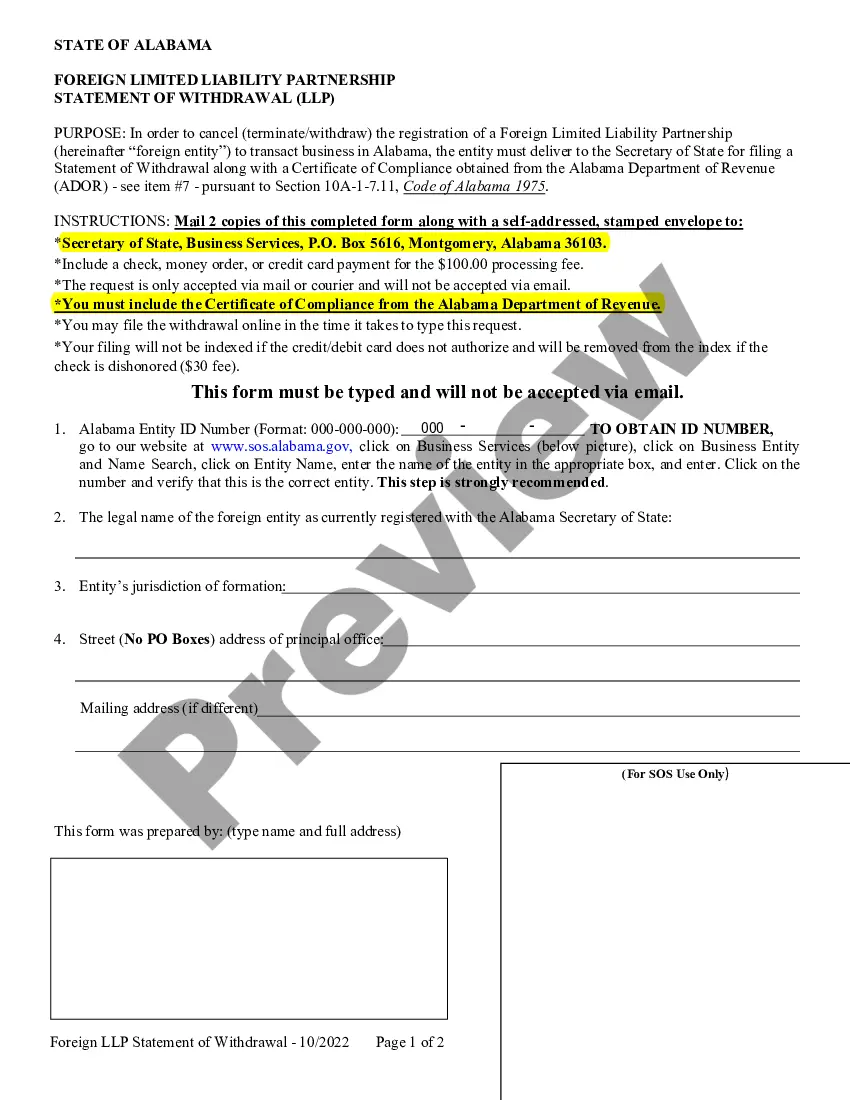

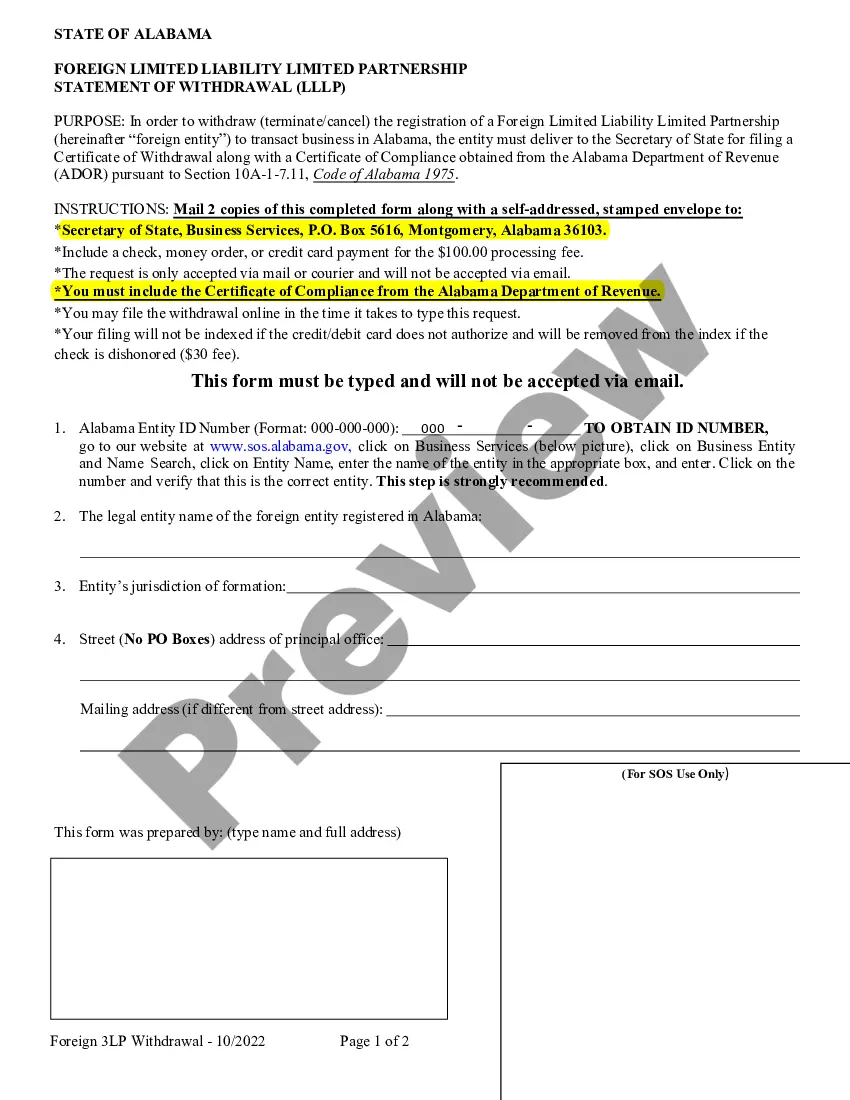

The Alabama Foreign Limited Partnership Certificate of Withdrawal is a document that must be filed with the Alabama Secretary of State when a foreign limited partnership withdraws from doing business in the state. This document serves as a legal notification of the withdrawal and must include the name of the partnership, date of filing, partnership ID number, and the signature of an authorized representative. There are two types of Alabama Foreign Limited Partnership Certificate of Withdrawal: the Voluntary Withdrawal and the Involuntary Withdrawal. The Voluntary Withdrawal is used when the partnership has decided to voluntarily terminate its business in the state, while the Involuntary Withdrawal is used when the partnership has been revoked, terminated, or has had its authority to do business withdrawn.

Alabama Foreign Limited Partnership Certificate of Withdrawal

Description

How to fill out Alabama Foreign Limited Partnership Certificate Of Withdrawal?

