Arkansas Default Judgment on Complaint for Collection of Debt

Description

Key Concepts & Definitions

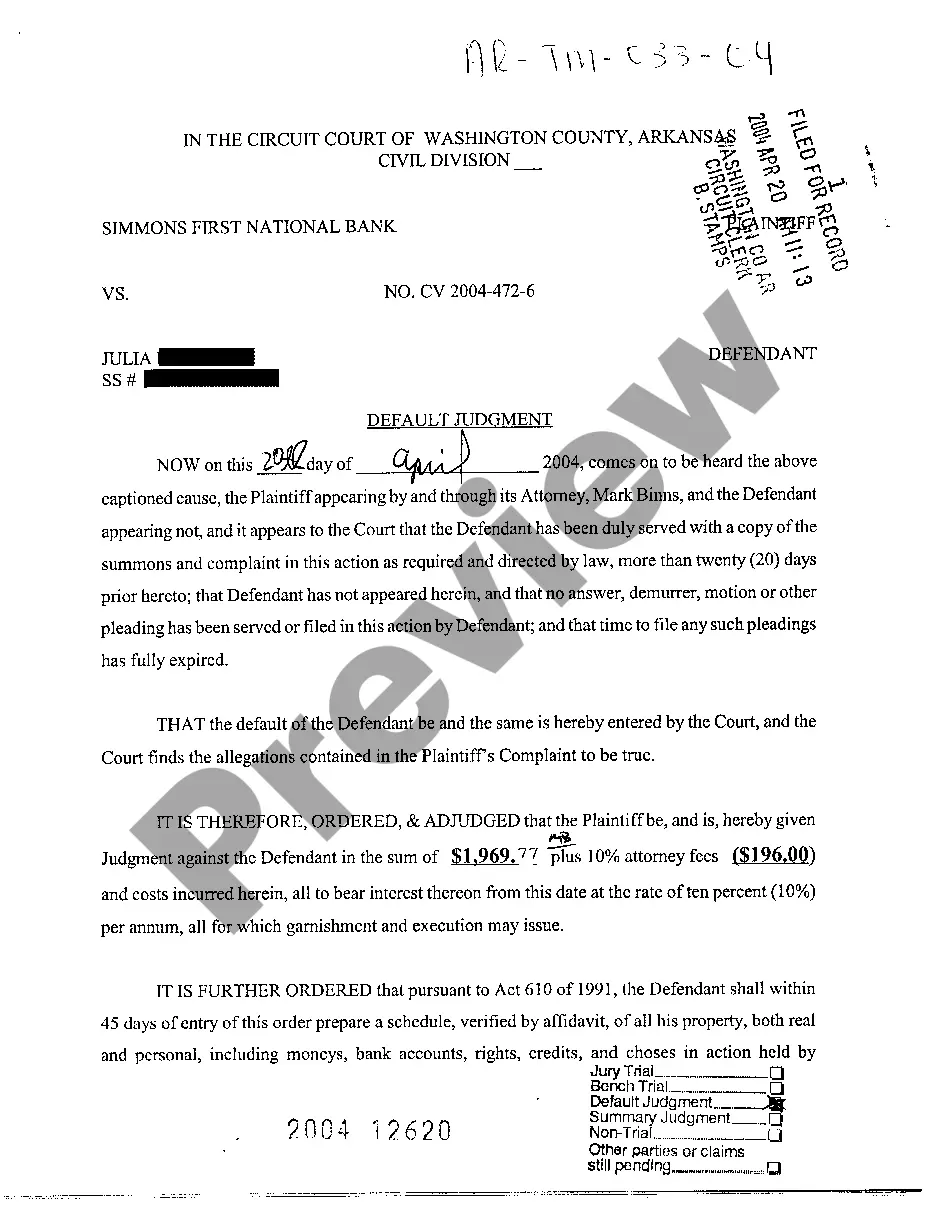

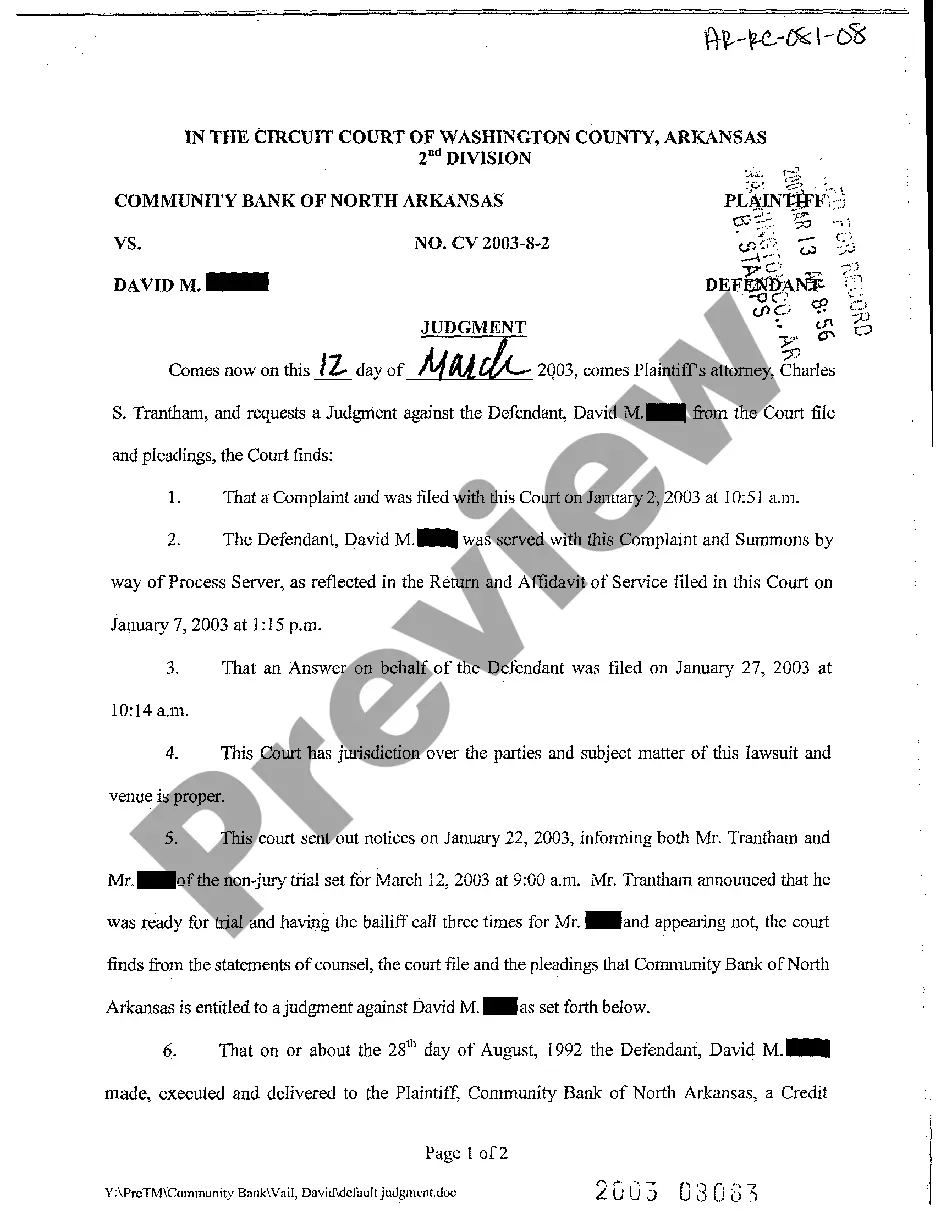

Default Judgment: A legal decision made by a court in favor of the plaintiff when the defendant fails to respond or appear in court. Complaint for Collection: A legal document filed by a creditor to begin court proceedings against a debtor to recover money owed. Collection Debt: An amount owed by a borrower, typically referring to past-due debts being pursued by creditors.

Step-by-Step Guide on Handling a Default Judgment on Complaint for Collection

- Review the Complaint: Analyze the claim details to understand the basis of the debt collection.

- Respond to the Complaint: To avoid a default judgment, timely respond to the complaint, ideally with the assistance of legal counsel.

- Attend Scheduled Court Hearings: Show up at all court dates related to the complaint to argue your case or present a defense.

- Settlement Negotiation: If possible, negotiate a settlement with the creditor to possibly lessen the debt burden.

- Comply with Court Orders: Follow any orders issued by the court as a result of the judgment to avoid further legal implications.

Risk Analysis of Ignoring a Complaint for Collection

Financial Impact: Increased debt due to accumulation of interest and possible legal fees. Credit Score Damage: Significant impact on credit ratings, making future financing difficult. Legal Consequences: Potential garnishment of wages, liens on property, and seizure of assets.

Glossary of Terms

- Small Business: Independently owned and operated companies that are limited in size and revenue depending on the industry.

- Real Estate: Property consisting of land and the buildings on it, along with its natural resources.

- Landlord Tenant: Legal term for the relationship between a property owner and a renter.

- Little Rock, Arkansas: The capital city of Arkansas, often involved in legal precedents related to real estate and landlord tenant disputes within the state.

