Alabama Resolution of Meeting of LLC Members to Purchase Real Estate

Description

How to fill out Resolution Of Meeting Of LLC Members To Purchase Real Estate?

Selecting the ideal authentic document template can be challenging.

Of course, there is an array of templates accessible online, but how can you locate the genuine type you require.

Utilize the US Legal Forms website. The service offers a vast selection of templates, including the Alabama Resolution of Meeting of LLC Members to Purchase Real Estate, which you can employ for business and personal purposes.

You can view the template using the Preview button and read the form description to confirm it is the right one for you.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to access the Alabama Resolution of Meeting of LLC Members to Purchase Real Estate.

- Use your account to browse through the legal forms you have previously acquired.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your locality/state.

Form popularity

FAQ

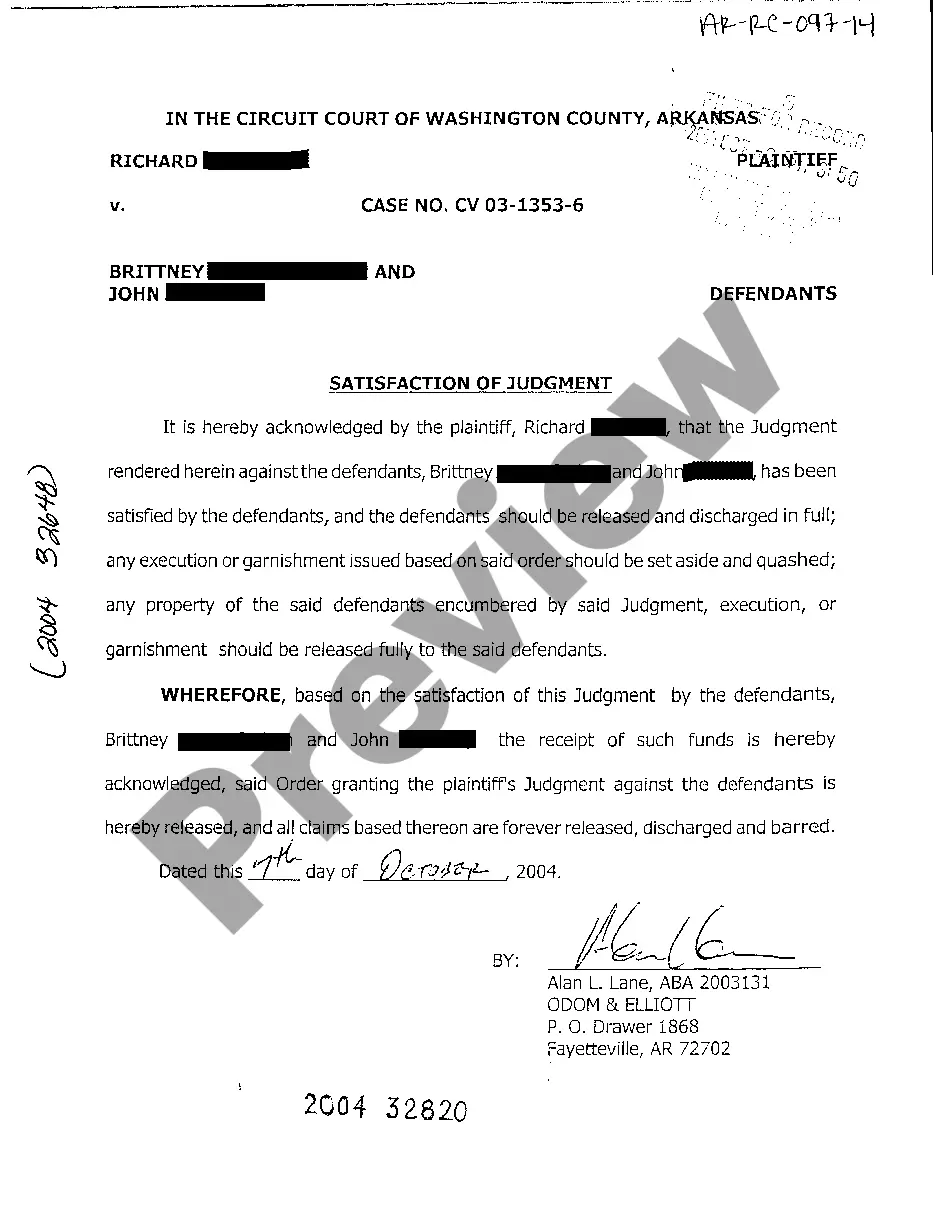

The purpose of a company resolution is to provide a clear record of important decisions made by the LLC's members or managers. These resolutions help establish legal authority and ensure that actions taken align with the LLC's goals and objectives. In the context of the Alabama Resolution of Meeting of LLC Members to Purchase Real Estate, having a documented resolution protects the interests of all members and affirms their commitment to the project.

A member resolution is a formal decision made by the members of an LLC, indicating their approval or disapproval of specific actions or policies. This document ensures that all members are on the same page and understand the implications of their decisions. Member resolutions are especially important when addressing significant actions, such as the Alabama Resolution of Meeting of LLC Members to Purchase Real Estate.

An operating agreement is a foundational document that outlines the ownership structure and operating procedures of an LLC. In contrast, a resolution is a specific decision made by members or managers, often regarding unique matters like the Alabama Resolution of Meeting of LLC Members to Purchase Real Estate. Essentially, the operating agreement provides governance, while resolutions provide actionable decisions.

