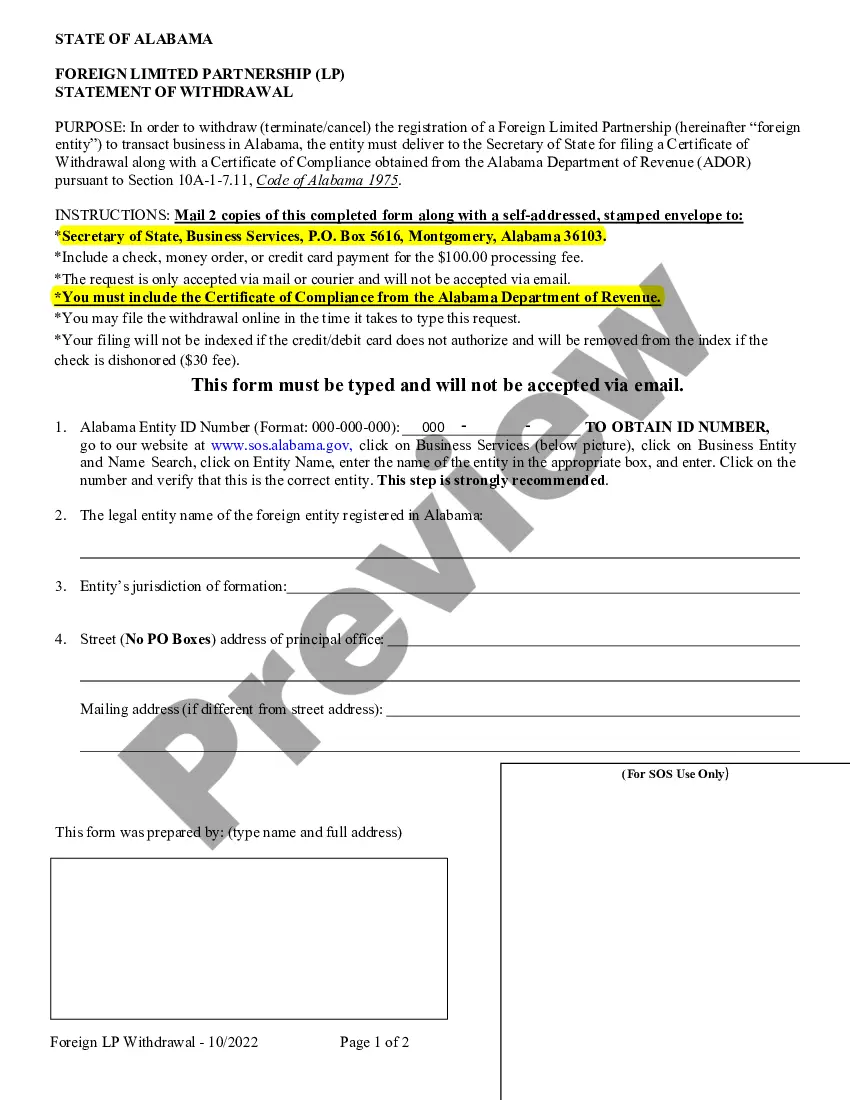

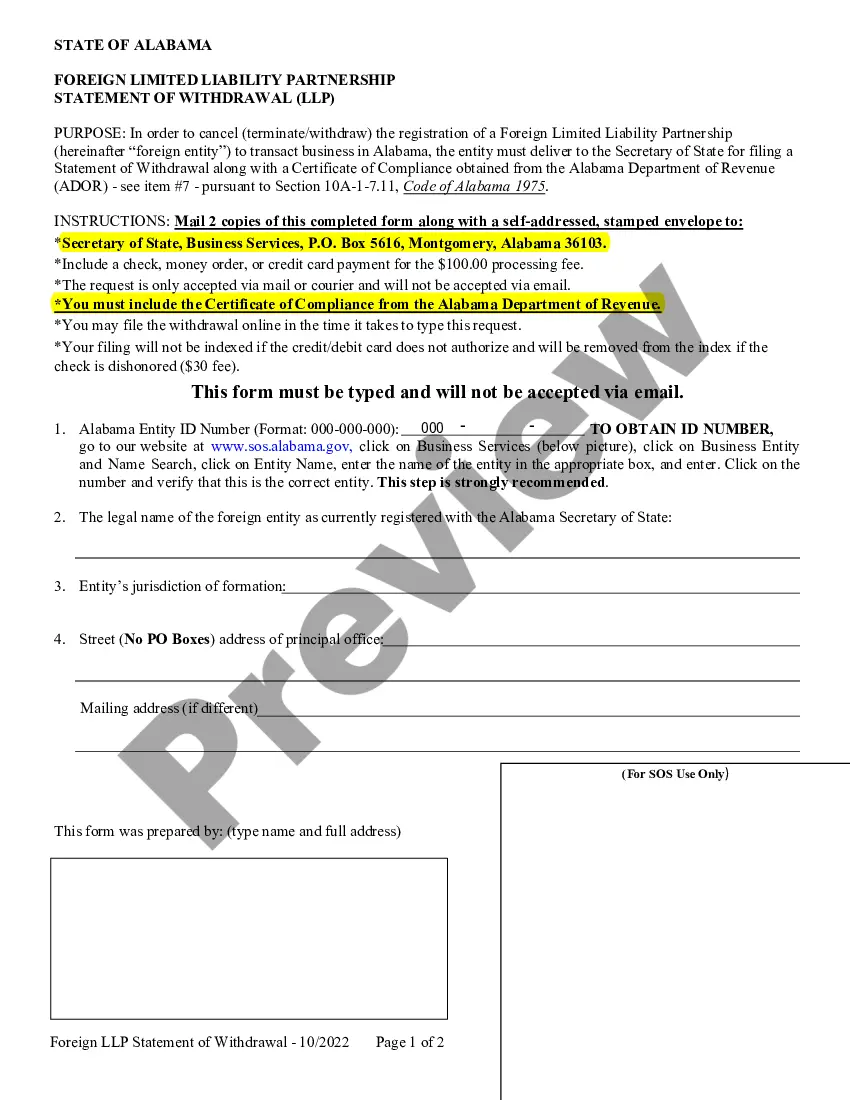

Alabama Foreign Limited Liability Limited Partnership (LL LP) Certificate of Withdrawal is a form used to officially document the withdrawal of a partner from an LL LP in the state of Alabama. The form is filed with the Alabama Secretary of State to terminate the partner's authority to act on behalf of the LL LP. There are two types of Alabama Foreign LL LP Certificate of Withdrawal: a Certificate of Withdrawal for an Individual Partner and a Certificate of Withdrawal for a Corporate Partner. The Certificate of Withdrawal for an Individual Partner must include the name and address of the LL LP, the name and mailing address of the individual withdrawing, the date of filing, the signature of the withdrawing partner, and the signature of a representative of the LL LP. The Certificate of Withdrawal for a Corporate Partner must include the name and address of the LL LP, the name and mailing address of the corporation withdrawing, the date of filing, the signature of an authorized officer of the withdrawing entity, and the signature of a representative of the LL LP.

Alabama Foreign LLLP Certificate of Withdrawal

Description

How to fill out Alabama Foreign LLLP Certificate Of Withdrawal?

US Legal Forms is the easiest and most lucrative method to locate suitable legal templates.

It boasts the largest online collection of business and personal legal documents created and validated by legal experts.

Here, you can access printable and fillable forms that adhere to federal and local regulations - just like your Alabama Foreign LLLP Certificate of Withdrawal.

Review the form description or preview the document to ensure you’ve selected the one that fits your requirements, or search for another using the search tab above.

Click Buy now when you’re confident about its suitability for all the criteria, and choose your preferred subscription plan.

- Acquiring your template requires just a few straightforward steps.

- Users with an existing account and valid subscription only need to Log In to the service and download the form to their device.

- Afterward, they can locate it in their profile in the My documents section.

- If you are using US Legal Forms for the first time, here’s how to obtain a well-prepared Alabama Foreign LLLP Certificate of Withdrawal.

Form popularity

FAQ

Voluntarily removing a member from an LLC involves following the procedures outlined in your operating agreement. Usually, the remaining members must agree to the removal, which may require a formal vote. After reaching this consensus, ensure you file an Alabama Foreign LLLP Certificate of Withdrawal to update the official records and maintain an accurate status for your LLC.

To remove someone from an LLC in Alabama, you first need to review your operating agreement, as it usually outlines the process. Typically, you may need a vote from the remaining members to approve the removal. Once you have approval, you should file an Alabama Foreign LLLP Certificate of Withdrawal with the Secretary of State to officially document the change and protect your business's interests.

