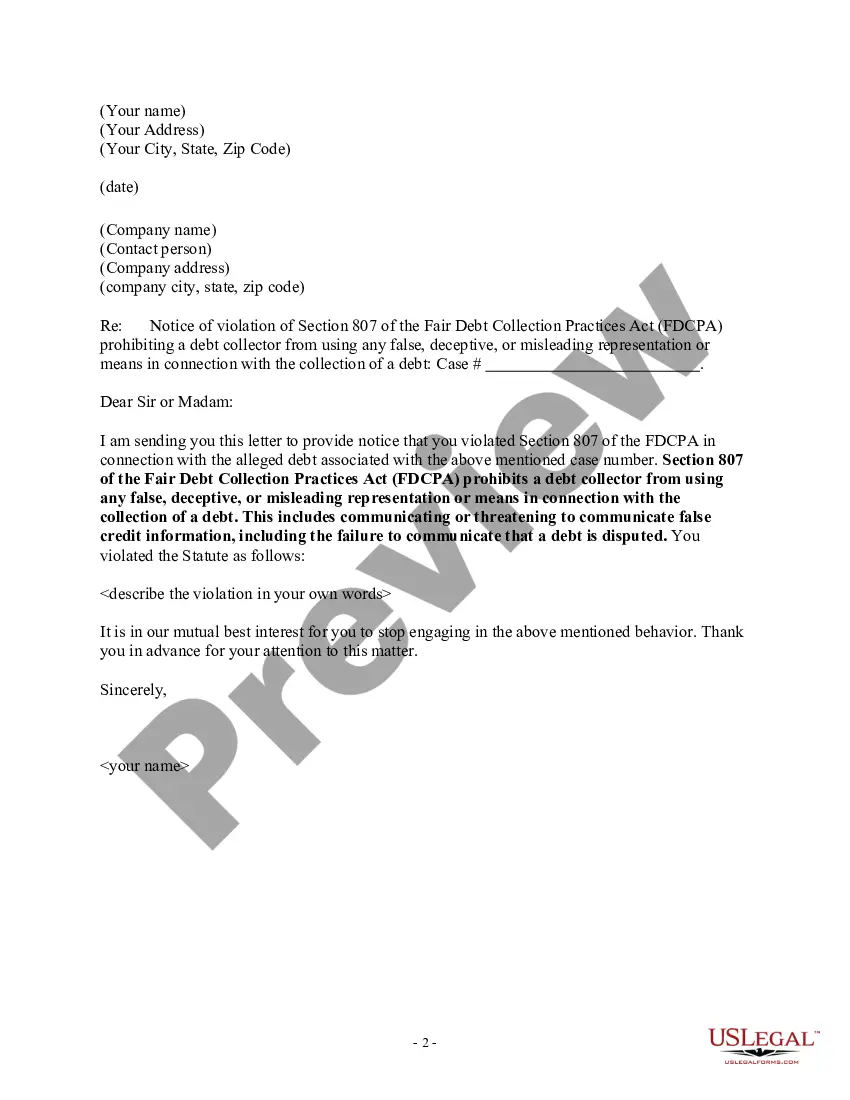

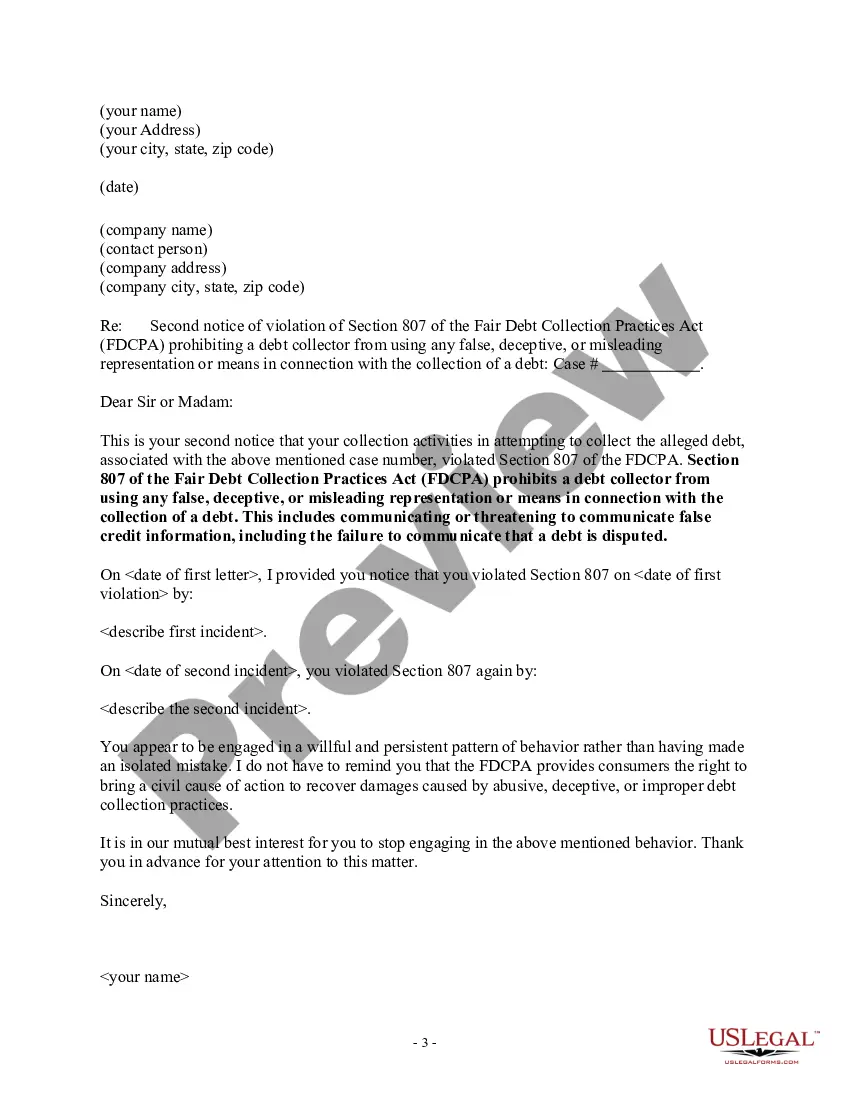

Missouri Notice of Violation of Fair Debt Act - False Information Disclosed

Description

How to fill out Notice Of Violation Of Fair Debt Act - False Information Disclosed?

Are you currently in a scenario where you require documentation for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding trustworthy ones can be challenging.

