Massachusetts Carpentry Services Contract - Self-Employed Independent Contractor

Description

How to fill out Carpentry Services Contract - Self-Employed Independent Contractor?

Have you encountered a scenario where you frequently need to obtain documents for either business or personal purposes.

There are numerous legal document templates available online, but finding ones you can trust is quite challenging.

US Legal Forms offers a wide array of form templates, such as the Massachusetts Carpentry Services Contract - Self-Employed Independent Contractor, designed to comply with both federal and state regulations.

Once you find the suitable form, click Purchase now.

Select the pricing plan you desire, fill in the necessary information to process your payment, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Massachusetts Carpentry Services Contract - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city or county.

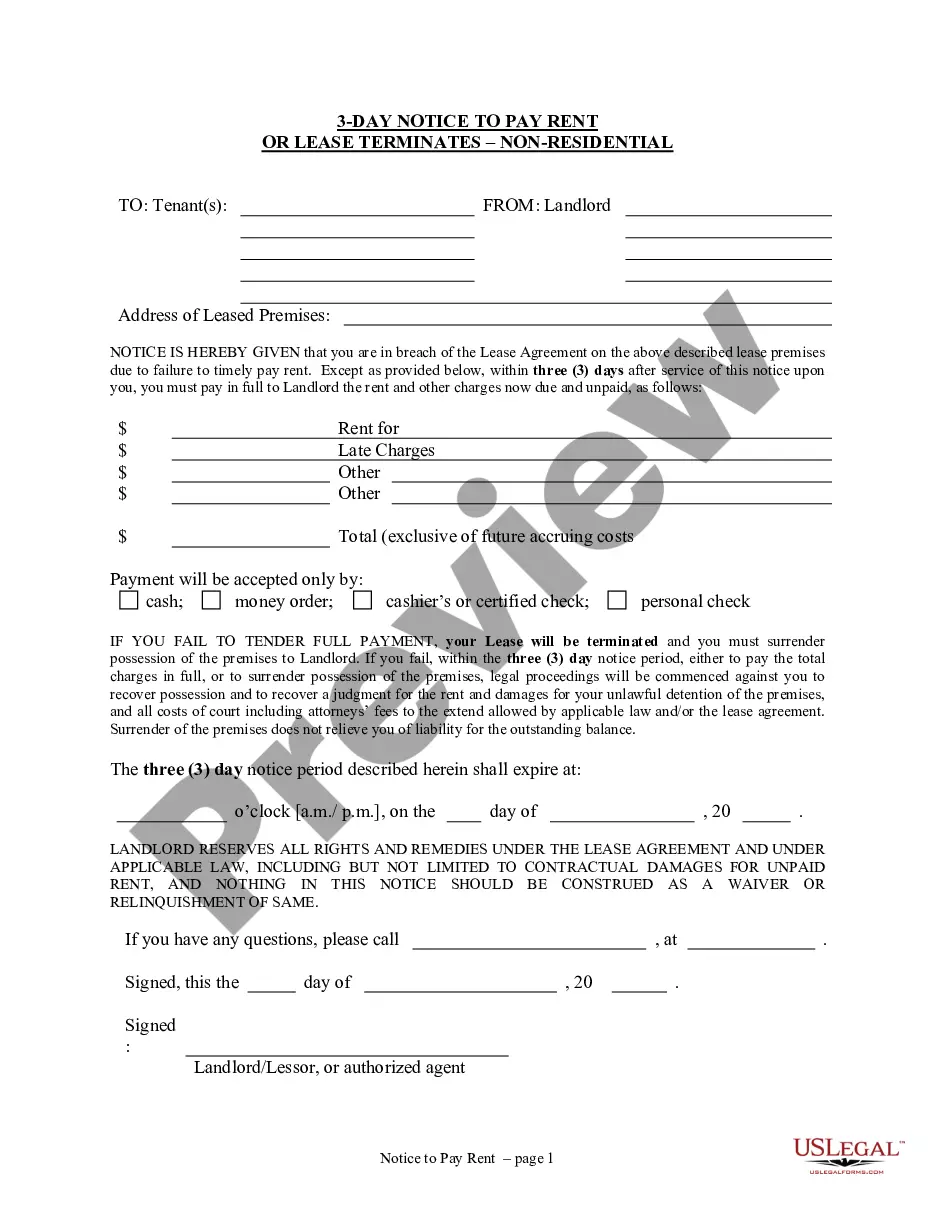

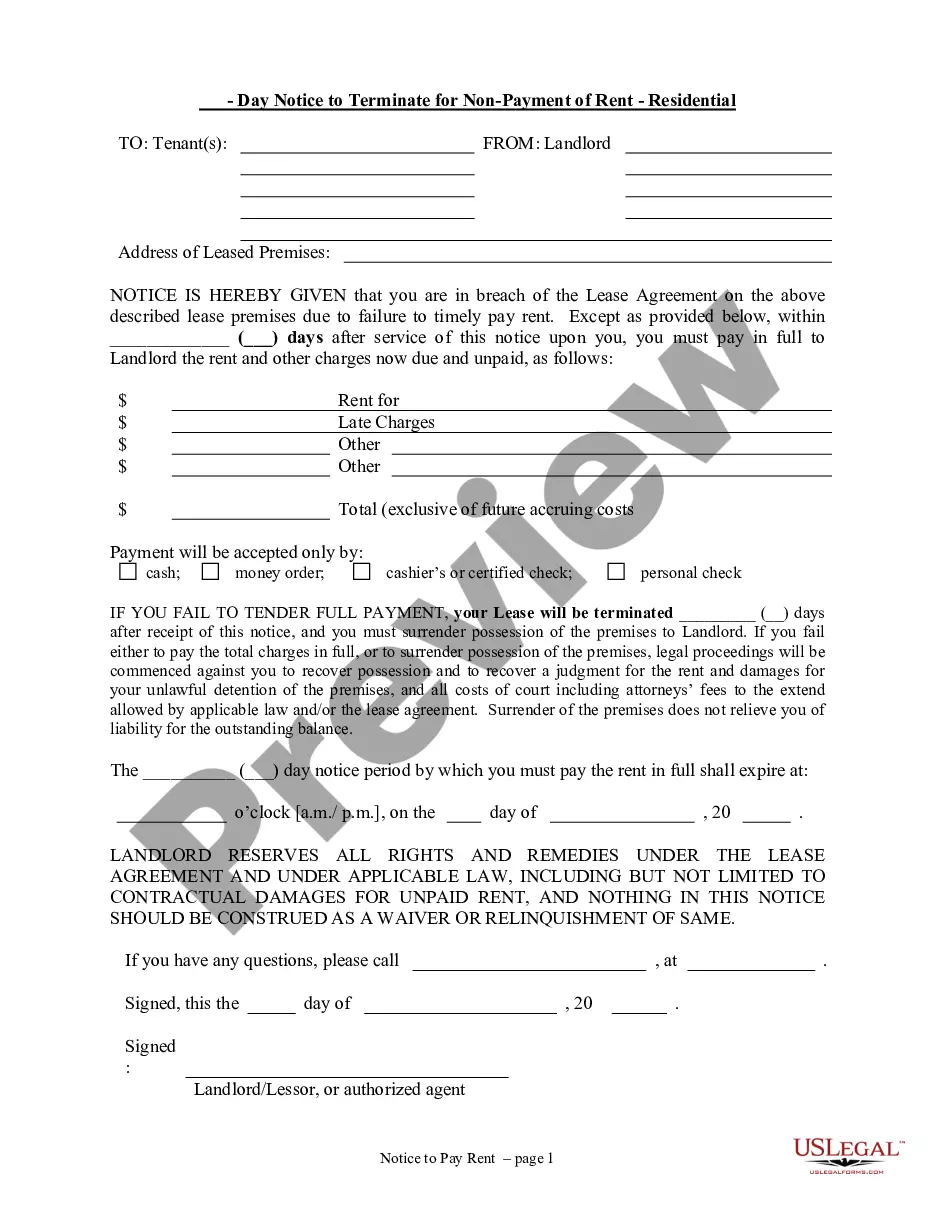

- Utilize the Review feature to scrutinize the form.

- Check the details to confirm you have selected the correct document.

- If the form does not meet your needs, use the Search field to locate a form that aligns with your requirements.

Form popularity

FAQ

The 3 hour rule in Massachusetts outlines specific guidelines for independent contractors regarding payment for job-related travel. If you are engaged in a carpentry service and your travel for work exceeds three hours, this can qualify for additional compensation. Understanding this rule is essential for creating a fair Massachusetts Carpentry Services Contract - Self-Employed Independent Contractor. Utilizing USLegalForms can help ensure your contract addresses these important details.

Yes, an independent contractor is considered self-employed. When you take on the role of an independent contractor in Massachusetts, it means you operate your own business rather than being an employee. This self-employment status impacts your responsibilities regarding taxes and benefits. Therefore, a Massachusetts Carpentry Services Contract - Self-Employed Independent Contractor can help clarify your obligations and protections.

The independent contractor agreement in Massachusetts is a legal document that establishes the working relationship between you and your client. This agreement, such as the Massachusetts Carpentry Services Contract - Self-Employed Independent Contractor, defines the expectations, deliverables, and payment structure. Having this contract in place not only clarifies the terms for both parties but also provides legal protection and a framework for your work arrangement.