Best Practices to Prevent Default Judgments

- Timely Communication: Always respond to legal notices and communications promptly.

- Legal Representation: Consider hiring a lawyer specializing in debt collection defense when facing a serious debt claim.

- Record Keeping: Maintain accurate records of all financial transactions and correspondence related to the debt.

How to fill out Arkansas Default Judgment On Complaint For Collection Of Debt?

Among countless paid and free samples you can find online, you cannot guarantee their validity.

For instance, it’s unclear who created them or if they possess the expertise necessary to fulfill your requirements.

Stay calm and make use of US Legal Forms!

Review the template by accessing the Preview feature. Click Buy Now to initiate the buying process or search for another template using the Search bar at the top. Select a pricing plan, register for an account, and pay for the subscription using your credit/debit card or PayPal. Download the form in your preferred file format. Once registered and subscribed, you can use your Arkansas Default Judgment on Complaint for Collection of Debt as often as you wish or as long as it stays valid in your state. Edit it with your favorite online or offline editor, fill it out, sign it, and produce a printed version. Achieve more for less with US Legal Forms!

- Find Arkansas Default Judgment on Complaint for Collection of Debt templates crafted by experienced attorneys.

- Avoid the costly and time-consuming task of searching for a lawyer and then paying them to draft a document that is readily available.

- If you have a membership, sign in to your account and locate the Download button adjacent to the file you need.

- You'll also have access to any saved templates in the My documents section.

- If you are using our site for the first time, adhere to the instructions below to obtain your Arkansas Default Judgment on Complaint for Collection of Debt quickly.

- Ensure that the document you find is applicable in your state.

Form popularity

FAQ

To file a lawsuit against a debt collector, you first need to gather evidence of the unfair practices you've experienced. Next, you will draft a complaint that outlines your claims and submit it to the appropriate court. If you're pursuing an Arkansas Default Judgment on Complaint for Collection of Debt, using a platform like UsLegalForms can help streamline the process and ensure your documentation meets legal requirements.

The eleven-word phrase to stop debt collectors is 'I do not acknowledge this debt, please cease all contact.' Using this statement can halt communication temporarily while you evaluate your options. Knowing such phrases is advantageous when dealing with an Arkansas Default Judgment on Complaint for Collection of Debt.

After a default judgment is issued in Arkansas, the creditor may seek to collect the debt. This could involve garnishing wages or seizing bank accounts. It’s important to act quickly and understand your options if you receive an Arkansas Default Judgment on Complaint for Collection of Debt.

The Arkansas Debt Collection Act regulates how debt collectors operate in the state. It aims to protect consumers from unfair or abusive debt collection practices. Familiarizing yourself with this act is vital, especially if you're facing an Arkansas Default Judgment on Complaint for Collection of Debt.

To answer a lawsuit in Arkansas, you must file a written response with the court, addressing each allegation made against you. You typically need to submit this response within 30 days of receiving the lawsuit. Properly addressing the lawsuit may include considering the possibility of an Arkansas Default Judgment on Complaint for Collection of Debt.

One frequent violation of the Fair Debt Collections Practices Act occurs when debt collectors contact consumers at inconvenient times. Other violations include harassment or falsely representing themselves. Being aware of these violations can help you protect your rights when managing an Arkansas Default Judgment on Complaint for Collection of Debt.

Arkansas debt relief generally involves negotiating with creditors or using debt management programs to reduce outstanding obligations. Individuals can explore options like credit counseling, debt consolidation, or bankruptcy. Understanding these avenues can be essential if facing an Arkansas Default Judgment on Complaint for Collection of Debt.

In Arkansas, a debt collector can attempt to collect a debt for a period of three to six years, depending on the type of debt. This time limit is part of the statute of limitations. If the debt is not collected within this timeframe, the collector typically cannot sue you for Arkansas Default Judgment on Complaint for Collection of Debt.

If your judgment for default is denied, it's essential to carefully review the court's ruling and understand the reasons behind the decision. You may consider filing a motion to reconsider or providing additional evidence to support your case. Taking proactive steps is crucial, particularly when dealing with the Arkansas Default Judgment on Complaint for Collection of Debt. Platforms like uslegalforms can guide you through drafting the appropriate legal documents.

After a default judgment is issued in Michigan, the court may allow the creditor to start collection activities. This may include wage garnishments, bank levies, or property liens. It's important to remember that similar steps occur under Arkansas Default Judgment on Complaint for Collection of Debt. If you find yourself facing such a situation, seeking legal advice may be beneficial.