic version more swiftly and efficiently.

Form popularity

FAQ

You will receive a notification from the Arizona Department of Economic Security once your unemployment claim is approved. You can also check your claim status online for real-time updates. It is critical to ensure that your Arizona Form U-1 is filled out correctly to avoid any delays in communication. Staying proactive during the process can help you stay informed about your claim's status.

Yes, you can collect unemployment in Arizona if you were fired, provided it was not due to misconduct. The nature of your termination heavily influences your eligibility, so it is important to accurately complete your Arizona Form U-1 to reflect your situation. If you were let go without valid reasons, you can expect to move forward with your claim. Make sure to understand your rights to navigate the process smoothly.

You may be denied unemployment in Arizona if you do not meet the criteria outlined in your Arizona Form U-1, such as insufficient work history or failure to report earnings accurately. Additionally, reasons like misrepresentation or refusal to accept suitable work can lead to denial. Understanding and carefully filling out the form can prevent misunderstandings that may result in denial. If you experience a denial, you can appeal the decision to clarify your circumstances.

Several factors can disqualify you for unemployment benefits in Arizona, including voluntarily quitting your job without good reason or being fired for misconduct. If you do not meet the work history requirements or fail to apply for suitable jobs, you may also face disqualification. Submitting a complete Arizona Form U-1 will provide the necessary details to assess your eligibility correctly. Keep these criteria in mind to ensure a smooth application process.

After your claim is approved, unemployment benefits in Arizona are generally deposited within 24 to 48 hours. This timing may vary based on your bank's processing times. Ensuring that your Arizona Form U-1 is completed accurately can help speed up this process. Keeping your contact information current can also assist in receiving payments without delay.

Once you submit your Arizona Form U-1, the approval process typically takes around two to three weeks. During this time, the Arizona Department of Economic Security reviews your application and any necessary documentation. It is important to provide accurate information to avoid delays. Regularly checking the status of your claim can also keep you informed.

In Arizona, misconduct for unemployment can include actions like theft, drug use, or repeated failure to meet job responsibilities. Essentially, if you demonstrate behavior that shows willful disregard for your employer's interests, it may be seen as misconduct. Understanding how Arizona Form U-1 relates to your situation can help clarify these issues. It is vital to ensure you present your case accurately when applying.

To print out your tax return, access the document from the accounting software or the IRS website if you filed electronically. If you used the Arizona Form U-1 for unemployment, check if it impacts your returns. For additional support in finding and printing your forms, USLegalForms offers user-friendly solutions.

You can get a copy of your Arizona tax return by requesting it from the Arizona Department of Revenue. If you initially filed using the Arizona Form U-1, ensure to mention that in your request. Using USLegalForms, you can find the right forms and instructions to streamline this process.

To request records from the Arizona Department of Revenue, you will typically need to submit a formal request through their official website. This may include specifying which records you need, such as those associated with the Arizona Form U-1. USLegalForms can assist you in drafting your request correctly to ensure a smooth process.