A resolution for an LLC manager is a document that grants authority to a manager to act on behalf of the LLC. This resolution outlines specific actions the manager can undertake, like entering into contracts or making financial decisions. Having a clear resolution helps in streamlining operations and ensures compliance with the Alabama Resolution of Meeting of LLC Members to Purchase Real Estate.

The resolution of members of an LLC is a formal document that outlines decisions made by the members regarding various business matters. It serves as a written record of agreements, including the Alabama Resolution of Meeting of LLC Members to Purchase Real Estate, ensuring clarity and accountability. This document helps maintain transparency among members and protects the interests of the LLC.

To transfer ownership of an LLC in Alabama, members need to follow a structured process. First, you must convene an Alabama Resolution of Meeting of LLC Members to Purchase Real Estate, which documents the decision to transfer ownership. Next, modify the operating agreement or create a membership interest transfer agreement that outlines the new ownership structure. Finally, file any necessary documents with the state to ensure the transfer is officially recognized, supporting a smooth ownership transition.

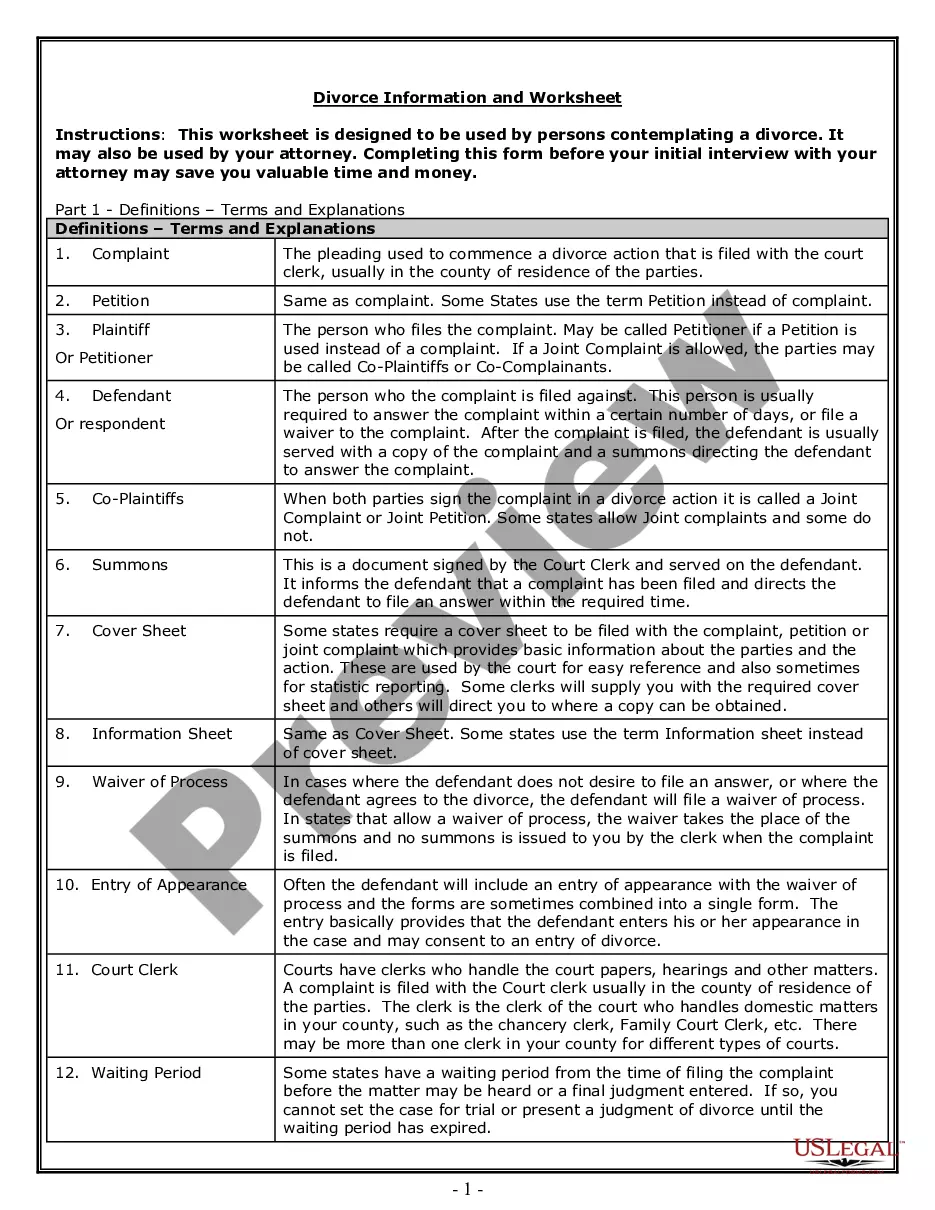

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

Unlike LLCs, corporations are required to make resolutions. Therefore, they are used to preparing them when shareholders or the board of directors make decisions. Although an LLC is not required to make resolutions, there are many reasons for getting in the habit of maintaining resolutions.

Sale Resolution or Sale Order means a resolution or resolutions of the Authority adopted by the Authority Board in accordance with Article II or an Order of the Chief Executive Officer, Chief Financial Officer or other specified Authority official authorizing the sale of a Series of Bonds in accordance with the terms

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...