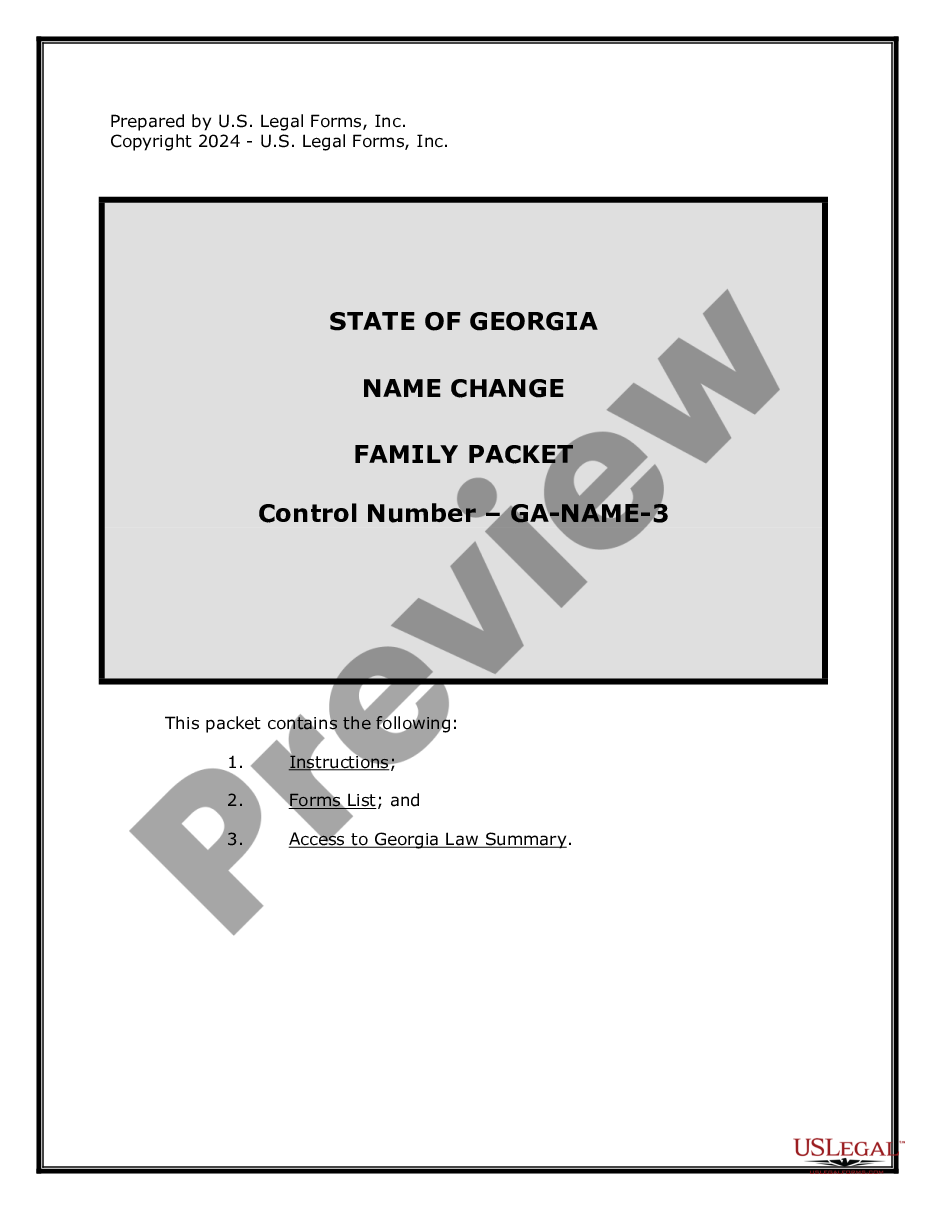

Drafting legal documents can be quite a hassle unless you have accessible fillable templates at hand. With the US Legal Forms online repository of official forms, you can feel assured about the forms you obtain, as they all comply with federal and state regulations and have been reviewed by our experts.

Obtaining your Alabama Foreign Limited Partnership Certificate of Withdrawal from our platform is as simple as pie. Previously registered users with an active subscription need only Log In and click the Download button after they find the correct template. Later, if necessary, users can also select the same document from the My documents section of their account.

Haven't you had a chance to explore US Legal Forms yet? Enroll in our service today to acquire any official document quickly and effortlessly each time you require it, and keep your documentation organized!

- Document compliance verification: Carefully examine the content of the form you wish to ensure it aligns with your requirements and adheres to your state regulations. Reviewing the document and its overall description will assist you in achieving this.

- Alternative search (optional): If you encounter any discrepancies, explore the library through the Search tab at the top until you identify a suitable form, and click Buy Now when you find the one you need.

- Account creation and form purchase: Register for an account with US Legal Forms. After account verification, Log In and choose your ideal subscription plan. Complete the payment to proceed (options for PayPal and credit cards are provided).

- Template download and further usage: Select the file format for your Alabama Foreign Limited Partnership Certificate of Withdrawal and click Download to save it to your device. Print it to fill out the documents by hand or utilize a versatile online editor to create an electronic copy more swiftly and efficiently.

