Arkansas Notice to Employees of Scheduled Authorization Expiration

Description

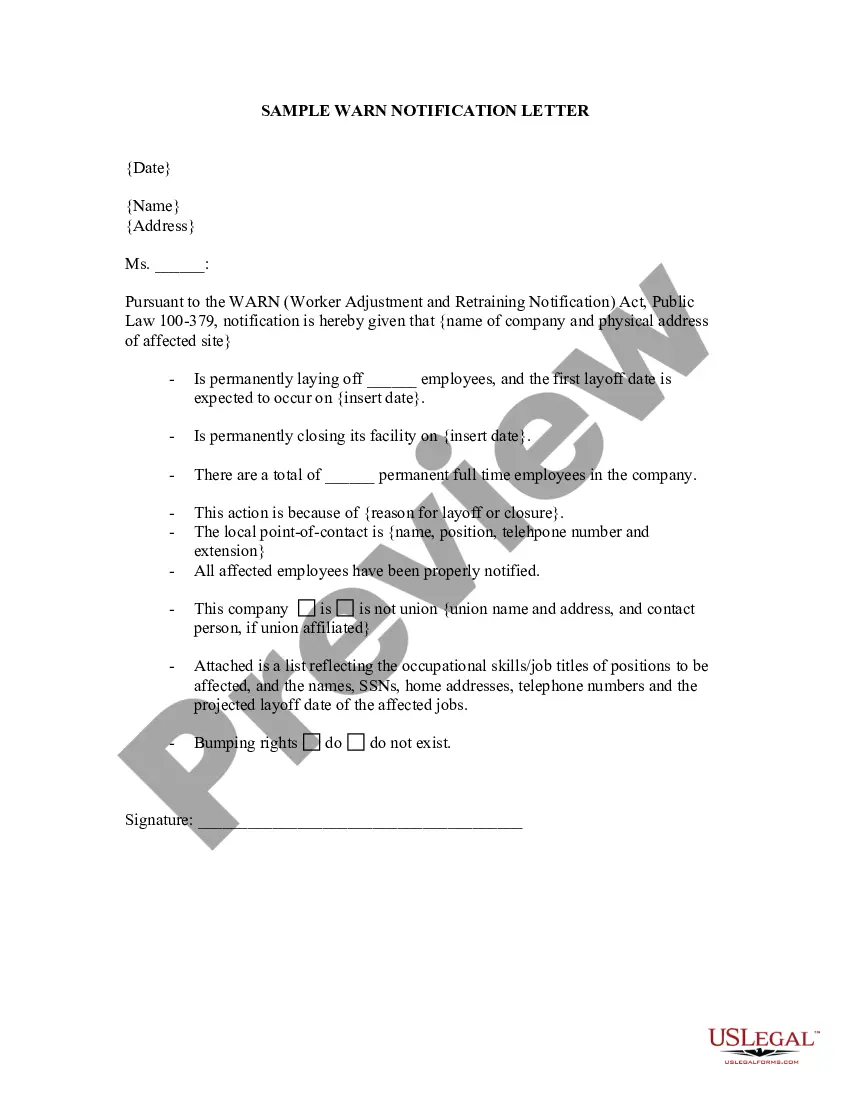

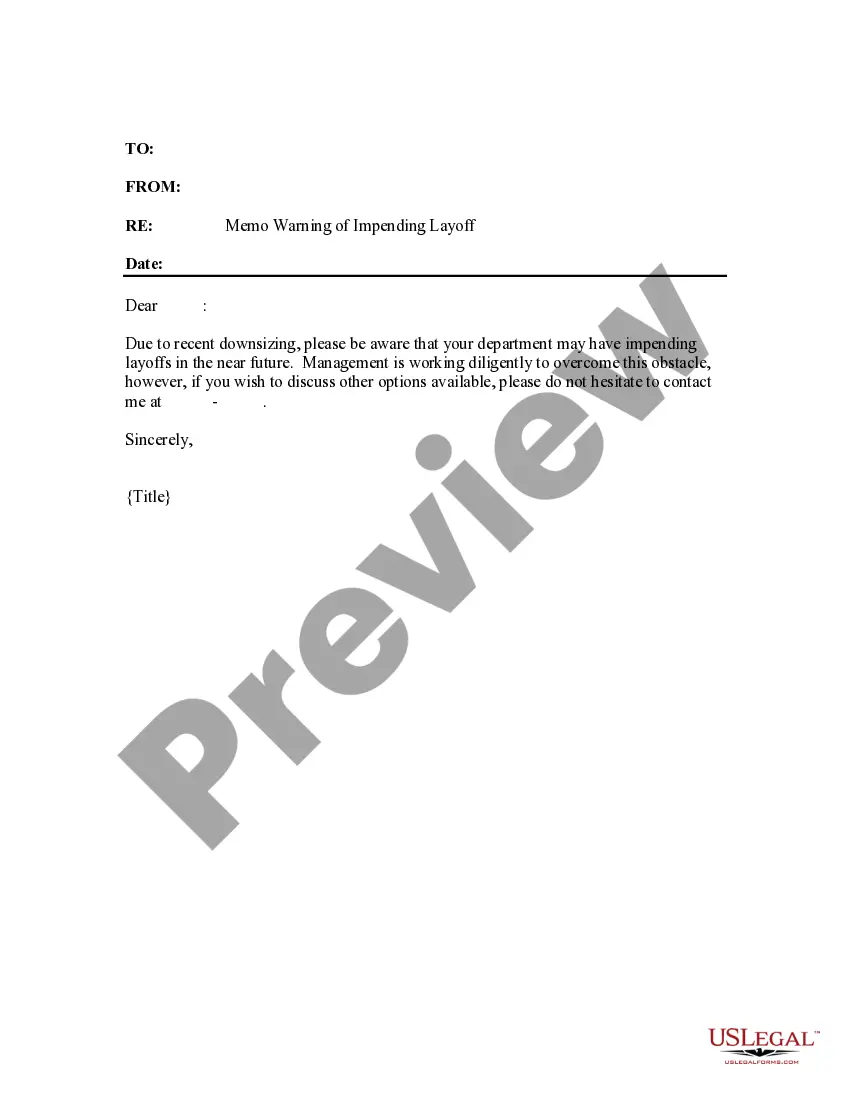

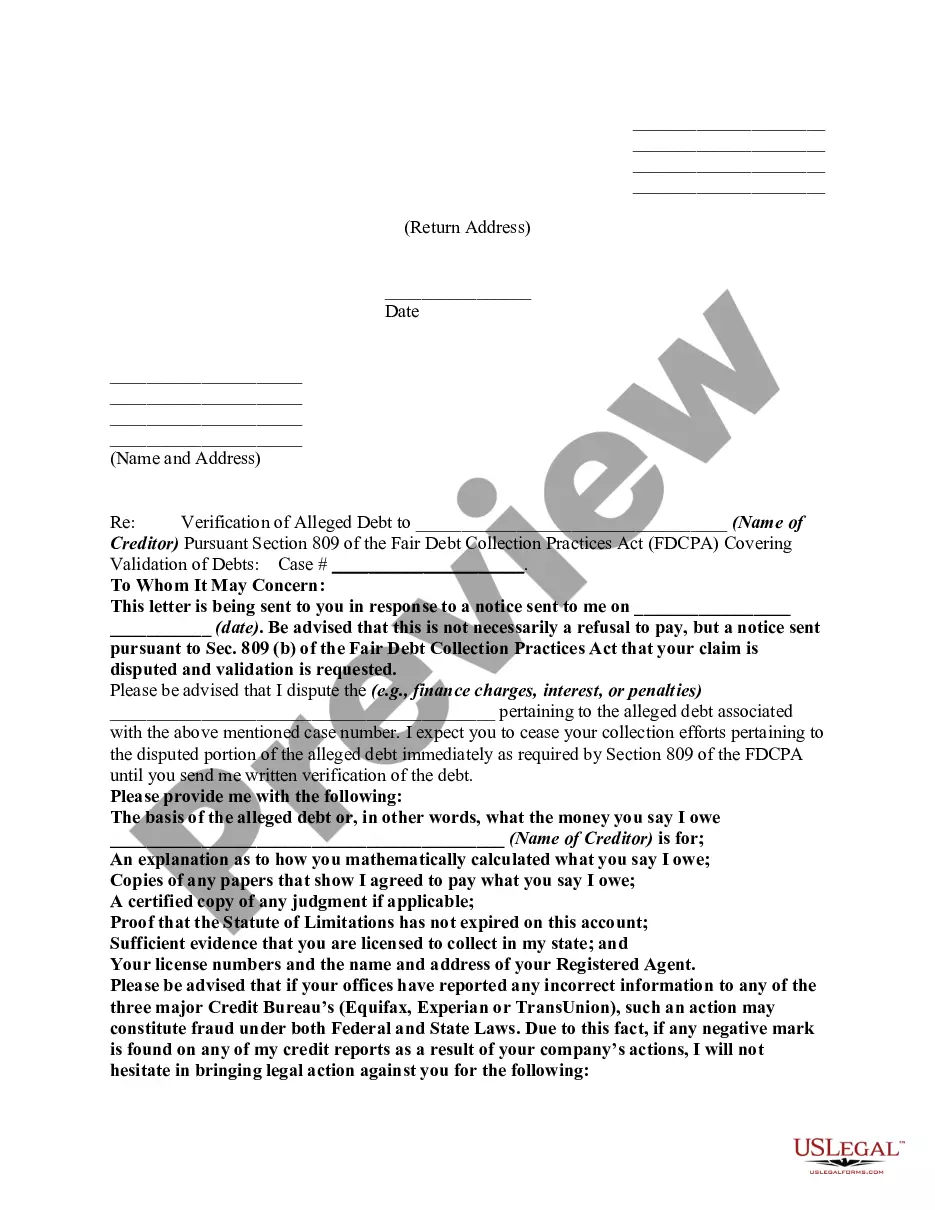

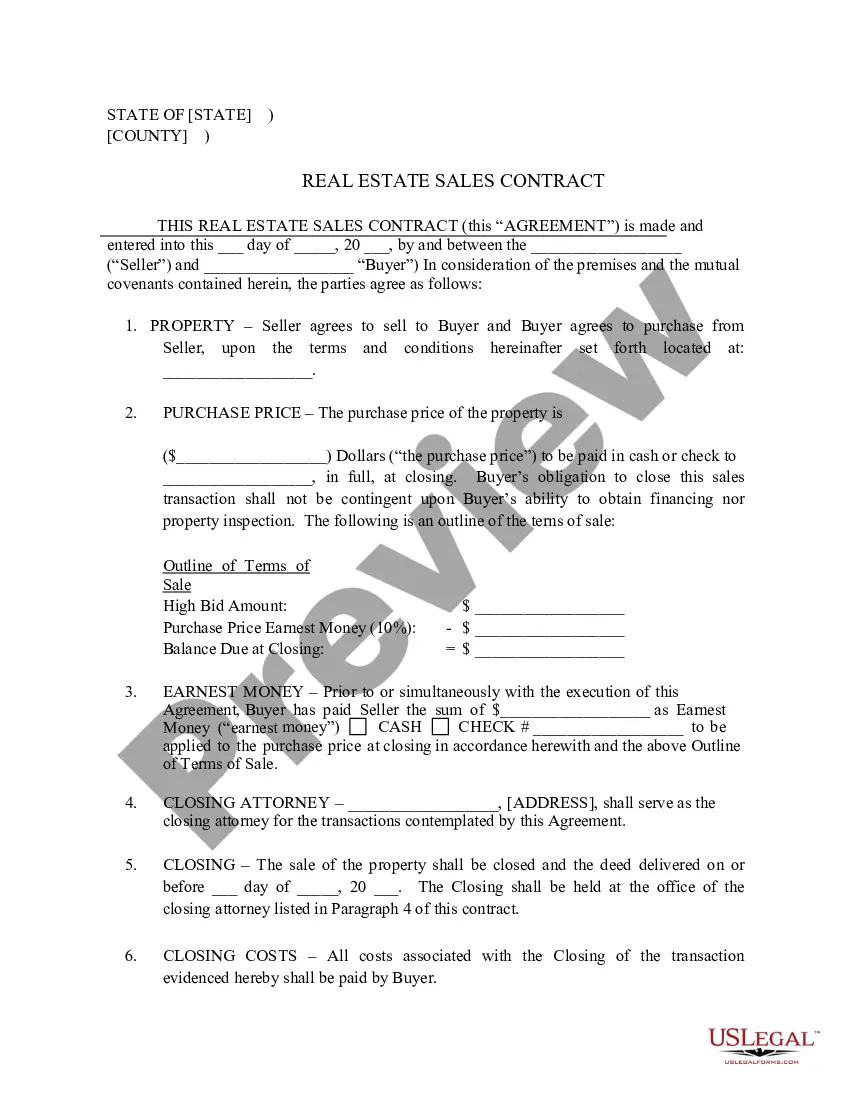

How to fill out Notice To Employees Of Scheduled Authorization Expiration?

It is feasible to dedicate multiple hours online searching for the legal documents template that meets the state and federal requirements you require.

US Legal Forms offers thousands of legal forms that are evaluated by experts.

It is easy to download or print the Arkansas Notice to Employees of Scheduled Authorization Expiration from our service.

Once you have found the template you want, click Buy now to proceed. Select the pricing plan you wish, input your credentials, and register for your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Select the format of the document and download it to your device. Make adjustments to your document if necessary. You can complete, edit, sign, and print the Arkansas Notice to Employees of Scheduled Authorization Expiration. