Arkansas Deed of Distribution from Personal Representative to two Individuals

About this form

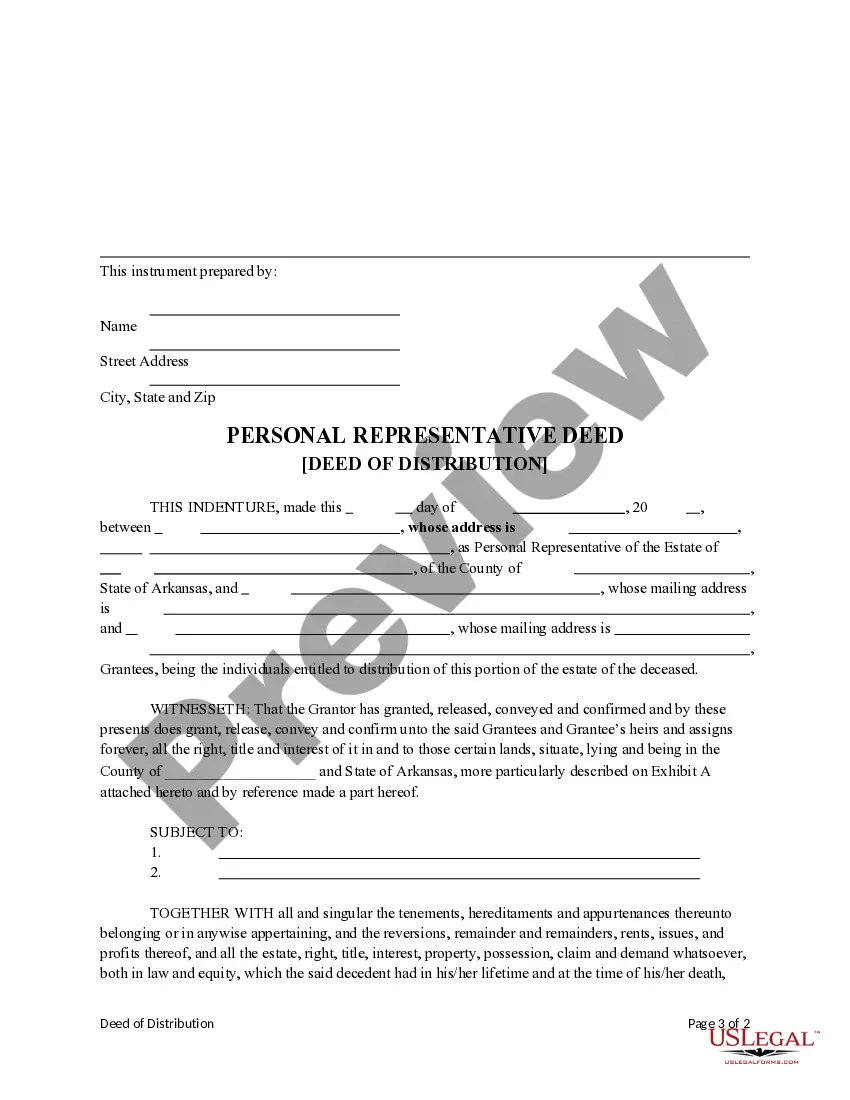

The Deed of Distribution from Personal Representative to two Individuals is a legal document that facilitates the transfer of property from a personal representative of an estate to two designated beneficiaries. This form ensures that the distribution process complies with state laws and provides a clear record of the transaction, distinguishing it from other types of deeds, such as quitclaim deeds or warranty deeds.

Key components of this form

- Identification of the Grantor (personal representative) and Grantees (beneficiaries).

