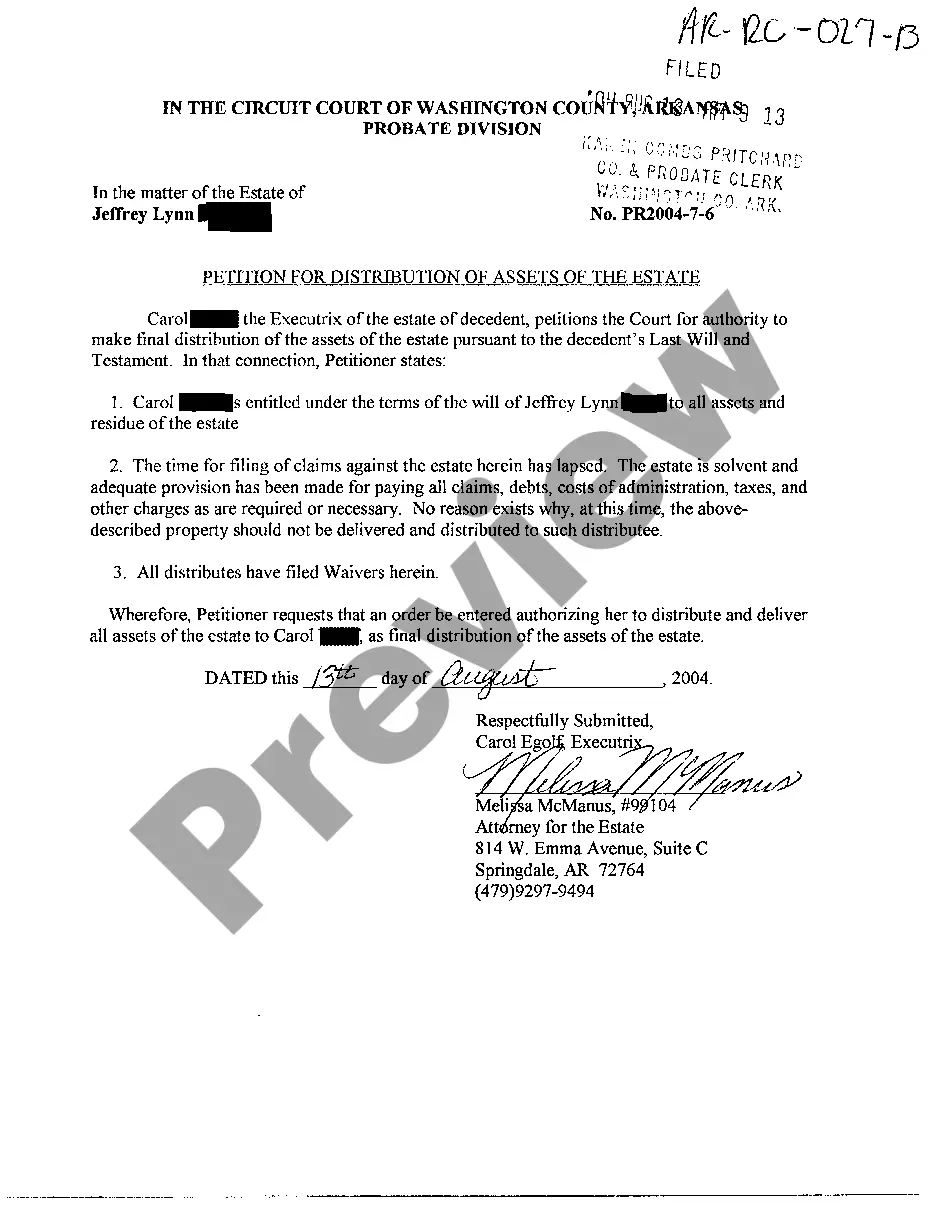

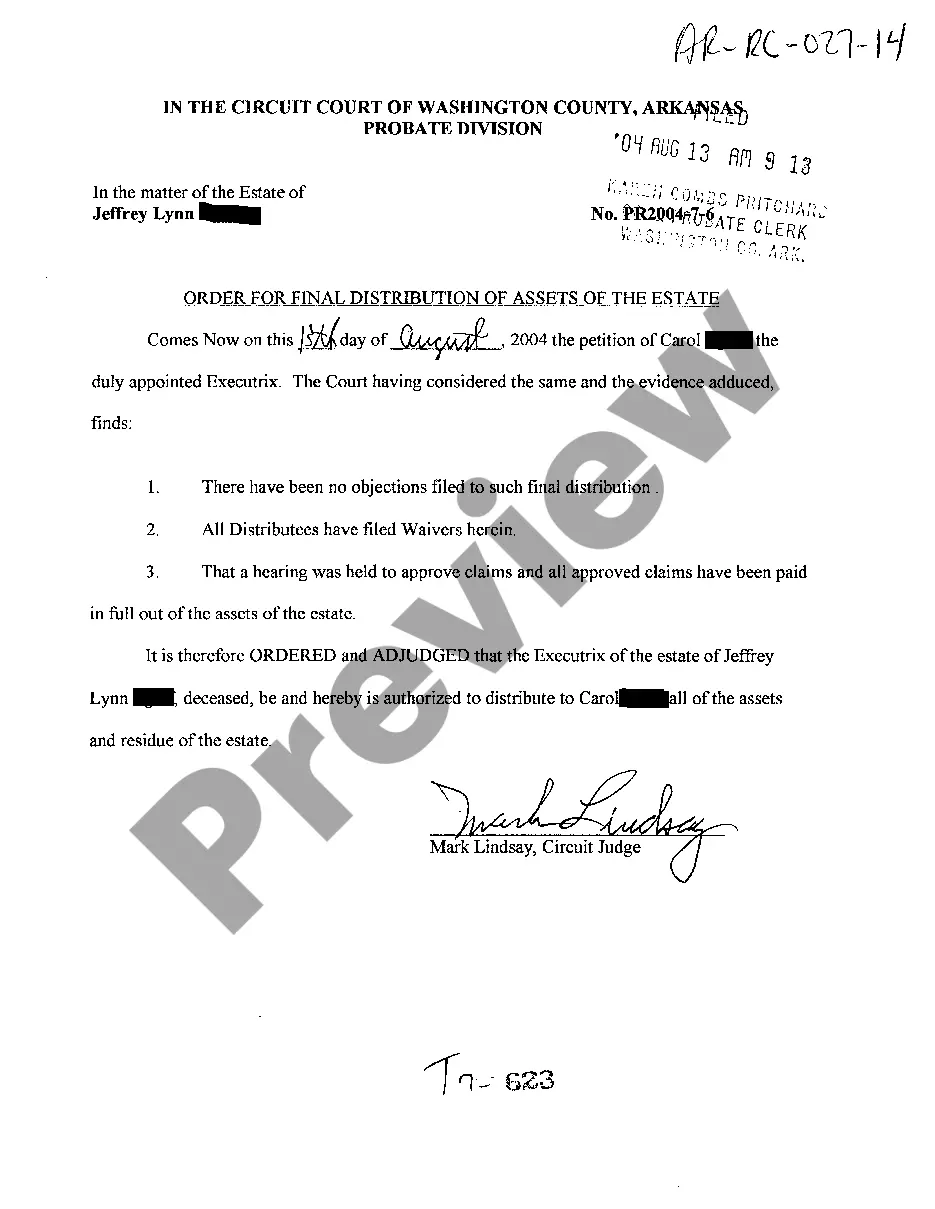

Arkansas Petition For Distribution of Assets of The Estate

Description

How to fill out Arkansas Petition For Distribution Of Assets Of The Estate?

Among a variety of complimentary and paid templates available online, you can't guarantee their reliability.

For instance, who created them or whether they possess the expertise required for your needs.

Always stay calm and utilize US Legal Forms!

