Alabama Executive Employee Stock Incentive Plan

Description

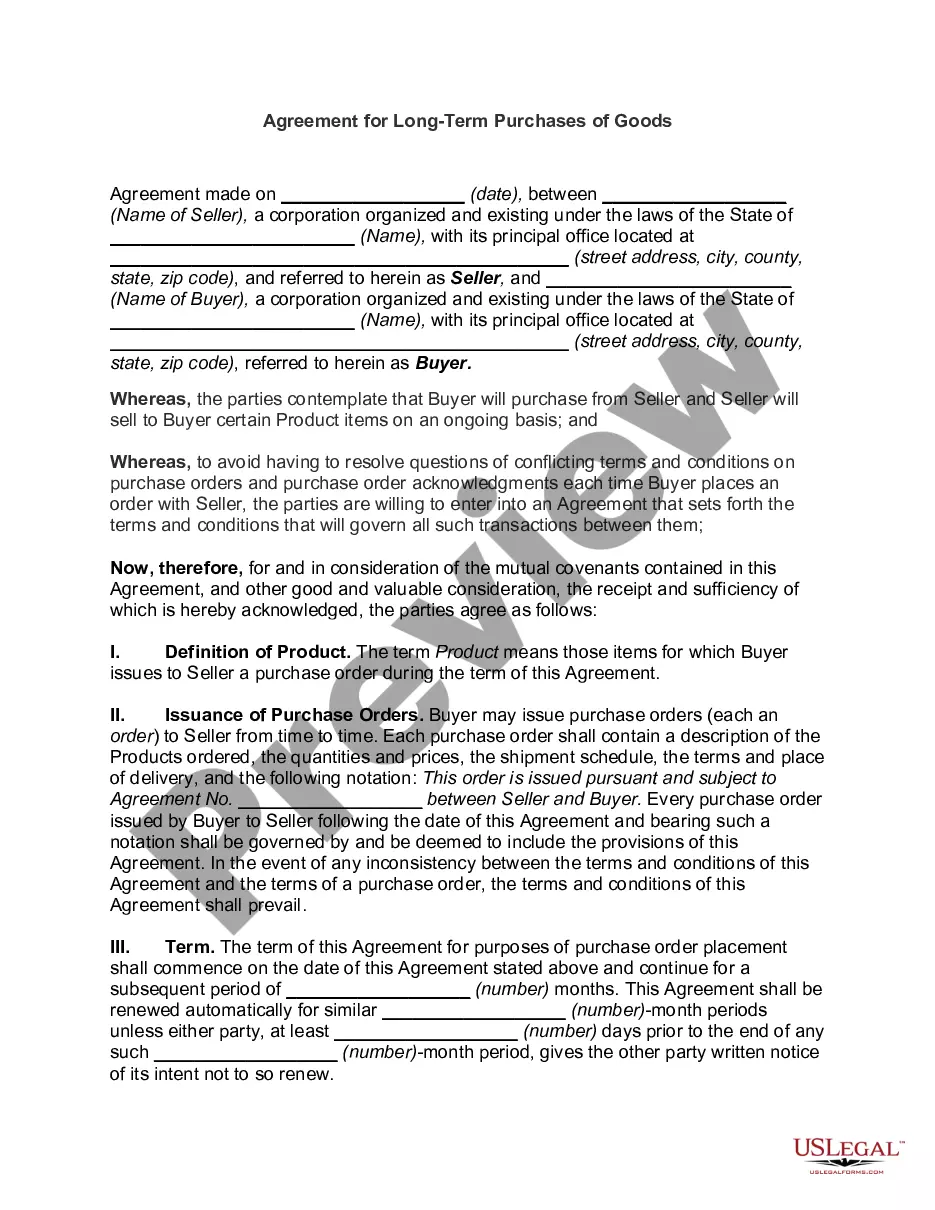

How to fill out Executive Employee Stock Incentive Plan?

If you need to download, access, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Use the site’s straightforward and convenient search functionality to find the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

Step 6. Choose the format of the legal document and download it to your device.

- Utilize US Legal Forms to obtain the Alabama Executive Employee Stock Incentive Plan in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and press the Download button to retrieve the Alabama Executive Employee Stock Incentive Plan.

- You can also access forms you previously downloaded through the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the directions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Be sure to read the instructions.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to locate alternative templates in the legal form category.

- Step 4. After you have found the form you need, click the Get now button. Select your preferred pricing plan and input your details to sign up for an account.

Form popularity

FAQ

The $100,000 rule for stock options restricts the amount of stock options that can be granted to an employee in a given year to $100,000. This rule applies to qualify for favorable tax treatment under the Alabama Executive Employee Stock Incentive Plan. Any stock options exceeding this limit may be taxed at ordinary income rates instead of capital gains rates. Understanding this rule helps executives maximize their benefits while planning their stock options.

To file an ESOP, you typically need to complete Form 5500 to report information about the plan and its financial condition. Participating in the Alabama Executive Employee Stock Incentive Plan might involve fulfilling specific filing requirements based on the plan's size and features. It’s wise to consult a tax professional or legal advisor for guidance tailored to your situation.

To report incentive stock options on your tax return, you will need to provide information from Form 3921 if you exercised any options during the year. Additionally, if you sold shares acquired through the Alabama Executive Employee Stock Incentive Plan, you'll report this on Schedule D. Keeping thorough records of your transactions will simplify this process.

If you exercise stock options during the year, your employer will report this on your W-2 form, usually under Box 1. The wages reflect any income associated with the Alabama Executive Employee Stock Incentive Plan. Make sure to reconcile this with your personal records to ensure you have reported all your income correctly.

Incentive stock options (ISOs) are generally not taxed at the time of exercise, which distinguishes them from other types of options. However, when you sell the stock acquired through the Alabama Executive Employee Stock Incentive Plan, you'll face capital gains tax on the profit. Understanding the holding periods involved can help maximize your tax benefits.

Stock options are typically reported on IRS Form 1099-MISC if you exercised them as a non-employee. If you're part of the Alabama Executive Employee Stock Incentive Plan, your employer will issue a 1099 showing the income from your exercised options. It's important to verify this information to ensure accurate reporting.

To report incentive stock options, you need to fill out IRS Form 3921. This form captures the details of your stock options exercised under the Alabama Executive Employee Stock Incentive Plan. Ensure that you include it when you file your annual tax return, as this will help determine your tax liability.

Yes, you must report your Employee Stock Ownership Plan (ESOP) on your taxes. This is because the Alabama Executive Employee Stock Incentive Plan involves ownership benefits that are considered taxable income. It's essential to keep accurate records of your ESOP participation to ensure compliance with IRS regulations.

Typically, incentive stock options are reserved for employees, but there are exceptions. Depending on the specific provisions of the Alabama Executive Employee Stock Incentive Plan, options may sometimes be granted to board members and certain consultants. It’s essential to consult the plan’s specifics for clarity on this issue.

Qualification for incentive stock options generally includes employees who meet the company’s performance and length-of-service criteria. Under the Alabama Executive Employee Stock Incentive Plan, qualifying employees often demonstrate commitment and performance over time. This approach ensures that only dedicated employees are rewarded.