Alabama Management Long Term Incentive Compensation Plan of of SCEcorp

Description

How to fill out Management Long Term Incentive Compensation Plan Of Of SCEcorp?

Are you inside a situation in which you require paperwork for possibly enterprise or personal reasons just about every working day? There are plenty of lawful document layouts accessible on the Internet, but finding versions you can depend on isn`t straightforward. US Legal Forms delivers a large number of type layouts, much like the Alabama Management Long Term Incentive Compensation Plan of of SCEcorp, which can be composed to fulfill federal and state specifications.

If you are already informed about US Legal Forms web site and possess your account, simply log in. After that, you can download the Alabama Management Long Term Incentive Compensation Plan of of SCEcorp format.

Should you not come with an accounts and would like to start using US Legal Forms, follow these steps:

- Discover the type you require and ensure it is to the proper metropolis/region.

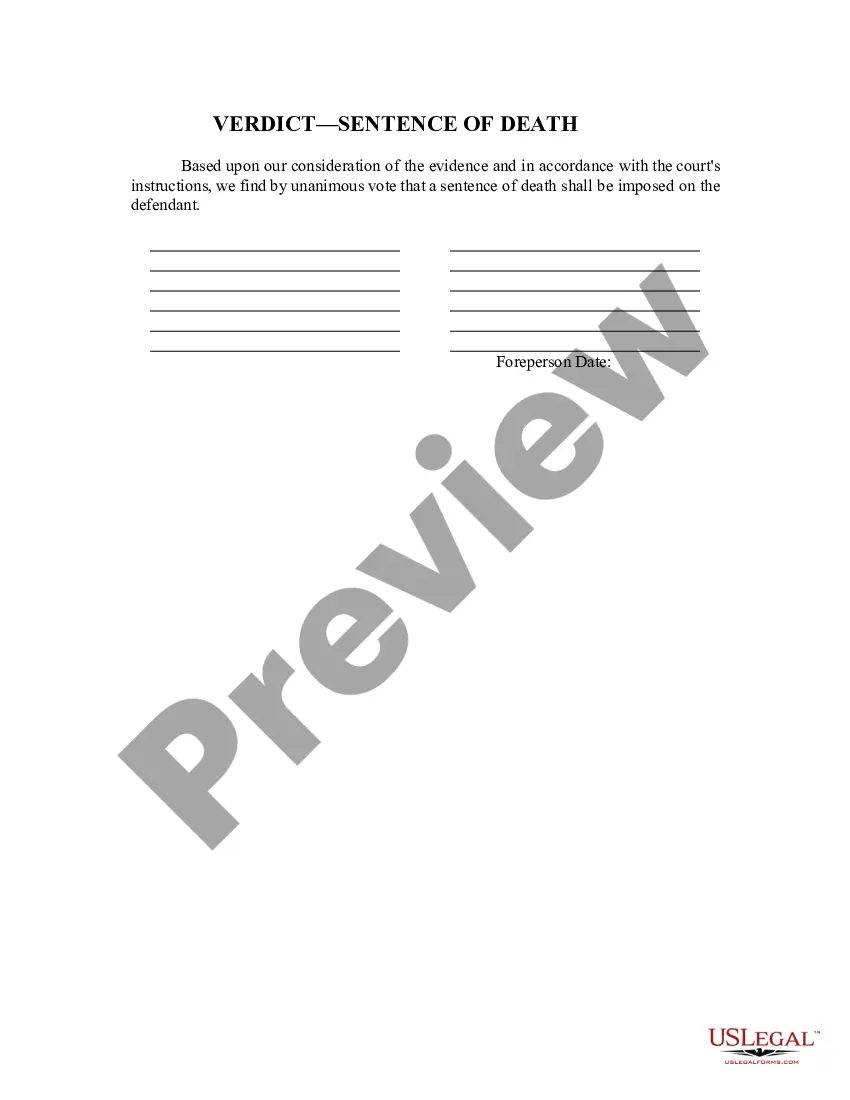

- Make use of the Review button to examine the form.

- See the description to ensure that you have chosen the proper type.

- When the type isn`t what you are searching for, utilize the Look for area to discover the type that fits your needs and specifications.

- Once you find the proper type, click on Buy now.

- Choose the costs plan you need, submit the required information to produce your account, and buy an order with your PayPal or Visa or Mastercard.

- Pick a convenient paper formatting and download your version.

Find all the document layouts you have bought in the My Forms menus. You can aquire a more version of Alabama Management Long Term Incentive Compensation Plan of of SCEcorp whenever, if possible. Just click on the necessary type to download or printing the document format.

Use US Legal Forms, one of the most extensive variety of lawful varieties, to conserve efforts and steer clear of blunders. The service delivers professionally produced lawful document layouts that can be used for a variety of reasons. Generate your account on US Legal Forms and initiate generating your way of life a little easier.

Form popularity

FAQ

term incentive plan (LTIP or LTI plan) is a deferred compensation strategy to attract, reward and motivate your employees, while also helping your company to retain valued talent and grow. LTIP prevalence: 98% of public companies provide LTIPs while 63% of private companies offer LTIPs. ( Source: SHRM)

Incentive compensation management is the strategic use of incentives to drive better business outcomes and more closely align sales rep behavior with the organization's goals. Incentives can be structured in multiple ways, including straight commissions, bonuses, prizes, ?spiffs,? awards, and recognition.

An annual incentive plan outlines compensation to be paid to employees when they achieve certain performance-related goals over 12 months. This compensation is in addition to their regular salary ? it may be an employee gift, cash incentive, or another type of bonus or reward.

For example, a manager agrees to give everyone working on a certain marketing account a $500 bonus if they can complete all deliverables and get client approval by the end of the week.

A good example of a monetary incentive is a sales-based incentive. Sales-based incentive compensation is ideal for employees who are responsible for talking to customers and closing sales. Employers often structure these incentive plans as a percentage, like 5% of all the deals each sales rep closes.

An annual incentive plan is a plan for compensation that is earned and paid based upon the achievement of performance goals over a one-year period. These plans motivate performance and align executives' work with the company's short-term performance goals.

It involves paying the employee a percentage of the profit (s)he generates. This variable compensation model is used to reward an employee's contribution to overall earnings. Commission is rarely capped and sometimes has an accelerator, at which point the employee receives a higher percentage.

For example, the employer may offer health insurance, dental insurance, life insurance, short- and long-term disability insurance and vision insurance. Employee retirement plans, like 401(k) plans, are another common form of indirect compensation. Equity-based programs are another compensation offering.