In this guaranty, the guarantor is guaranteeing both payment and performance of all leases now or later entered into with lessee and all the obligations and liabilities due and to become due to lessor from lessee under any lease, note, or other obligation of lessee to lessor. Such a blanket guaranty would suggest a close business relationship between the lessee and guarantor like that of a parent and subsidiary corporation.

Arkansas Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease

Description

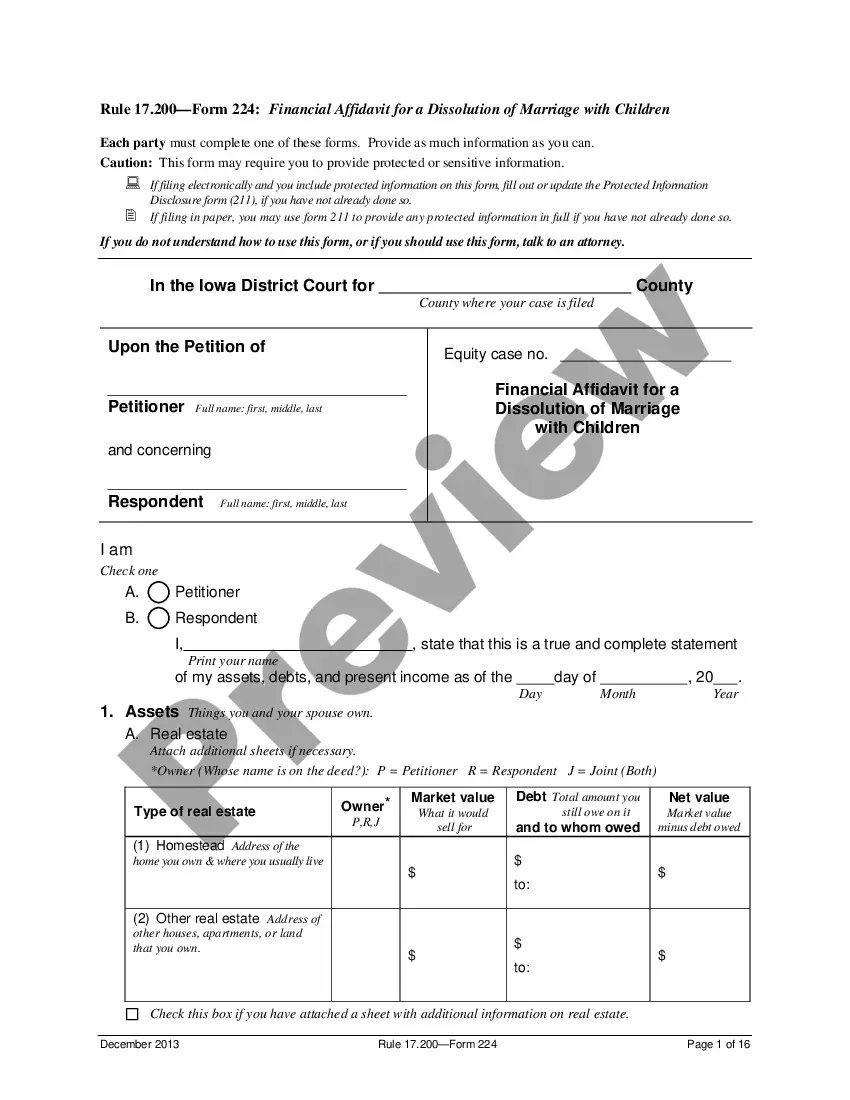

How to fill out Continuing Guaranty Of Payment And Performance Of All Obligations And Liabilities Due To Lessor From Lessee Under Lease?

You have the capability to invest multiple hours online searching for the sanctioned document template that meets the state and federal standards you need.

US Legal Forms provides thousands of legal documents that are vetted by professionals.

You can conveniently obtain or print the Arkansas Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease from the service.

First, ensure that you have selected the correct document template for the region/town that you choose. Review the form outline to verify that you have chosen the right template. If available, utilize the Review button to check the document template as well. To retrieve an additional version of the form, utilize the Search field to find the template that suits your needs and requirements. Once you have identified the template you desire, click Purchase now to proceed. Select the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms. Complete the payment. You can use your credit card or PayPal account to pay for the legal document. Choose the file format and download it to your device. Make modifications to your document if required. You can complete, edit, sign, and print the Arkansas Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal documents. Employ professional and state-specific templates to address your business or personal requirements.

- If you presently possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Arkansas Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease.

- Each legal document template you purchase is yours indefinitely.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

A payment guaranty is a formal agreement where an individual or entity commits to ensure that payments are made by the lessee. This contract often includes detailed terms describing the obligations and conditions under which the guaranty applies. In the realm of an Arkansas Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, it can significantly reduce the lessor's risk and bolster confidence in the transaction.

The guarantee of payment clause is a provision that specifies that a third party agrees to take responsibility for the lessee’s obligations in case of a default. This clause operates under the principle that a guarantor will step in to fulfill the payment duties, providing peace of mind to the lessor. In an Arkansas Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, this clause reinforces trust between both parties.

The purpose of a payment guarantee is to provide assurance to the lessor that the lessee will fulfill their financial obligations. It serves as a protective measure, ensuring that even if the lessee defaults, obligations under the lease will still be met. This is especially important within the framework of an Arkansas Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, as it mitigates risks associated with non-payment.

A payment clause typically includes specific terms regarding the timing, amount, and method of payments from the lessee to the lessor. For instance, it may state, 'Lessee shall make monthly payments of $1,000 on the first day of each month, without any deductions.' In the context of an Arkansas Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, this clause ensures clarity and consistency in payment expectations.