If you already hold a subscription, Log In to your account and find the Download button beside the desired file. You will also be able to access all previously downloaded documents in the My documents section.

- Explore Arkansas Petition For Distribution of Assets of The Estate examples crafted by expert legal professionals.

- and steer clear of the costly and prolonged procedure of searching for a lawyer.

- and subsequently compensating them to compose documents for you.

- that you can conveniently locate on your own.

Form popularity

FAQ

Determining who is next in line for inheritance depends on the relationship to the deceased. Generally, spouses, children, and relatives have priority based on Arkansas law. When handling these matters, the Arkansas Petition For Distribution of Assets of The Estate helps clarify the rightful recipients. To ensure accuracy and comply with legal requirements, utilizing a service like uslegalforms can be beneficial.

Arkansas inheritance laws govern how assets are distributed after someone's death. These laws dictate the need for the Arkansas Petition For Distribution of Assets of The Estate, especially when a formal process is necessary. They outline the rights of heirs, how debts are settled, and how the estate is divided among beneficiaries. For detailed guidance, reaching out to uslegalforms can simplify navigating these laws.

The order of heirs refers to the sequence in which individuals are entitled to inherit from an estate. In Arkansas, priority typically goes to the spouse and children, followed by parents and siblings. Understanding this order is crucial when filing an Arkansas Petition For Distribution of Assets of The Estate, as it ensures that distributees receive their fair share according to the law. Consulting with a knowledgeable resource can clarify any uncertainties regarding heirship.

Sorting out inheritance involves reviewing the deceased's will and identifying the beneficiaries. In cases where there is no will, the Arkansas Petition For Distribution of Assets of The Estate becomes essential. This petition helps determine the rightful heirs according to Arkansas law, thereby streamlining the division of assets. Engaging with a legal platform like uslegalforms can provide guidance throughout this process.

In Arkansas, you are required to file for probate within 60 days of the death of the decedent. Timely filing ensures that you comply with state laws and begin the administration of the estate efficiently. Failing to file can lead to complications in distributing the estate's assets. For an easy and organized approach to navigate the process, access the US Legal Forms platform, which offers guidance relevant to the Arkansas Petition For Distribution of Assets of The Estate.

In Arkansas, creditors generally have up to one year after the decedent's death to present their claims against the estate. However, there are specific timelines and procedures to follow based on the type of debt. It's essential to respond to creditors timely to protect the estate's assets. For clarity on your obligations and rights, consider referencing resources available on US Legal Forms regarding the Arkansas Petition For Distribution of Assets of The Estate.

To contest a will in Arkansas, you must file a formal claim in the probate court where the will is filed. It's important to present valid grounds for disputing the will, such as lack of testamentary capacity or undue influence. Gathering evidence and having a clear understanding of the legal process is crucial for success. Seeking assistance from US Legal Forms can help guide you through the necessary steps related to the Arkansas Petition For Distribution of Assets of The Estate.

To obtain a small estate affidavit in Arkansas, you need to prepare the affidavit that meets the state's legal requirements. This document allows you to collect assets without going through full probate. After drafting the affidavit, present it to the appropriate financial institutions or third parties holding the deceased's assets. Utilizing a resource like US Legal Forms can simplify this process and ensure your affidavit aligns with the Arkansas Petition For Distribution of Assets of The Estate.

The best way to distribute estate assets depends on individual preferences and estate size. Utilizing an estate plan or will helps ensure assets go to the intended beneficiaries smoothly. Working with professionals familiar with the Arkansas Petition For Distribution of Assets of The Estate can simplify this process, ensuring all legal requirements are met efficiently.

Certain assets are exempt from probate in Arkansas, including life insurance policies, retirement accounts, and assets held in joint tenancy with right of survivorship. These assets can pass directly to beneficiaries without going through the probate process. Understanding these exemptions helps in estate planning. Filing an Arkansas Petition For Distribution of Assets of The Estate can help clarify which assets qualify.