Massachusetts Self-Employed Drywall Services Contract

Description

How to fill out Self-Employed Drywall Services Contract?

Are you currently in a position where you need documents for either professional or personal purposes almost all the time.

There are numerous legal document templates available online, but finding forms you can trust is not simple.

US Legal Forms offers thousands of form templates, including the Massachusetts Self-Employed Drywall Services Agreement, which are crafted to comply with state and federal regulations.

Select the pricing plan you prefer, fill in the required information to create your account, and pay for your order using PayPal or Visa or Mastercard.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Massachusetts Self-Employed Drywall Services Agreement anytime if needed. Just select the necessary form to download or print the document template. Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid errors. The service provides properly crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Massachusetts Self-Employed Drywall Services Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

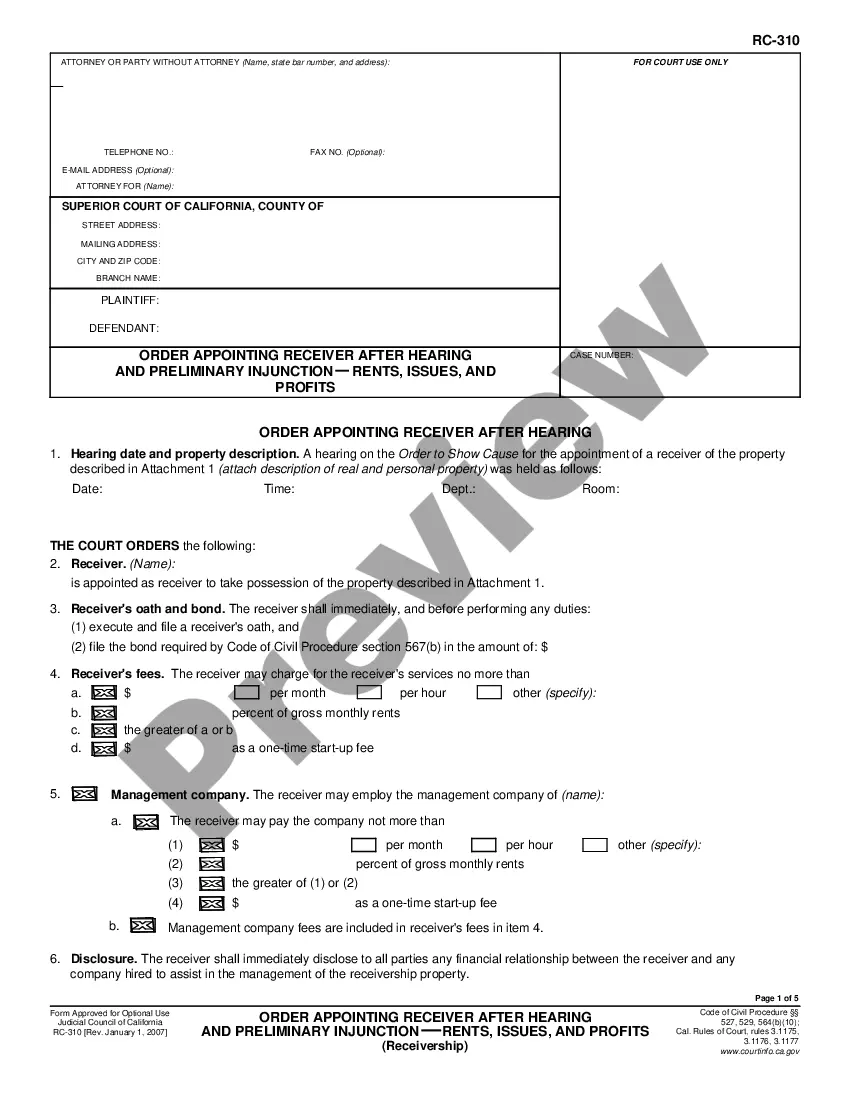

- Use the Preview option to examine the form.

- Check the details to ensure you have selected the correct form.

- If the form isn't what you're looking for, use the Lookup field to find the form that meets your needs.

- Once you find the right form, click on Purchase now.

Form popularity

FAQ

A legally binding contract consists of five essential elements. Initially, there must be a clear offer, followed by acceptance from the other party. Next, consideration must be present, meaning both parties agree to exchange something valuable. Additionally, the parties involved should have the legal capacity to enter the agreement. Finally, the contract must have a lawful purpose, ensuring it aligns with legal standards. Understanding these aspects is crucial when drafting a Massachusetts Self-Employed Drywall Services Contract.

To create a valid enforceable contract, you need four key elements. First, there must be an offer, which is a clear proposal made by one party. Second, the acceptance of that offer must occur, where the other party agrees to the terms. Third, consideration is necessary, meaning both parties must exchange something of value. Lastly, both parties must have the legal capacity to enter into a Massachusetts Self-Employed Drywall Services Contract, ensuring they are of sound mind and not under duress.

In Massachusetts, a contractor is generally liable for their work for six years after the completion of a project. This period allows homeowners to seek recourse for any defects or issues that arise. When entering into a Massachusetts Self-Employed Drywall Services Contract, it is important to understand this liability period to protect your investment.

Yes, it is legal to remodel your own house in Massachusetts. Homeowners have the right to perform renovations and improvements without a contractor, as long as they adhere to local codes and regulations. However, if you plan to hire a contractor, consider a Massachusetts Self-Employed Drywall Services Contract to ensure all aspects of the project are properly documented.

The Home Improvement Act in Massachusetts establishes standards for home improvement contracts and protects consumers from unfair practices. This act mandates that contracts over a certain amount must be in writing and signed by both parties. Understanding this act is essential when entering into a Massachusetts Self-Employed Drywall Services Contract, as it outlines your rights as a homeowner.

The home improvement contractor law in Massachusetts regulates the conduct of contractors who perform home improvement work. This law requires contractors to register with the state and obtain a Home Improvement Contractor Registration. If you are considering a Massachusetts Self-Employed Drywall Services Contract, it is crucial to ensure that your contractor is compliant with this law to protect your rights.

Filling out an independent contractor agreement requires you to provide essential information about both parties, including contact details. Clearly outline the services to be rendered, referencing the Massachusetts Self-Employed Drywall Services Contract. Additionally, include payment terms, project timelines, and any other relevant conditions. Utilizing platforms like USLegalForms can simplify the process and ensure all necessary components are included.

Writing an independent contractor agreement requires you to begin with the names and addresses of both parties. Then, define the services to be provided under the Massachusetts Self-Employed Drywall Services Contract, including payment details and deadlines. It’s also wise to include clauses on confidentiality and termination. Finally, ensure both parties review and sign the document to formalize the agreement.

Filling out an independent contractor form involves providing your personal information, such as your name, address, and Social Security number. Additionally, you'll need to describe the services you will provide, including specifics related to the Massachusetts Self-Employed Drywall Services Contract. It's important to accurately complete all sections to ensure compliance with tax regulations. If you need assistance, consider using USLegalForms to streamline the process.

To fill out a contract agreement for Massachusetts Self-Employed Drywall Services, start by clearly stating the names of the parties involved. Next, outline the scope of work, payment terms, and deadlines. Be sure to include any specific conditions or requirements that may apply. Finally, both parties should sign and date the agreement to make it legally binding.