To remove someone from an LLC in Alabama, you generally need to refer to your operating agreement for specific procedures. This may involve holding a vote among members and documenting the decision. Once an individual is removed, you may also consider filing amendments with the Secretary of State, and if dissolution is necessary, the Alabama Foreign LLLP Certificate of Withdrawal may come into play.

An example of a foreign LLC would be an e-commerce business formed in California but selling products to customers in Alabama. To conduct its operations legally in Alabama, this California LLC must file as a foreign LLC in the state and obtain the necessary permissions. In case of dissolution, it would file the Alabama Foreign LLLP Certificate of Withdrawal to terminate its business activities correctly.

You might need a foreign LLC to legally operate your business outside your home state while still protecting your personal assets. Establishing a foreign LLC allows you to expand your business reach and tap into new markets, like Alabama, without relinquishing your LLC's original status. Additionally, having a foreign LLC can offer various tax advantages and enhance your business credibility.

An LLC refers to a Limited Liability Company formed in a particular state, while a foreign LLC is one that is established in a different state but conducts business in Alabama. Each type operates under the laws and regulations of its home state, yet foreign LLCs must also comply with the registration and reporting requirements in Alabama. Understanding this distinction allows you to ensure proper compliance and avoid legal issues.

Whether your LLC should be classified as domestic or foreign depends on where you conduct your business. If you primarily operate in Alabama and formed your LLC in that state, it is domestic. However, if you formed your LLC in another state but do business in Alabama, you will register as a foreign LLC and may eventually need to file an Alabama Foreign LLLP Certificate of Withdrawal if you choose to dissolve.

In an educational context, withdrawal refers to a student's formal decision to leave a school or program. This can relate to various reasons such as personal issues, health problems, or a desire to transfer. Unlike simply dropping a class, a withdrawal indicates a more substantial commitment to exiting the educational institution. While this differs from the Alabama Foreign LLLP Certificate of Withdrawal, both involve taking decisive steps to end a relationship with an organization.

When an LLC is withdrawn, it means that the business has officially terminated its legal status in its registered state. In Alabama, this process involves filing the Alabama Foreign LLLP Certificate of Withdrawal. This action prevents the LLC from incurring ongoing fees, taxes, or legal obligations. It allows the owners to redirect their focus and resources elsewhere without the burden of an inactive entity.

A certificate of withdrawal is a legal document that signifies the formal dissolution of a business entity’s operations in a specific jurisdiction. For Alabama, the Alabama Foreign LLLP Certificate of Withdrawal explicitly indicates that a limited liability partnership is withdrawing from the state. This ensures that the partnership is no longer subject to state regulations and obligations. It is an essential step in the business closure process.