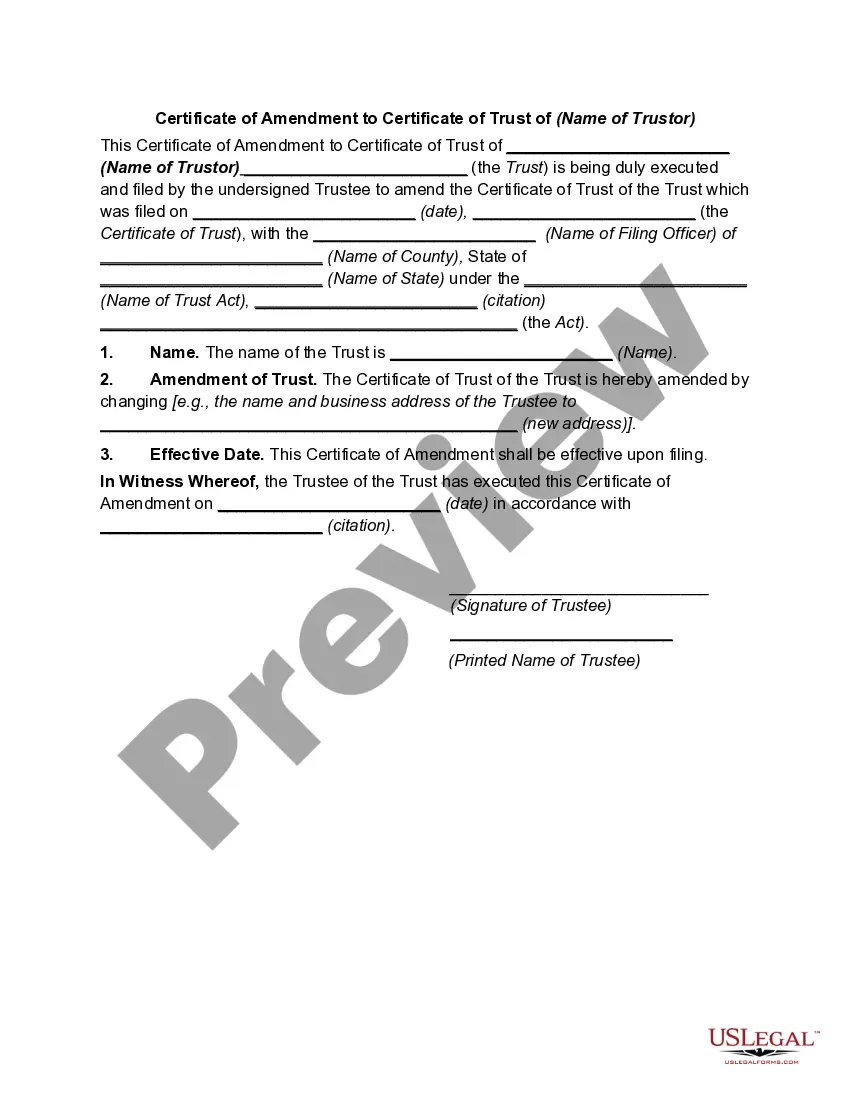

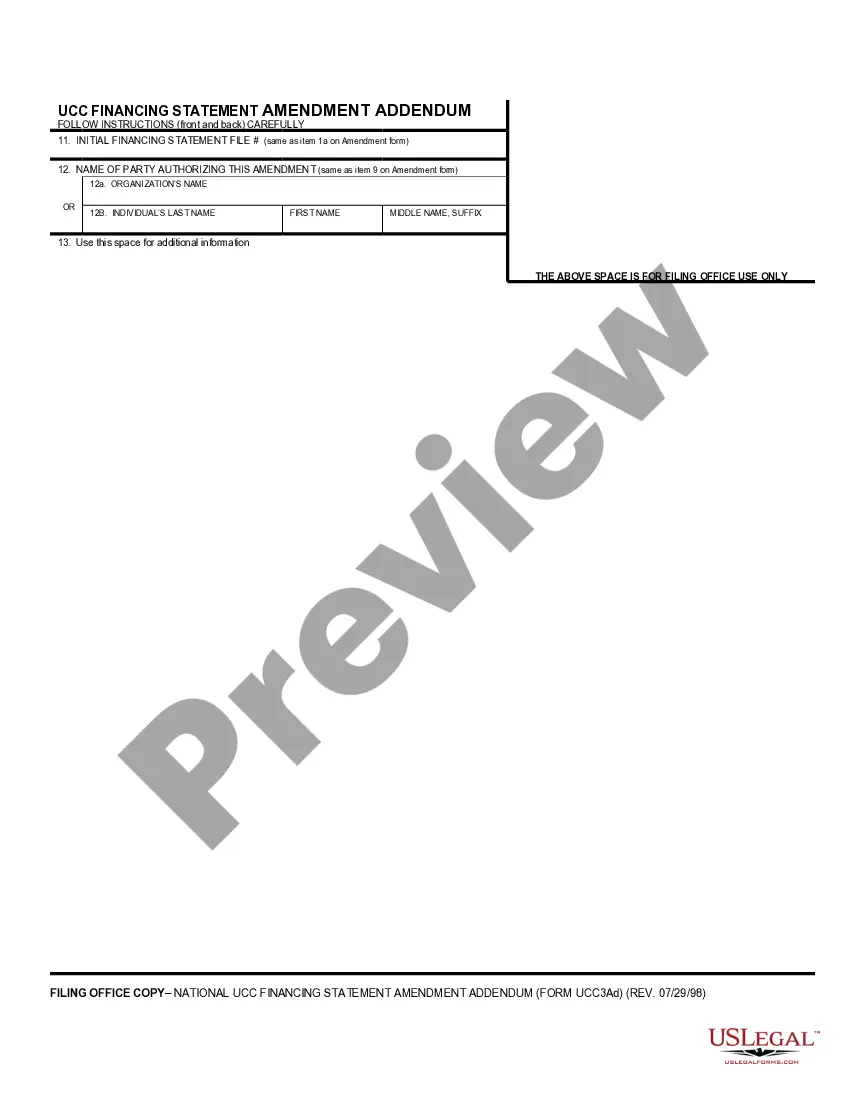

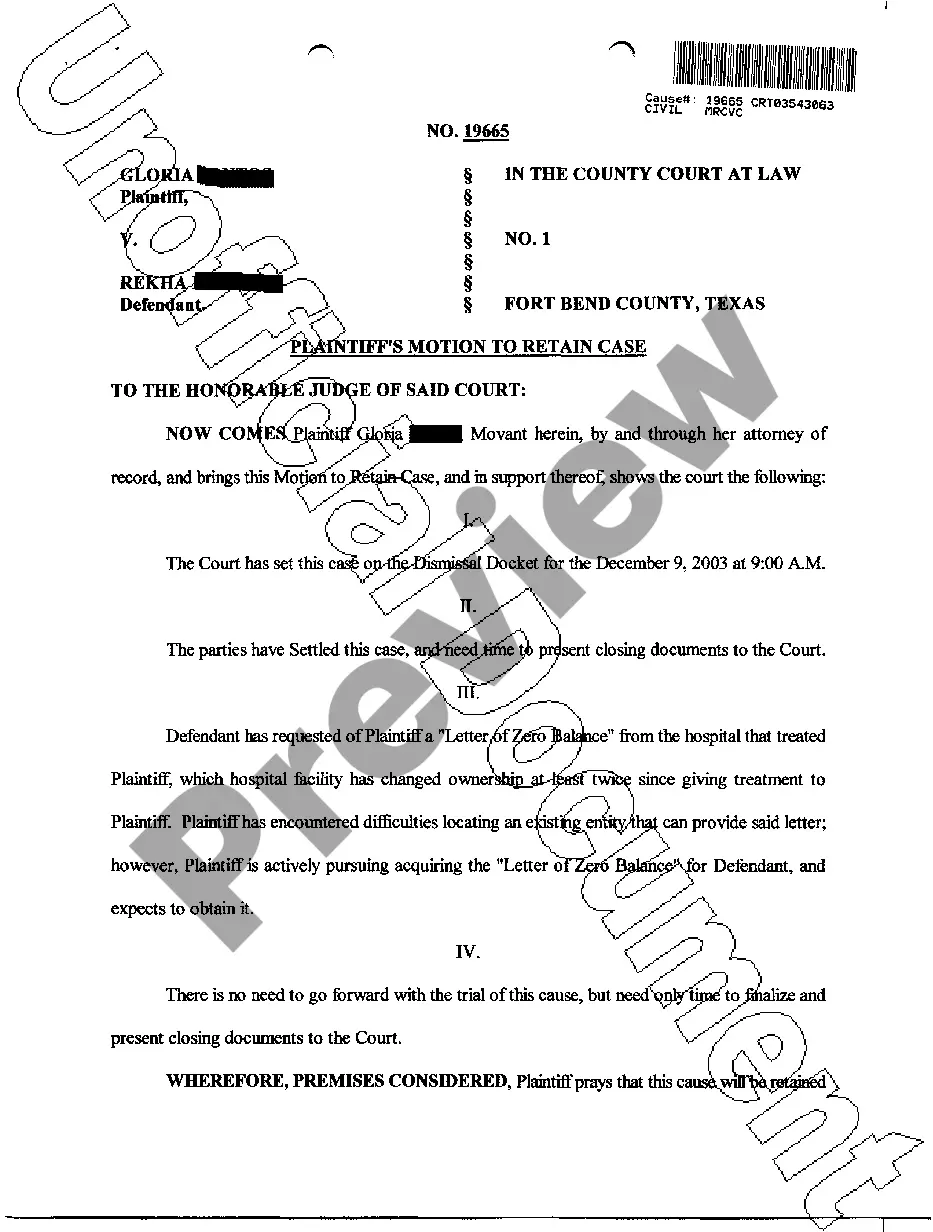