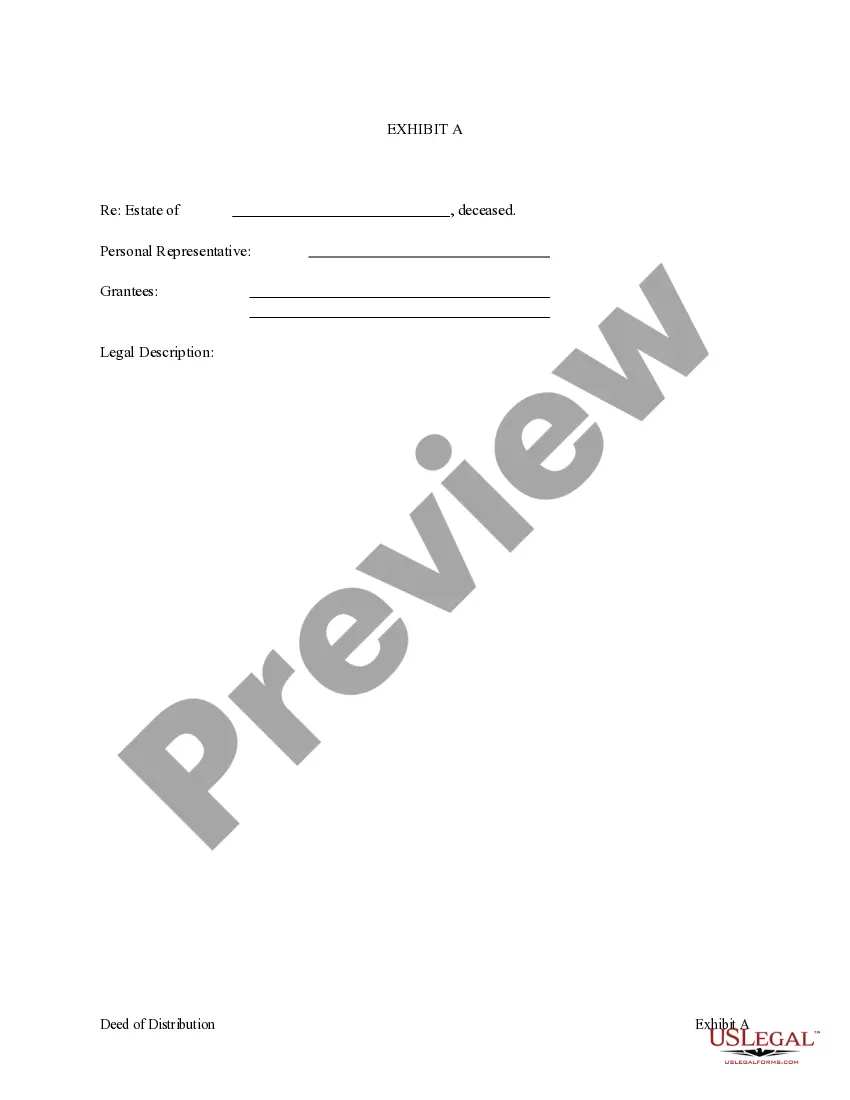

- Description of the property being conveyed, including legal details as outlined in Exhibit A.

- Covenant of the Grantor affirming their authority as the personal representative of the estate.

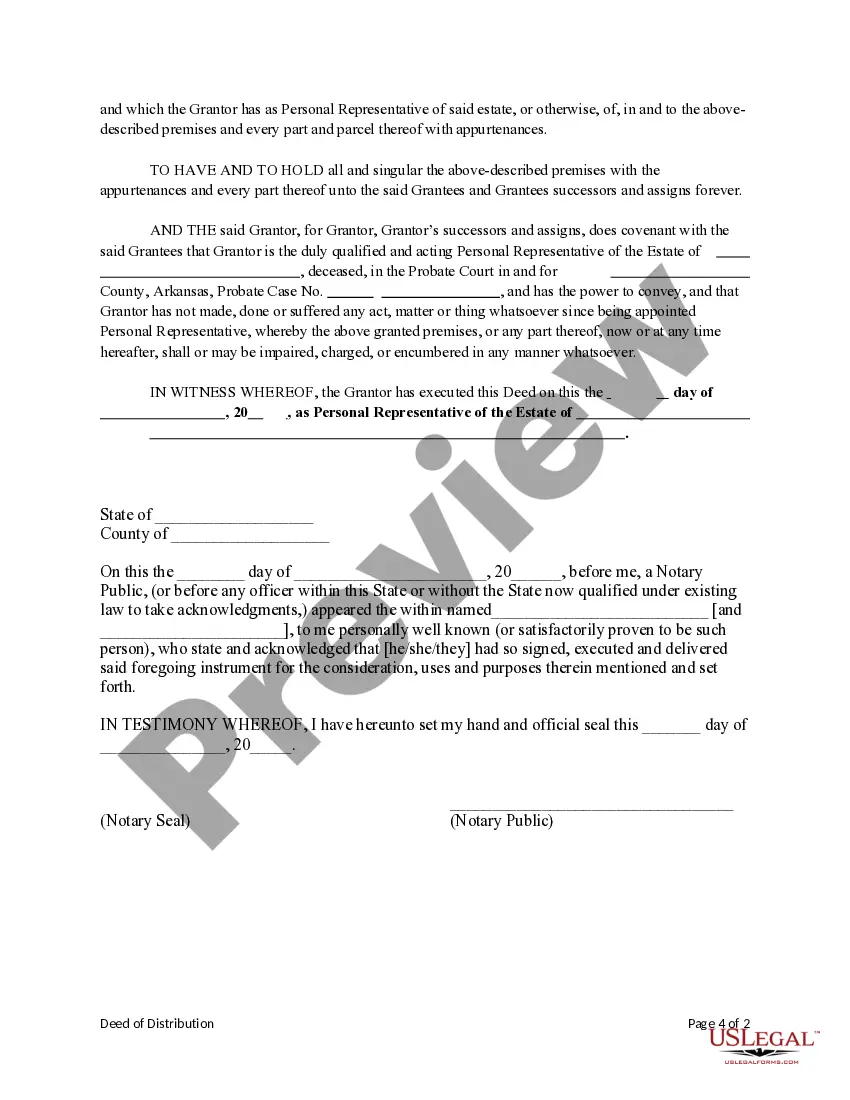

- Signatures of the Grantor and witnesses, if applicable.

