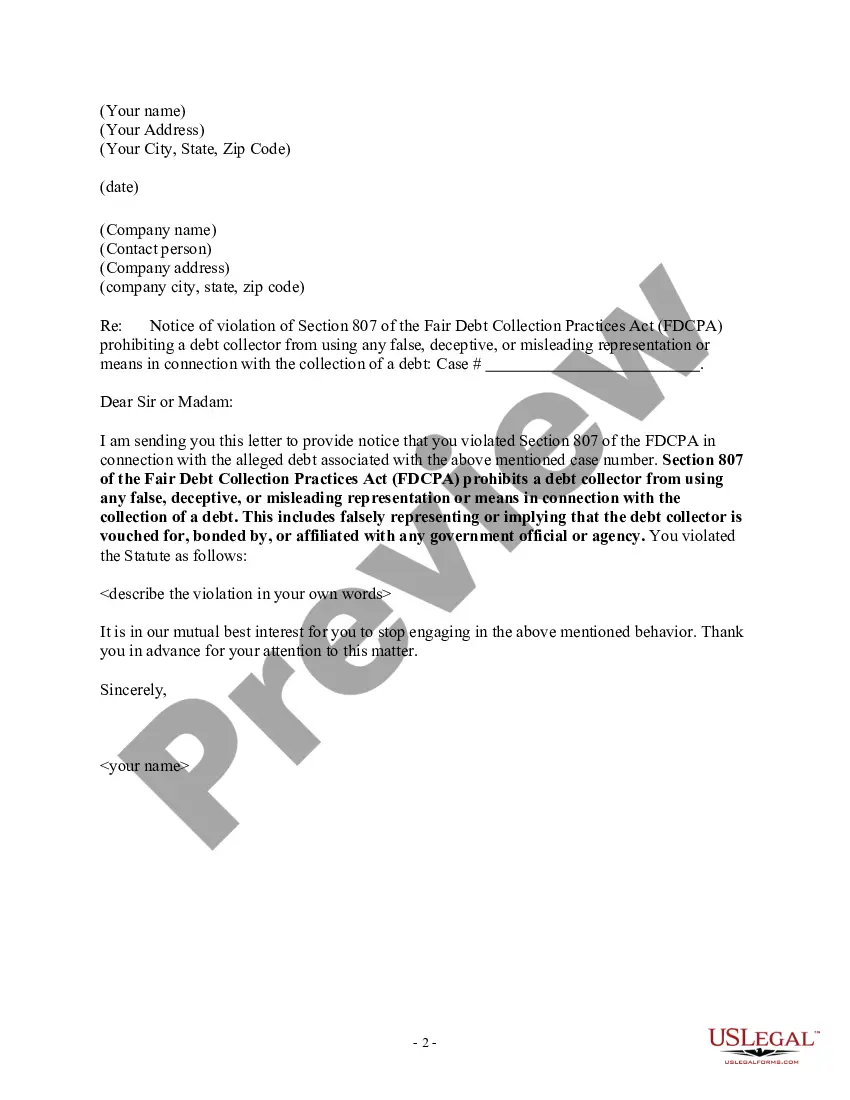

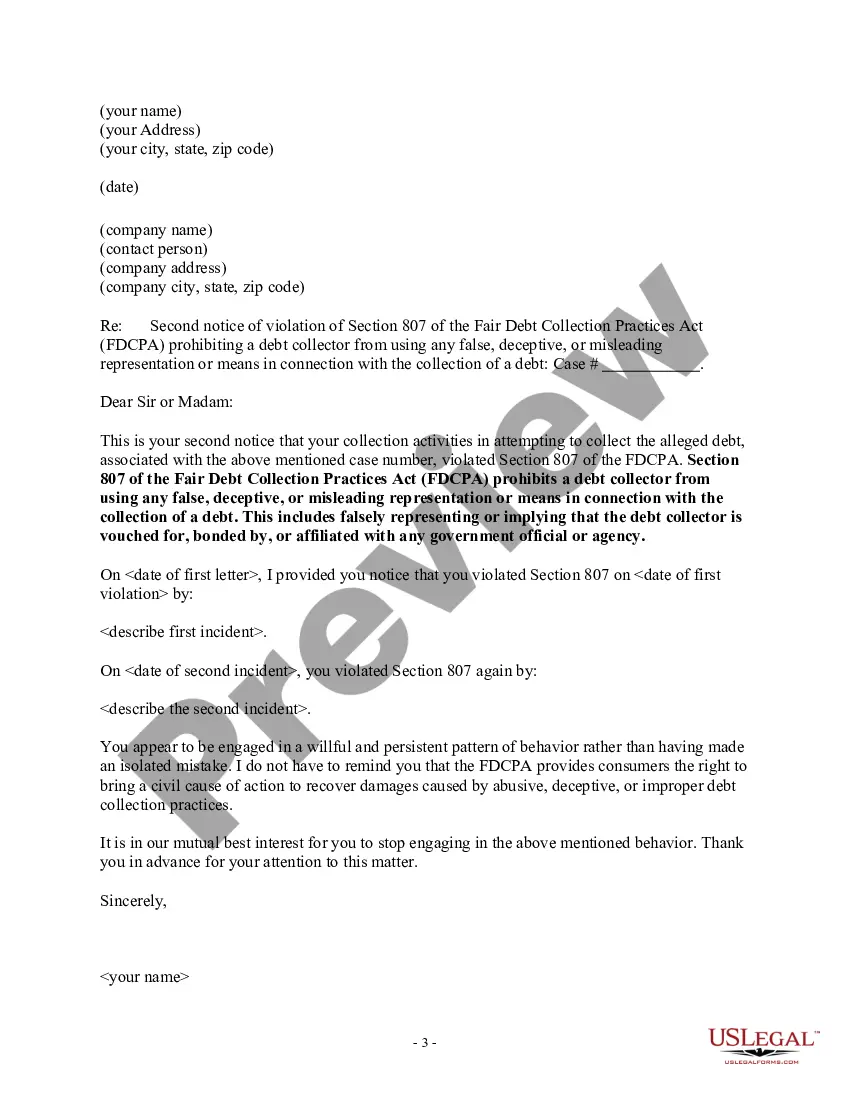

Missouri Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

How to fill out Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

You can dedicate numerous hours online searching for the authentic documents template that complies with the federal and state requirements you need.

US Legal Forms offers a vast collection of authentic forms that can be reviewed by experts.

You can easily download or print the Missouri Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself from our platform.

If available, take advantage of the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the Missouri Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself.

- Each authentic document template you obtain is yours to keep indefinitely.

- To acquire another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are utilizing the US Legal Forms website for the first time, follow the simple instructions below.

- Initially, confirm that you have selected the correct document template for the region/city you choose.

- Review the form description to ensure you have selected the appropriate form.

Form popularity

FAQ

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Depending on the type of debt, Missouri statute of limitations on debt range between five to 10 years. After that period has passed, the debt becomes time-barred, which means collectors no longer have the right to sue you.

In Missouri, the statute of limitations varies depending on the type of debt. Unsecured debt. This is a type of debt without collateral, e.g., credit cards and personal loans. The statute of limitations of unsecured debt with a written contract is ten years, while that of a verbal contract is five years.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.

Under Missouri law, a judgment is considered active (collectible) for ten years. This includes a monetary judgment as well as any real property liens resulting from that judgment.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

The FDCPA broadly prohibits a debt collector from using 'any false, deceptive, or misleading representation or means in connection with the collection of any debt. ' 15 U.S.C. § 1692e. The statute enumerates several examples of such practices, 15 U.S.C.

Debts that may not be covered are those that are not incurred voluntarily, such as income taxes, parking and speeding tickets, and domestic support obligations like child support and alimony, or spousal support.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.