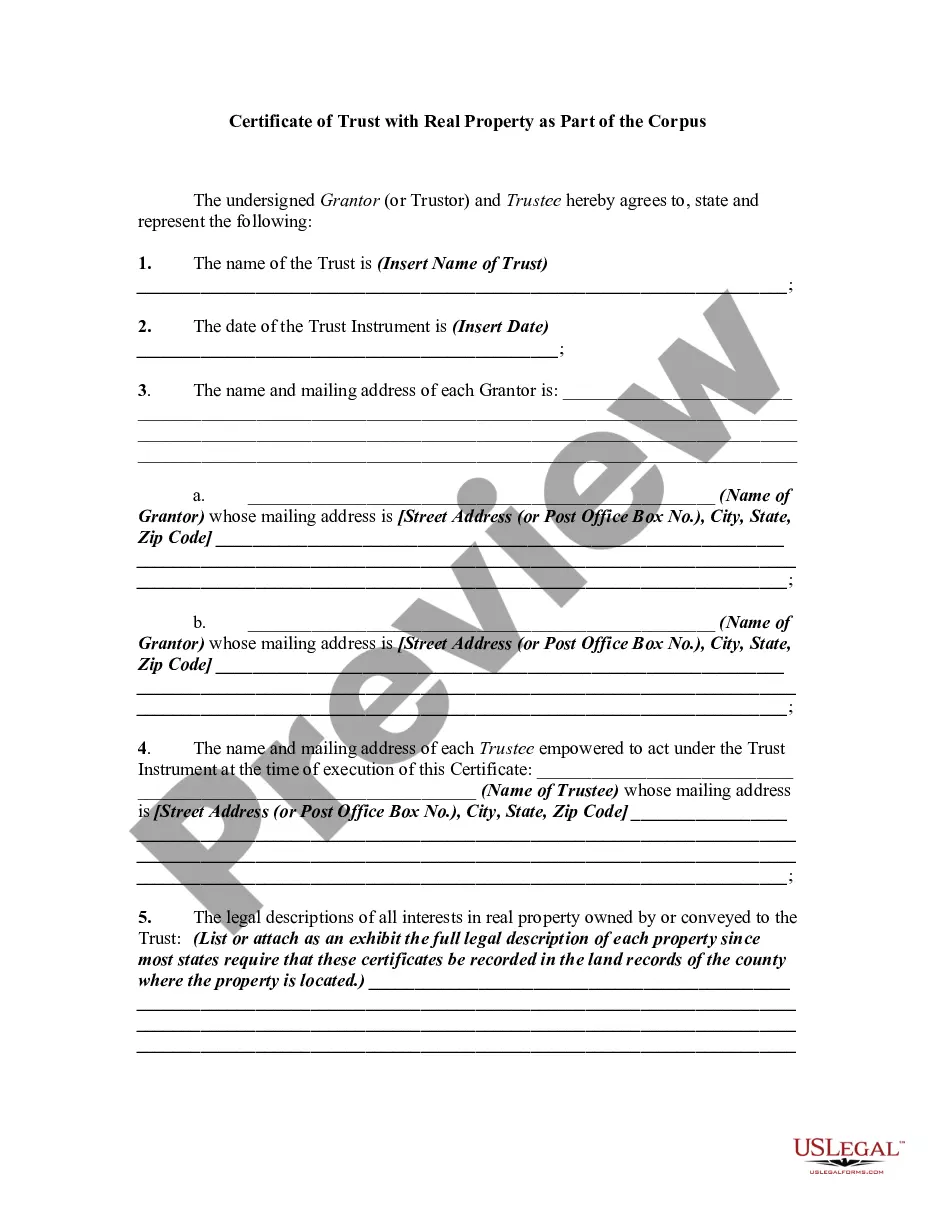

US Legal Forms offers thousands of form templates, including the Missouri Notice of Violation of Fair Debt Act - False Information Disclosed, designed to comply with federal and state regulations.