When to use this document

This form should be used when a personal representative needs to distribute property or assets from an estate to multiple beneficiaries. Common scenarios include settling an estate after a loved one has passed away, ensuring that each beneficiary receives their share of the estate's assets, or when executing the terms of a will that specifies property distribution.

Who needs this form

- Personal representatives of an estate tasked with distributing assets.

- Beneficiaries named in the estate who are receiving property.

- Individuals seeking to comply with state distribution laws during the estate settlement process.

Instructions for completing this form

- Identify the parties involved: the Grantor (personal representative) and the Grantees (beneficiaries).

- Clearly specify the property being conveyed, using the information in Exhibit A.

- Enter the date of the distribution.

- Include the required signatures from the Grantor and any witnesses if needed.

- Ensure that all provided information is accurate and complete for legal validity.

Notarization requirements for this form

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Common mistakes

- Failing to include complete and accurate property descriptions.

- Not obtaining necessary signatures or witness confirmations.

- Using the form without verifying compliance with local statutes.

- Leaving sections blank or not completed correctly, which can lead to legal issues.

Advantages of online completion

- Immediate access to a professionally drafted legal document.

- Editability allows you to customize the form to meet your unique needs.

- Convenient download option, enabling completion at your own pace.

- Peace of mind knowing the form complies with the relevant legal standards.

Form popularity

FAQ

While it's possible to complete a transfer on death deed without a lawyer, having legal guidance can ensure the process is handled correctly. A lawyer can provide clarity on Arkansas laws and help you draft an Arkansas Deed of Distribution from Personal Representative to two Individuals if necessary. This can help avoid potential issues or disputes among heirs. Therefore, consulting with a legal professional can be a prudent step in ensuring a smooth transfer.

A personal representative's deed of distribution is a legal document used in Arkansas to transfer property from an estate to its beneficiaries or heirs. This deed is executed by the personal representative of the estate as part of settling the deceased's affairs. It serves to formally convey ownership from the estate to individuals, detailing the property and the names of the new owners. Using an Arkansas Deed of Distribution from Personal Representative to two Individuals helps clarify the transfer process and protect the rights of the beneficiaries.

To transfer a property deed from a deceased relative in Arkansas, the personal representative of the estate must handle the process. They will prepare an Arkansas Deed of Distribution, which conveys the property to the designated heirs or beneficiaries. This deed must include the deceased's information and a legal description of the property, and then it should be filed with the county clerk's office. Completing these steps will ensure the property is legally transferred to the rightful individuals.

No, you cannot transfer a deed to a deceased person in Arkansas. Once an individual passes away, title to their property must be transferred through their estate. The Arkansas Deed of Distribution from Personal Representative to two Individuals can legally convey property to heirs or beneficiaries listed in the will. Thus, all property transfers must occur posthumously, based on the instructions in the will or the laws of intestacy.

To change your personal representative for an estate, you will need to petition the probate court in Arkansas. You should present valid reasons for the change, such as the current representative's inability to perform their duties. If approved, the court will appoint a new personal representative and update the estate's records. It’s essential to follow the legal procedures to ensure the new representative can handle tasks, including managing the Arkansas Deed of Distribution from Personal Representative to two Individuals.

Transferring a deed after death in Arkansas typically involves the personal representative of the deceased's estate. The representative must execute an Arkansas Deed of Distribution to properly transfer property to the beneficiaries. This deed must clearly identify the deceased individual, the property, and the new owners. Once completed, it needs to be recorded with the county clerk to formalize the transfer.

To transfer ownership of a property in Arkansas, you will need to prepare a deed that specifies the transfer of interest from the current property owner to the new owner. This deed should include the names of both parties and a legal description of the property. Once the deed is executed, it must be filed with the appropriate county clerk's office. If you are dealing with an Arkansas Deed of Distribution from Personal Representative to two Individuals, this process will be governed by state laws regarding estates.

In Arkansas, if an estate's value exceeds $100,000, it typically must go through probate proceedings. This requirement ensures that the estate is properly administered and distributed. Utilizing the Arkansas Deed of Distribution from Personal Representative to two Individuals can facilitate the transfer of assets without the lengthy probate process when it is appropriate. Therefore, it's wise to understand your options.

Heirs in Arkansas generally have three years to claim their inheritance from the date of the decedent's death. This timeline can be complex, especially when using the Arkansas Deed of Distribution from Personal Representative to two Individuals. It is advisable to take action promptly and consult legal advice to secure your rights as an heir.

In Arkansas, the order of inheritance typically follows the state's intestacy laws if there is no will. Spouses, children, and certain other relatives generally inherit first. Understanding this order is crucial, especially when dealing with the Arkansas Deed of Distribution from Personal Representative to two Individuals. Seek guidance to ensure proper distribution according to the law.