Arkansas Standard Conditions of Acceptance of Escrow

Description

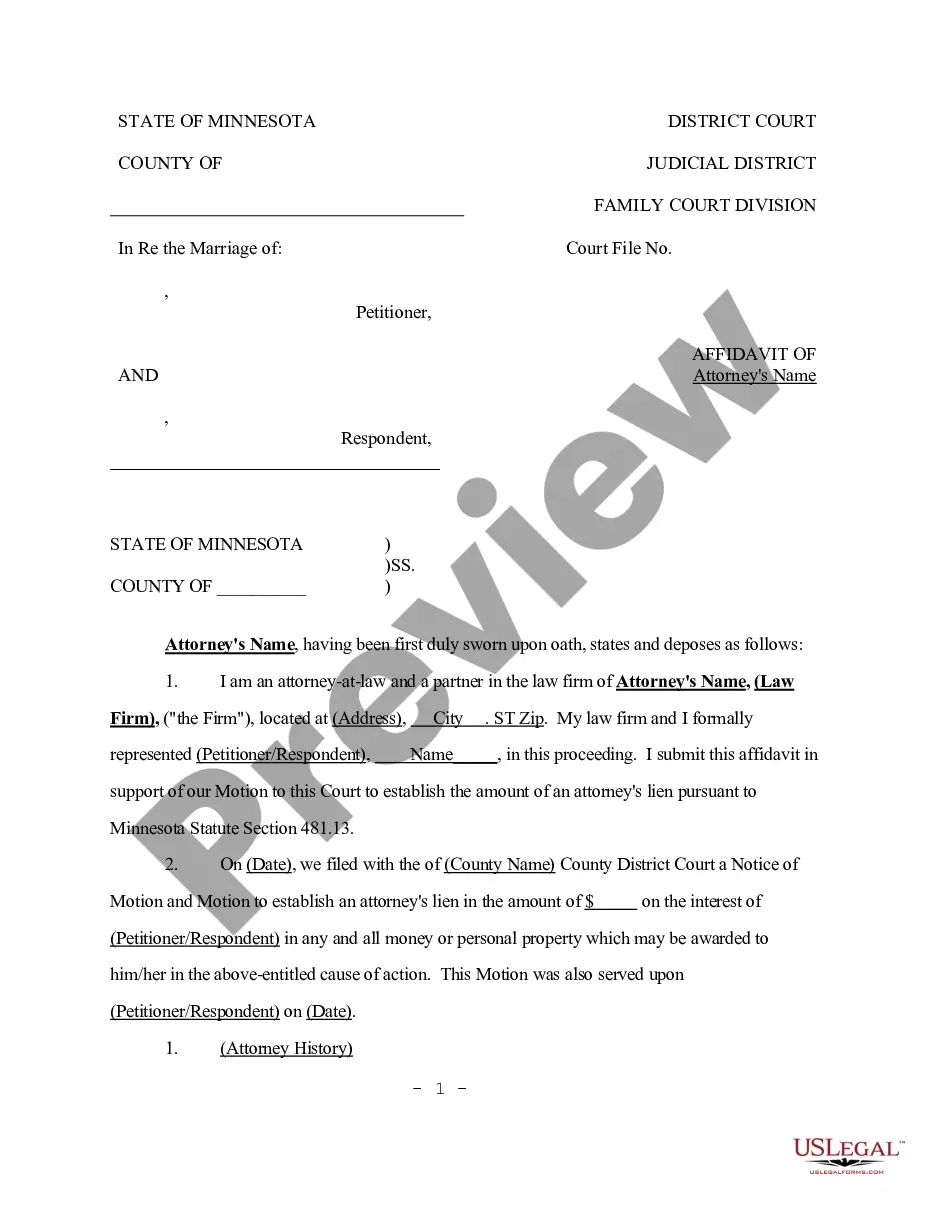

How to fill out Standard Conditions Of Acceptance Of Escrow?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal form templates that you can download or print.

By utilizing the site, you can find thousands of forms for business and personal purposes, categorized by groups, states, or terms. You can access the latest versions of forms such as the Arkansas Standard Terms of Acceptance of Escrow in just moments.

If you already hold a subscription, sign in and download the Arkansas Standard Terms of Acceptance of Escrow from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Arkansas Standard Terms of Acceptance of Escrow. Every template you added to your account does not expire and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Gain access to the Arkansas Standard Terms of Acceptance of Escrow with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are straightforward steps to help you start.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the details of the form.

- Consult the form description to confirm you have selected the right document.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Review Contract ClausesThe seller might have a clause hidden deep in the contract that allows him to cancel the escrow without penalties for any reason he wishes to do so. Look for that carefully when going over the contract or you could get caught up in a mess down the road.

Despite being in a "caveat emptor" state, Arkansas home sellers might want to make some disclosures to property buyers. Updated by Ilona Bray, J.D. If you're looking to sell your Arkansas home, there's you will likely face lower paperwork requirements than sellers in other states.

Arizona: Real estate attorneys are not essential for closing but may be advised by your real estate agent. Arkansas: Real estate attorneys are not essential for closing but may be advised by your real estate agent.

Commonly, there aren't definite disclosure laws and the sale prices will only reflect on public records if the seller submits one. These states are the following: Alabama, Arkansas, Louisiana, Nevada, North Carolina, Oklahoma, Rhode Island, and Tennessee.

As in all real property transactions in Arkansas, there is no disclosure statute addressing the individual owner/seller.

Seller closing costs are fees you pay when you finalize the sale of your home in Arkansas. These include the costs of verifying and transferring ownership to the buyer and many are unavoidable. In Arkansas, you'll pay about 1.2% of your home's final sale price in closing costs, not including realtor fees.

The short list of states that lean toward caveat emptor is:Alabama.Arkansas.Georgia.North Dakota.Virginia.Wyoming.

Under current law, the SELLER is required to disclose all known conditions that affect the health or safety of a prospective purchaser. SELLER discloses to PURCHASER that SELLER knows of no defects in the subject property, other than those deficiencies disclosed in this form.

Arkansas' escrow process is similar to other states where a closing agent, (who is often an escrow agent or representative from a title company) is used to complete the transaction. In Arkansas, buyers and sellers often consummate the transaction at the same closing (or 'settlement') table.