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you may Log In and click on the Download button.

- After that, you can complete, revise, print, or sign the Arkansas Notice to Employees of Scheduled Authorization Expiration.

- Every legal document template you acquire is yours for a long duration.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Read the form description to confirm you have chosen the right form.

- If available, use the Review button to preview the document template at the same time.

- To find another version of the form, use the Search section to locate the template that meets your needs and requirements.

Form popularity

FAQ

Yes, Arkansas follows the at-will employment doctrine. This means that an employer can terminate an employee for any reason, as long as it does not violate federal or state laws. Employees also have the right to quit their jobs without notice. Understanding the Arkansas Notice to Employees of Scheduled Authorization Expiration can help you navigate your rights and responsibilities in this at-will environment, ensuring you stay informed about your employment status.

The unemployment insurance tax is computed on the wages paid to each employee on a calendar quarter basis. The current taxable wage base that Arkansas employers are required by law to pay unemployment insurance tax on is ten thousand dollars ($10,000) per employee, per calendar year.

The Appeal Tribunal or an AESD Local Office must receive your appeal within the 20day appeal period shown on the Determination. Remember that you must continue to file weekly claims during the appeals process.

To file a weekly claim or to check the status of your claim, please visit ArkNet, Arkansas' continued claim filing system.

The Pandemic Unemployment Assistance (PUA) program will end on June 26, 2021. Weekly benefits will continue to be paid to those eligible through the week ending June 26, 2021.

While some states have labor regulations requiring that employees be allowed one or more workday rest periods, the Arkansas government has no such regulations.

Q: How will I receive my unemployment benefits? A: Benefits are issued either Direct Deposit or by Debit Card. Direct Deposit takes about 2-3 days from the date the payment is processed. To select Direct Deposit, you must enter your account and routing numbers after logging into your account on .

30.2 All employers in the State of Arkansas must provide the notice as set out in Attachment A of Rule 30 to an employee upon that employee's separation from employment.

The State minimum wage is: $9.25 per hour effective January 1, 2019; $10.00 per hour effective January 1, 2020; $11.00 per hour effective January 1, 2021. The Arkansas Minimum Wage Act covers employers with 4 or more employees.

No Arkansas Law Requires Meal or Rest Breaks In other words, although breaks are not required, employers must pay employees for time they spend working and for shorter breaks during the day.