This is a sample Purchase and Sale agreement for the interest and rights to oil, gas and minerals, and related equipment, owned by one of the parties. The Agreement contains many detailed provisions addressing the rights and obligations of both parties.

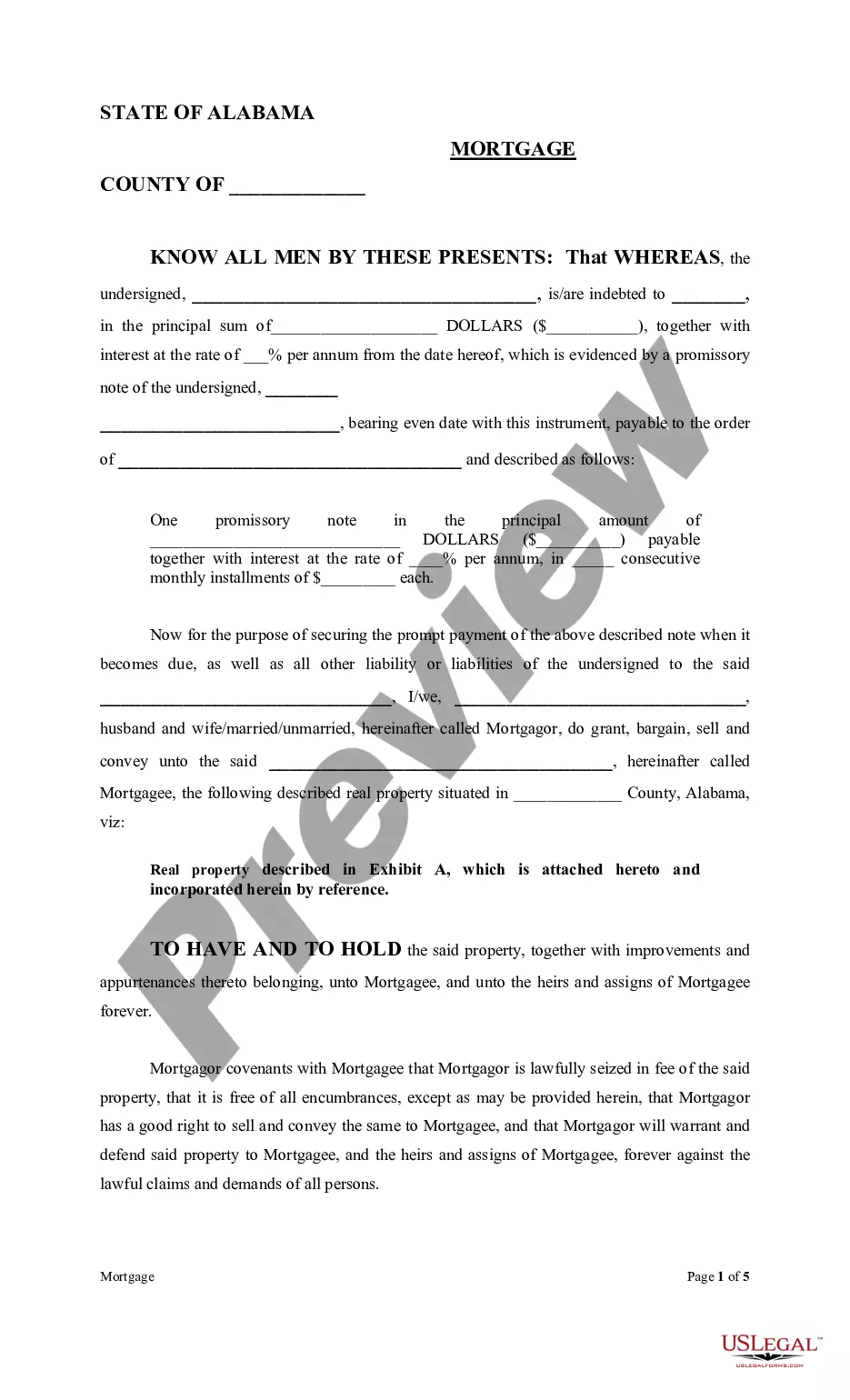

Alabama Wrap Around Mortgage

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Wrap Around Mortgage?

