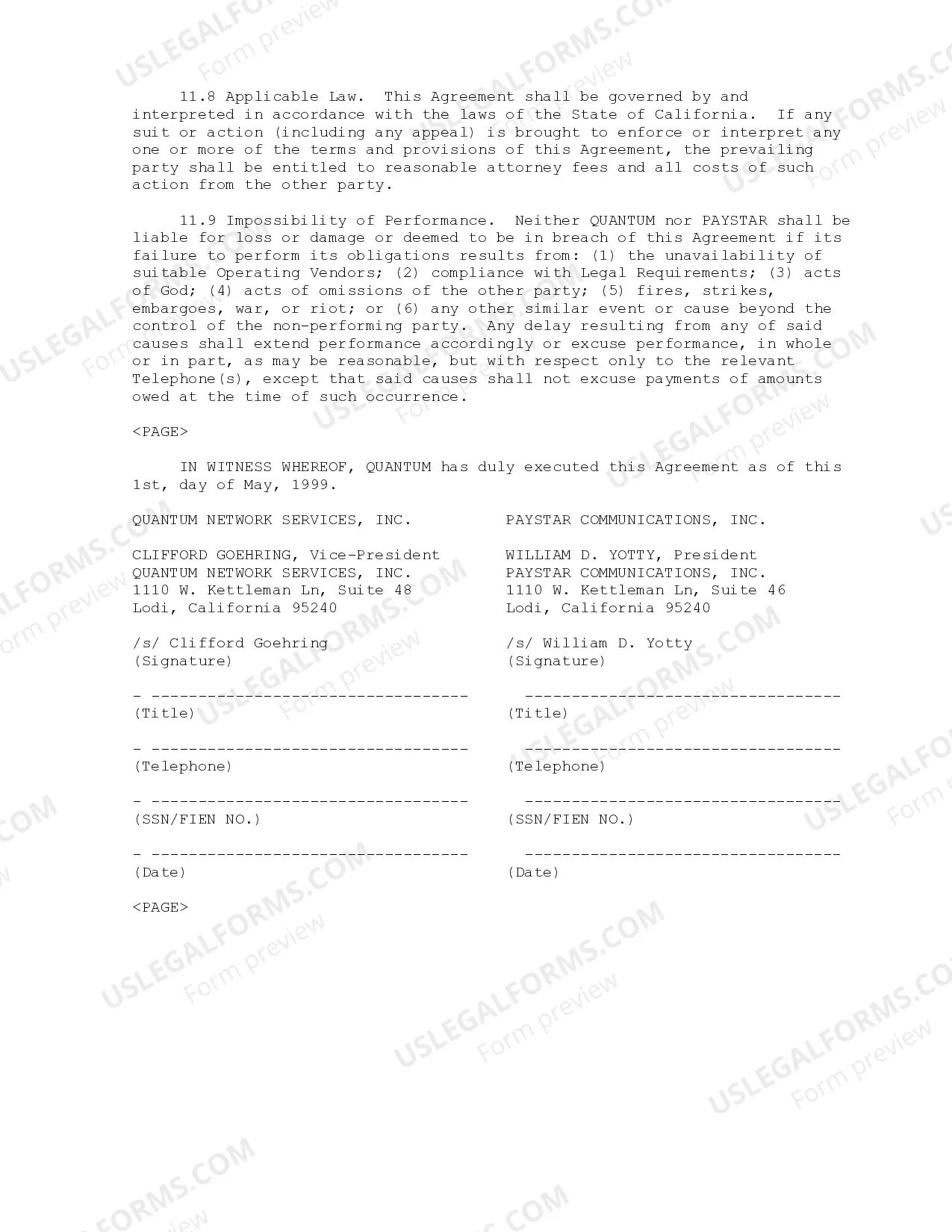

Nebraska Pay Telephone Services Agreement

Description

How to fill out Pay Telephone Services Agreement?

You are able to commit hrs on-line trying to find the lawful record format that suits the state and federal needs you want. US Legal Forms offers a large number of lawful forms that are analyzed by specialists. You can actually down load or print the Nebraska Pay Telephone Services Agreement from our assistance.

If you have a US Legal Forms accounts, you may log in and click the Acquire option. Following that, you may complete, revise, print, or signal the Nebraska Pay Telephone Services Agreement. Each and every lawful record format you purchase is your own property for a long time. To get one more copy for any purchased kind, check out the My Forms tab and click the corresponding option.

If you are using the US Legal Forms web site for the first time, follow the easy guidelines under:

- Initial, ensure that you have chosen the correct record format for the region/metropolis of your choosing. See the kind outline to make sure you have picked out the proper kind. If available, use the Review option to check throughout the record format too.

- If you want to get one more version of your kind, use the Research area to find the format that fits your needs and needs.

- Upon having located the format you want, click Acquire now to continue.

- Pick the costs prepare you want, type in your credentials, and register for a free account on US Legal Forms.

- Complete the transaction. You may use your charge card or PayPal accounts to purchase the lawful kind.

- Pick the format of your record and down load it for your system.

- Make changes for your record if possible. You are able to complete, revise and signal and print Nebraska Pay Telephone Services Agreement.

Acquire and print a large number of record templates utilizing the US Legal Forms site, that offers the largest collection of lawful forms. Use skilled and condition-certain templates to deal with your small business or specific needs.

Form popularity

FAQ

Local sales tax rates The Nebraska (NE) state sales tax rate is currently 5.5%. Depending on local municipalities, the total tax rate can be as high as 7.5%, but food and prescription drugs are exempt.

To apply for a Nebraska Identification Number, you can either register online, or complete the Nebraska Tax Application, Form 20. If you indicate that you will be collecting sales tax, you will be issued a Sales Tax Permit. The permit must be displayed at each retail location.

If you already have a Nebraska Identification Number, you can find it on previous correspondence from the Nebraska Department of Revenue, by contacting the agency at 800-742-7474, or by visiting their Contact Us page for email.

Charges for repair and installation labor are taxable when the property being repaired, replaced, or installed is taxable. See Sales and Use Tax Regulation 1-082, Labor Charges, and If you provide repair or maintenance services. Labor charges to new or upgraded parts or accessories are taxable.

Nebraska Tax Rates, Collections, and Burdens Nebraska has a 5.50 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 6.95 percent. Nebraska's tax system ranks 29th overall on our 2023 State Business Tax Climate Index.

Option 3 contractors are consumers of all manufacturing machinery and equipment purchased and annexed by them. Option 3 contractors must pay tax on purchases of machinery and equipment even if the machinery and equipment will be used by a manufacturer.

You have three options for filing and paying your Nebraska sales tax: File online ? File Form 10 online at the Nebraska Department of Revenue. You can also remit your payment through Nebraska E-Pay. File by mail ? You can use Form 10 and file and pay through the mail. AutoFile ? Let TaxJar file your sales tax for you.