Sample Letter for Note and Deed of Trust

Description

How to fill out Sample Letter For Note And Deed Of Trust?

Use US Legal Forms to get a printable Sample Letter for Note and Deed of Trust. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most complete Forms catalogue online and provides reasonably priced and accurate templates for customers and legal professionals, and SMBs. The documents are grouped into state-based categories and a few of them might be previewed prior to being downloaded.

To download templates, customers must have a subscription and to log in to their account. Press Download next to any form you need and find it in My Forms.

For individuals who don’t have a subscription, follow the following guidelines to quickly find and download Sample Letter for Note and Deed of Trust:

- Check to make sure you get the right template with regards to the state it’s needed in.

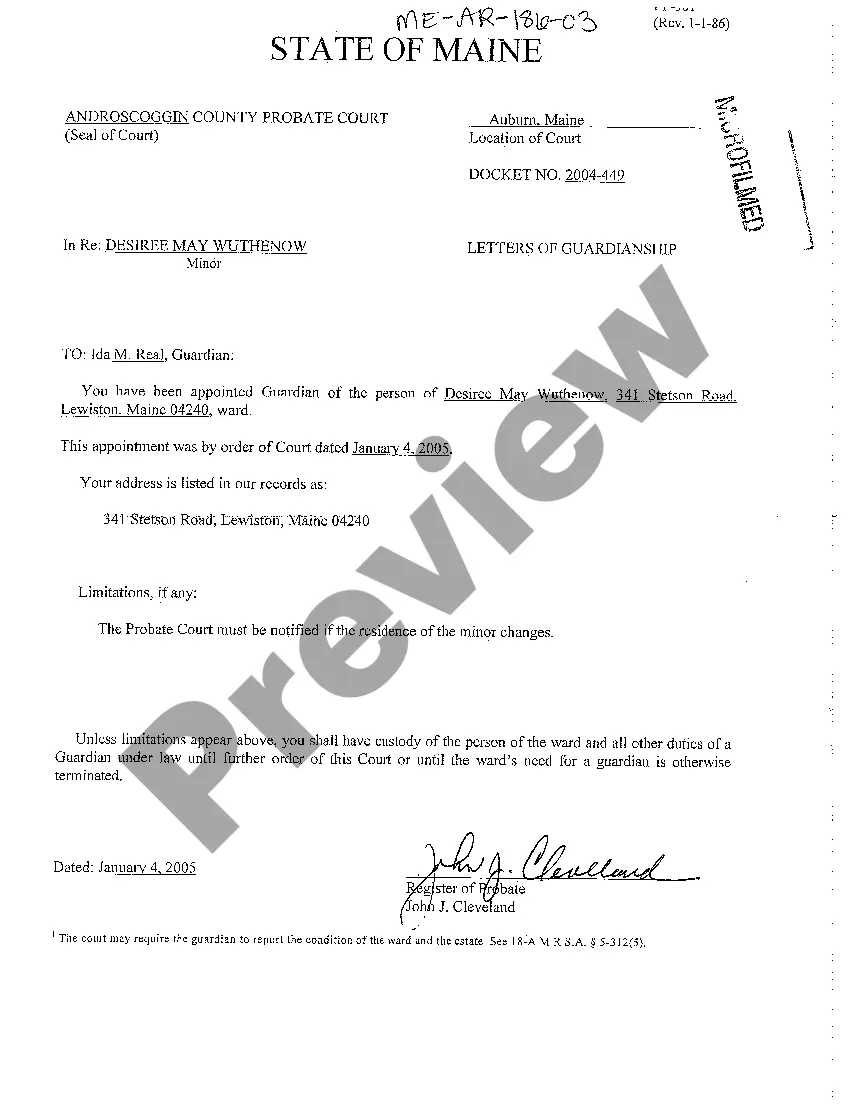

- Review the form by reading the description and by using the Preview feature.

- Press Buy Now if it is the document you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Use the Search field if you want to find another document template.

US Legal Forms provides thousands of legal and tax samples and packages for business and personal needs, including Sample Letter for Note and Deed of Trust. Over three million users have used our service successfully. Select your subscription plan and get high-quality forms in just a few clicks.

Form popularity

FAQ

How much each person contributes to the deposit, and how much will be repaid to them. What percentage of the property each person will own, and how the money will be split if the property is sold. How much each person will pay towards the mortgage, and how the mortgage will ultimately be paid off.

Yes. The deed is a fully legally binding document which can be produced in a court of law as long as it has been signed and executed correctly.

1. What is the Difference Between the Note and Deed of Trust? A note, usually known as a promissory note, which is a written promise to repay a loan. Whereas, a trust deed is a document used to protect paying back of a loan that is being documented as a lien counter to the borrowers real estate.

Co-signers, often parents or other relatives with excellent credit and income, help under-qualified borrowers obtain mortgages. They act as guarantors and do not live in the home or hold an ownership interest. Lenders require co-signers to sign the note, but not the deed, at closing.

A deed of trust includes most of the same information as a mortgage, including:A legal description of the property that's used as security or collateral for the mortgage. The names of parties: trustee, trustor, and beneficiary. The inception and maturity dates of the loan.

What Is a Trust Deed? A trust deedalso known as a deed of trustis a document sometimes used in real estate transactions in the U.S. It is a document that comes into play when one party has taken out a loan from another party to purchase a property.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)