Mississippi Loan Plan for Key Employees

Description

How to fill out Loan Plan For Key Employees?

If you have to complete, obtain, or produce authorized document web templates, use US Legal Forms, the biggest variety of authorized forms, which can be found online. Utilize the site`s easy and convenient look for to get the files you want. Numerous web templates for business and specific purposes are sorted by classes and claims, or key phrases. Use US Legal Forms to get the Mississippi Loan Plan for Key Employees within a few mouse clicks.

When you are currently a US Legal Forms customer, log in to your bank account and click the Obtain key to obtain the Mississippi Loan Plan for Key Employees. You can also access forms you formerly delivered electronically within the My Forms tab of the bank account.

If you work with US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for your correct city/land.

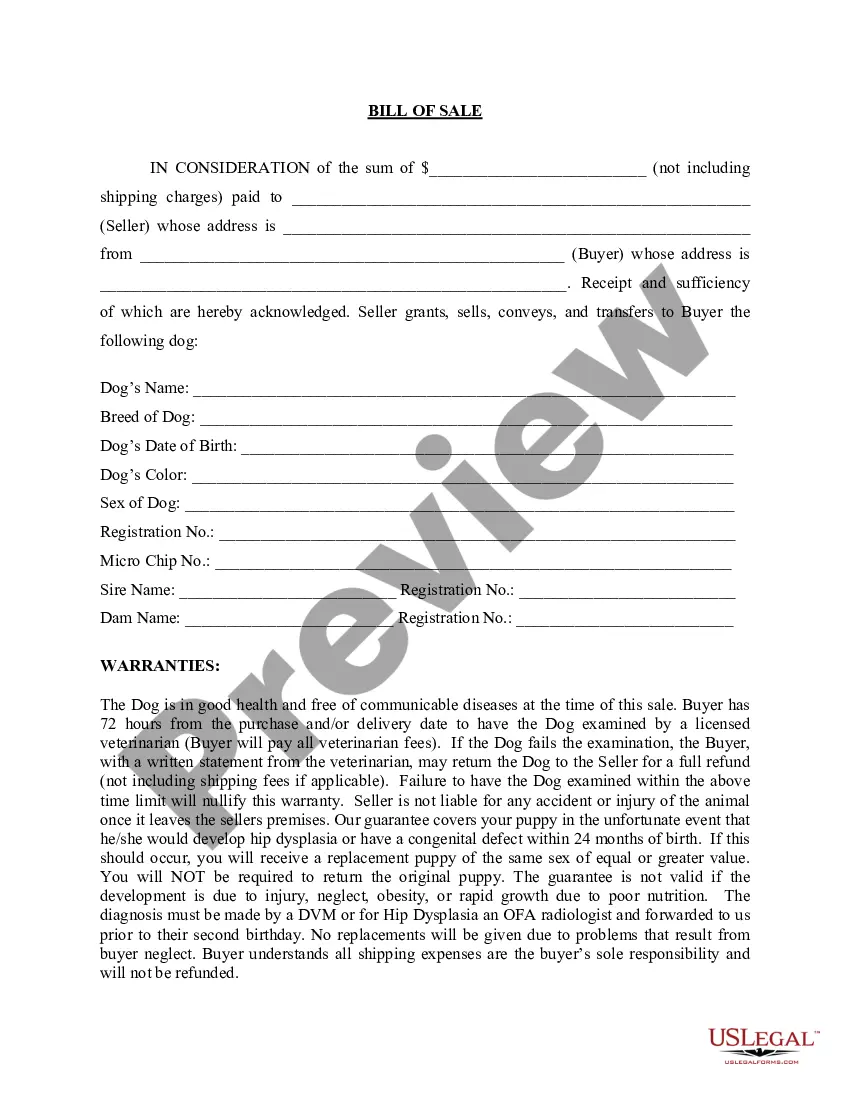

- Step 2. Make use of the Review option to examine the form`s articles. Do not forget to see the information.

- Step 3. When you are unhappy using the form, utilize the Search area at the top of the display to find other variations of your authorized form design.

- Step 4. When you have located the form you want, click on the Get now key. Select the prices strategy you favor and add your credentials to register for an bank account.

- Step 5. Approach the deal. You may use your Мisa or Ьastercard or PayPal bank account to accomplish the deal.

- Step 6. Find the file format of your authorized form and obtain it in your system.

- Step 7. Comprehensive, revise and produce or indication the Mississippi Loan Plan for Key Employees.

Every authorized document design you acquire is yours permanently. You may have acces to each form you delivered electronically within your acccount. Select the My Forms area and select a form to produce or obtain once again.

Remain competitive and obtain, and produce the Mississippi Loan Plan for Key Employees with US Legal Forms. There are many skilled and status-particular forms you can utilize for your personal business or specific needs.

Form popularity

FAQ

PERS is a defined benefit plan, which is a plan designed based on strength in numbers, automatic participation, and pooled risk so that members may receive a benefit for life at retirement. While you and your employer contribute to PERS on your behalf, your benefit is not based on these contributions.

Public Employees' Retirement System of Mississippi (PERS): The employee's pre-tax contribution is 9.00% of gross wages and the University contribution is 17.40% of the employee's gross income. PERS is a defined benefits plan which entitles qualified employees to a guaranteed retirement benefit.

Your initial retirement benefit is calculated using projected wages certified by your employer before your termination date. After your final wages are reported, PERS will audit your account and, if necessary, adjust your benefit for any underpayment or overpayment.

PERS 13th Check is the annual 3% cost of living increase given to current public sector employees and Mississippi retirees at the year's end. The 13th Check or payment is paid to the ex-employees entirely by employer contributions.

Normally the Legislature does not provide direct appropriations to PERS. Instead, it is supported by governmental entities paying 17.4% of payroll for each employee. In addition, employees pay 9% of their payroll into the system, and the system also receives investment earnings.

PERS Public Employee Retirement System refers to both the state retirement plan and the agency that administers it. PERS Eligibility Date The date an employee is eligible for membership in one of the PERS retirement plans.

PERS is a defined benefit plan, which is a plan designed based on strength in numbers, automatic participation, and pooled risk so that members may receive a benefit for life at retirement.