Form popularity

FAQ

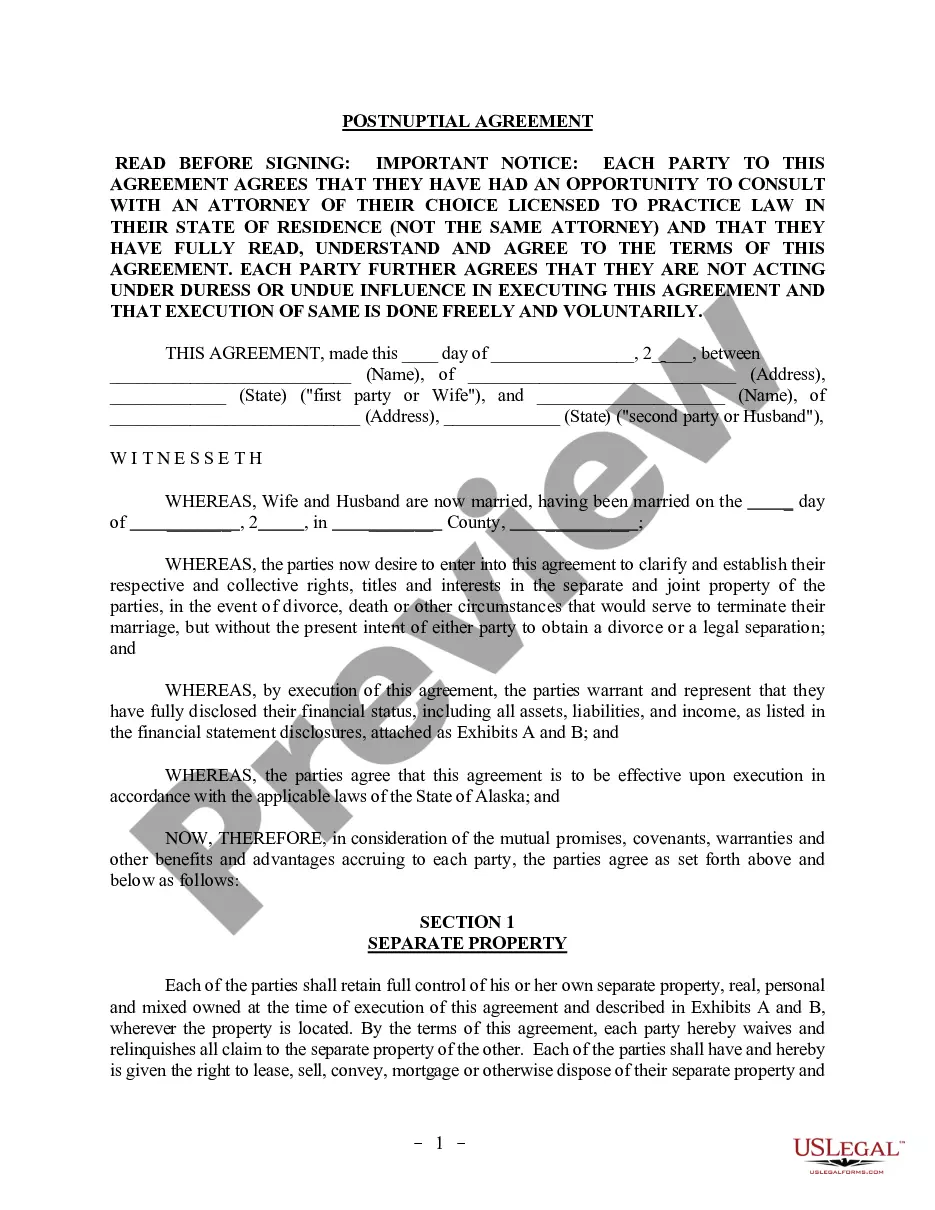

A qualified foreign entity is a business that has been authorized to do business in a state outside its home state. This designation allows it to operate legally within the state. To withdraw from operations, the entity will need to file an Alabama Foreign Limited Partnership Certificate of Withdrawal for closure and compliance.

A foreign limited liability partnership, or foreign LLP, is a partnership registered in a state different from where it originally formed. This structure provides both operational flexibility and liability protection for its partners. It is essential to follow the state regulations for registration and dissolution, including for the Alabama Foreign Limited Partnership Certificate of Withdrawal.

A foreign entity is a business that operates in a state other than its state of formation. An LLC, or Limited Liability Company, is a specific type of business structure that provides personal liability protection. Understanding these distinctions is crucial when considering the Alabama Foreign Limited Partnership Certificate of Withdrawal.