Once you obtain the correct form, click Acquire now.

Choose the payment plan you prefer, fill in the required information to generate your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can obtain the Missouri Notice of Violation of Fair Debt Act - False Information Disclosed template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Utilize the Review button to examine the document.

- Check the details to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Lookup field to find the form that suits your needs.

Form popularity

FAQ

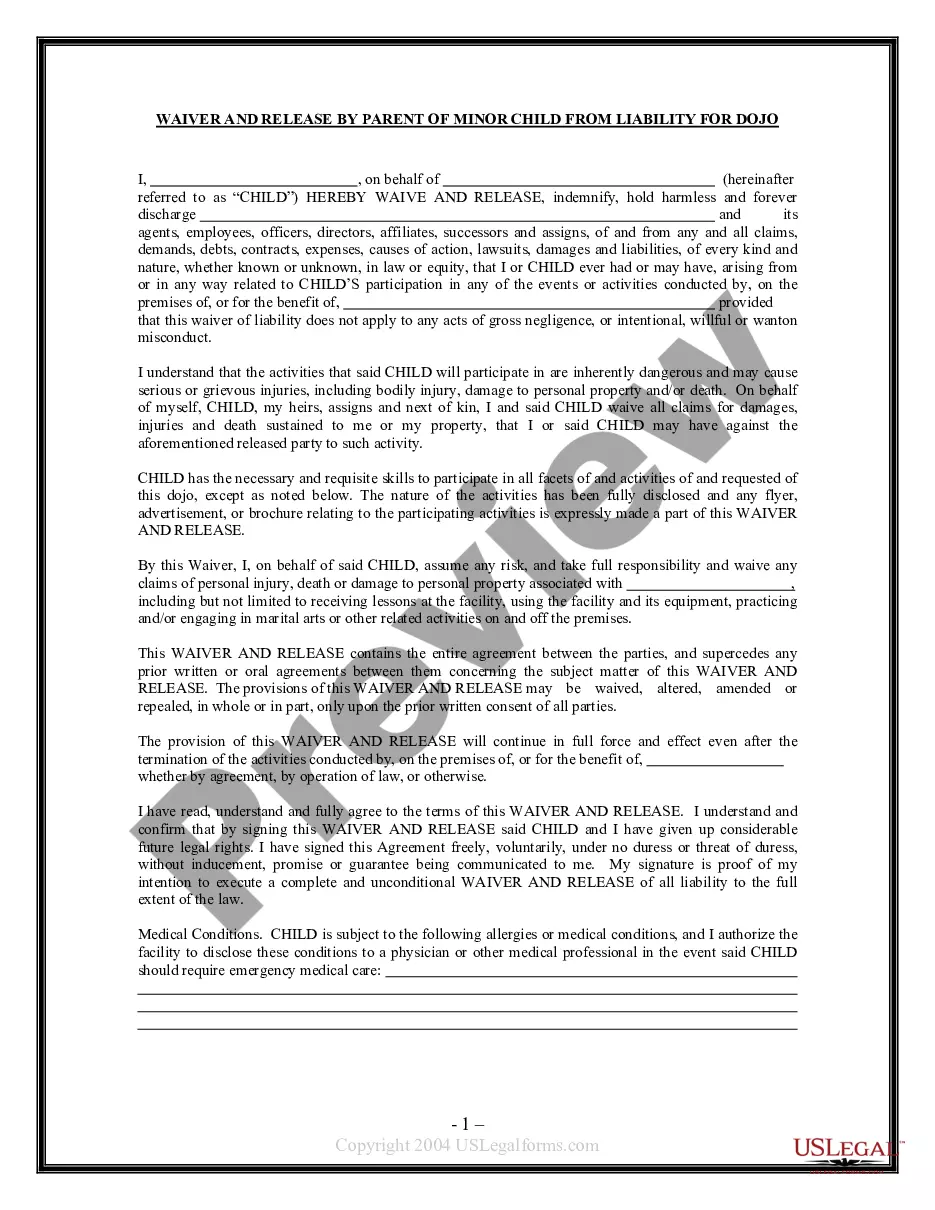

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

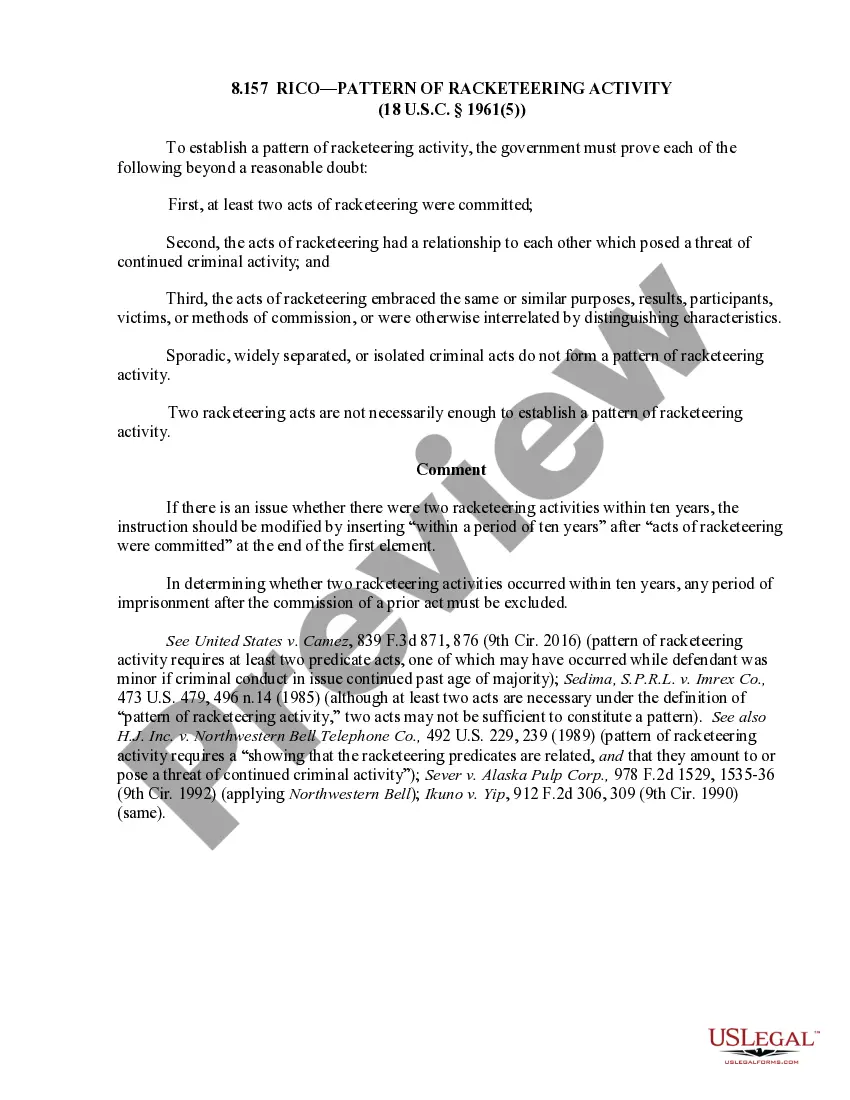

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

You can sue a company for sending you to collections for a debt that you don't owe. If a debt collector starts calling you out of the blue, but you know perfectly well that you made the payment in question, the law gives you the right to file an action in court against the company.

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

Under the Fair Credit Reporting Act (FCRA) (15 U.S.C. § 1681 and following), you may sue a credit reporting agency for negligent or willful noncompliance with the law within two years after you discover the harmful behavior or within five years after the harmful behavior occurs, whichever is sooner.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.