A guarantee of recourse obligations, similar to the previous terms, indicates that if the lessee fails to satisfy their obligations, the guarantor will cover those debts. This arrangement provides significant reassurance to lessors involved in the Arkansas Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease. It fosters a secure environment for partnerships and leasing agreements.

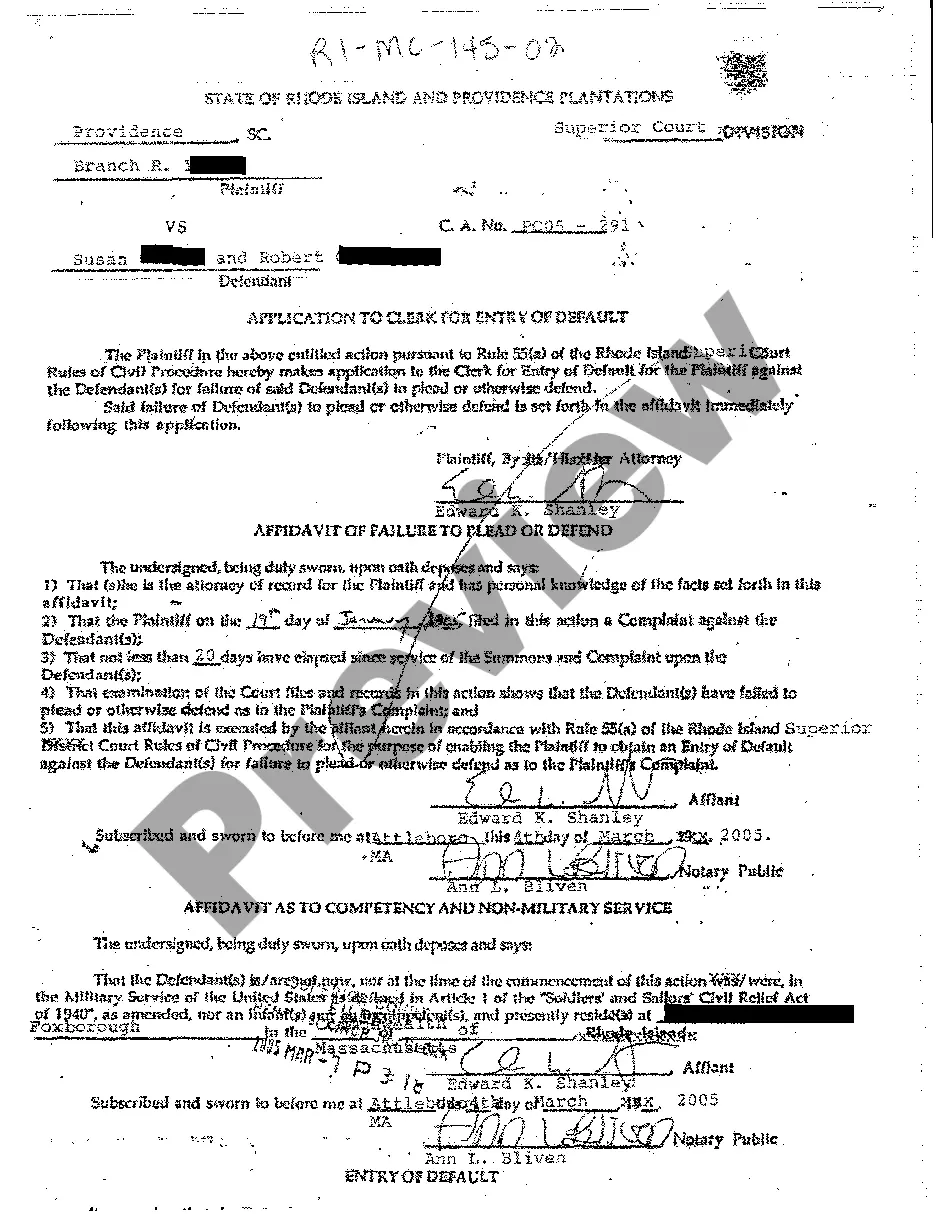

The elements of breach of guaranty typically include the existence of a valid guaranty agreement, a default by the primary obligor, and a failure of the guarantor to meet their obligations. Understanding these elements is crucial within the scope of the Arkansas Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease. Identifying a breach early allows both parties to take timely action.

A guaranty of payment clause explicitly states the guarantor’s commitment to cover the payment obligations of the lessee. This clause is a vital part of the Arkansas Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, as it clarifies the roles and responsibilities in terms of financial performance. Such clarity helps minimize disputes and ensures financial accountability.

The guaranty of recourse obligations means that the guarantor agrees to take on the financial responsibilities if the lessee defaults. It provides the lessor with the assurance that they will receive payment, regardless of the lessee’s financial situation. In the framework of the Arkansas Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, this guarantees a smoother financial experience.

The key difference lies in the ability of the creditor to pursue the guarantor. A recourse guaranty allows the lessor to seek payment from the guarantor, while a non-recourse guaranty limits the lessor's recovery solely to the collateral provided. When dealing with the Arkansas Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, understanding this distinction helps both parties assess their risks and responsibilities.

A recourse obligation is a debt or liability for which the creditor can seek repayment from the guarantor if the primary obligor defaults. In the context of the Arkansas Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, it means the lessor can pursue the guarantor for payment. This aspect is vital, as it provides an additional layer of security for the lessor’s investment.