Writing a contract as an independent contractor involves creating a clear outline of your services, payment details, and project deadlines. Begin by identifying the parties involved and define the scope of work to be performed. When crafting your Massachusetts Carpentry Services Contract - Self-Employed Independent Contractor, ensure you include clauses related to termination, confidentiality, and liability to protect yourself and your client.

As a self-employed independent contractor in Massachusetts, you typically fill out a W-9 form to provide your taxpayer identification number. Additionally, you may need to prepare a Massachusetts Carpentry Services Contract - Self-Employed Independent Contractor to outline the terms of your engagement. This contract details payment terms, project scope, and timeline, helping both parties understand their responsibilities clearly.

To become authorized as an independent contractor in the US, you typically need to obtain any necessary licenses and permits relevant to your trade and state. Depending on your location, this may include registering your business and getting a tax identification number. You should also consider the Massachusetts Carpentry Services Contract - Self-Employed Independent Contractor, as it outlines the legal framework for your services. Always check local regulations to ensure compliance.

Creating an independent contractor contract involves several key steps. First, outline the services you will provide, payment terms, and timelines. Next, include clauses that address confidentiality and dispute resolution. Using the Massachusetts Carpentry Services Contract - Self-Employed Independent Contractor template from USLegalForms can simplify this process and ensure you have a comprehensive and legally sound agreement.

An independent contractor carpenter is a skilled professional who offers carpentry services independently rather than working as an employee for a company. This means you manage your own business, set your own hours, and determine your rates. Understanding the Massachusetts Carpentry Services Contract - Self-Employed Independent Contractor is essential for outlining your responsibilities and rights in this arrangement. This contract establishes a clear business relationship with your clients.

Yes, you can create your own legally binding contract using the Massachusetts Carpentry Services Contract - Self-Employed Independent Contractor. It is important to include all essential elements, such as payment terms, scope of work, and duration. Additionally, make sure that both you and the client sign the document to ensure its validity. For convenience, consider using online platforms like USLegalForms, which provide templates tailored to your needs.