Utilizing Alabama Wrap Around Mortgage examples crafted by expert attorneys helps you avert stress when completing paperwork.

Simply download the example from our website, complete it, and request a lawyer to verify it.

This approach can save you significantly more time and expenses than searching for legal advice to create a file entirely from the beginning for you.

Utilize the Preview feature and review the description (if provided) to determine if you need this specific example, and if so, simply click Buy Now. Find another example using the Search field if necessary. Choose a subscription that suits your preferences. Begin with your credit card or PayPal. Choose a file format and download your document. Once you have completed all the prior steps, you will be ready to fill out, print, and sign the Alabama Wrap Around Mortgage template. Be sure to thoroughly review all entered information for accuracy before submitting or sending it out. Reduce the time you spend on document completion with US Legal Forms!

- If you have already purchased a US Legal Forms membership, just Log In to your account and revisit the sample webpage.

- Locate the Download button next to the template you are reviewing.

- After you download a document, you will find all your stored examples in the My documents tab.

- If you lack a subscription, it’s not a major issue.

- Just follow the instructions below to register for an account online, obtain, and complete your Alabama Wrap Around Mortgage form.

- Verify that you are acquiring the correct state-specific document.

Form popularity

FAQ

In an Alabama Wrap Around Mortgage, the seller typically retains the title to the property while the buyer obtains an equitable interest. The buyer makes regular payments to the seller, who continues to manage the existing mortgage obligations. This arrangement allows buyers to gain control and use the property while the seller maintains legal ownership. It is important to document the terms clearly to protect everyone involved in this unique agreement.

To set up an Alabama Wrap Around Mortgage, you first need to ensure that both parties understand the terms and obligations involved. It involves drafting a formal agreement that outlines payment terms, interest rates, and the responsibilities of each party. Utilizing platforms like uslegalforms can help you create a comprehensive, legally binding document tailored to your specific needs. Engaging with a legal expert for this process is advisable to navigate the complexities.

In an Alabama Wrap Around Mortgage, the seller remains responsible for the underlying loans. Even though the buyer makes payments to the seller, the seller must ensure payments are made to the original lender on time. This ongoing responsibility can create complications if the buyer defaults. Thus, clear communication and legal advice are essential in these transactions.

To set up a wrap around mortgage, start by defining the terms with the seller, including interest rates and payment schedules. Next, ensure both parties have a thorough understanding of the existing mortgage obligations and legal stipulations involved in the transaction. It's vital to document the agreement properly to protect both the buyer and seller. For assistance in navigating this process, consider using uslegalforms, which provides essential templates and guidance for executing an Alabama wrap around mortgage.

Many banks and financial institutions in Alabama are open to wrap around mortgages, although their acceptance may vary. Wrap around mortgages offer a unique structure that benefits both buyers and sellers, allowing them to negotiate terms that suit their needs. It's important to consult with a knowledgeable lender who understands the intricacies of Alabama wrap around mortgages to ensure a smooth transaction. Consider exploring platforms like uslegalforms for guidance on legal requirements and documentation to facilitate this process.

In the context of a wraparound mortgage, the mortgagee is typically the seller who retains the original financing while extending new financing to the buyer. This dual role can create unique dynamics regarding payment obligations. Both parties must understand their rights and responsibilities. If you are uncertain about the details of an Alabama Wrap Around Mortgage, consider consulting with a professional in the field.

Many banks have policies against traditional wrap-around mortgages due to the risks involved. However, sellers may still provide such financing options independently. It’s essential to evaluate potential lenders' willingness to cooperate with wrap-around agreements. If you are exploring an Alabama Wrap Around Mortgage, consider utilizing services that specialize in this area to facilitate the process.

In a wrap-around mortgage, the original property owner retains the title to the property while the buyer makes payments to the seller. This arrangement allows the seller to continue paying their existing mortgage while also financing the buyer. It creates a unique situation for both parties. For those interested in an Alabama Wrap Around Mortgage, this structure can offer flexibility and potential financial benefits.