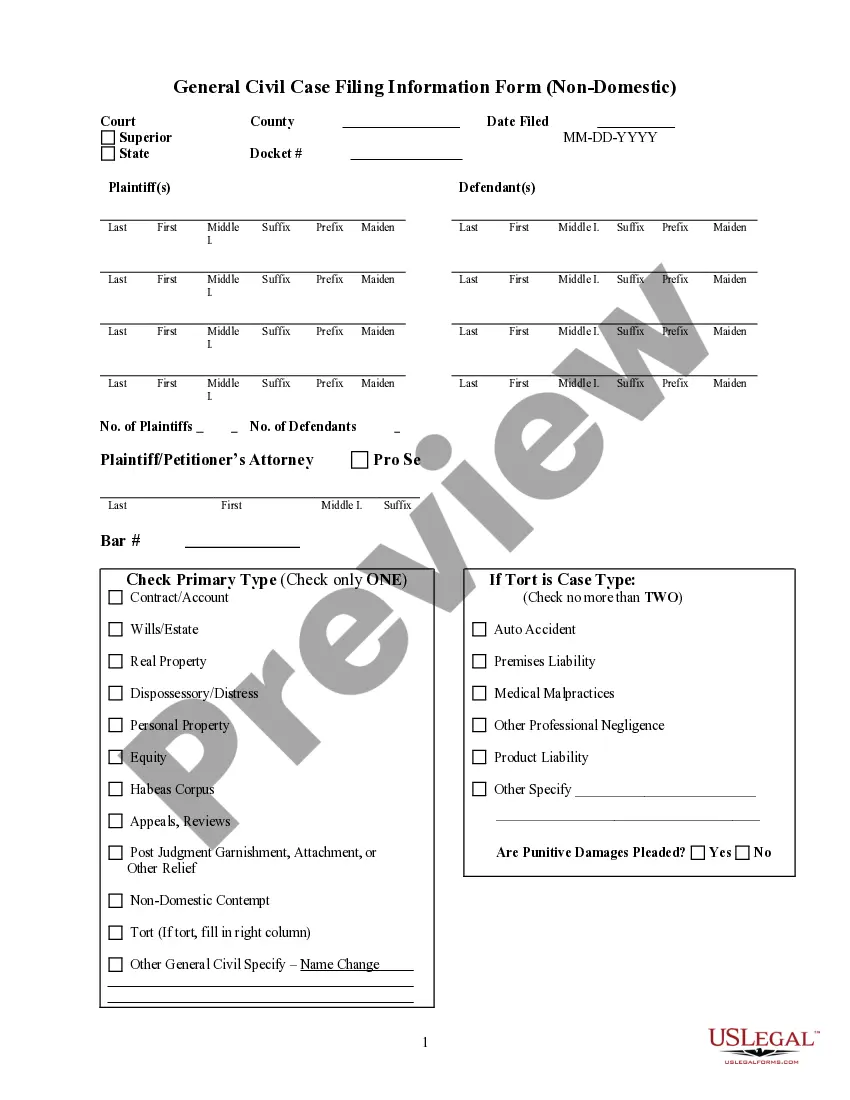

Forming a partnership LLC in Alabama begins with choosing a unique name and filing your Articles of Organization with the Secretary of State. You should outline the partnership structure in your operating agreement. Remember, once formed, you may need an Alabama Foreign Limited Partnership Certificate of Withdrawal should you choose to dissolve your partnership.

To dissolve a foreign LLC in Alabama, you must file a Certificate of Withdrawal with the Alabama Secretary of State. This document confirms your decision to cease operations and formally withdraw your business from the state. Ensuring proper compliance minimizes potential legal issues down the line.

Registering a foreign business in the US involves researching state-specific requirements. Generally, you need to apply for permission to operate in each state where your business will be active. Using the Alabama Foreign Limited Partnership Certificate of Withdrawal can simplify your exit when necessary.

To register as a foreign entity in Alabama, you must file an application with the Alabama Secretary of State. This includes submitting a Certificate of Good Standing from your home state. Additionally, you will need to obtain an Alabama Foreign Limited Partnership Certificate of Withdrawal if you decide to dissolve your registration later.

To shut down an LLC in Alabama, start by gathering your members to discuss the decision to dissolve. After reaching a consensus, you will need to file the Alabama Foreign Limited Partnership Certificate of Withdrawal to complete the formal dissolution process. Ensuring that you meet all state requirements helps alleviate any future liability and secures a proper closure for your LLC.

Yes, you can close your LLC yourself. To do this, follow your operating agreement for guidance, and make sure to file the Alabama Foreign Limited Partnership Certificate of Withdrawal to formally dissolve the entity. Handling the closure independently can save resources, but ensure that you fulfill all necessary obligations to avoid future complications.

When stepping down from an LLC, you should start by reviewing your operating agreement and discussing your decision with other members. It's important to file the necessary documents, such as the Alabama Foreign Limited Partnership Certificate of Withdrawal, to officially remove your name from the LLC’s records. This action helps clarify your separation from the business and protects your interests moving forward.